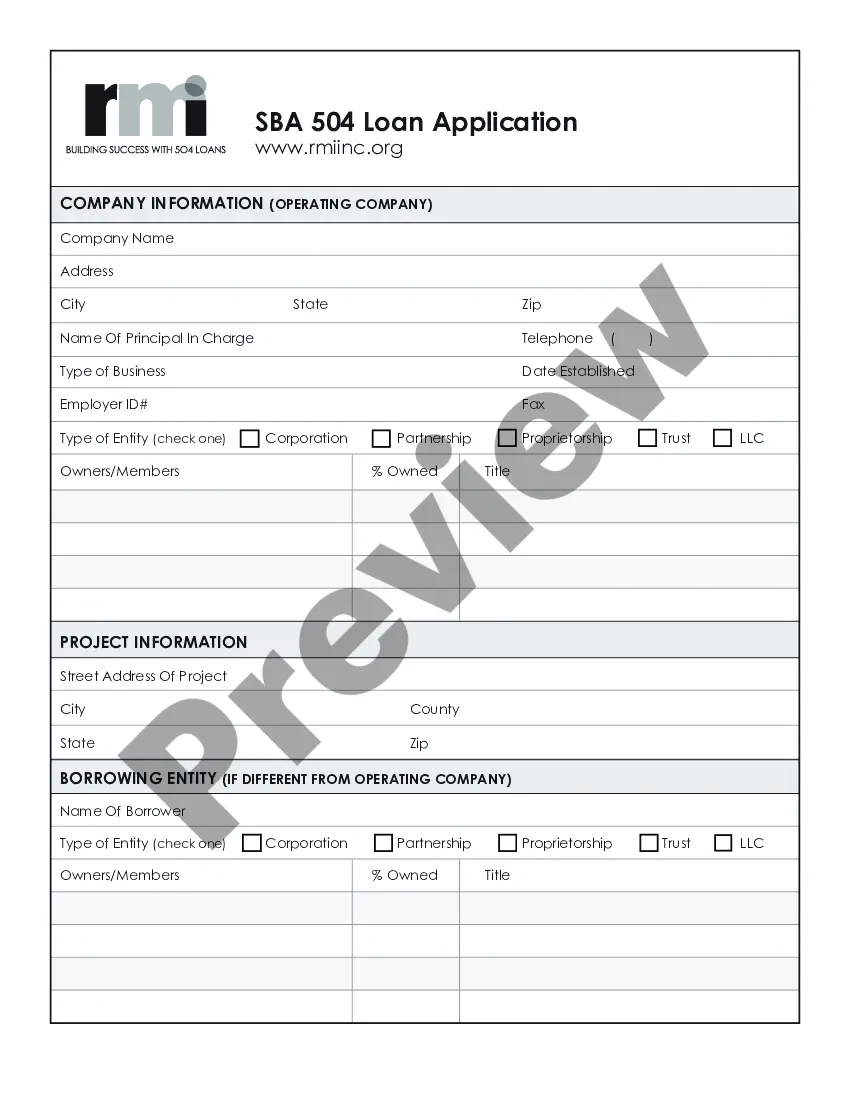

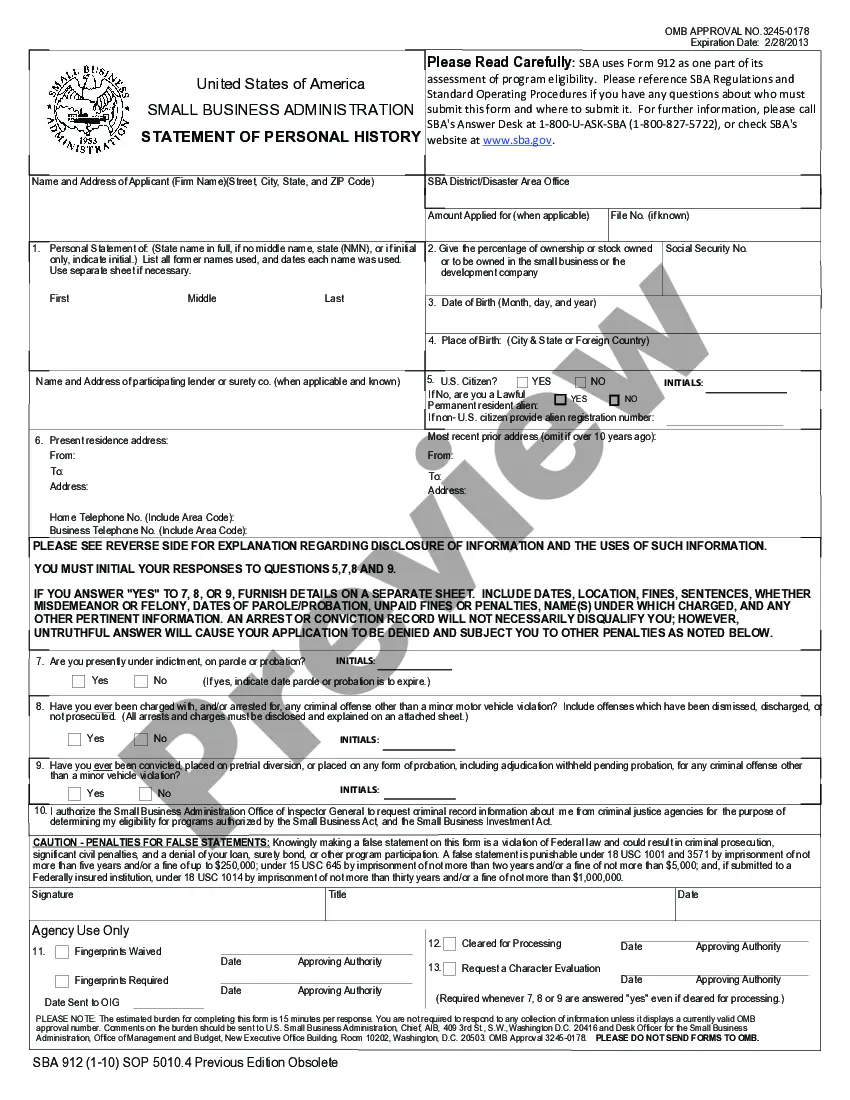

Illinois Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

US Legal Forms - one of many largest libraries of legal kinds in the States - gives a wide array of legal document web templates you can download or printing. While using internet site, you may get a huge number of kinds for organization and person functions, categorized by classes, states, or search phrases.You can find the latest variations of kinds just like the Illinois Small Business Administration Loan Application Form and Checklist within minutes.

If you have a membership, log in and download Illinois Small Business Administration Loan Application Form and Checklist through the US Legal Forms collection. The Down load switch will show up on each and every form you look at. You have accessibility to all earlier saved kinds in the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, listed below are basic recommendations to help you started off:

- Make sure you have selected the right form for your personal town/county. Click the Review switch to check the form`s content material. Browse the form outline to ensure that you have selected the right form.

- When the form doesn`t fit your specifications, make use of the Research industry on top of the display screen to discover the the one that does.

- If you are happy with the shape, confirm your selection by clicking the Purchase now switch. Then, pick the costs prepare you want and provide your credentials to register to have an bank account.

- Method the transaction. Make use of credit card or PayPal bank account to perform the transaction.

- Select the structure and download the shape on your device.

- Make modifications. Load, edit and printing and indication the saved Illinois Small Business Administration Loan Application Form and Checklist.

Every web template you added to your bank account does not have an expiry particular date and it is your own property for a long time. So, in order to download or printing yet another duplicate, just go to the My Forms portion and then click around the form you will need.

Gain access to the Illinois Small Business Administration Loan Application Form and Checklist with US Legal Forms, one of the most considerable collection of legal document web templates. Use a huge number of professional and express-distinct web templates that satisfy your company or person demands and specifications.

Form popularity

FAQ

The minimum credit score required for an SBA loan depends on the type of loan. For SBA Microloans, the minimum credit score is typically between 620-640. For SBA 7(a) loans, the minimum credit score is typically 640, but borrowers may find greater success if they can boost their credit score into the 680+ range.

SBA only makes direct loans in the case of businesses and homeowners recovering from a declared disaster. SBA partners with lenders to help increase small business access to loans.

