Illinois Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can find the most recent versions of forms like the Illinois Resolution of Meeting of LLC Members to Sell or Transfer Stock within moments.

Review the form outline to confirm you have chosen the right form.

If the form doesn't meet your needs, use the Search field at the top of the screen to find the one that does.

- If you already have a subscription, Log In and download the Illinois Resolution of Meeting of LLC Members to Sell or Transfer Stock from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You have access to all previously downloaded forms from the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

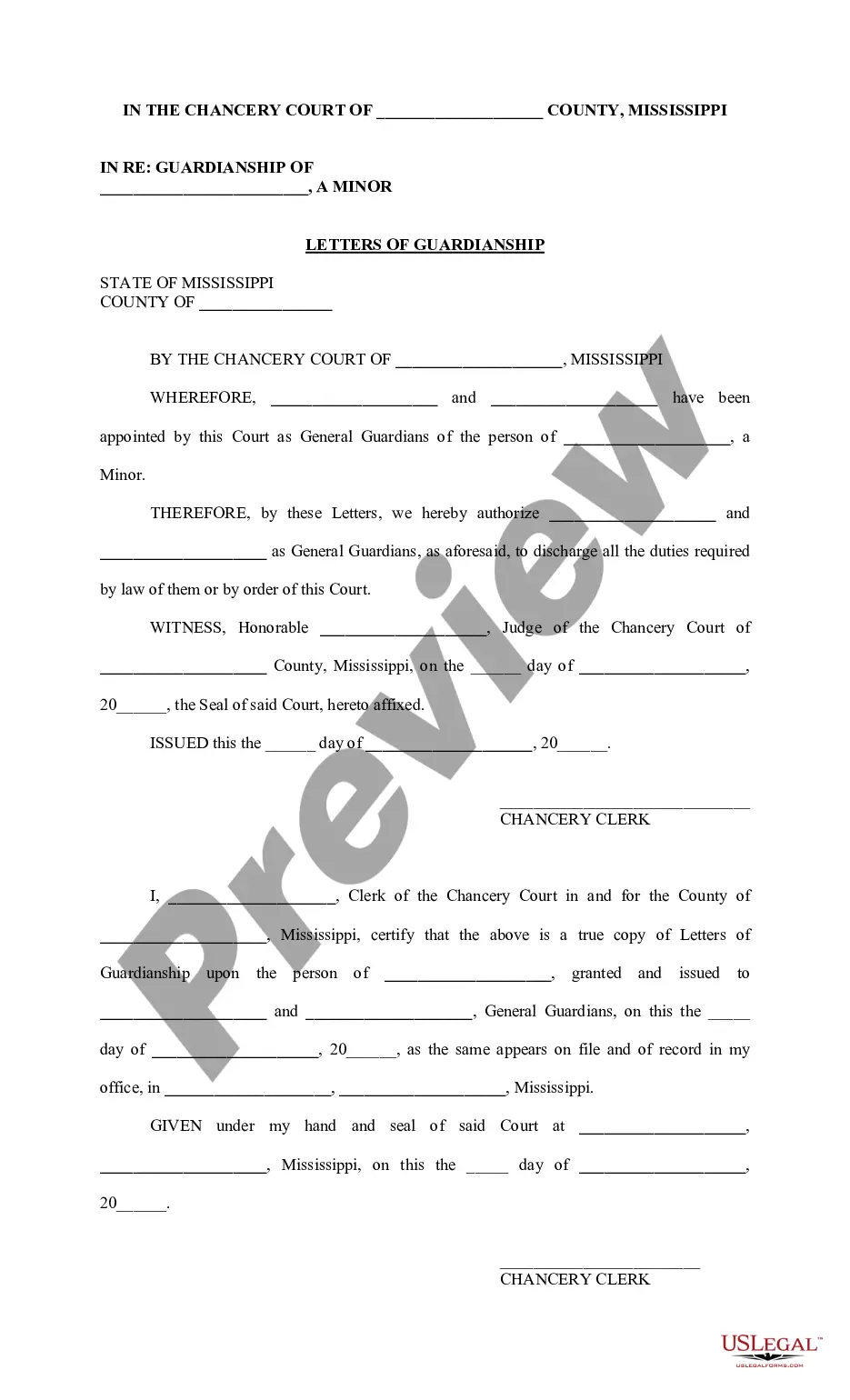

- Click the Preview button to check the form’s content.

Form popularity

FAQ

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

To amend your Articles of Organization for an Illinois LLC, you must file Articles of Amendment with the Illinois Secretary of State, Department of Business Services, Limited Liability Division. In addition, you must pay a $50 filing fee.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

There are two main ways to transfer ownership of your LLC: Transferring partial interest in an LLC: This applies if you are not selling the entire business, and you do not have 100 percent ownership. Selling your LLC: This applies if you are transferring ownership of your entire business to someone else.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

Updating your Business Informationelectronically through MyTax Illinois,by calling us at 217-785-3707,by email at REV.CentReg@illinois.gov, or.at one of our offices.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

To amend your Articles of Organization for an Illinois LLC, you must file Articles of Amendment with the Illinois Secretary of State, Department of Business Services, Limited Liability Division. In addition, you must pay a $50 filing fee. Below, you'll find a step-by-step guide to amending your Illinois LLC.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.