Illinois Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

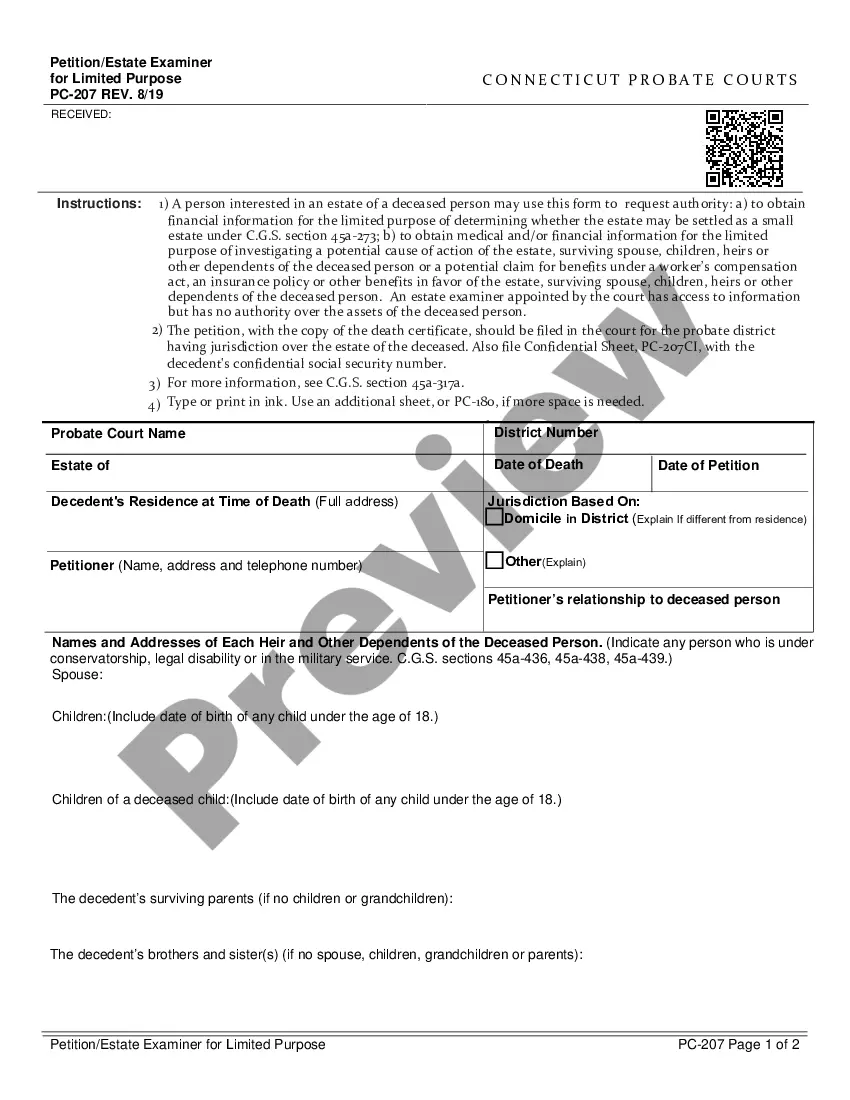

How to fill out Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

You can invest hours online searching for the lawful papers format which fits the federal and state demands you want. US Legal Forms supplies 1000s of lawful varieties which are examined by professionals. You can easily obtain or printing the Illinois Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance from my services.

If you have a US Legal Forms bank account, you are able to log in and click the Obtain switch. Following that, you are able to total, revise, printing, or signal the Illinois Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Each lawful papers format you purchase is your own property permanently. To acquire one more version for any purchased form, go to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms web site initially, adhere to the easy instructions under:

- Initial, be sure that you have chosen the right papers format for that state/area of your choice. Browse the form outline to ensure you have chosen the correct form. If offered, make use of the Preview switch to search throughout the papers format also.

- In order to find one more variation of your form, make use of the Look for field to discover the format that meets your requirements and demands.

- Once you have identified the format you need, click Acquire now to continue.

- Select the prices strategy you need, key in your credentials, and sign up for a free account on US Legal Forms.

- Full the purchase. You should use your Visa or Mastercard or PayPal bank account to purchase the lawful form.

- Select the file format of your papers and obtain it to the product.

- Make modifications to the papers if needed. You can total, revise and signal and printing Illinois Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

Obtain and printing 1000s of papers themes while using US Legal Forms site, which offers the largest selection of lawful varieties. Use professional and express-certain themes to deal with your company or specific needs.

Form popularity

FAQ

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

A qualified retirement plan is a retirement plan established by an employer that is designed to provide retirement income to designated employees and their beneficiaries, which meets certain IRS Code requirements in terms of both form and operation.

Using life insurance in a qualified plan does offer several advantages, including: The ability to use pre-tax dollars to pay premiums that would otherwise not be tax-deductible. Fully funding the retirement benefit at the premature death of the plan participant.

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

A nonqualified plan is a type of tax-deferred, employer-sponsored retirement plan that falls outside of Employee Retirement Income Security Act (ERISA) guidelines.

A NQDC plan is unfunded if either assets have not been set aside by your employer to pay plan benefits (that is, your employer pays benefits from its general assets on a "pay as you go" basis), or assets have been set aside but those assets remain subject to the claims of your employer's creditors (often referred to as

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

Key Takeaways Traditional IRAs, while sharing many of the tax advantages of plans like 401(k)s, are not offered by employers and are, therefore, not qualified plans.

A qualified retirement plan is a retirement plan recognized by the IRS where investment income accumulates tax-deferred. Common examples include individual retirement accounts (IRAs), pension plans and Keogh plans. Most retirement plans offered through your job are qualified plans.