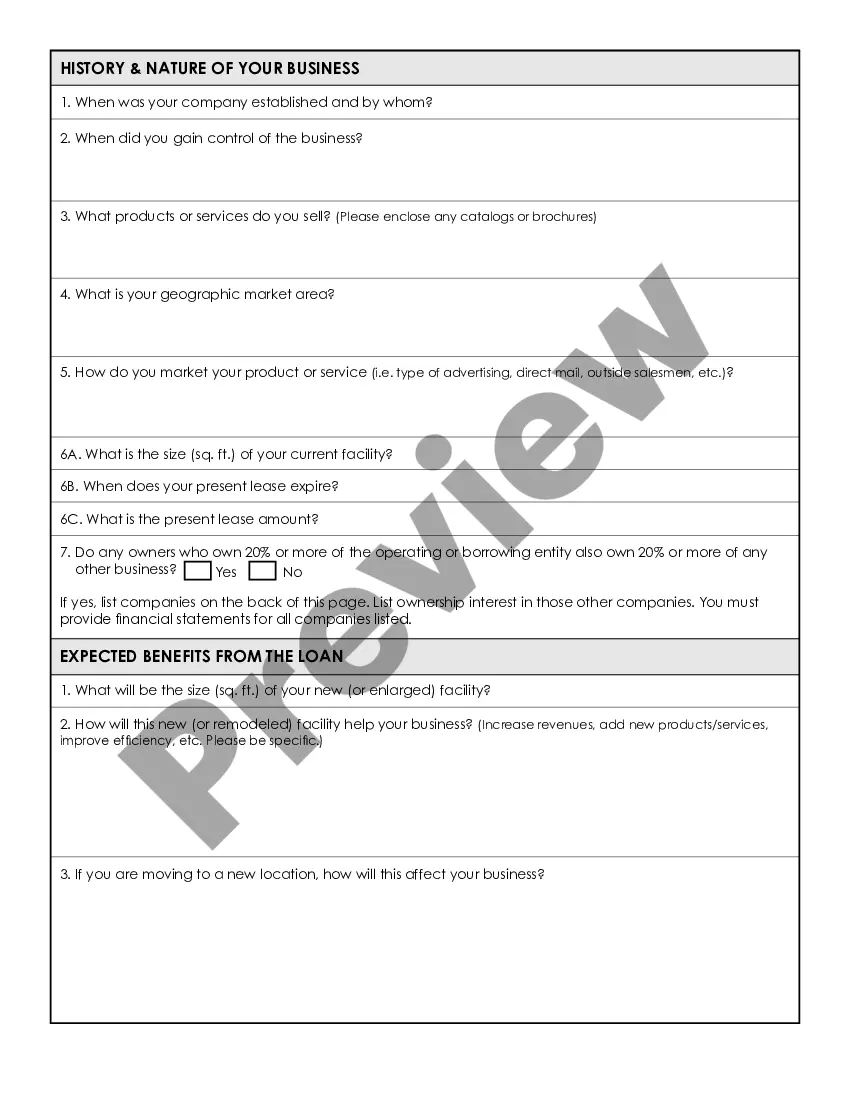

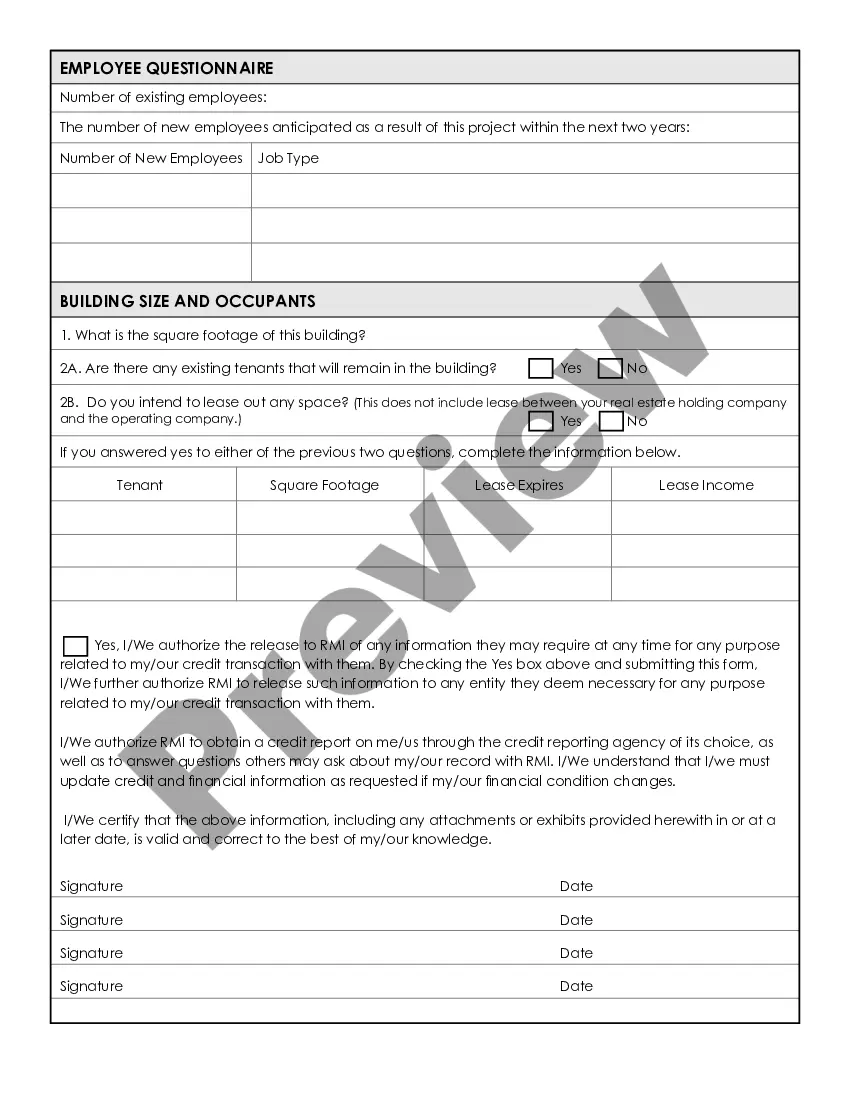

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

On average, most SBA loans take 30 to 90 days from applying to funding. 7(a) loan subtypes are backed directly by the SBA. Approval can take 30 to 60 days. Microloans are loans for smaller amounts of $50,000 or less.

