Arizona Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest

Description

How to fill out Assignment Of Oil And Gas Leases Of All Interest, Reserving An Overriding Royalty Interest?

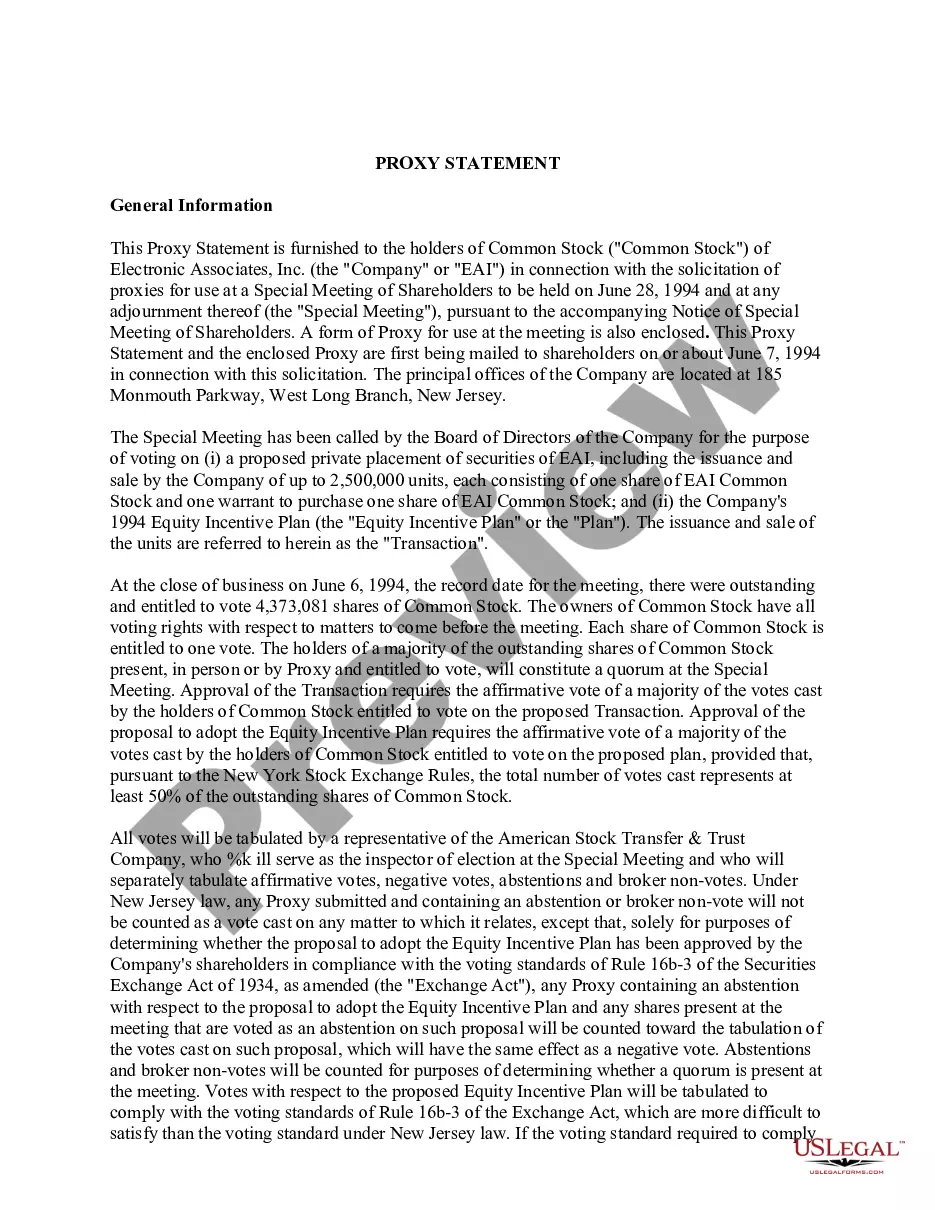

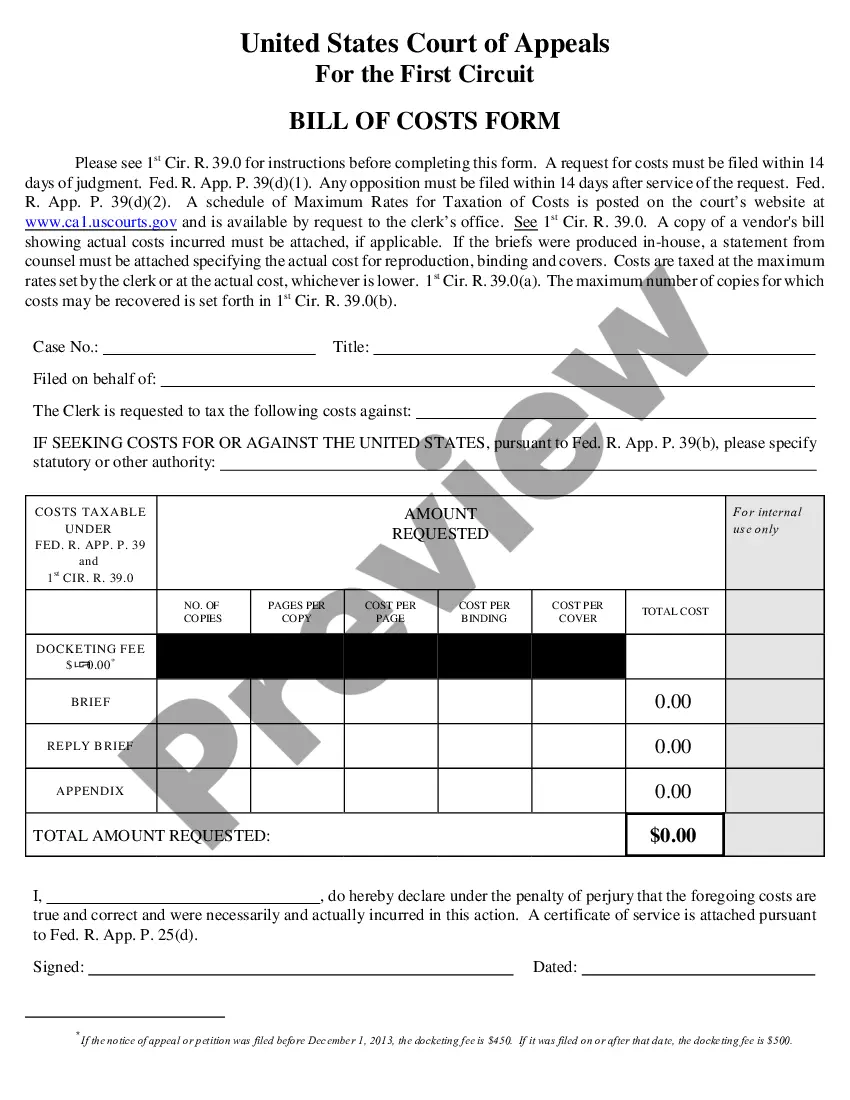

Choosing the best legal document template could be a have a problem. Needless to say, there are plenty of web templates available on the Internet, but how would you obtain the legal type you need? Use the US Legal Forms internet site. The service gives 1000s of web templates, like the Arizona Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest, that you can use for enterprise and personal requirements. All of the kinds are inspected by pros and meet up with state and federal requirements.

If you are already registered, log in to the accounts and then click the Download switch to obtain the Arizona Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest. Utilize your accounts to search from the legal kinds you possess purchased previously. Visit the My Forms tab of the accounts and obtain one more version of the document you need.

