Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property

Description

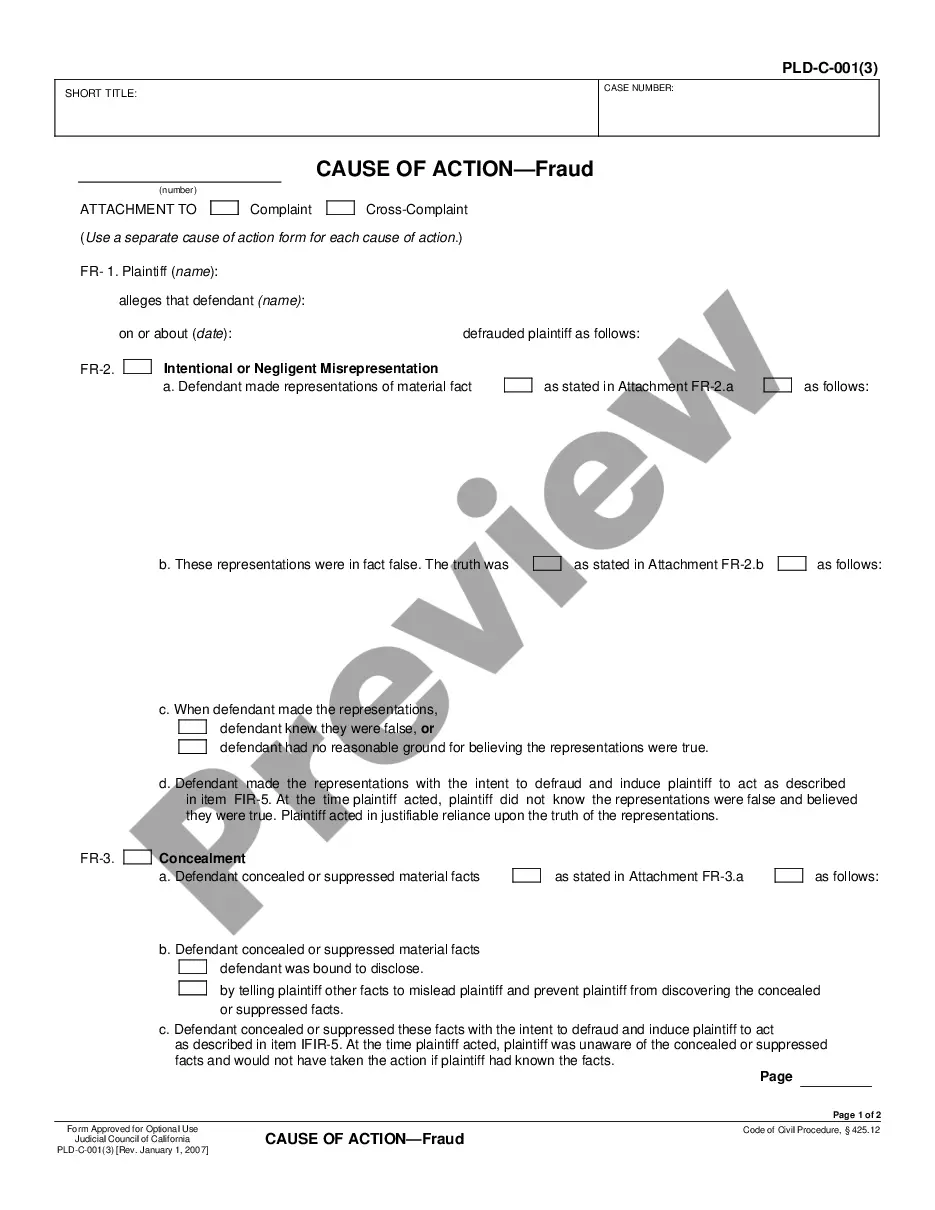

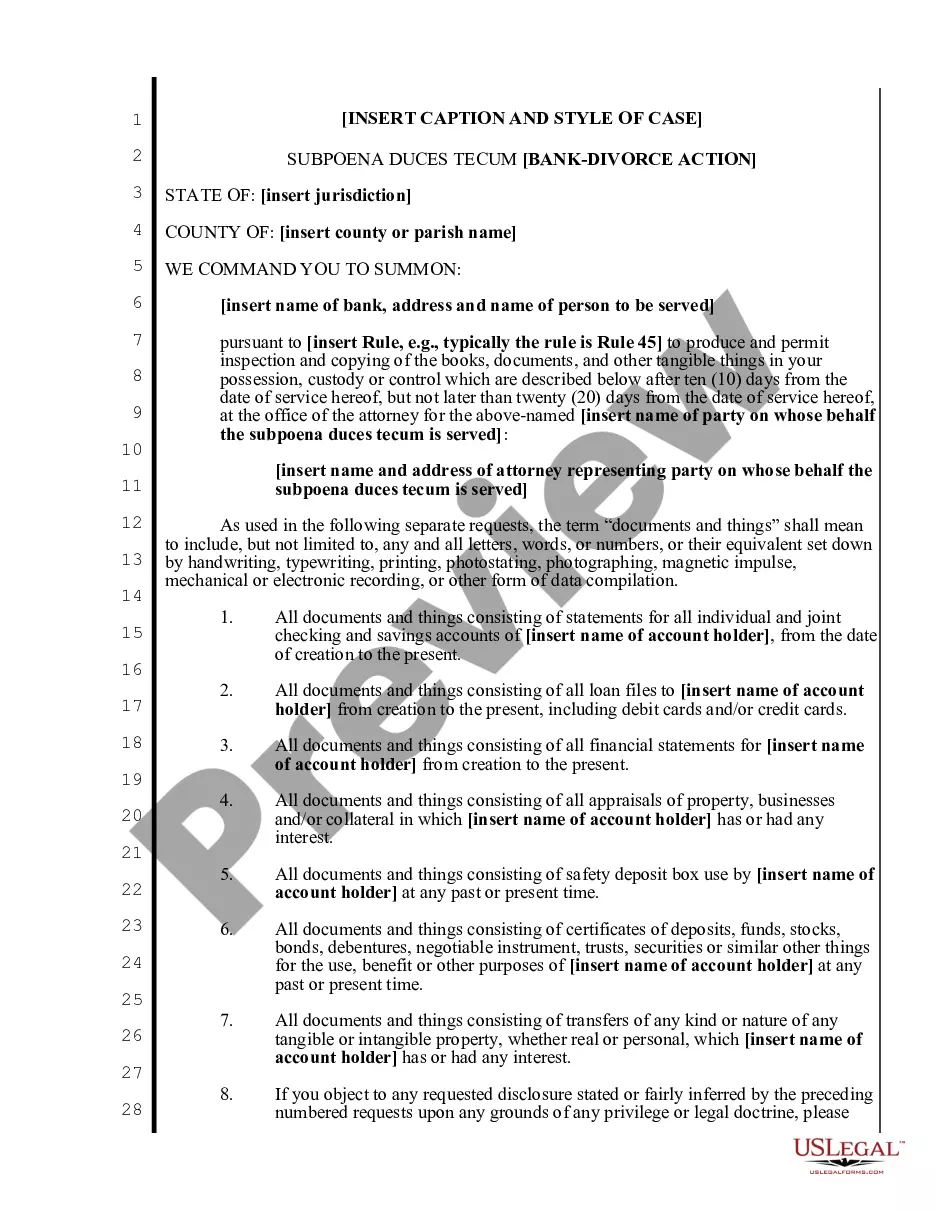

How to fill out Notice Of The Findings Of The Lost Property To Apparent Owner Of Property?

Selecting the appropriate legitimate document template can be quite a challenge. Obviously, there are numerous templates accessible online, but how do you find the valid format you need? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property, that can be utilized for business and personal needs. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download option to obtain the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property. Use your account to browse through the legal documents you may have purchased previously. Visit the My documents tab in your account and get another copy of the document you need.

Fill out, modify, print, and sign the acquired Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property. US Legal Forms is undoubtedly the largest repository of legal forms where you can find various document templates. Use the service to procure professionally-crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

- First, ensure you have selected the correct form for your area/county. You can review the form using the Preview option and examine the form summary to confirm that this is indeed the right one for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident that the form is appropriate, click on the Purchase now button to acquire the form.

- Select the payment plan you prefer and input the necessary information. Create your account and complete your order using your PayPal account or credit card.

- Choose the format and download the legal document template to your device.

Form popularity

FAQ

Dormant account rules in Illinois dictate how long an account can remain inactive before it is deemed unclaimed. Typically, an account is considered dormant after five years of inactivity. Institutions must follow the guidelines of the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property, which requires them to notify account holders before this status is declared. It is wise for account holders to regularly check their accounts to avoid potential issues.

Unclaimed property does not technically expire, but there are specific timelines after which it may be turned over to the state. In Illinois, if the owner does not reclaim property within the specified dormancy period, it is declared unclaimed. The Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property serves as an important warning, encouraging owners to take action before their property is officially transferred.

