Illinois Unanimous Consent of Shareholders in Place of Annual Meeting

Description

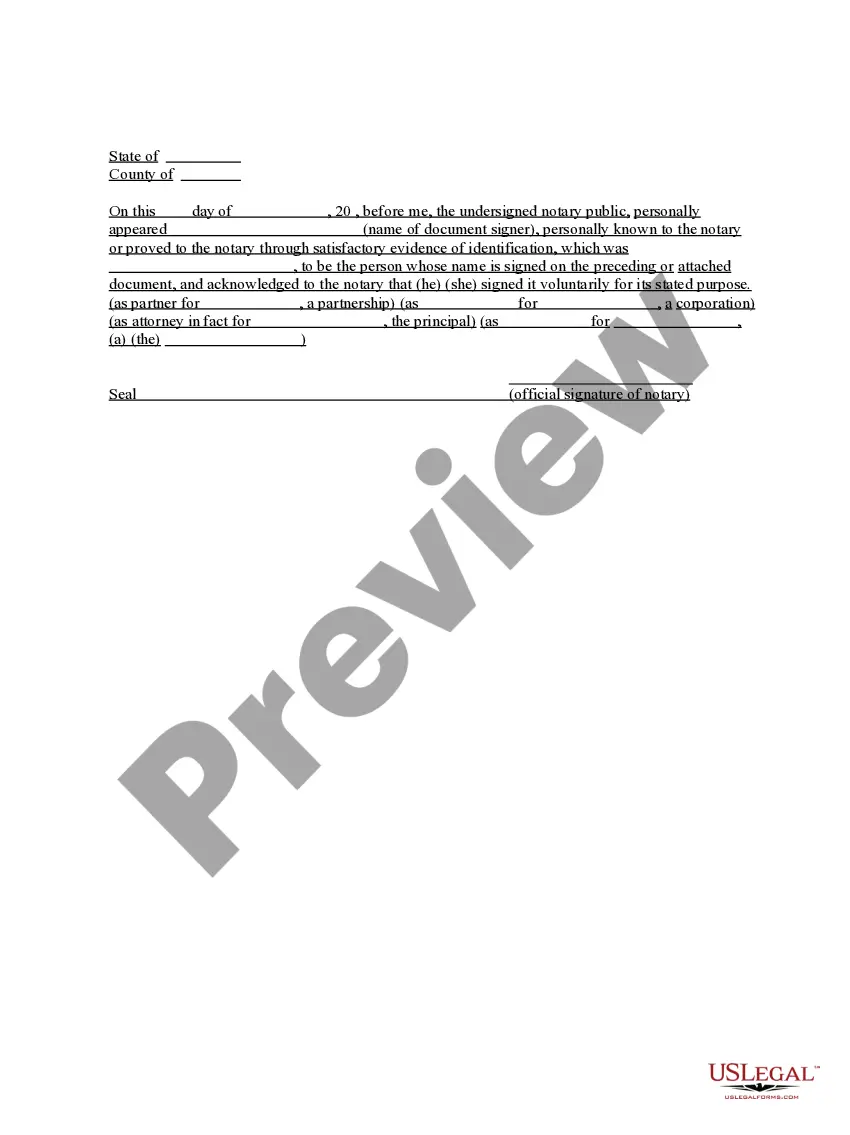

How to fill out Unanimous Consent Of Shareholders In Place Of Annual Meeting?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates that you can obtain or print.

By using the website, you can find numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can locate the latest versions of forms like the Illinois Unanimous Consent of Shareholders in Place of Annual Meeting in just seconds.

Read the form details to ensure you have selected the right form.

If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- If you currently hold a monthly subscription, Log In and obtain the Illinois Unanimous Consent of Shareholders in Place of Annual Meeting from the US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously saved forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to check the form's content.

Form popularity

FAQ

A unanimous shareholder is an individual or entity that holds shares in a company and agrees with the decisions made by all other shareholders. In the context of Illinois Unanimous Consent of Shareholders in Place of Annual Meeting, this term highlights the importance of collective agreement among all shareholders for effective governance. Their cooperation ensures smooth operations and quick decision-making processes.

A unanimous shareholder agreement is a contract among shareholders that outlines how the corporation will be managed and the rights of the shareholders. It typically requires all shareholders' approval for any changes to the agreement. This agreement can help facilitate smoother operations, especially when leveraging the Illinois Unanimous Consent of Shareholders in Place of Annual Meeting. Establishing this agreement fosters clear expectations and strengthens relationships between shareholders.

Any action required or permitted to be taken at a shareholders' meeting may be taken without a meeting if a written consent setting forth the action so taken is signed by all shareholders entitled to vote with respect to the subject matter thereof.

One of your key rights as a shareholder is the right to vote your shares in corporate elections. Shareholder voting rights give you the power to elect directors at annual or special meetings and make your views known to company management and directors on significant issues that may affect the value of your shares.

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda.

Usually, there are no requirements for limited liability companies to hold annual meetings like corporations. However, the internal organizational documents, such as the LLC operating agreement, may require that the members hold regular meetings.

What happens if the corporation does not hold an annual shareholder meeting or written consent action? If a corporation fails to hold an annual meeting, one consequence is that the shareholders may seek a court order to hold a meeting and elect directors.

Shareholder meetings are a regulatory requirement which means most public and private companies must hold them. Notification of the meeting's date and time is often accompanied by the meeting's agenda. Meetings are generally administrative sessions that follow a specific format set forth well in advance.

Below are the steps required for holding the shareholder meeting:Schedule the meeting time/date/place and send out the notice to all shareholders.Conduct the meeting.Draft the meeting minutes.

Anyone who owns stock in a company has a voting right to the decisions that the company makes. The fewer shares someone owns, the less voting power they have. Voting has a significant impact on the price of the shares someone owns.