Illinois Sample Letter for Ad Valorem Tax Exemption

Description

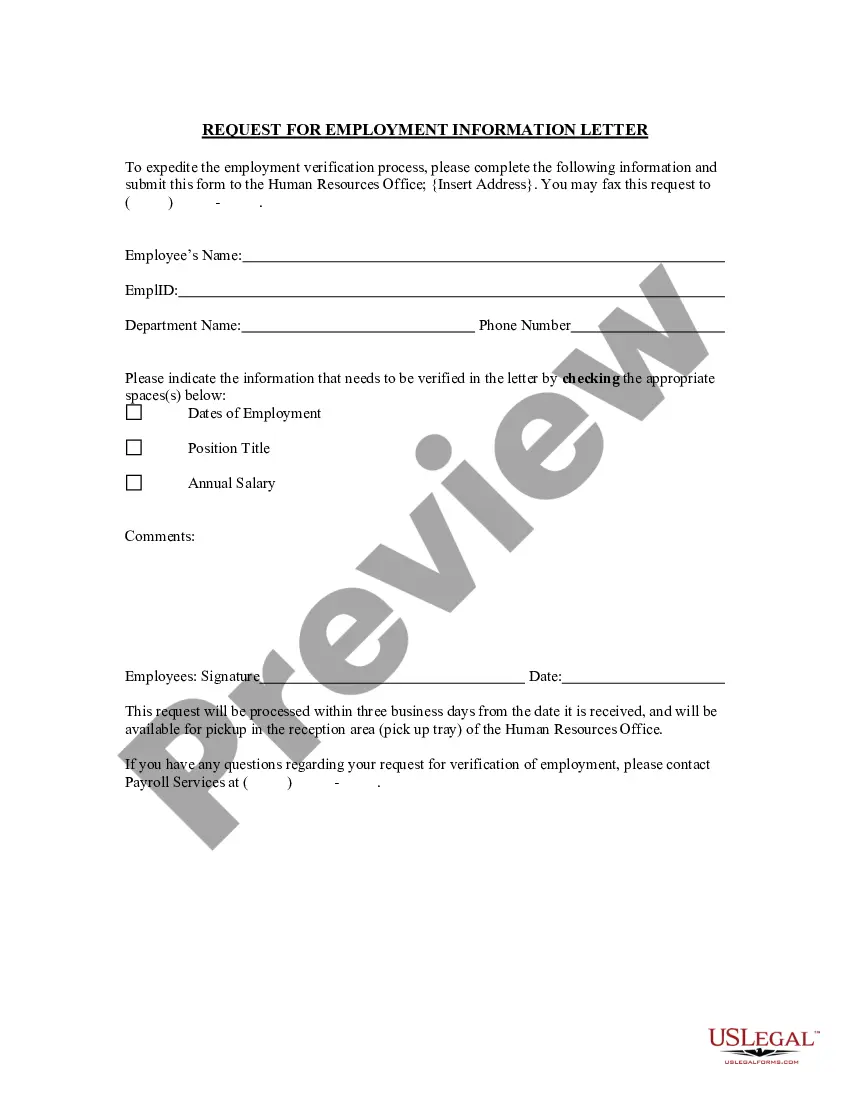

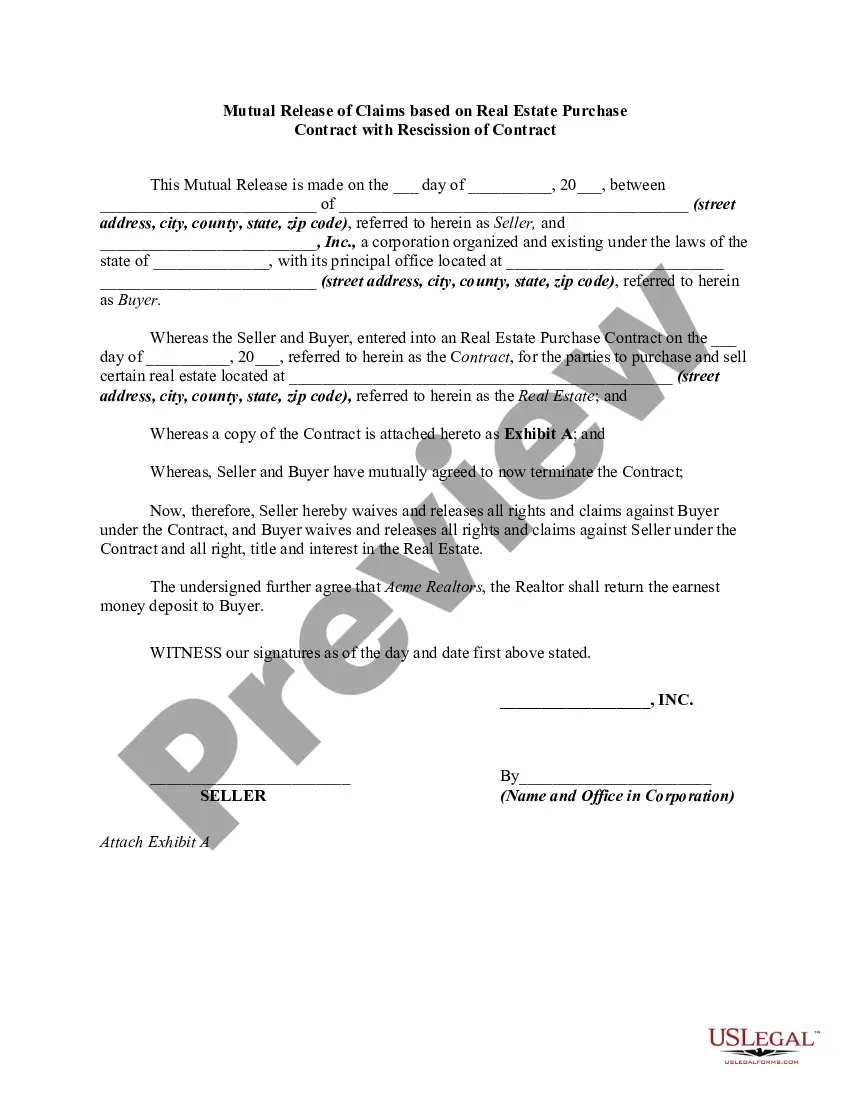

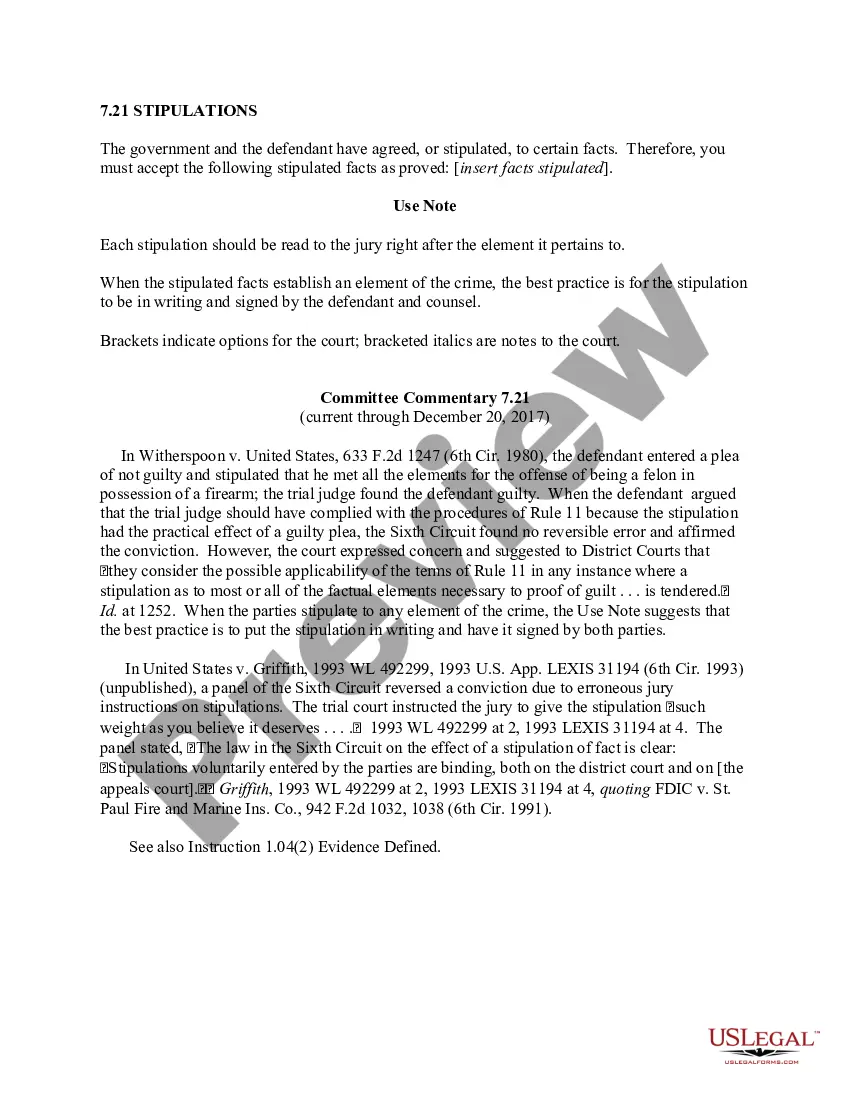

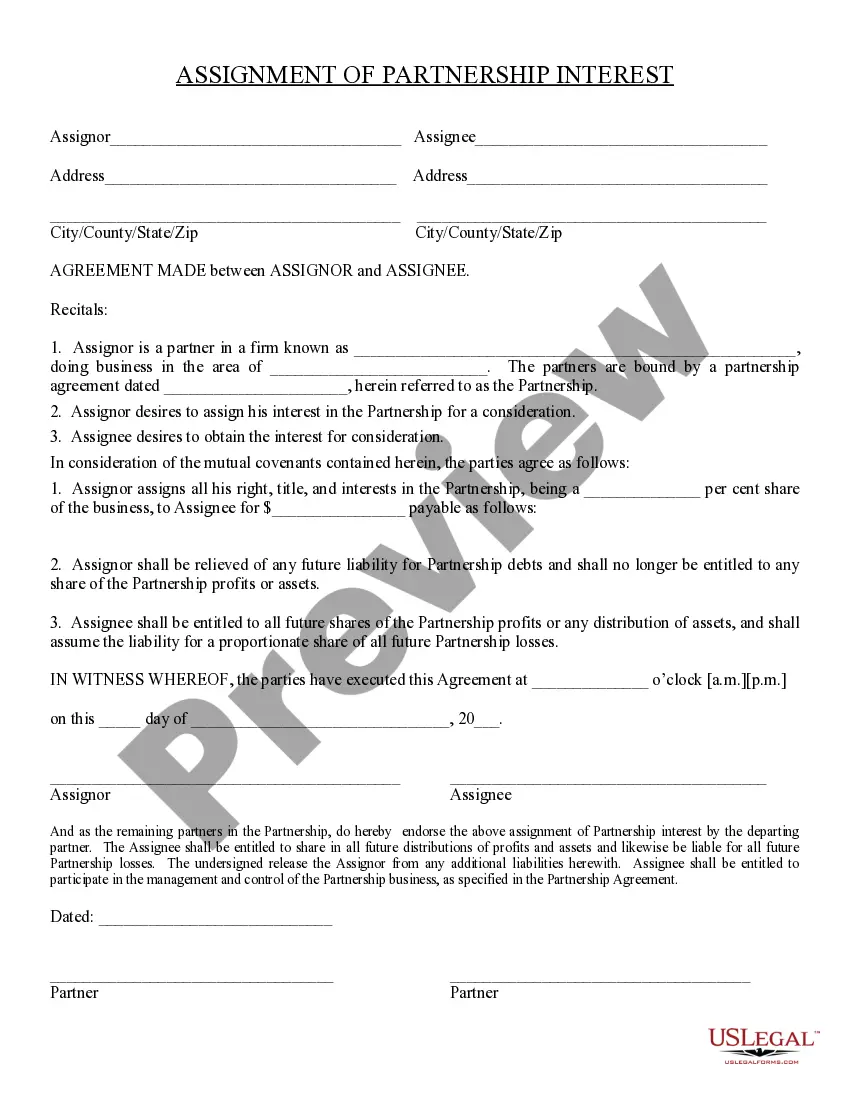

How to fill out Sample Letter For Ad Valorem Tax Exemption?

If you have to comprehensive, download, or print lawful papers themes, use US Legal Forms, the largest collection of lawful types, which can be found on the web. Use the site`s simple and easy practical look for to obtain the paperwork you need. Different themes for company and specific purposes are categorized by groups and suggests, or key phrases. Use US Legal Forms to obtain the Illinois Sample Letter for Ad Valorem Tax Exemption with a handful of mouse clicks.

If you are currently a US Legal Forms customer, log in for your account and click on the Acquire button to find the Illinois Sample Letter for Ad Valorem Tax Exemption. You can also gain access to types you in the past delivered electronically inside the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for your correct area/country.

