This form is intended for a major commercial office complex. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses

Description

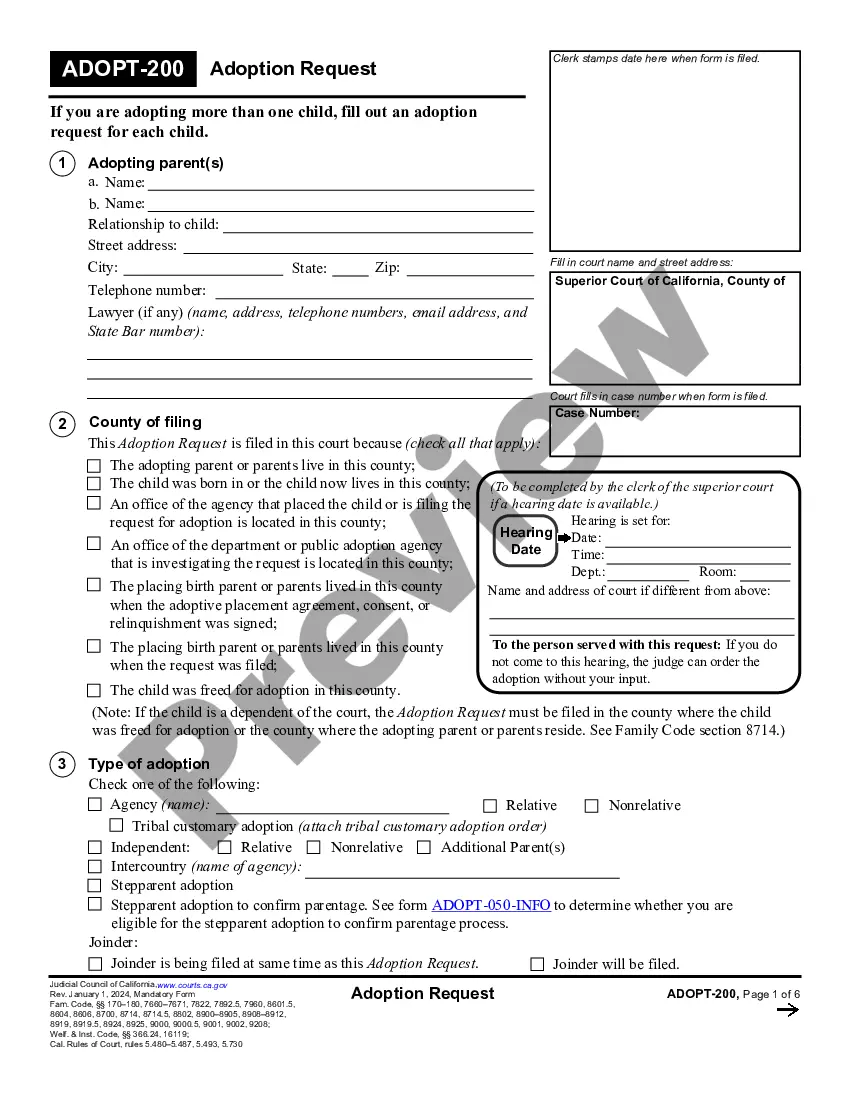

How to fill out Detailed Office Space Lease With Lessee To Pay Pro-rata Share Of Expenses?

Locating the appropriate legal document template can be quite challenging.

Of course, there are multiple templates accessible online, but how do you discover the legal form you require.

Utilize the US Legal Forms website. This service offers a plethora of templates, such as the Illinois Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses, which can be utilized for both business and personal purposes.

You can preview the form by using the Preview option and review the form details to confirm it is suitable for your needs.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to acquire the Illinois Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses.

- Use your account to browse the legal forms you have previously obtained.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your area/region.

Form popularity

FAQ

In the context of commercial real estate, the term Pro Rata Share is a method of calculating a tenant's share of a building's expenses based upon a calculation defined in a tenant's lease. Pro Rata Share of expenses is generally expressed as a percentage.

Pro rata is a Latin term meaning in proportion that is used to assign or allocate value in proportion to something that can accurately and definitively be measured or calculated.

In an absolute net lease, the tenant is responsible for everything; the tenant pays the property taxes, insurance, and all maintenance (both structural and non-structural). The landlord has zero operating expense responsibilities, and the tenant often pays everything directly.

A single net lease requires the tenant to pay only the property taxes in addition to rent. With a double net lease, the tenant pays rent plus the property taxes as well as insurance premiums. A triple net lease, also known as a net-net-net lease, requires the tenant to pay rent plus all three additional expenses.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

Also known as tenant's pro rata share. The portion of a building occupied by the tenant expressed as a percentage. When a tenant is responsible for paying its proportionate share of the landlord's costs for the building, such as operating expenses and real estate taxes, the tenant pays this amount over a base year.

Tenant's Share may also be referred to as Tenant's Proportionate Share, Pro Rata Share or simply PRS. It represents the percentage of the Defined Area that is occupied by a particular tenant.

A double net lease (also known as a 'net-net' or 'NN' lease) is a lease agreement in which the tenant is responsible for both property taxes and premiums for insuring the building.

Unfortunately, most commercial leases specify that rent can be adjusted upwards only, which means your rent can only either increase or stay the same with each review. Even if market prices are falling, your rent will remain static rather than decrease.

How to negotiate a commercial lease for your retail store: 15 tipsSettle ahead of time on your budget, your must-haves, and your nice-to-haves.Get an agent or lawyer to negotiate for you.Do negotiate on more than one location at the same time.Don't pay asked base rent.Check the square footage yourself.More items...?