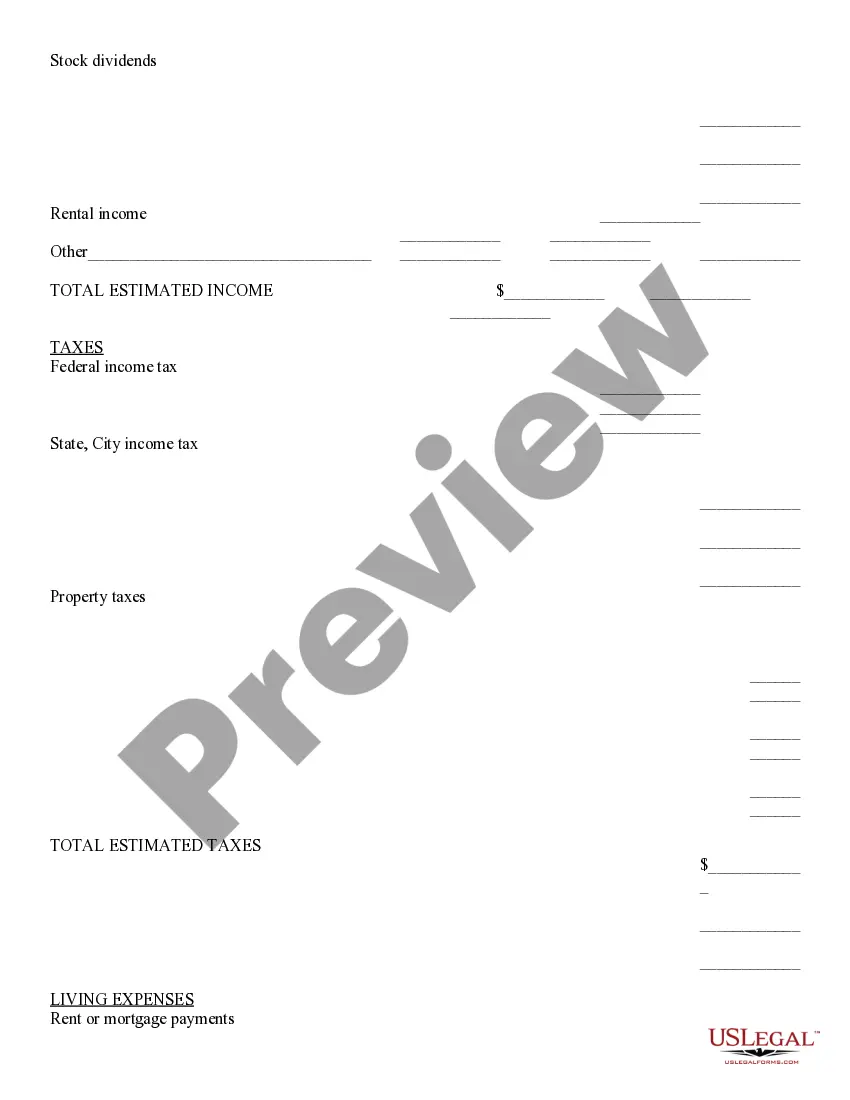

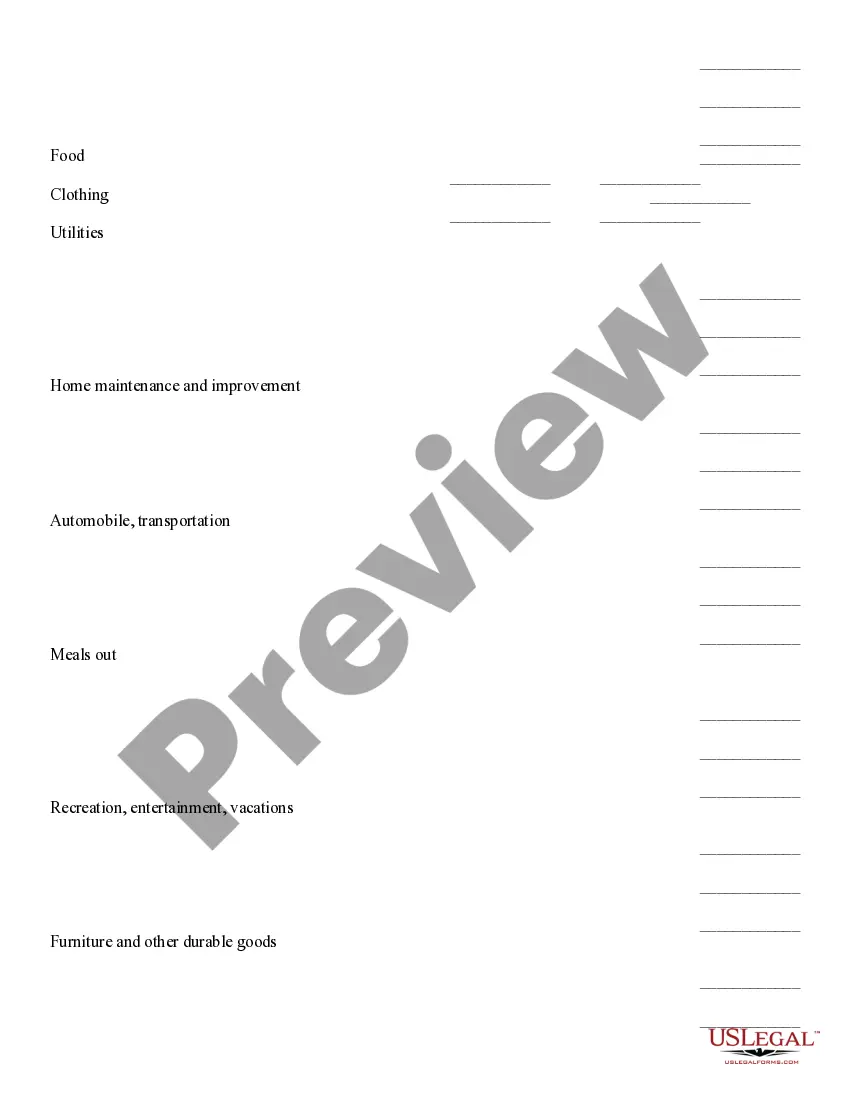

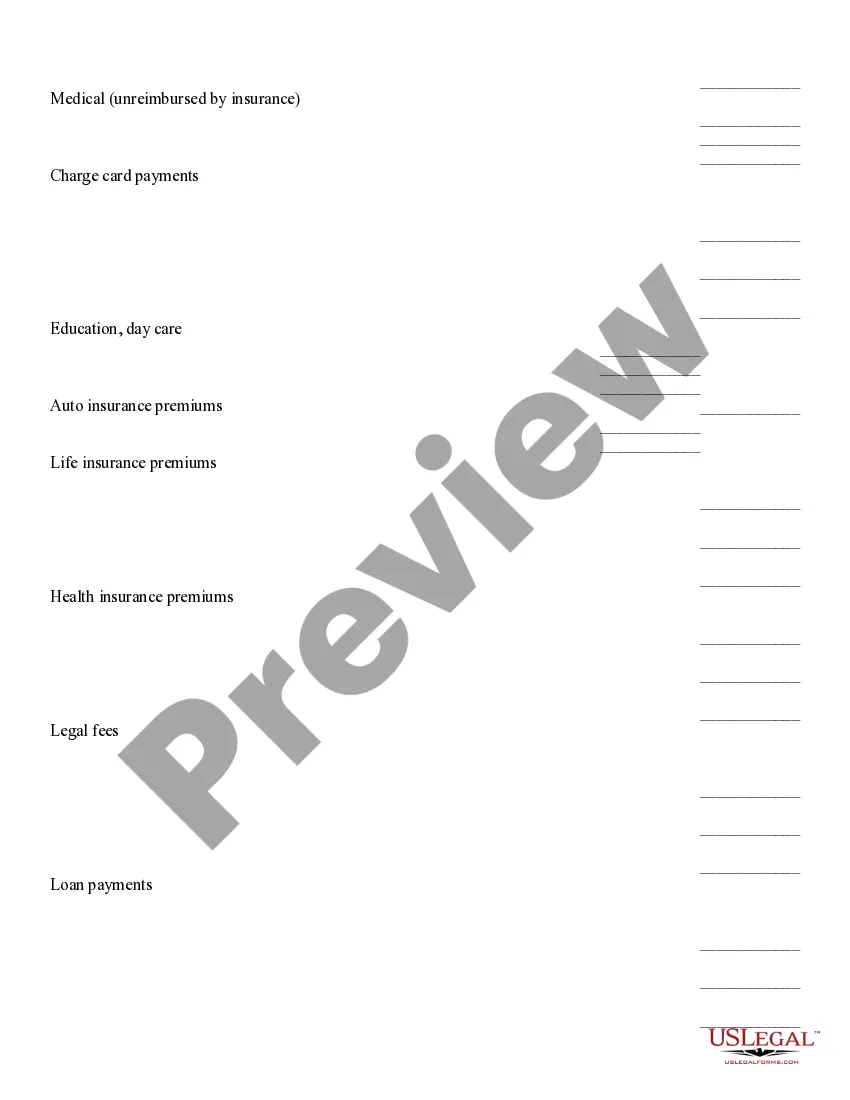

Illinois Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

You can devote hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides numerous legal forms that can be reviewed by experts.

You can effortlessly download or print the Illinois Retirement Cash Flow from your service.

- If you possess a US Legal Forms account, you can sign in and then click the Obtain button.

- Afterward, you can complete, modify, print, or sign the Illinois Retirement Cash Flow.

- Every legal document template you purchase is yours for an extended period.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your preference.

- Check the form description to make certain you have chosen the appropriate template.

Form popularity

FAQ

Eligibility. To receive a pension benefit, you must have a minimum of 10 years of credited service with SERS. You may retire at: Age 67, with 10 years of credited service.

