Illinois Location Worksheet

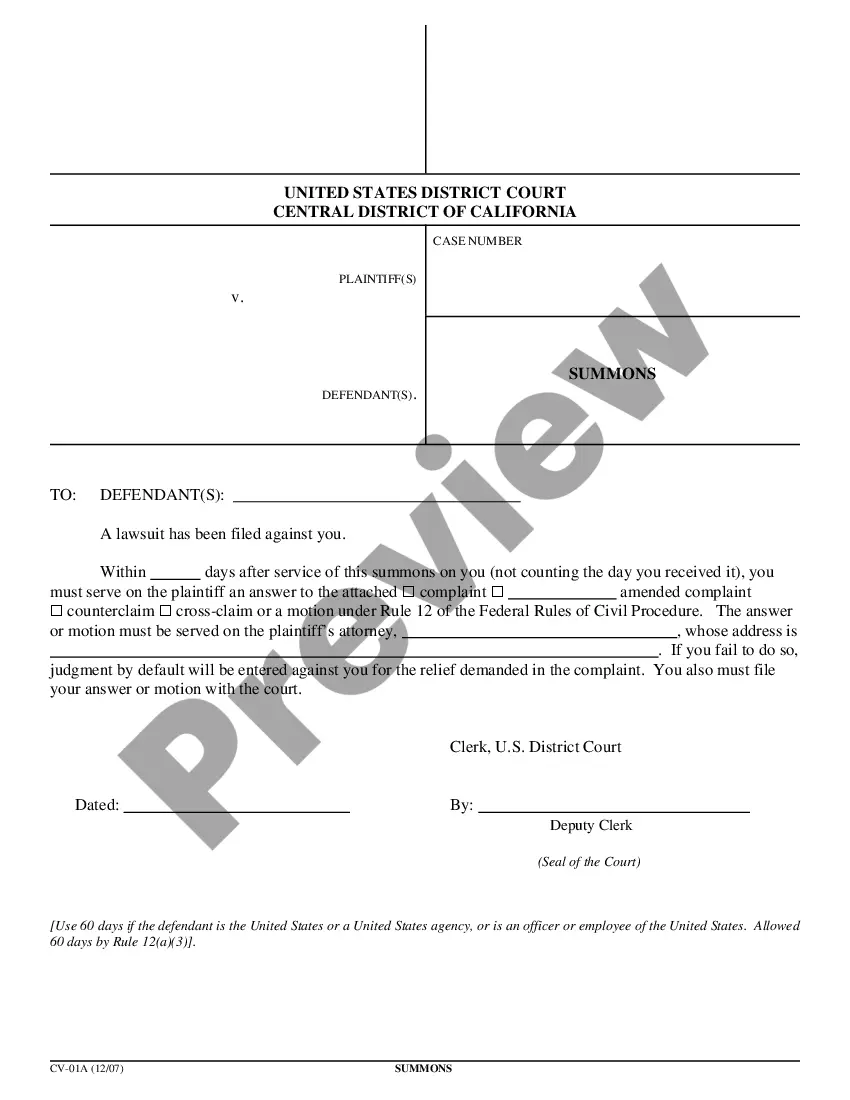

Description

How to fill out Location Worksheet?

Have you found yourself in a scenario where you require paperwork for either professional or personal reasons nearly every day? There are numerous legal document templates available online, yet finding ones you can trust is not easy.

US Legal Forms offers thousands of document templates, such as the Illinois Location Worksheet, designed to fulfill federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Illinois Location Worksheet template.

- Acquire the form you require and ensure it corresponds to the correct city/state.

- Use the Review feature to evaluate the document.

- Read the description to confirm that you have selected the correct form.

- If the document is not what you are looking for, utilize the Search area to find the form that fits your needs.

- Once you find the right template, click Buy now.

- Select your desired pricing plan, fill in the required details to create your account, and complete the payment using your PayPal or Visa/Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To determine where to file state taxes, start by considering where you resided during the tax year. The Illinois Location Worksheet is a valuable resource that helps you trace your residency throughout the year. It provides the information necessary for understanding your state tax obligations. Gathering this data ensures that your tax situation is handled appropriately and reduces the risk of errors.

If you have moved during the tax year, you should file your taxes in the state where you maintained your primary residence for the majority of the year. To clarify this, the Illinois Location Worksheet is a helpful tool that can guide you in determining your filing state. If you divided your time equally between states, consider where you earned more income. This consideration plays a crucial role in correctly determining your tax obligations.

When filing your IL 1040, you should include any necessary forms and schedules relevant to your income and deductions. Additionally, attach the Illinois Location Worksheet if you have moved or if your residency status is unclear. Providing this information ensures that your tax return is complete, reducing the likelihood of delays in processing. Always check that you have included any forms required for your specific situation.

Determining the state to file taxes in largely depends on your residency during the tax year. If you moved, consider using the Illinois Location Worksheet to establish your primary residence for tax purposes. It provides essential information about where you lived and worked throughout the year. This clarity can help you file your taxes correctly and avoid unnecessary complications.

The reject code IL1040 10000 1 typically indicates a problem with the information reported on your Illinois tax return. This code suggests that the state lacks the necessary documentation for processing your IL1040 form. To resolve this issue, refer to the Illinois Location Worksheet, as it can help you clarify your address and residency status, ensuring accurate submission.

The 1049 form is a tax document used to report various income sources in Illinois. It helps to provide clarity on your taxable income, aiding your tax filing process. Utilizing the Illinois Location Worksheet can assist you in accurately filling out the 1049 form. It is crucial to ensure proper reporting to avoid issues with state taxes.

Yes, state taxes are generally based on your residency status. When you live in Illinois, your income is subject to Illinois state taxes. This is important to consider when using the Illinois Location Worksheet. The worksheet helps determine your tax responsibilities based on your location.

To fill out your 1040, you will need a variety of documents including your W-2 forms, 1099s, and receipts for any deductions. It's also beneficial to have your Social Security number handy, along with any dependent information. Using an Illinois Location Worksheet can help you compile all of these details into one convenient format. This preparation ensures a smoother and more accurate tax filing experience.

To fill out Schedule 1 line 1, you must report additional income that does not appear on your Form 1040. This can include earnings like rental income or unemployment compensation. An Illinois Location Worksheet can assist you in methodically listing all additional income sources. By organizing this information ahead of time, you can confidently complete this part of your tax return.

The simplest Form 1040 is often referred to as the 1040-EZ, which is designed for straightforward tax situations, mainly for those with no itemized deductions. However, be aware that this form has specific eligibility requirements, including income limits. If your situation is more complex, use the Illinois Location Worksheet to gather necessary information, ensuring ease when completing the detailed Form 1040. This method helps streamline your tax filing process.