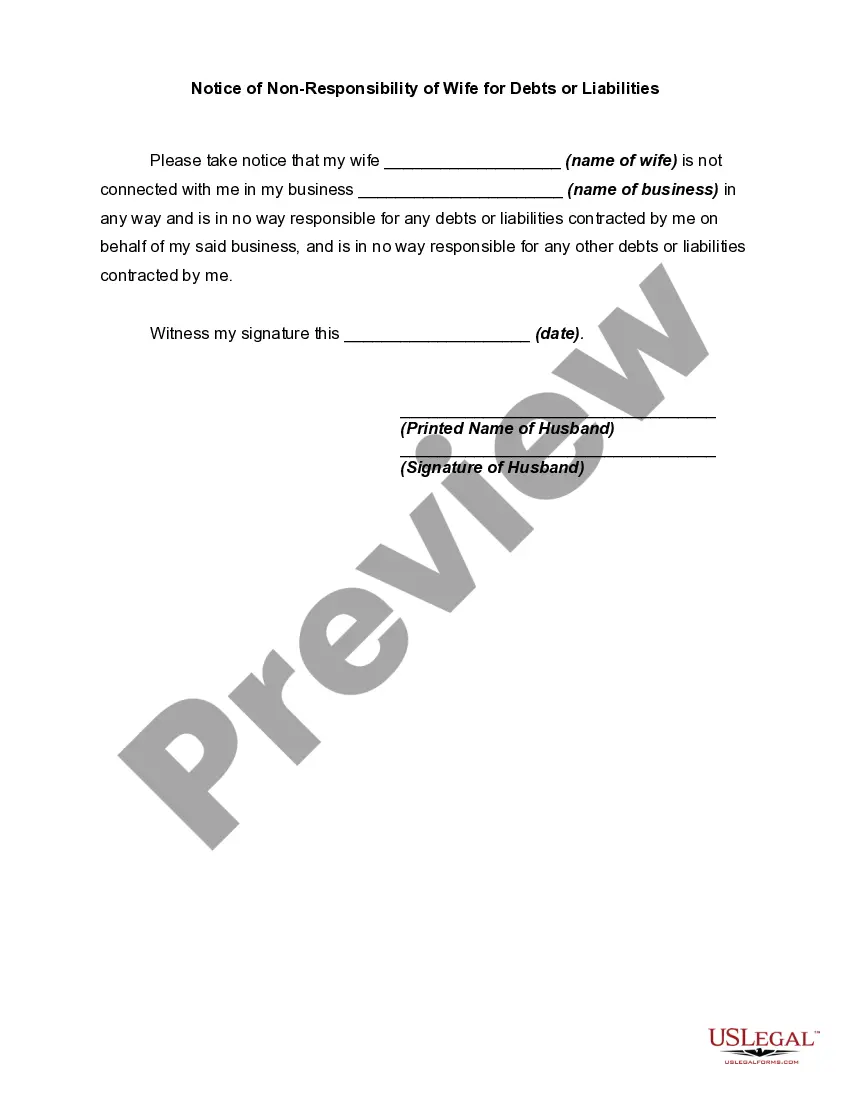

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Are you presently in a situation where you require documents for occasional business or personal uses nearly every time.

There are numerous legal document templates available online, but finding reliable versions is not easy.

US Legal Forms offers a vast array of form templates, including the Illinois Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse, which is designed to comply with federal and state regulations.

Once you've found the appropriate form, click Purchase now.

Choose the payment plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Illinois Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is customized for the correct city/state.