In Illinois, the dormancy period refers to the length of time before property is considered unclaimed. For most types of personal property, this period spans five years, prompting businesses to report these findings accordingly. The Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property plays a crucial role in notifying owners ahead of this deadline, ensuring they have the opportunity to reclaim their property.

The dormancy period for unclaimed property in Illinois typically lasts for five years. During this timeframe, businesses or organizations must make efforts to locate the owner and notify them, as outlined by the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property. After the dormancy period, the property may be turned over to the state, making it essential for owners to act promptly.

In Illinois, the duration for which unclaimed property is kept depends on the type of property. Generally, unclaimed property is held for a period of five years before it is reported to the state. The Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property ensures that apparent owners are notified during this time, allowing them to reclaim their belongings.

The lost and found law in Illinois outlines how unclaimed property is handled, ensuring that items lost by individuals can be returned to their rightful owners. When an entity finds lost property, they must report it and notify the apparent owner in accordance with the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property. This law provides a structured process for individuals to reclaim their lost possessions.

To claim unclaimed property in Illinois, you typically need documentation such as identification, proof of address, and, in the case of deceased individuals, a death certificate. Additional documents may be necessary based on your relationship to the owner. The Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property outlines the required documents to ensure a smooth claim process.

In Illinois, property is generally considered abandoned after three years of inactivity, although this can vary based on the type of property. Various factors can influence this timeframe, so it’s crucial to be aware of the specifics related to your situation. You can refer to the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property for clarity.

You will not get in trouble for claiming unclaimed property as long as you are the rightful owner or have legal rights to it. Making a false claim, however, can lead to legal issues, so it's essential to provide accurate information. Trust the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property to help you navigate the claim process properly.

The processing time for unclaimed property in Illinois can vary, but it typically takes several weeks to a few months. The speed of processing depends on the completeness of your claim and the volume of applications being handled. Keep an eye on the updates provided through the Illinois Notice of the Findings of the Lost Property to Apparent Owner of Property for more information.