Illinois Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

Should you desire to completely, obtain, or generate lawful document templates, utilize US Legal Forms, the most extensive collection of legal documents accessible online.

Take advantage of the website's user-friendly and accessible search feature to locate the documents you need.

Various templates for business and personal uses are sorted by categories and topics, or keywords. Employ US Legal Forms to find the Illinois Revocable Trust for Grandchildren with just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to each form you downloaded within your account. Go to the My documents area and select a form to print or download again.

Acquire and download, and print the Illinois Revocable Trust for Grandchildren with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Illinois Revocable Trust for Grandchildren.

- You can also find forms you have previously submitted electronically within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

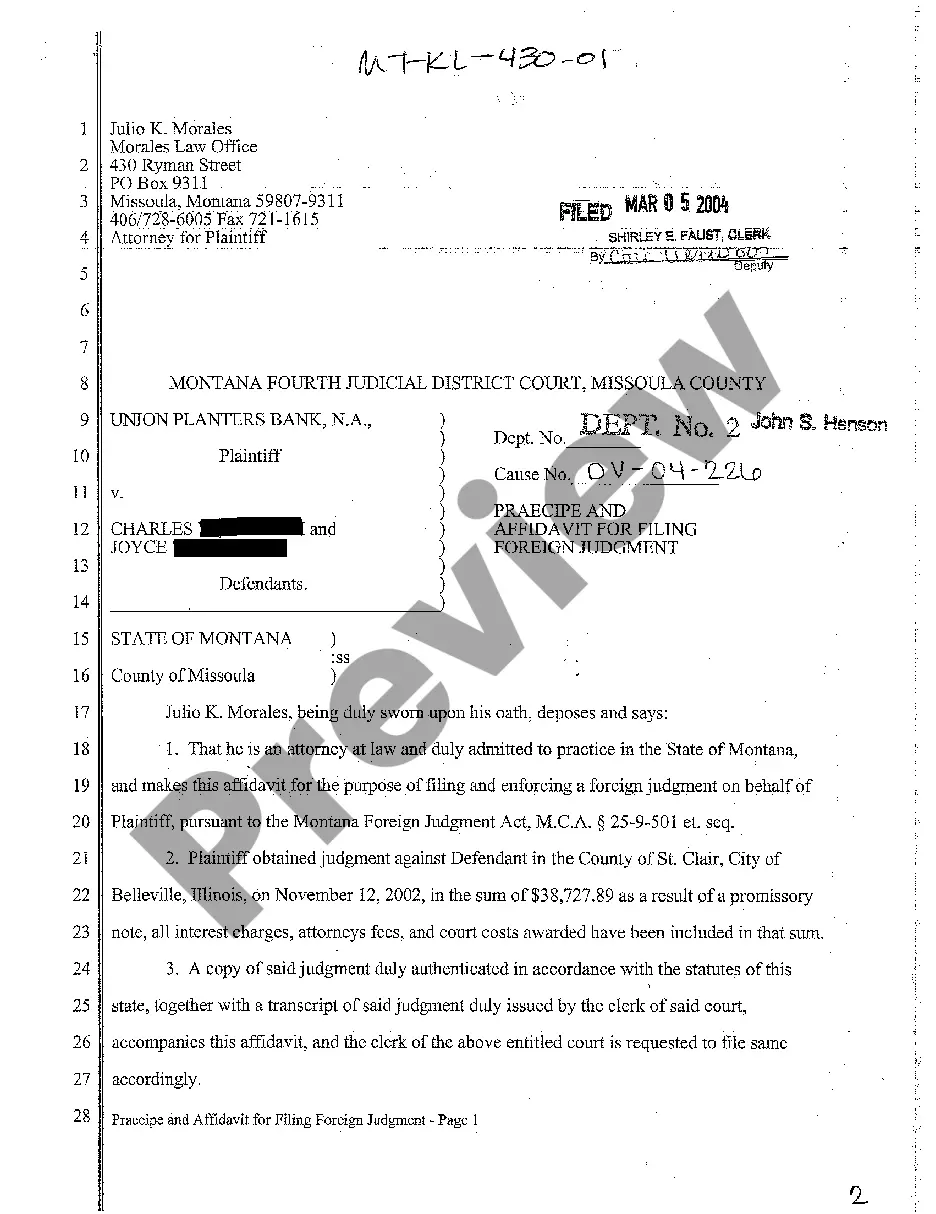

- Step 1. Ensure that you have selected the form for the appropriate city/region.

