Illinois Sample Letter for Assets and Liabilities of Decedent's Estate

Description

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

If you have to comprehensive, download, or print out legitimate papers themes, use US Legal Forms, the most important selection of legitimate forms, that can be found on the web. Make use of the site`s simple and easy handy look for to obtain the papers you need. Numerous themes for organization and personal purposes are sorted by classes and states, or search phrases. Use US Legal Forms to obtain the Illinois Sample Letter for Assets and Liabilities of Decedent's Estate within a few mouse clicks.

Should you be previously a US Legal Forms customer, log in for your account and then click the Download button to find the Illinois Sample Letter for Assets and Liabilities of Decedent's Estate. You can also entry forms you in the past acquired from the My Forms tab of your respective account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your appropriate city/nation.

- Step 2. Make use of the Review choice to check out the form`s articles. Don`t overlook to read through the outline.

- Step 3. Should you be not happy together with the develop, use the Search field towards the top of the display to discover other models from the legitimate develop web template.

- Step 4. Upon having found the shape you need, click on the Get now button. Opt for the pricing prepare you choose and add your references to sign up to have an account.

- Step 5. Process the purchase. You can utilize your charge card or PayPal account to finish the purchase.

- Step 6. Pick the structure from the legitimate develop and download it on your own system.

- Step 7. Total, revise and print out or indication the Illinois Sample Letter for Assets and Liabilities of Decedent's Estate.

Every legitimate papers web template you acquire is your own property permanently. You may have acces to each and every develop you acquired inside your acccount. Click the My Forms section and select a develop to print out or download once more.

Compete and download, and print out the Illinois Sample Letter for Assets and Liabilities of Decedent's Estate with US Legal Forms. There are millions of expert and condition-certain forms you can utilize for your personal organization or personal requires.

Form popularity

FAQ

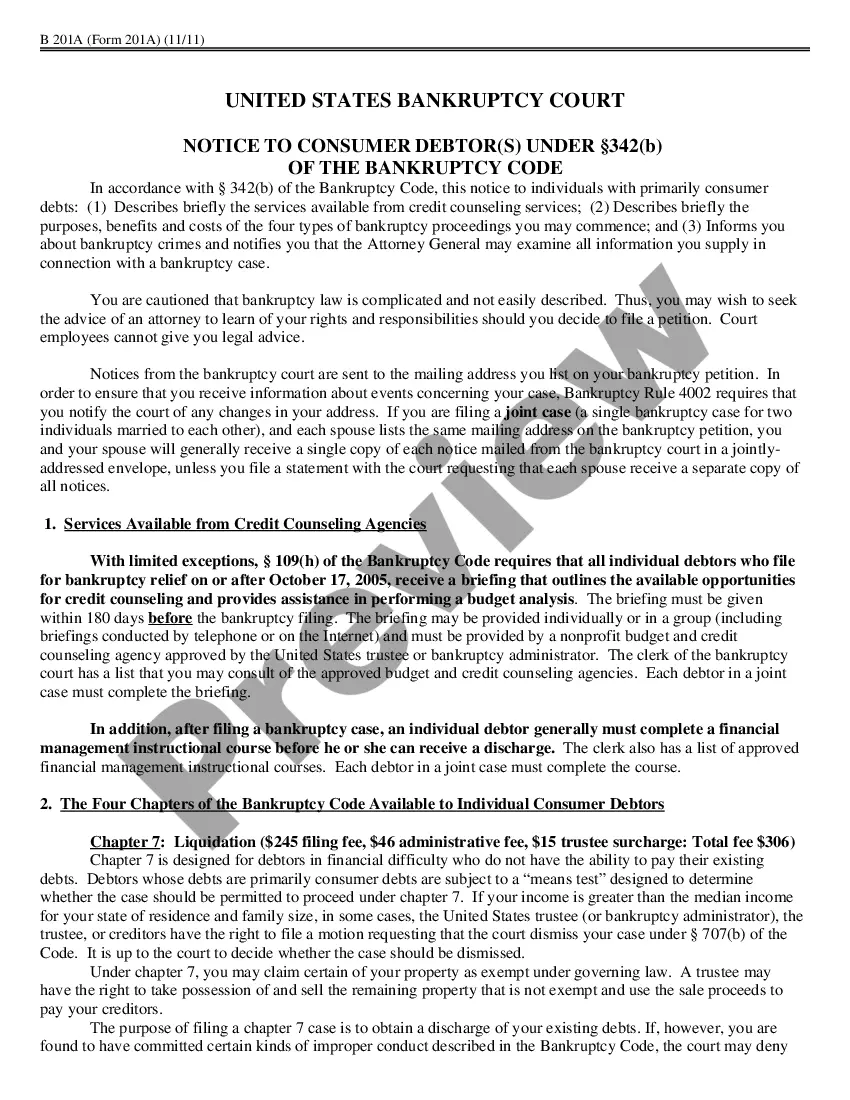

Deadline to file a Petition for Letters of Administration: 30 days after death. Letters of Administration are granted by an Illinois probate court to determine the person who will administer the estate of someone who dies without a will.

Do I Have to List All Bank Accounts on the Inventory? Yes. Any and all bank accounts that the decedent owned must be listed on the inventory. This is true even if the bank accounts were held with payable-on-death (POD) designations or if the bank accounts were jointly held with the right of survivorship.

A Deed of Estate Inventory (?Deed?) is a summary of all the deceased's assets and liabilities and list of the heirs. In addition, it acts as a tax notification on the basis of which inheritance tax is imposed on the heirs.

What's Included in A Small Estate Affidavit? Provide the name of the person who died and the date of the death. State that the value of the assets in the estate is less than $50,000. State that at least 60 days have passed since the death. State that no application to appoint a personal representative has been granted.

Assets should be clearly identified, listed in reasonable detail, and valued as of the decedent's date of death (not the date the inventory is prepared).

This inventory must include all of the decedent's (i) personal estate under your supervision and control, (ii) interest in any multiple party account (which is defined in Part 2) in any financial institution, (iii) real estate over which you have a power of sale, and (iv) other real estate that is an asset of the ...

In Illinois, executors who are tasked with administering an estate must begin the process by petitioning the probate court in the county where the decedent resided for a letter of testamentary, or a letter of administration.