Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

Selecting the optimal legal document template can pose a challenge. Naturally, there are numerous templates accessible online, yet how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, suitable for business and personal needs. All forms are reviewed by professionals and comply with state and federal regulations.

If you're already registered, Log In to your account and click the Download button to obtain the Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. Use your account to search through the legal forms you have previously purchased. Visit the My documents tab in your account to retrieve another copy of the document you need.

Complete, edit, print, and sign the obtained Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. US Legal Forms boasts the largest collection of legal forms where you can find various document templates. Utilize this service to download well-crafted documents that meet state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

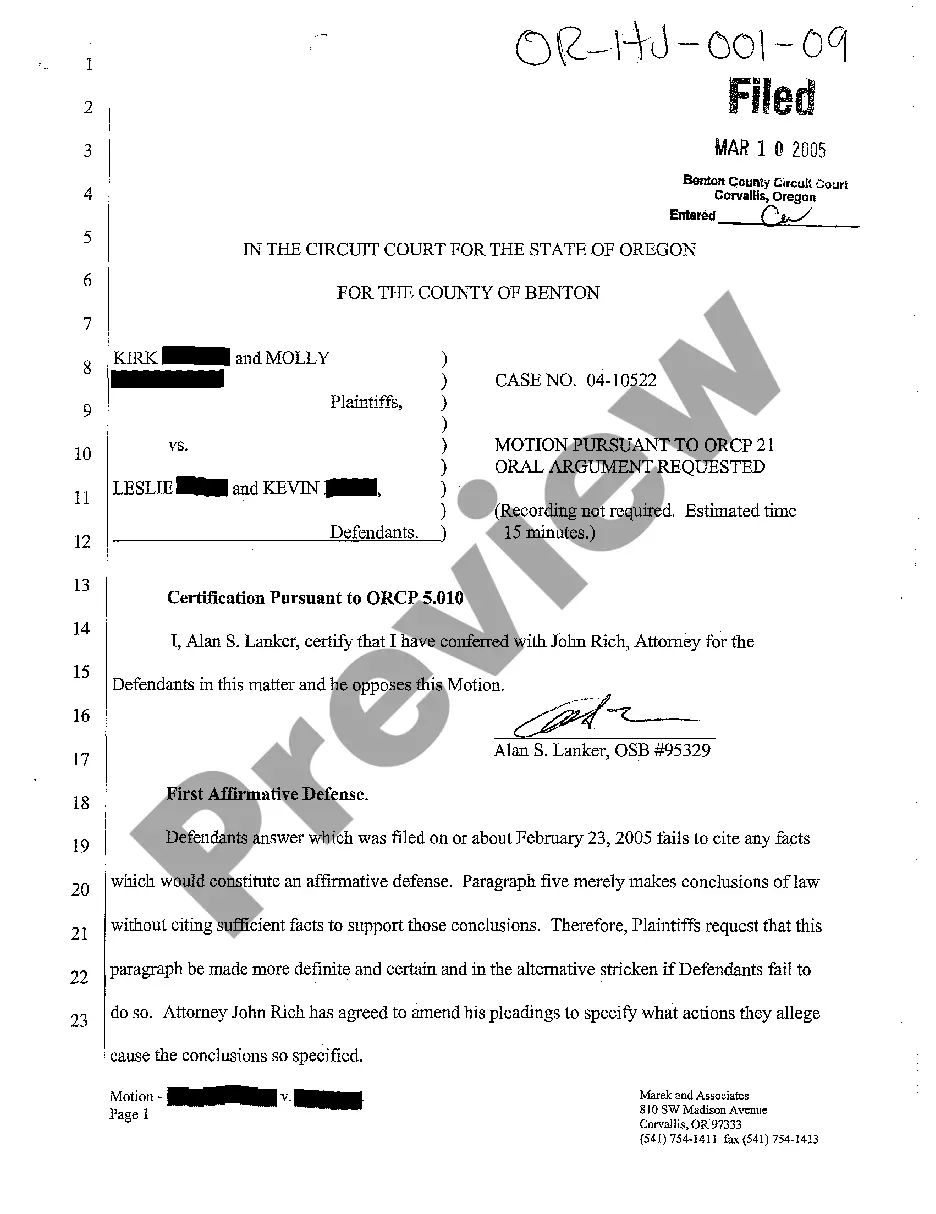

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are confident that the form is suitable, click the Acquire now button to download the form.

- Choose the pricing plan you need and enter the required information. Create your account and complete your order using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

Form popularity

FAQ

compete clause in a Shareholders Agreement prevents shareholders from engaging in business activities that directly compete with the corporation. This clause serves to protect the corporation's interests and maintain its competitive edge. When structuring your Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, including a noncompete clause can be a crucial consideration for securing the company’s future.

The main points of a Shareholders Agreement include ownership structure, share transfer procedures, and shareholder rights and responsibilities. Additionally, it often covers voting rights, dividend distribution, and non-compete obligations. Understanding these elements is crucial for creating an Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions that aligns with your company's goals.

compete clause in a shareholder agreement restricts shareholders from engaging in competitive activities after they leave the corporation. This clause is vital in protecting the company's interests and trade secrets. In the Illinois Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, such clauses help ensure that outgoing shareholders do not harm the business by leveraging insider knowledge.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

The main things to consider including in a shareholders' agreement are:The nature of the company and its purpose.The process for appointing a director.How decisions about the company will be made.How disputes will be resolved.The shareholders' rights to information.How shares will be distributed and sold.More items...?

Events Covered Under a Buyout Agreementa divorce settlement in which a partner's ex-spouse stands to receive a partnership interest in the company. the foreclosure of a debt secured by a partnership interest. the personal bankruptcy of a partner, or. the disability, death, or incapacity of a partner.

A shareholders' agreement is a legally enforceable contract and the rules on its enforceability, and the remedies available in the event of a breach, will in many cases be the normal rules of contract law.

A partnership buyout is when the director of a company buys out the shares of their partner and terminates a partnership agreement or buys out the co-director over time until the full share has been purchased.

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.