If you are a brand new end user of US Legal Forms, listed here are easy guidelines that you can stick to:

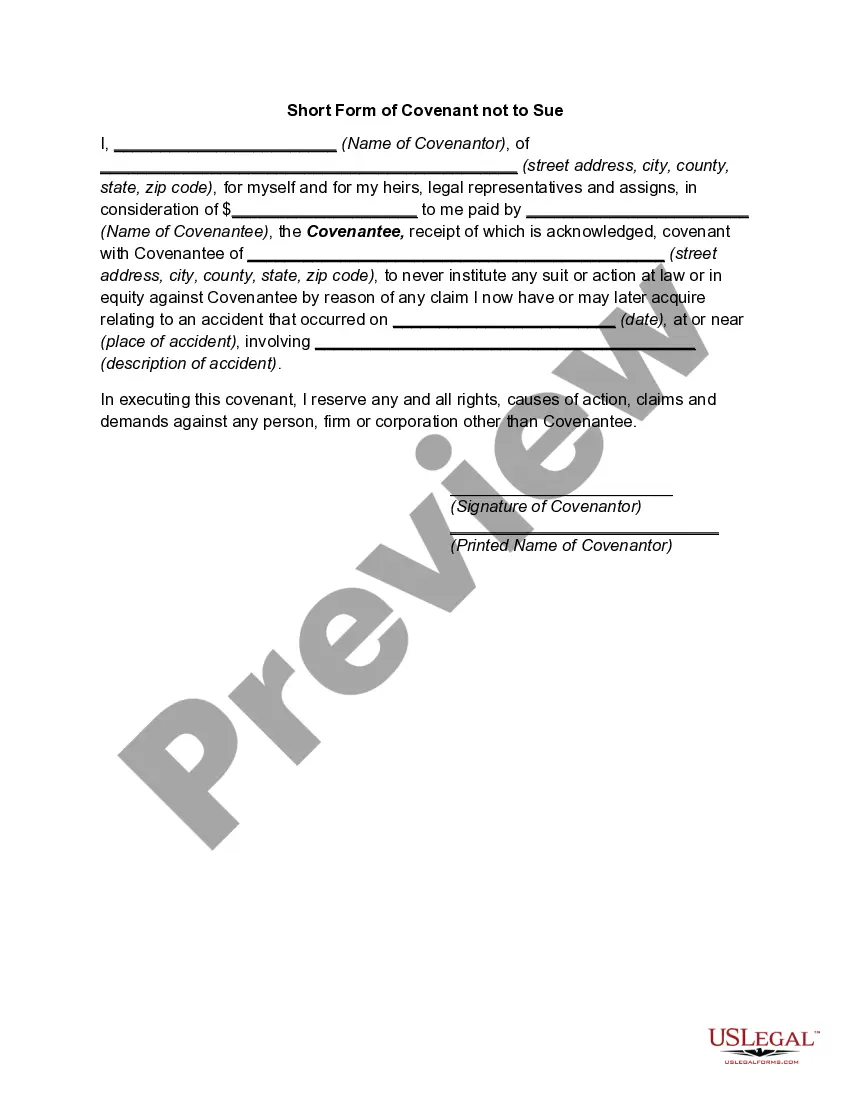

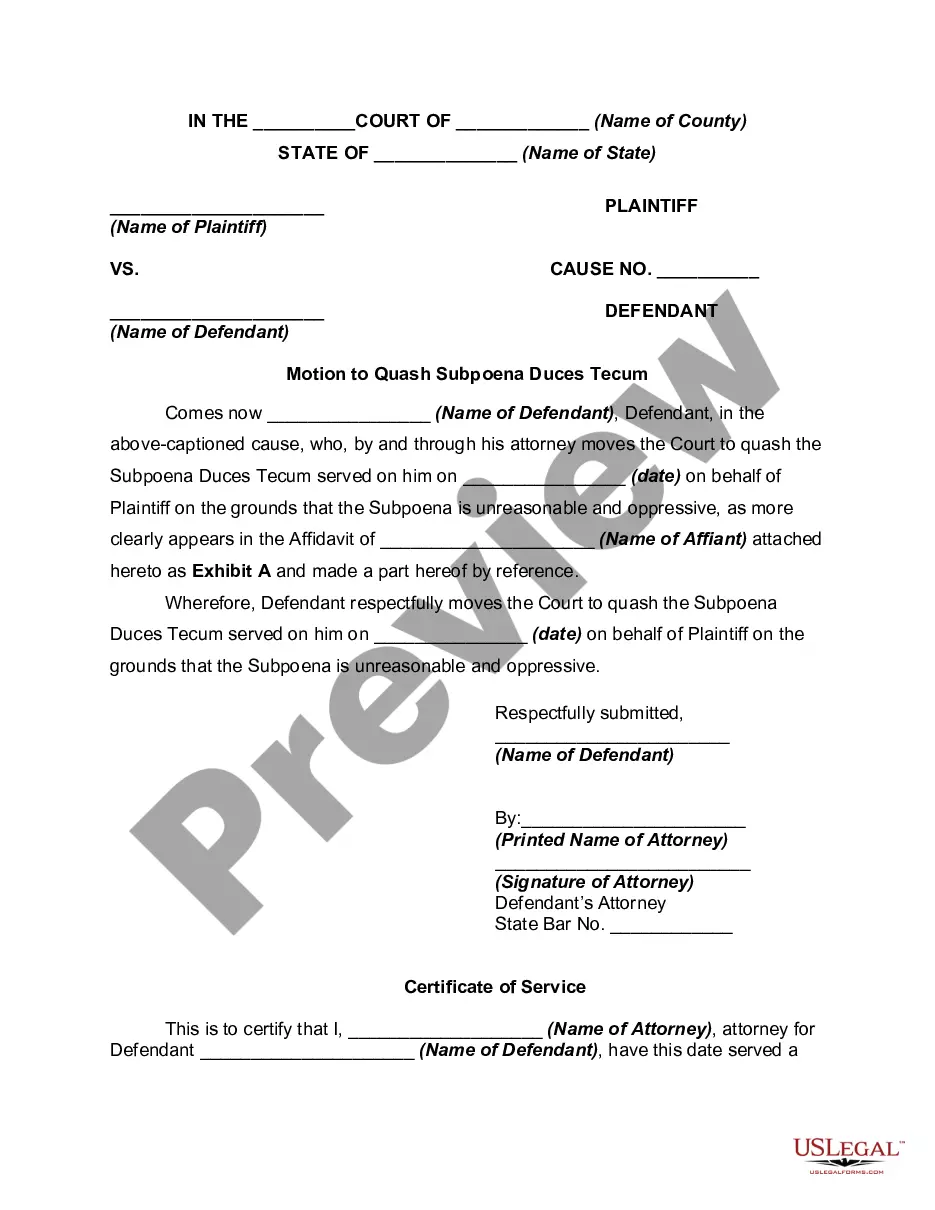

- Initial, make sure you have selected the correct type for your town/area. You can look through the shape utilizing the Preview switch and look at the shape description to ensure it is the best for you.

- When the type will not meet up with your expectations, take advantage of the Seach industry to find the proper type.

- When you are certain that the shape is acceptable, select the Get now switch to obtain the type.

- Pick the pricing program you want and enter in the necessary information and facts. Build your accounts and buy the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Select the data file formatting and acquire the legal document template to the system.

- Total, revise and produce and sign the acquired Arizona Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest.

US Legal Forms is the largest local library of legal kinds for which you can find a variety of document web templates. Use the company to acquire skillfully-manufactured documents that stick to state requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

The oil and gas business; assignments are the documents used. to accomplish transfers of lease rights .1./ Although the. common form of assignment may appear to be a rather simple. document, the respective rights and obligations of the parties.

The most prevalent example of a term oil and gas interest is an oil and gas lease, which creates in the lessee a leasehold estate commonly referred to in the oil and gas industry as a working or operating interest. The rights granted under an oil and gas lease to a lessee may vary from lease to lease.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

Net Revenue Interest is the portion of an oil and gas leaseholder's interest in production that they are entitled to receive as part of their lease. The amount is calculated after deducting all royalty payments, production costs, and other fees.