This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased

Description

How to fill out Bill Of Sale And Assumption Of Debt Secured By The Personal Property Being Purchased?

Selecting the ideal legitimate document template can be quite a challenge. Naturally, there are numerous layouts accessible online, but how can you find the legitimate format you need.

Utilize the US Legal Forms website. This service offers thousands of layouts, such as the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, which can be utilized for both business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to receive the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. Utilize your account to access the legitimate forms you have previously obtained. Navigate to the My documents tab of your account and obtain another version of the document you desire.

Overall, complete, modify, print, and sign the acquired Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased. US Legal Forms is indeed the largest repository of legitimate forms where you can find various document layouts. Utilize this service to download properly crafted documents that adhere to state specifications.

- If you are a new user of US Legal Forms, here are simple steps that you can follow.

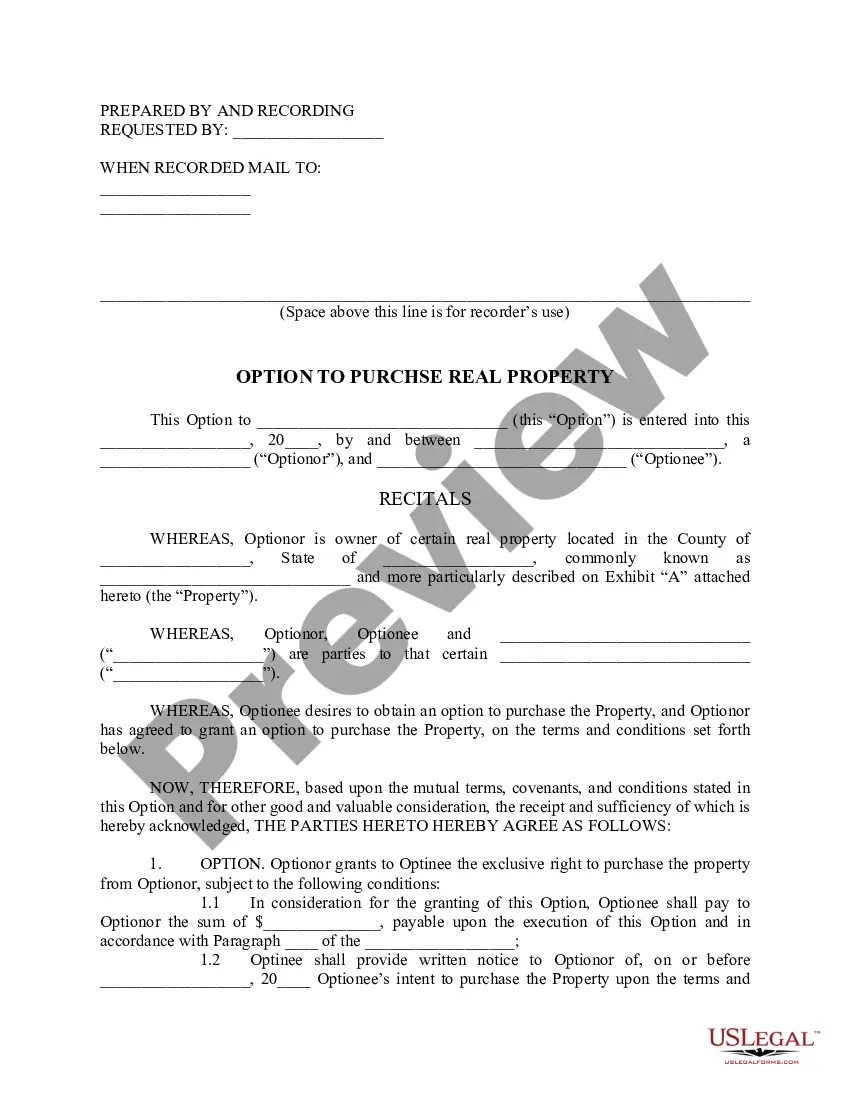

- First, ensure you have selected the correct template for your area/state. You can preview the form using the Preview button and read the form description to verify it is suitable for you.

- If the form does not satisfy your requirements, utilize the Search field to find the appropriate form.

- When you are certain that the form is suitable, click the Get now button to receive the form.

- Select the pricing plan you prefer and enter the necessary details. Create your account and complete your order using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legitimate document template to your device.

Form popularity

FAQ

To sell a business in Illinois, you must first assess the value of your business and gather all relevant financial documents. Next, use the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased to properly document the transaction. Additionally, ensure compliance with any state regulations, including those outlined in the Bulk Sale Act, to protect yourself and your creditors during the sale process.

The Bulk Sale Act in Illinois governs the sale of a substantial portion of a business's assets, aiming to protect creditors in the event of a business sale. Under this act, sellers must provide notice to creditors to disclose existing debts before the transfer can take place. By relying on the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, you can ensure compliance with this act and safeguard your interests.

In Illinois, the notice to creditors regarding a bulk sale must be recorded at least ten days prior to the actual sale date. This requirement ensures that all creditors are given the opportunity to respond before the transfer of assets occurs. Utilizing the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased helps streamline your transaction while also adhering to these critical legal requirements.

A bulk sale tax is a tax that may apply when a business sells a significant portion of its assets rather than liquidating individual items. This tax helps enforce the bulk sales law by ensuring that any outstanding debts to creditors are addressed before assets are transferred. When preparing the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, understanding the bulk sale tax can help you avoid unexpected liabilities.

In Illinois, certain sales are exempt from sales tax, including sales of food for human consumption and prescription medications. Additionally, sales made to government entities and non-profit organizations often enjoy tax exemptions. When using the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, you should keep these exemptions in mind, as they can reduce the overall financial burden of your transaction.

Several states, including Illinois, still maintain bulk sales laws to regulate the transfer of business assets. These laws are designed to protect creditors by ensuring that they are notified of significant asset sales. If you are using an Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, it is crucial to understand the implications of these laws in your state. Always consult the specific regulations applicable in your area.

Generally, once a bill of sale is signed in Illinois, it is challenging for someone to back out of it. The Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased reflects a mutual agreement. However, if fraud or coercion is involved, there may be grounds for cancellation. Always consult legal experts if you find yourself questioning a signed bill of sale.

Yes, a bill of sale is legally binding in Illinois as long as certain conditions are met. When you create an Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, it serves as proof of the transaction. Ensure all details are accurate and that both parties sign the document. This clarity and mutual agreement make it enforceable under Illinois law.

A bill of sale becomes legally binding in Illinois when it includes specific details, like the names of both parties, a description of the property, and signatures. The Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased requires this information to establish clear terms. Additionally, both parties must willingly agree to the terms of the sale. Without these elements, the bill may not hold up in court.

Yes, you can obtain a title with a bill of sale in Illinois. When you complete a transaction involving personal property, the Illinois Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased acts as a crucial document. It helps you establish ownership and provides necessary details for title transfer. Make sure to keep this document safe for your records.