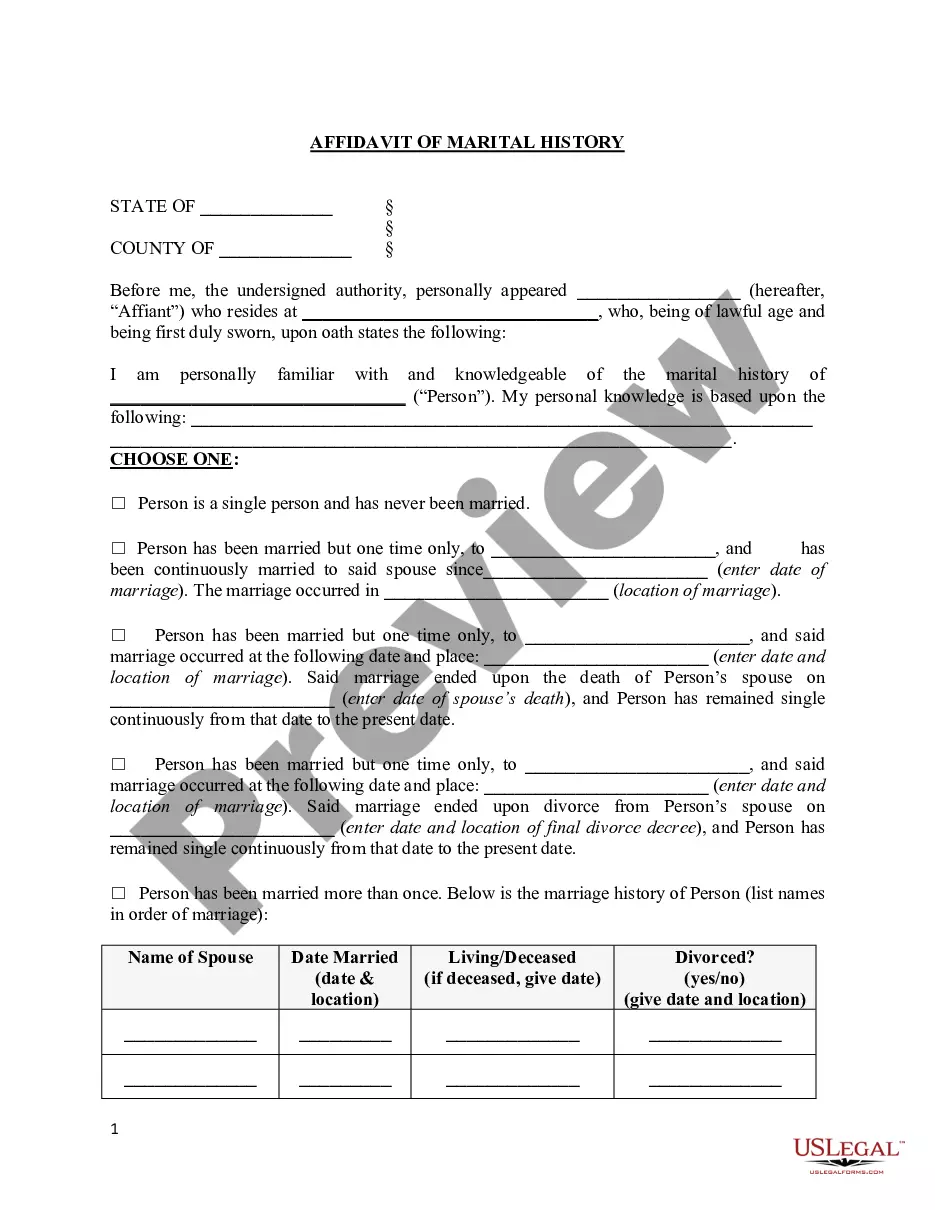

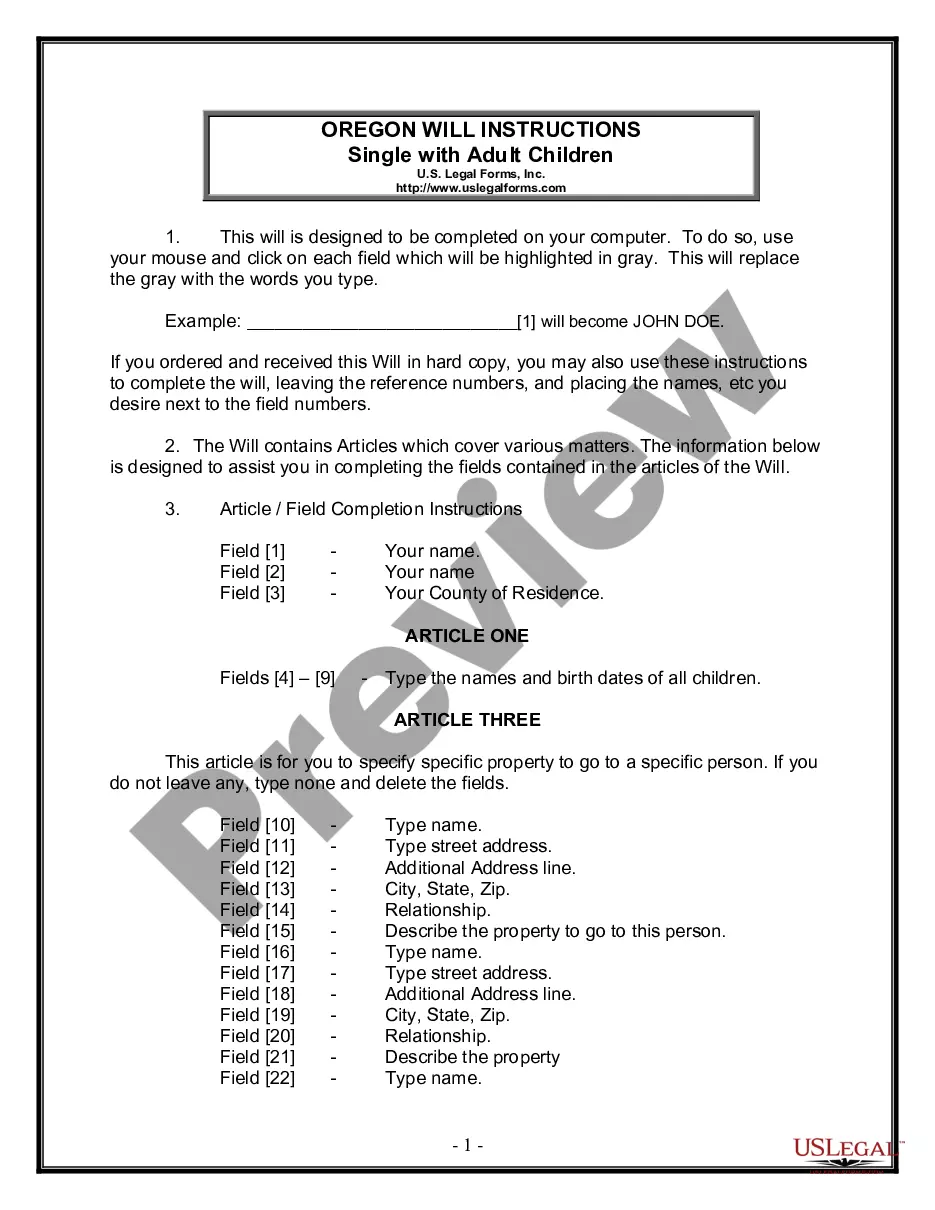

- Utilize the Preview button to review the form.

- Examine the outline to confirm that you have selected the correct form.

- If the form does not match your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

In Illinois, whether a wife can be held responsible for her husband's tax debt depends on various factors, including how the debt was incurred. Through the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, spouses can clarify their financial boundaries. If the wife qualifies as an innocent or non-obligated spouse, she may protect herself from those debts. Understanding these nuances is vital for maintaining your financial well-being.

liable spouse is one who cannot be held accountable for the debts accrued by their partner. This concept is emphasized in the Illinois Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse. Being a nonliable spouse assures you that your financial stability remains intact despite your partner's financial choices. This distinction is essential for protecting your credit and property.

obligated spouse refers to an individual who is not legally responsible for their partner’s debts. Under the Illinois Notice of NonResponsibility for Debts or Liabilities Contracted by Spouse, such individuals can shield their credit and assets from joint obligations. This status is crucial for ensuring that personal financial matters remain separate. Understanding your role as a nonobligated spouse can help safeguard your assets.

An innocent spouse is someone who can prove they were unaware of their partner's tax liabilities. Under the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, this designation protects your assets from your spouse’s debts. To be classified as an innocent spouse, you must demonstrate a lack of knowledge of any financial misconduct. This protection allows you to avoid the burden of unexpected liabilities.

Yes, Illinois provides an injured spouse form that helps protect individuals from being responsible for their spouse's debts. This form is part of the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. By filing this, you can assert your claim to protect your assets from your partner's financial obligations. It's a proactive step to ensure your financial security.

