This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

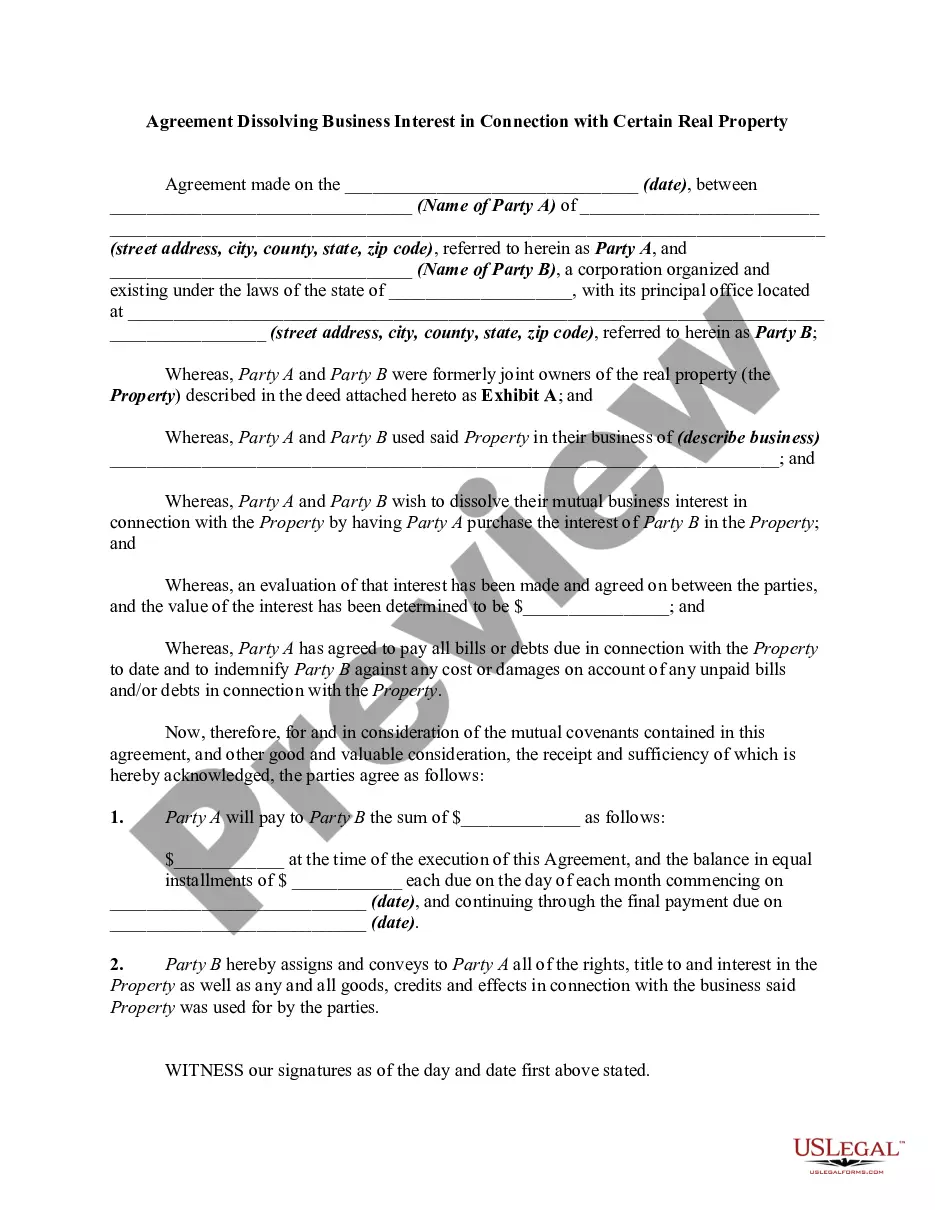

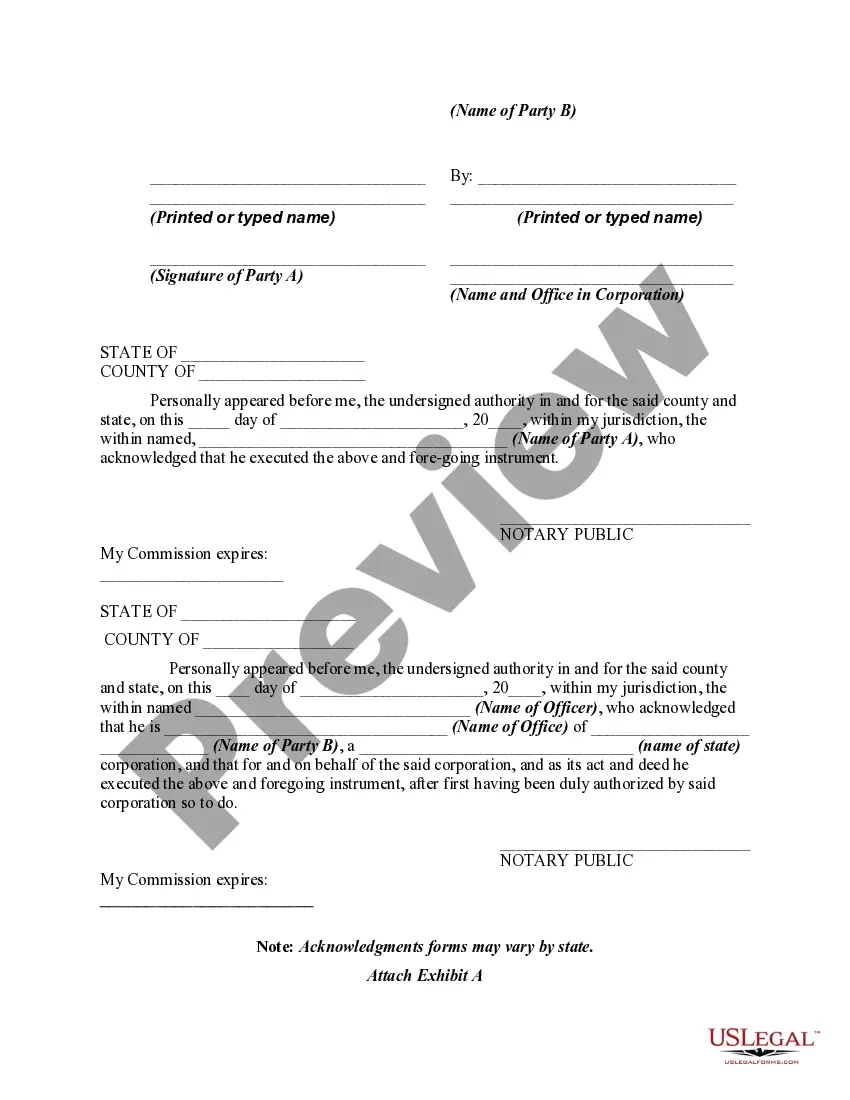

Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

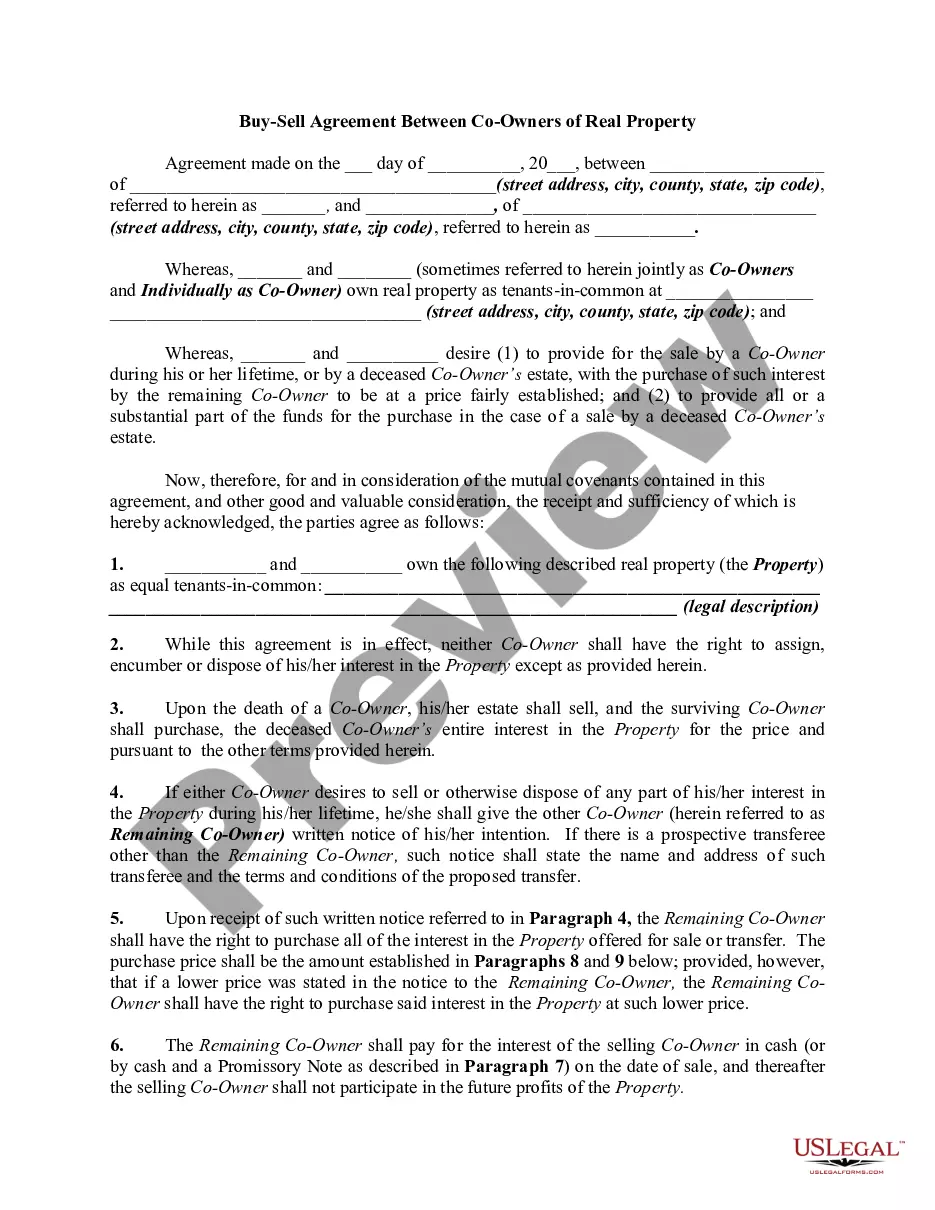

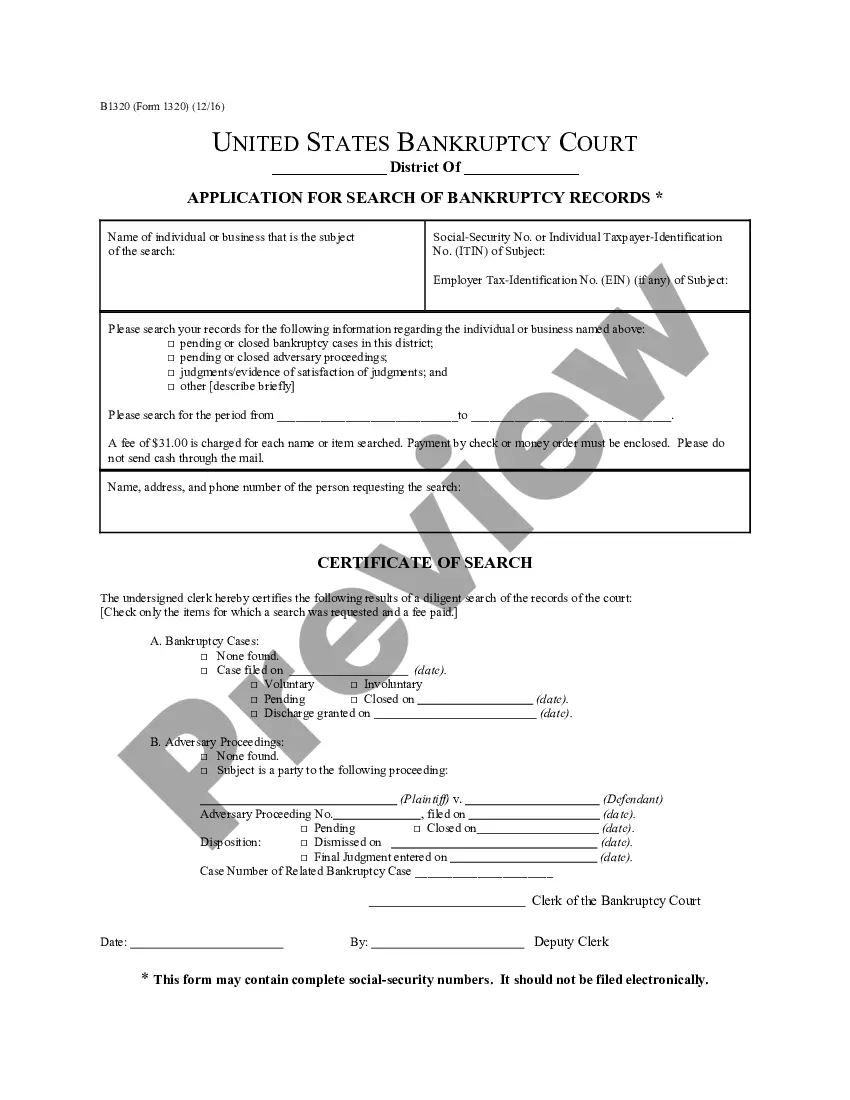

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By using the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property within minutes.

If you already have a subscription, Log In to download the Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device.

- Ensure you have selected the correct form for your city/region.

- Click on the Preview button to examine the form's content.

- Read the form description to confirm you have selected the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- When you are satisfied with the form, confirm your choice by hitting the Get Now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

After an LLC is closed or dissolved, members may still face liability depending on the nature of the obligations incurred prior to dissolution. It's vital to settle any business debts and complete necessary paperwork to protect yourself from future claims. Using the Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property can help navigate these liabilities effectively.