- Step 2. Utilize the Review solution to check out the form`s information. Don`t overlook to learn the information.

- Step 3. If you are not satisfied using the develop, take advantage of the Search discipline at the top of the monitor to find other variations of the lawful develop template.

- Step 4. After you have found the shape you need, go through the Purchase now button. Pick the prices program you choose and add your credentials to register for an account.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal account to finish the financial transaction.

- Step 6. Choose the file format of the lawful develop and download it on your product.

- Step 7. Full, modify and print or indicator the Illinois Sample Letter for Ad Valorem Tax Exemption.

Every lawful papers template you acquire is yours permanently. You have acces to each and every develop you delivered electronically in your acccount. Go through the My Forms segment and choose a develop to print or download once again.

Be competitive and download, and print the Illinois Sample Letter for Ad Valorem Tax Exemption with US Legal Forms. There are thousands of specialist and condition-distinct types you may use for the company or specific requirements.

Form popularity

FAQ

To renew your Sales Tax Exemption (E) number, your organization must submit the following required documentation: Form STAX-1, Application for Sales Tax Exemption; a copy of your current exemption letter with your E99# on it; a copy of your Articles of Incorporation, OR if not incorporated, your Constitution;

For persons dying in 2023, the federal exemption for Federal Estate Tax purposes is $12,920,000. The exclusion amount for Illinois Estate Tax purposes is $4,000,000. The exclusion amount is a taxable threshold and not a credit against tax.

Property Tax Exemptions Homeowner Exemption. Senior Citizen Exemption. Senior Freeze Exemption. Longtime Homeowner Exemption. Home Improvement Exemption. Returning Veterans' Exemption. Disabled Veterans' Exemption. Disabled Persons' Exemption.

You may file up to 4 exemptions. These may include: homeowner residents, senior citizens, veterans, disabled veterans, those with disabilities, and home improvements. The remaining value (called the ?Adjusted Equalized Assessed Value?) is multiplied by your local tax rate.

Purchasers may either document their tax-exempt purchases by completing Form CRT-61, Certificate of Resale, or by making their own certificate. A copy of the certificate must be provided to the retailer. Certificates of Resale should be updated at least every three years.

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

Your Illinois Sales Tax Exemption Certificate is an important tax document that authorizes you under the Retailers' Occupation Tax Act to purchase tangible personal property for use or consumption tax-free. { If not, contact us immediately.

You send a cover letter to the IL Department of Revenue, written on your organization's letterhead, requesting the tax exemptions. Include with the letter copies of the charity's articles of incorporation, bylaws, IRS letter granting tax-exempt status, an explanation of the charity's activities and goals.