Section 609.2 addresses the process for the allocation of parental responsibilities. This section outlines how courts determine child custody and visitation rights, ensuring that the best interests of the child are prioritized. It's essential to comprehend Section 609.2, especially if it involves the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. Having clarity on these laws can aid in making informed decisions during marital disputes.

In Illinois, there is no specific age when a child can outright refuse to see a parent, but the child's wishes are given significant weight during custody evaluations. Judges consider the child’s maturity and understanding of the situation. This aspect of family law often intersects with discussions about the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse regarding the financial implications of custody arrangements. Legal guidance can help you navigate these complexities.

In Illinois, a spouse may be held responsible for medical bills under certain circumstances, especially if the bills arise from shared marital duties. However, the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse serves to establish clear boundaries regarding this responsibility. Understanding these rules can help you navigate potential liabilities that could arise. If needed, consult a legal professional for tailored advice.

Section 602.7 provides essential guidelines regarding the financial responsibilities between spouses during and after marriage. This section is particularly relevant for understanding the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. It clarifies that one spouse may not be responsible for the debts incurred by the other without prior knowledge or agreement. Utilizing this knowledge can protect your financial interests.

In Illinois, a wife is not automatically responsible for her husband's debts incurred before their marriage. However, if debts are accrued during the marriage, both spouses may share responsibility. This can vary depending on the nature of the debt and state regulations. Implementing the Illinois Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can offer clarity on your financial obligations.