New York-based financial services company Bankrate looked at a number of criteria important to retirees to develop a ranking of the best and worst states for retirement. Missouri came in at No. 3 on the list, with Illinois trailing at No. 47.

There is some good tax news for retirees in Illinois: Social Security benefits and income from most retirement plans are exempt. Plus, the state's 4.95% flat income tax rate is relatively low.

On average, the career state pensioner currently receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over his or her lifetime. In all, 53 percent of the over 213,000 state pensioners in Illinois can expect to receive lifetime pension benefits of more than $1 million.

To receive a pension benefit, you must have a minimum of 10 years of credited service with SERS. You may retire at: Age 67, with 10 years of credited service.

Illinois. Retirement Income: Overall, Illinois is one of the least tax-friendly states for retirees. However, it's the only Midwestern state that completely exempts 401(k), IRA and pension income from tax. Pension and 401(k) income must be from a qualified employee benefit plan to be tax-free, though.

Most, but not all, retirees will find Illinois to be tax-friendly. The state has full deductions for Social Security, pension income and income from retirement savings accounts, including IRAs. In other words, retirees who are not working won't be subject to the state's 4.95% flat income tax rate.

Illinois exempts nearly all retirement income from taxation, including Social Security retirement benefits, pension income and income from retirement savings accounts. However, the state has some of the highest property and sales taxes in the country.

SERS provides retirement benefits for state employees. The system provides a defined benefit (DB) pension, a retirement plan that typically offers a modest but stable monthly retirement income that lasts the remainder of a retiree's life.

On Monday, WalletHub put out its ranking of the best states to retire to and Illinois came in No. 45 with a score of 44.27 out of 100, with neighboring Missouri No. 17 with a score of 52.13.