Illinois Freeware License Terms

Description

How to fill out Freeware License Terms?

Have you found yourself in a circumstance where you need documents for either business or personal purposes daily.

There are numerous legitimate document templates available online, yet locating reliable ones is not easy.

US Legal Forms provides thousands of template options, including the Illinois Freeware License Terms, which are crafted to meet federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors.

The service offers expertly crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Illinois Freeware License Terms template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct area/region.

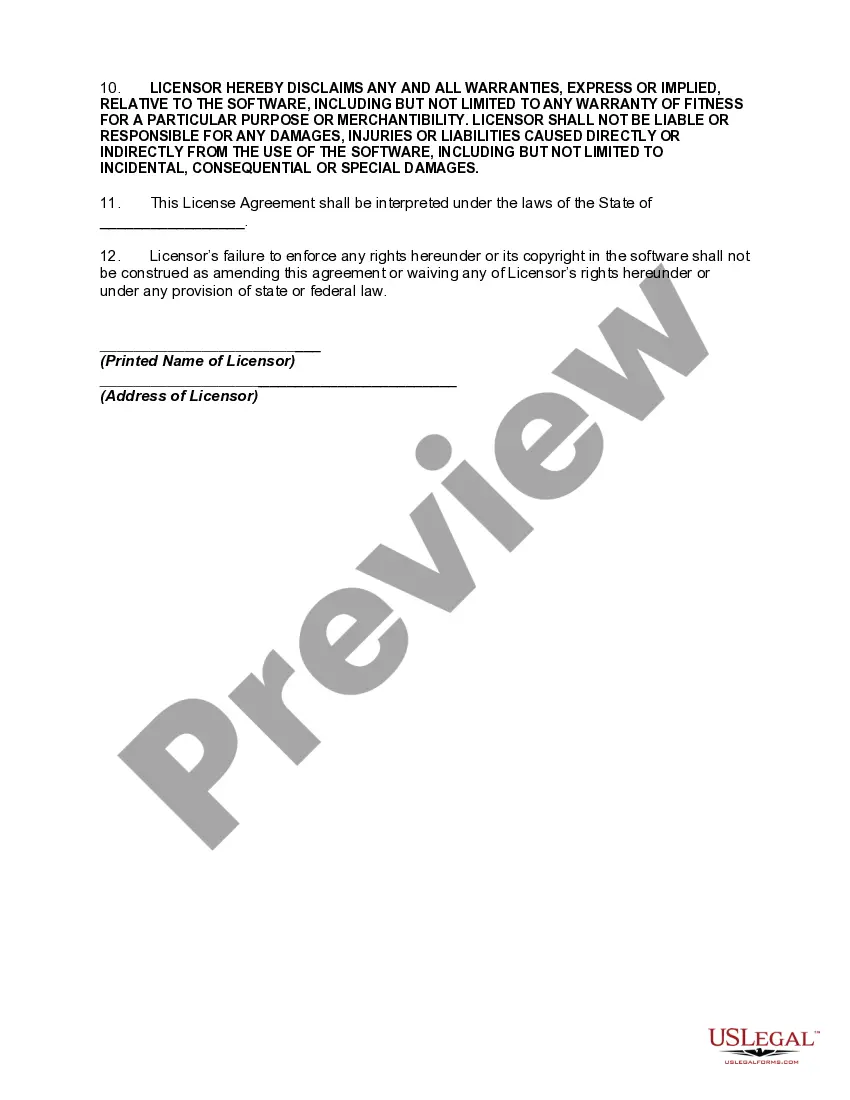

- Use the Review button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you require, utilize the Search field to find the form that meets your needs and criteria.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, fill in the necessary information to process your payment, and complete your order using PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of Illinois Freeware License Terms anytime if necessary. Click on the desired form to download or print the document template.

Form popularity

FAQ

There are four main types of software licenses: proprietary, open source, freeware, and shareware. Each type has its own set of usage rights and restrictions. Understanding the Illinois Freeware License Terms is crucial for selecting the right license for your needs and ensuring you're compliant with all applicable laws and regulations.

Opening a restaurant in Illinois requires various licenses, including a business license, a food service establishment license, and potentially a liquor license, depending on your offerings. Understanding the required licenses helps ensure compliance with state and local regulations. Utilizing resources like uslegalforms can simplify the application process and help you navigate the Illinois Freeware License Terms relevant to your business.

Software as a service (SaaS) can be taxable in Illinois, depending on how the service is rendered. If SaaS provides tangible personal property or is used merely as a transaction facility, it may fall under taxable services. Be sure to analyze your offerings under the Illinois Freeware License Terms, as understanding these distinctions can help optimize your tax obligations.

Several services are exempt from Illinois sales tax, including certain educational services, medical services, and some professional services. Businesses providing software under the Illinois Freeware License Terms may also qualify for specific exemptions based on how they structure their services. Always check the updates to the tax code to ensure compliance and benefit from available exemptions.

In Illinois, the tax deductibility of software licenses can vary based on the type of software and its use in your business. Generally, expenses related to software used for business purposes may be deductible. However, it is advisable to familiarize yourself with the Illinois Freeware License Terms and possibly consult with a tax advisor to ensure you maximize your deductions.

License fees can be subject to sales tax in Illinois, but it depends on the nature of the software and its use. For instance, if the software is considered tangible personal property, the Illinois Freeware License Terms may apply differently. It is important to review the specific terms of each license and consult with a tax professional to understand your obligations fully.

There are several factors that may disqualify you from obtaining a PERC card in Illinois. These include specific criminal convictions, failure to meet educational requirements, or not adhering to the Illinois Freeware License Terms. It is crucial to review the eligibility standards closely to avoid complications. If you're uncertain about your eligibility, uslegalforms can provide comprehensive resources to assess your situation.

In Illinois, the taxation of software licenses can depend on the licensing agreement. Generally, software licenses that grant permanent use may be taxable, while temporary licenses could be treated differently. Understanding the Illinois Freeware License Terms can be beneficial, as they outline relevant regulations. For clarity on your specific situation, consider consulting uslegalforms for precise information.

To obtain a PERC card in Illinois, you need to follow a structured application process. Start by completing the application and ensuring you meet the eligibility criteria. Additionally, familiarize yourself with the Illinois Freeware License Terms, as they may provide useful details about the process. If you require guidance, uslegalforms offers valuable resources to help you navigate obtaining your PERC card.