Dissolving an LLC can lead to loss of business identity and continuity, impacting your operations and relationships with clients. Furthermore, the process may involve financial obligations, such as settling debts and filing final tax returns. To streamline this process, the Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property can offer valuable assistance and clarity.

A dissolved LLC no longer exists as a legal entity due to formal filing, while a terminated LLC might cease operations but still exist legally until officially dissolved. The distinction matters, especially for legal and tax obligations. To understand these processes better, consider the Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property for clear guidelines.

Dissolving a company and closing a company are related but distinct processes. When you dissolve a business, you officially terminate its legal existence, while closing may refer to the day-to-day operations ceasing without formal legal termination. It's essential to follow the correct procedures for dissolution to ensure compliance with the Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property.

The Limited Partnership Act outlines the requirements for forming and managing limited partnerships in Illinois. It details the roles and liabilities of general and limited partners and addresses the process to dissolve partnerships. In connection with certain real property, an Illinois Agreement Dissolving Business Interest can streamline this dissolution process, ensuring clarity and legal compliance.

The Illinois Limited Liability Company Act establishes the framework for forming and operating LLCs in the state. This act includes rules for the management, operation, and dissolution of LLCs, particularly relevant when dealing with agreements dissolving business interests in connection with certain real property. Compliance with this act ensures that your LLC functions smoothly.

In Illinois, an LLC, or Limited Liability Company, provides personal liability protection to its owners, while an LLP, or Limited Liability Partnership, primarily benefits professional partners. Both entities can utilize an Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property to manage the dissolution process properly. Choosing the right entity depends on the specific business needs and liability concerns.

The Illinois Partnership Act governs the formation and operation of partnerships in Illinois. It defines the rights and responsibilities of partners and outlines how partnerships can dissolve, especially when related to agreements dissolving business interests in connection with certain real property. Understanding this act can help you navigate partnership structures effectively.

To permanently close your business, start by following the necessary steps to dissolve your LLC or corporation. This involves filing an Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property and settling all business debts and obligations. Additionally, you should notify your employees, clients, and any contractors involved. For a seamless closure process, USLegalForms provides vital templates and legal guidance to ensure all steps are handled correctly.

Dissolving an LLC involves formally ending the business's existence through an official process, which may include an Illinois Agreement Dissolving Business Interest in Connection with Certain Real Property, while terminating signifies halting business operations without completing the formal dissolution. Dissolution requires filing paperwork with the state, and settling debts, whereas termination can be a more informal process. Understanding these differences can help you choose the right path for your LLC's closure. Using resources from USLegalForms can simplify this process.