- Step 2. Use the Review option to examine the details of the form. Remember to verify the information.

- Step 3. If you are unhappy with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. After you find the form you need, click the Get now button. Choose the pricing plan that suits you and provide your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Illinois Revocable Trust for Grandchildren.

Form popularity

FAQ

The Illinois Revocable Trust for Grandchildren is often considered the best type of trust for this purpose. It allows you to set specific terms on how the assets will be managed and distributed to your grandchildren. Additionally, it can help in avoiding probate, which speeds up access to funds when your grandchildren need it most. Explore this option to ensure a thoughtful and secure financial legacy.

An effective way to leave an inheritance to your grandchildren is through an Illinois Revocable Trust for Grandchildren. This trust secures your assets while providing guidelines on how they will be distributed. Moreover, it offers peace of mind, knowing that you can adjust the trust according to changing family circumstances. Consult with estate planning professionals to tailor this trust to your specific desires.

In Illinois, the terms living trust and revocable trust generally refer to the same concept. Both trusts allow you to maintain control over your assets during your lifetime and modify the terms as needed. An Illinois Revocable Trust for Grandchildren falls into this category, specifically designed to benefit your grandchildren. Understanding these nuances can help you make informed decisions for your estate planning.

While no trust can completely eliminate inheritance taxes, an Illinois Revocable Trust for Grandchildren can help minimize their impact. By placing your assets in this trust, you can potentially keep them out of your estate, reducing property taxes after you pass away. Consult an estate planning attorney to tailor the trust in a way that affords the maximum tax benefits. Planning now can save your heirs a significant amount in potential taxes.

The Illinois Revocable Trust for Grandchildren can be an ideal way to leave an inheritance to your grandchildren. This trust allows you to specify how and when your grandchildren receive their inheritance, providing structure and protection. Additionally, it can reduce the complications typically associated with probate, ensuring your wishes are carried out smoothly. Consider this option to give your grandchildren a secure financial future.

One effective option for leaving assets to your children is an Illinois Revocable Trust for Grandchildren. This trust allows you to maintain control over your assets while providing for your children. It also offers flexibility, enabling you to modify the trust as your family dynamics change. Overall, it serves as a secure way to ensure your children inherit your wealth.

In Illinois, trusts, including an Illinois Revocable Trust for Grandchildren, do not need to be recorded. Unlike real estate deeds, which require recording, trusts can remain private documents. This means that you do not need to file a trust with the court, allowing you to maintain greater control over the terms and beneficiaries. For those interested in creating an Illinois Revocable Trust for Grandchildren, platforms like USLegalForms can provide the necessary documents and guidance to ensure everything is properly set up.

One effective way to leave property to your children after your death is by establishing an Illinois Revocable Trust for Grandchildren. This type of trust allows you to manage and distribute your assets according to your wishes while minimizing complications for your heirs. By using a revocable trust, you retain control over your assets during your lifetime, and after your passing, the trust helps streamline the distribution process, often avoiding probate entirely. Consider using platforms like US Legal Forms to create a tailored trust that ensures your grandchildren receive their inheritance efficiently.

Setting up a revocable trust in Illinois involves several key steps. Begin by deciding on a trustee, writing a trust document, and transferring your assets into the trust. Utilize the tools from U.S. Legal Forms to simplify the process of establishing your Illinois Revocable Trust for Grandchildren, making it easier to ensure your wishes are honored.

To create a revocable trust in Illinois, you need to draft a trust agreement that outlines the terms and conditions. You must then transfer your assets into the trust. Using U.S. Legal Forms, you can find templates and guidance to help establish an Illinois Revocable Trust for Grandchildren tailored to your family's needs.