Illinois Sample Letter for Credit - Christmas Extension Announcement

Description

How to fill out Sample Letter For Credit - Christmas Extension Announcement?

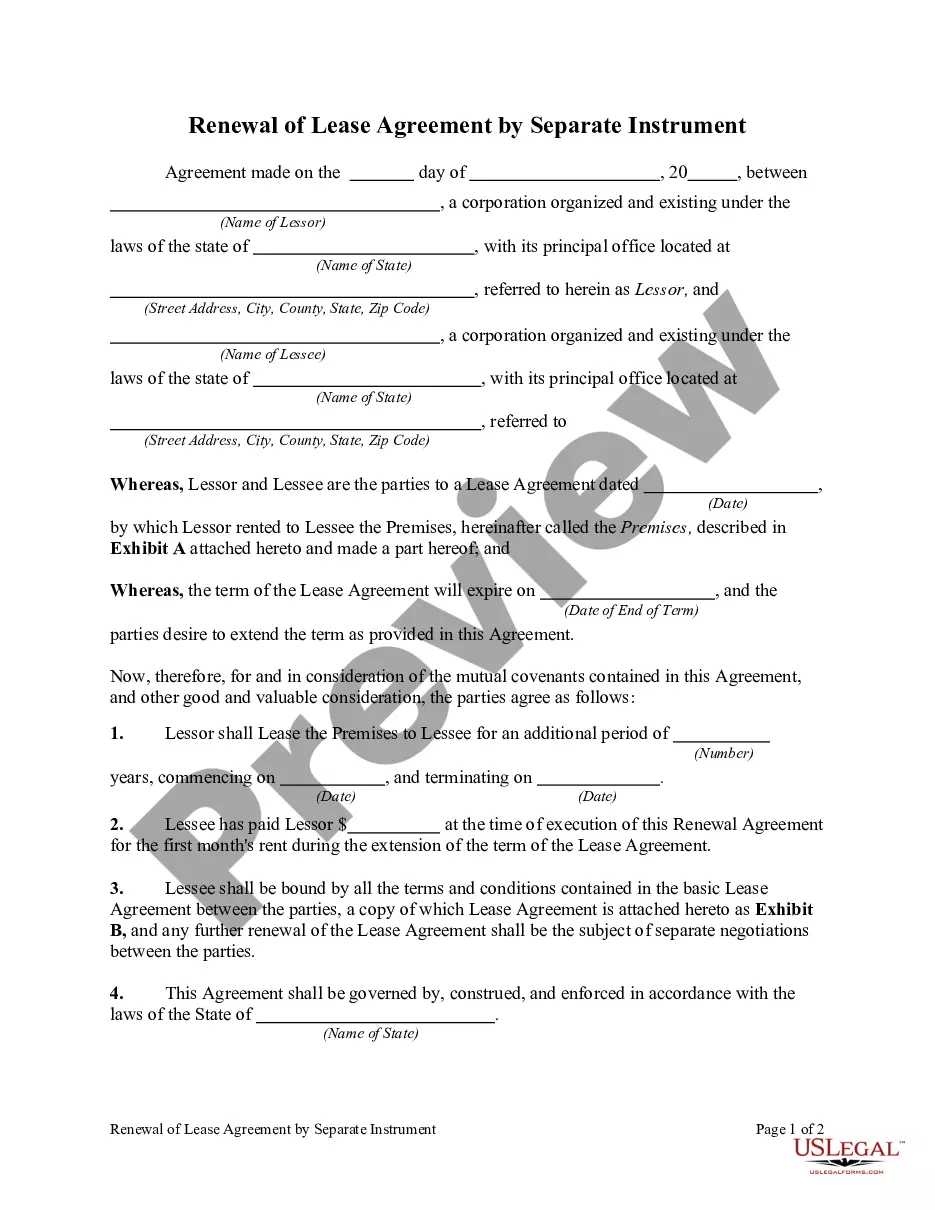

Have you found yourself in a situation where you require documents for either business or specific purposes nearly every day.

There are numerous legal document templates available online, but locating reliable ones is not easy.

US Legal Forms offers thousands of template options, including the Illinois Sample Letter for Credit - Christmas Extension Announcement, that are designed to meet state and federal requirements.

When you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Sample Letter for Credit - Christmas Extension Announcement template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/state.

- Utilize the Review button to evaluate the form.

- Read the description to confirm you have selected the proper form.

- If the form is not what you need, use the Search box to find a form that meets your needs and specifications.

Form popularity

FAQ

Yes, Illinois does require corporations to file for an extension if they cannot meet the tax filing deadline. Applying for an extension allows businesses additional time to complete their tax returns, which is essential for proper compliance. It’s important to file the extension correctly to avoid any penalties. As you prepare your request, the Illinois Sample Letter for Credit - Christmas Extension Announcement may offer valuable insights.

Receiving a letter from the Illinois Department of Revenue signals that they need to communicate something important about your tax situation. This could be due to an inquiry, notification of a tax adjustment, or a request for action on your part. Understanding the reason can help you respond appropriately. If you need to draft a response, use the Illinois Sample Letter for Credit - Christmas Extension Announcement as a helpful resource.

Filing an extension for Illinois state taxes involves completing specific forms provided by the Illinois Department of Revenue. You will generally need to submit an application for extension before the tax deadline. This gives you extra time to file your tax return without incurring penalties. For advice on how to structure your extension request, consider the Illinois Sample Letter for Credit - Christmas Extension Announcement.

The Illinois Department of Revenue may send you a letter for several reasons, usually concerning your taxes. It could relate to a filing issue, missing documentation, or a request for further information. It's important that you take the time to understand the content of any letters received. If you need to respond, the Illinois Sample Letter for Credit - Christmas Extension Announcement can serve as an effective template.

Mail from the Department of Revenue is often related to your tax filings or payments. They may send letters explaining changes to your tax account, requests for information, or notifications of audits. It's essential to review this mail carefully to determine any required actions. In case of confusion, reference the Illinois Sample Letter for Credit - Christmas Extension Announcement for guidance on correspondence.

The Illinois Department of Revenue collects various taxes, including income tax, sales tax, and property tax. Their role is to ensure compliance with state tax laws and to facilitate revenue collection for state services. Understanding what they collect is essential for any taxpayer in Illinois. To assist you in communicating with the department, consider using the Illinois Sample Letter for Credit - Christmas Extension Announcement.

To request a letter ID for your Illinois taxes, you should contact the Illinois Department of Revenue directly. They have specific procedures in place to assist taxpayers in obtaining this information. You may need to provide personal identification details to verify your identity. Using the Illinois Sample Letter for Credit - Christmas Extension Announcement can help streamline your request.

Receiving a certified letter from the Department of Revenue typically indicates that they need to communicate important information regarding your tax status. This could be related to unpaid taxes, specific documentation, or other tax matters. It’s crucial to read the letter carefully to understand the context. For those interested, you might consider utilizing the Illinois Sample Letter for Credit - Christmas Extension Announcement as it could guide you in responding appropriately.