Illinois Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

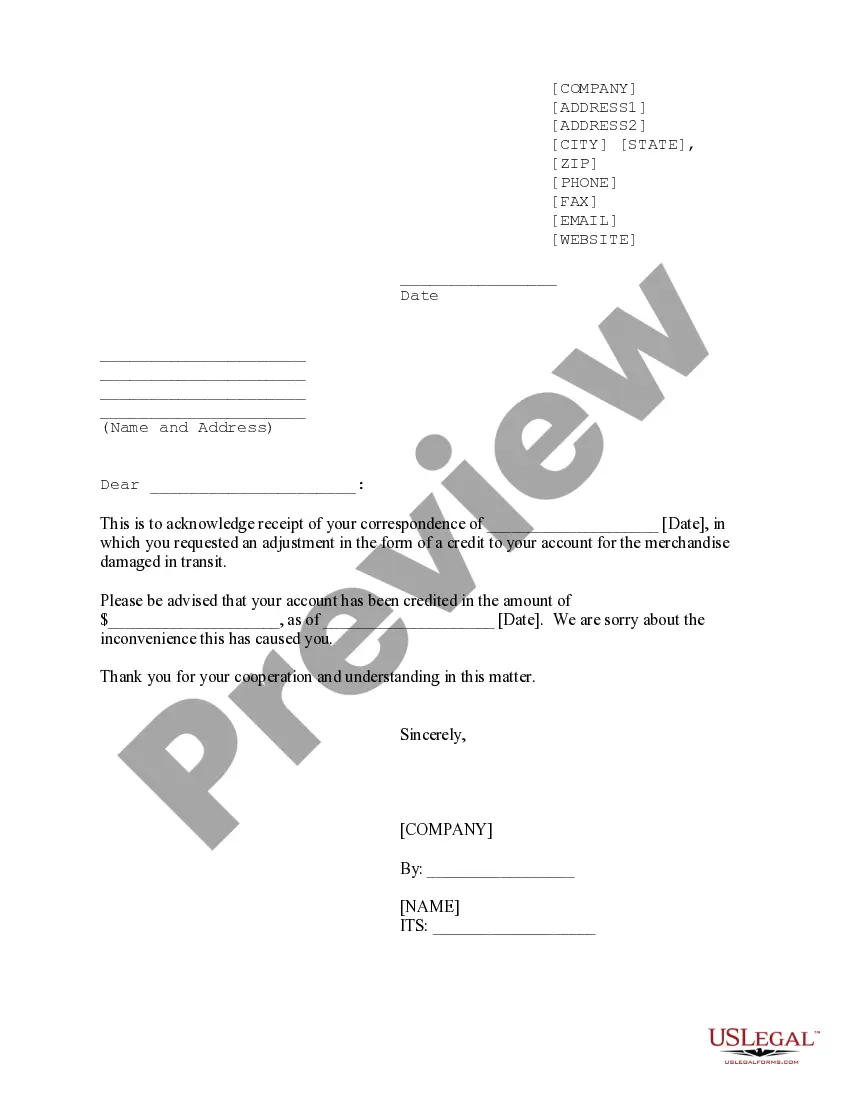

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

If you have to full, acquire, or produce legitimate papers layouts, use US Legal Forms, the greatest collection of legitimate kinds, that can be found on the web. Make use of the site`s easy and convenient look for to discover the files you want. A variety of layouts for business and person reasons are categorized by classes and says, or keywords. Use US Legal Forms to discover the Illinois Sample Letter to City Clerk regarding Ad Valorem Tax Exemption within a number of clicks.

Should you be presently a US Legal Forms customer, log in to the accounts and click on the Download button to have the Illinois Sample Letter to City Clerk regarding Ad Valorem Tax Exemption. You can also access kinds you earlier saved in the My Forms tab of the accounts.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form to the appropriate area/nation.

- Step 2. Use the Preview method to look over the form`s content material. Don`t overlook to learn the information.

- Step 3. Should you be not happy with the type, make use of the Search industry near the top of the monitor to discover other models from the legitimate type template.

- Step 4. When you have located the form you want, click the Acquire now button. Choose the pricing strategy you choose and add your qualifications to sign up for an accounts.

- Step 5. Approach the purchase. You should use your bank card or PayPal accounts to finish the purchase.

- Step 6. Pick the formatting from the legitimate type and acquire it on your own product.

- Step 7. Total, edit and produce or signal the Illinois Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

Every single legitimate papers template you get is your own property eternally. You have acces to every single type you saved in your acccount. Click on the My Forms section and choose a type to produce or acquire once again.

Contend and acquire, and produce the Illinois Sample Letter to City Clerk regarding Ad Valorem Tax Exemption with US Legal Forms. There are many specialist and express-specific kinds you can utilize to your business or person requirements.

Form popularity

FAQ

Use MyTax Illinois to quickly renew your Sales Tax Exemption (E) number electronically by scanning the above required documentation and attaching the scanned files to your renewal request.

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

To apply for an Illinois sales tax exemption number, your organization should submit Form STAX-1, Application for Sales Tax Exemption, or Apply for or Renew a Sales Tax Exemption online using MyTax Illinois.

Use MyTax Illinois to quickly renew your Sales Tax Exemption (E) number electronically by scanning the above required documentation and attaching the scanned files to your renewal request. How do I reinstate or renew my tax-exempt (E) number? Illinois Department of Revenue (.gov) ? ... ? Answer Illinois Department of Revenue (.gov) ? ... ? Answer

If there are no changes to the account (i.e. legal address, contact information, owners/officers/members/managers), and the account is in a Renewal Pending state or the Certificate of Registration or License has not been expired more than three years, you may email us at REV.CentReg@Illinois.gov or call Central ... When does my Certificate of Registration or License expire? Illinois Department of Revenue (.gov) ? ... ? Answer Illinois Department of Revenue (.gov) ? ... ? Answer

Effective June 7, 2023, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. Resources pertaining to this change may be found below. Illinois Department of Revenue illinois.gov illinois.gov

To apply for an Illinois sales tax exemption number, your organization should submit Form STAX-1, Application for Sales Tax Exemption, or Apply for or Renew a Sales Tax Exemption online using MyTax Illinois. Do certain organizations qualify for a retailers' occupation and use tax ... illinois.gov ? answer.398.html illinois.gov ? answer.398.html

Property Tax Exemptions Homeowner Exemption. Senior Citizen Exemption. Senior Freeze Exemption. Longtime Homeowner Exemption. Home Improvement Exemption. Returning Veterans' Exemption. Disabled Veterans' Exemption. Disabled Persons' Exemption.