Illinois Farmers Market Application and Rules and Regulations

Description

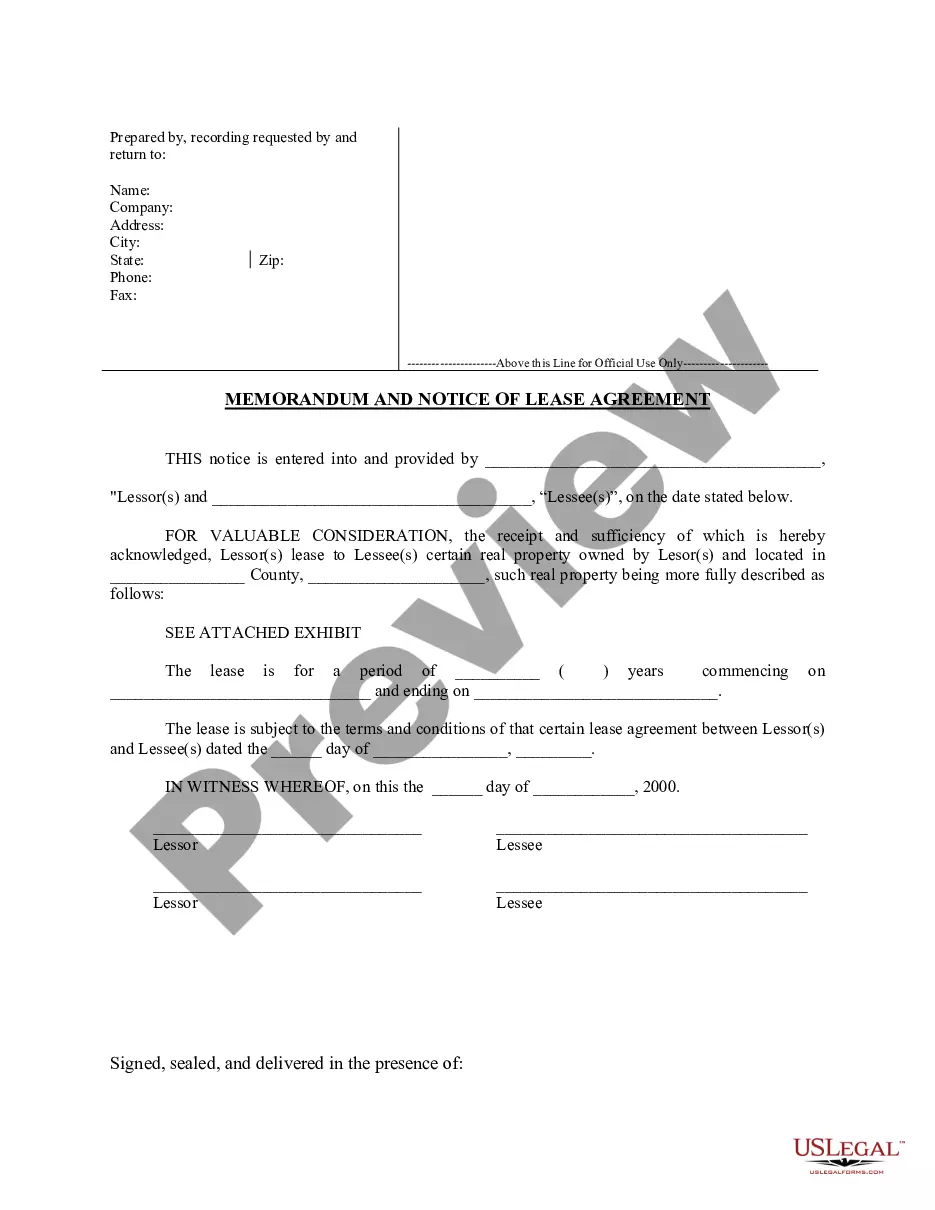

How to fill out Farmers Market Application And Rules And Regulations?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Illinois Farmers Market Application and Rules and Regulations, which can be utilized for business and personal needs.