You may get denied an SBA loan if your business could obtain financing elsewhere or has a wealth of assets above the loan amount requested. You also probably won't get approved if you've had a past default on a government loan. Finally, the SBA disqualifies specific industries, including: Financial institutions.

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

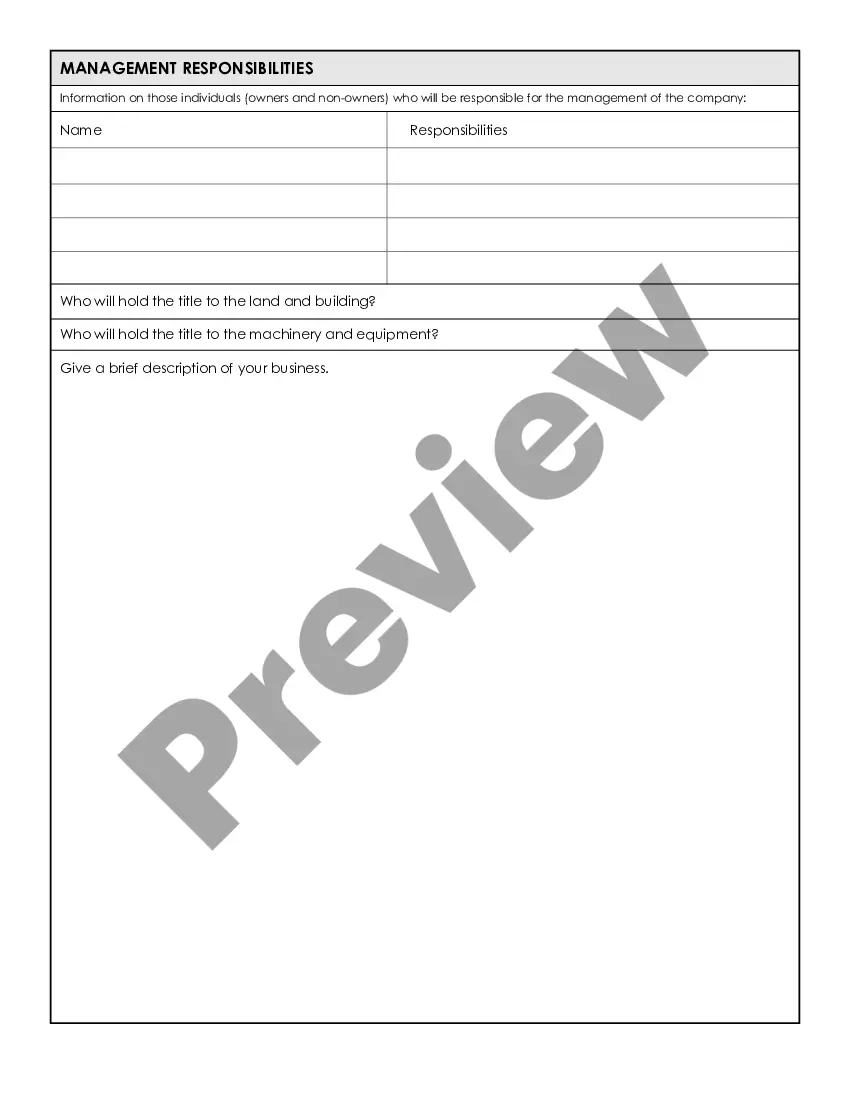

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.