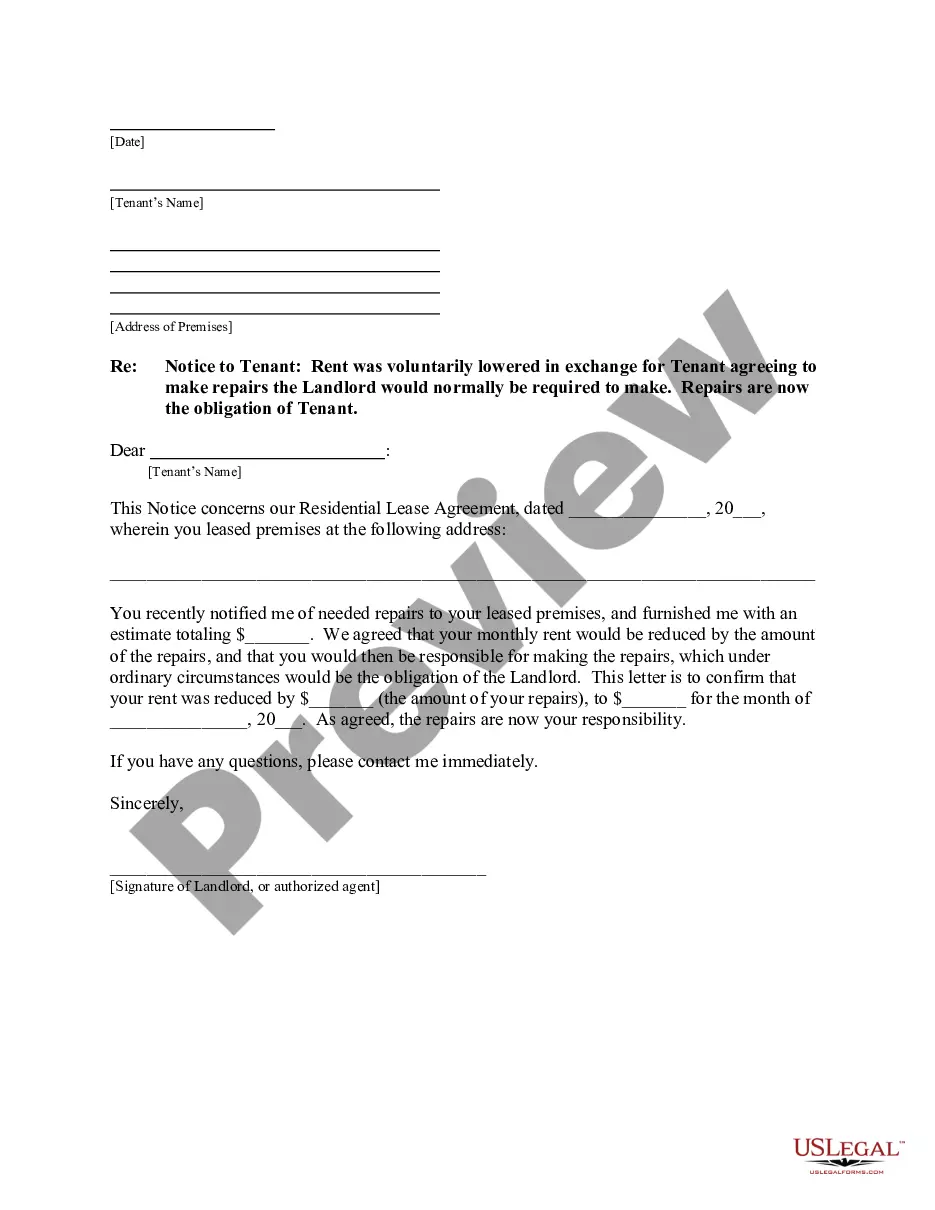

This form is a business type form that is formatted to allow you to complete the form using Adobe Acrobat or Word. The word files have been formatted to allow completion by entry into fields. Some of the forms under this category are rather simple while others are more complex. The formatting is worth the small cost.

Illinois Yearly Expenses by Quarter

Description

How to fill out Yearly Expenses By Quarter?

Should you wish to total, obtain, or print legal document templates, utilize US Legal Forms, the most significant repository of legal documents available online.

Employ the site's straightforward and convenient search to locate the paperwork you need.

Various templates for business and personal applications are categorized by types and claims, or keywords.

Every legal document template you acquire is yours for life. You can access all forms you saved in your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and obtain, then print the Illinois Yearly Expenses by Quarter with US Legal Forms. There are numerous professional and state-specific documents available for your personal business or individual needs.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review feature to examine the form's content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find different types in the legal form format.

- Step 4. After you have located the form you need, click the Buy now button. Select the pricing plan you prefer and provide your details to create an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Access the format of the legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Illinois Yearly Expenses by Quarter.

Form popularity

FAQ

Illinois' newly approved $46.5 billion budget is set to temporarily bring financial relief to residents through direct checks, a suspension of grocery taxes and a freeze on the state's fuel tax.

Illinois' newly approved $46.5 billion budget is set to temporarily bring financial relief to residents through direct checks, a suspension of grocery taxes and a freeze on the state's fuel tax. The House voted to approve the budget just before 6 a.m. Saturday, less than two days after Gov. J.B.

The federal budget covers a wide range of expenditures, but most of the tax revenue is spent on just a handful of government programs. The largest portion of tax revenue is spent to support the military, pay for Social Security, and health care programs.

Let's take a look at some of the big pieces.Social Security. Social Security was created to provide income for retired workers over the age of 65 and accounts for a large chunk of mandatory spending.Health Care.Veterans Benefits.National Defense.Transportation.Education.Veterans Benefits.Health.

Illinois' newly signed $46.5 billion budget, which includes $1.8 billion in election-year tax relief and put a $1 billion deposit into the state's rainy day fund, will go into effect in just under three months.

Illinois's budget basics According to the National Association of State Budget Officers (NASBO), Illinois's total expenditures in fiscal year (FY) 2021 were $87.5 billion, including general funds, other state funds, bonds, and federal funds.

Revenues come mainly from tax collections, licensing fees, federal aid, and returns on investments. Expenditures generally include spending on government salaries, infrastructure, education, public pensions, public assistance, corrections, Medicaid, and transportation.

Expenditures Where does the Money Go? As shown in Figure 2, the two largest spending categories in Illinois are health/social services and education, with these two categories comprising approximately 69 percent of expenditures.

Income and sales taxes account for nearly two-thirds of state revenue. Illinois state government expects to spend $39 billion in 2017 $5 billion more than the revenues it will collect, according to data from the Governor's Office of Management and Budget.