You can browse the form using the Preview button and review the form outline to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to find the correct form. When you are certain that the form will work, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, and print the finalized Illinois Farmers Market Application and Rules and Regulations. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Utilize the service to obtain professionally-crafted papers that adhere to state requirements.

- All of the forms have been reviewed by professionals and comply with state and federal requirements.

- If you are currently registered, Log In to your account and click the Download button to obtain the Illinois Farmers Market Application and Rules and Regulations.

- Use your account to search through the legal forms you have purchased previously.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

A local farmers market typically features vendors selling food and produce grown within a defined regional area. These markets prioritize fresh, locally sourced products, supporting local economies and farmers. It’s important to understand the Illinois Farmers Market Application and Rules and Regulations, as they often define the criteria for what constitutes a local market. Engaging with your community can make your market more successful and authentic.

Creating your own farmers market involves several steps, starting with a clear business plan and understanding local regulations. You will need to identify a suitable location, engage with local farmers and vendors, and promote the market within the community. Familiarizing yourself with the Illinois Farmers Market Application and Rules and Regulations is vital to ensure compliance. Resources like UsLegalForms can assist you in managing the legal aspects efficiently.

Usually, you need a business license to sell at a farmers market. While some markets may allow exceptions, most require licenses to ensure compliance with local regulations. Therefore, it’s essential to check the Illinois Farmers Market Application and Rules and Regulations to understand the requirements of the specific market you wish to join. Using resources like UsLegalForms can help you secure the necessary permits.

While it's not mandatory to have an LLC to sell at a farmers market, forming one can offer liability protection and credibility. An LLC structure separates your business assets from personal assets, which can be beneficial. Review the Illinois Farmers Market Application and Rules and Regulations to determine if an LLC suits your specific situation. Consulting legal advice may further clarify your options.

Yes, you generally need to file taxes for your sales at a farmers market. The income you generate is subject to federal and state taxation, and it's crucial to keep accurate records of your earnings. Understanding the Illinois Farmers Market Application and Rules and Regulations will help you comply with tax obligations. Consulting with a tax professional can also provide valuable insights.

No, you are not required to have an LLC to sell products, but it is a strong option worth considering. Depending on your business structure, the Illinois Farmers Market Application and Rules and Regulations may allow you to operate as a sole proprietor without forming an LLC. Nevertheless, an LLC can safeguard your personal liability and may be beneficial for your business's long-term growth. Exploring the options provided by uslegalforms can help you make the best decision regarding your selling strategy.

You typically do not need an LLC to sell at farmers markets in Illinois. However, the Illinois Farmers Market Application and Rules and Regulations encourage vendors to protect themselves legally, which an LLC can help achieve. Many vendors opt for an LLC to limit personal liability and simplify tax obligations. Before you begin selling, consulting with a professional can guide you through what makes the most sense for your situation.

When operating a farmstand, you do not necessarily need an LLC; however, forming one can provide legal protections for your personal assets. The Illinois Farmers Market Application and Rules and Regulations indicate that many vendors choose to establish an LLC for liability protection. Having an LLC can also improve your credibility with customers. Therefore, it is wise to consider the benefits of an LLC before starting your farmstand.

While liability insurance is not always required to sell at farmers markets, it is highly recommended to protect yourself from potential claims. The Illinois Farmers Market Application and Rules and Regulations may specify insurance requirements, so reviewing these guidelines is wise. Having coverage can give you peace of mind and reassure customers about your commitment to safety. For more information and options related to insurance, USLegalForms can help clarify your needs.

The term 'farmers market' is typically written in lowercase letters and may include an apostrophe if referring to a market owned by farmers. When describing guidelines or registering with the Illinois Farmers Market Application and Rules and Regulations, clarity and correctness are essential. Using the correct terminology can impact your professionalism and understanding of the rules. For complete documentation and assistance, consider using USLegalForms.