Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

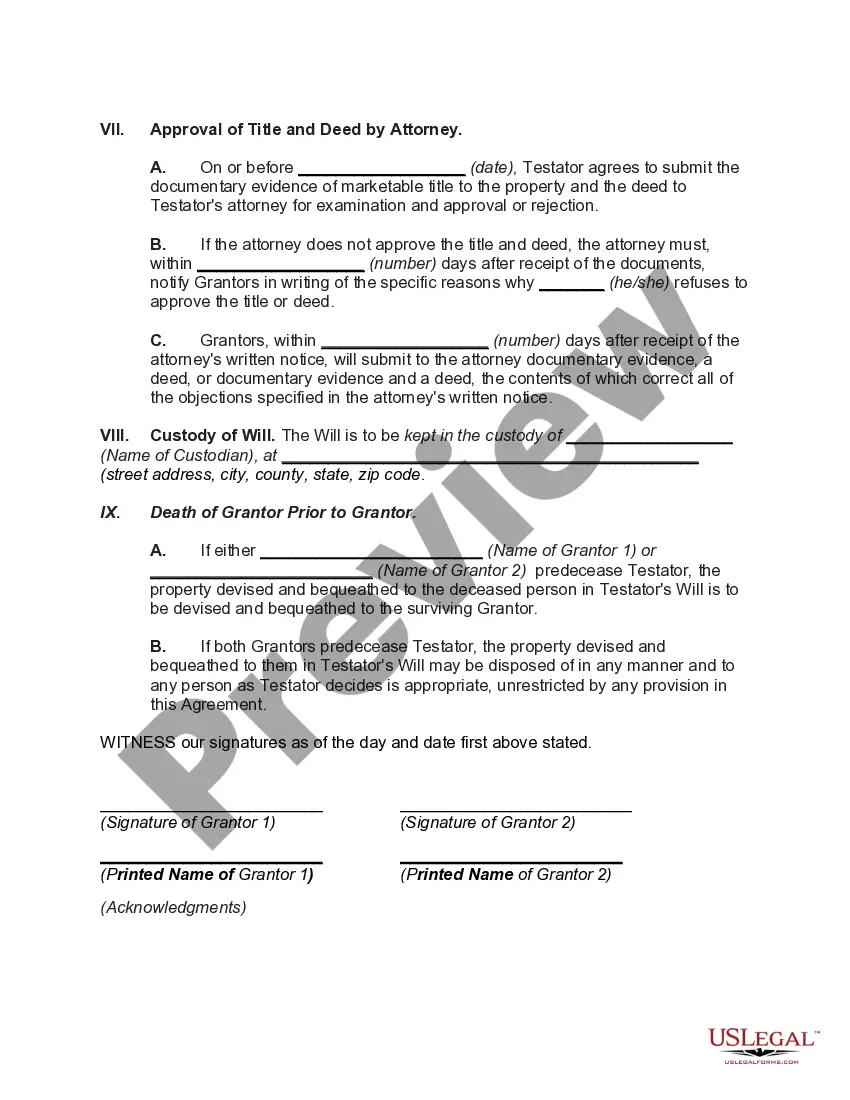

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

If you intend to finalize, download, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's user-friendly and convenient search feature to locate the documents you require.

A range of templates for business and personal uses are organized by categories and states, or keywords. Leverage US Legal Forms to acquire the Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator with just a few clicks.

Every legal document format you obtain is yours permanently. You can access every form you saved in your account.

Navigate to the My documents section and select a form to print or download again. Engage and download, and print the Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to access the Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

- You can also view forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Verify that you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form format.

- Step 4. Once you have found the form you desire, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

Form popularity

FAQ

To transfer property after a parent's death in Illinois without a will, the estate must go through the intestate succession process as defined by state law. Typically, this involves identifying the rightful heirs and filing for letters of administration. If the property is jointly owned, it may pass to the surviving owner. Considering paths like the Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator can simplify this process and avoid probate delays.

In Florida, an executor generally has the authority to sell property without needing permission from other heirs, provided this power is granted in the will. However, it is essential to follow the terms of the will correctly and adhere to state laws. If other heirs have concerns, they may wish to consult legal advice. When considering an Illinois Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, understanding the executor's role is crucial.

Legacy, also called Bequest, in law, generally a gift of property by will or testament. The term is used to denote the disposition of either personal or real property in the event of death.

If you have no living descendants, your spouse gets all of the intestate property. If you have living descendants, your spouse will get half of the inheritance, and your descendants will get the other half of the inheritance.

If you register an account in TOD (also called beneficiary) form, the beneficiary you name will inherit the account automatically at your death. No probate court proceedings will be necessary; the beneficiary will deal directly with the brokerage company to transfer the account.

When preparing a will, life insurance policy, or retirement account, you designate an individual or organization, known as the beneficiary, to receive the benefits or proceeds when you pass away. A bequest is a gift of your personal property upon your passing to a person or entity by means of a will or trust.

An Illinois transfer-on-death instrument (also known as an Illinois TOD deed form) transfers property automatically when a property owner dies. It functions in much the same way as a beneficiary designation on a bank account.

Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

Beneficiary: Someone named in a legal document to inherit money or other property. Wills, trusts, and insurance policies commonly name beneficiaries; beneficiaries can also be named for "payable-on-death" accounts. Bequeath: To leave property at one's death; another word for "give."

To get that done, take the signed deed to the land records office for the county in which the real estate is located. This office is commonly called the county recorder, land registry, or register of deeds, or sometimes it's part of the county clerk's office.