No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Illinois Rejection of Claim and Report of Experience with Debtor

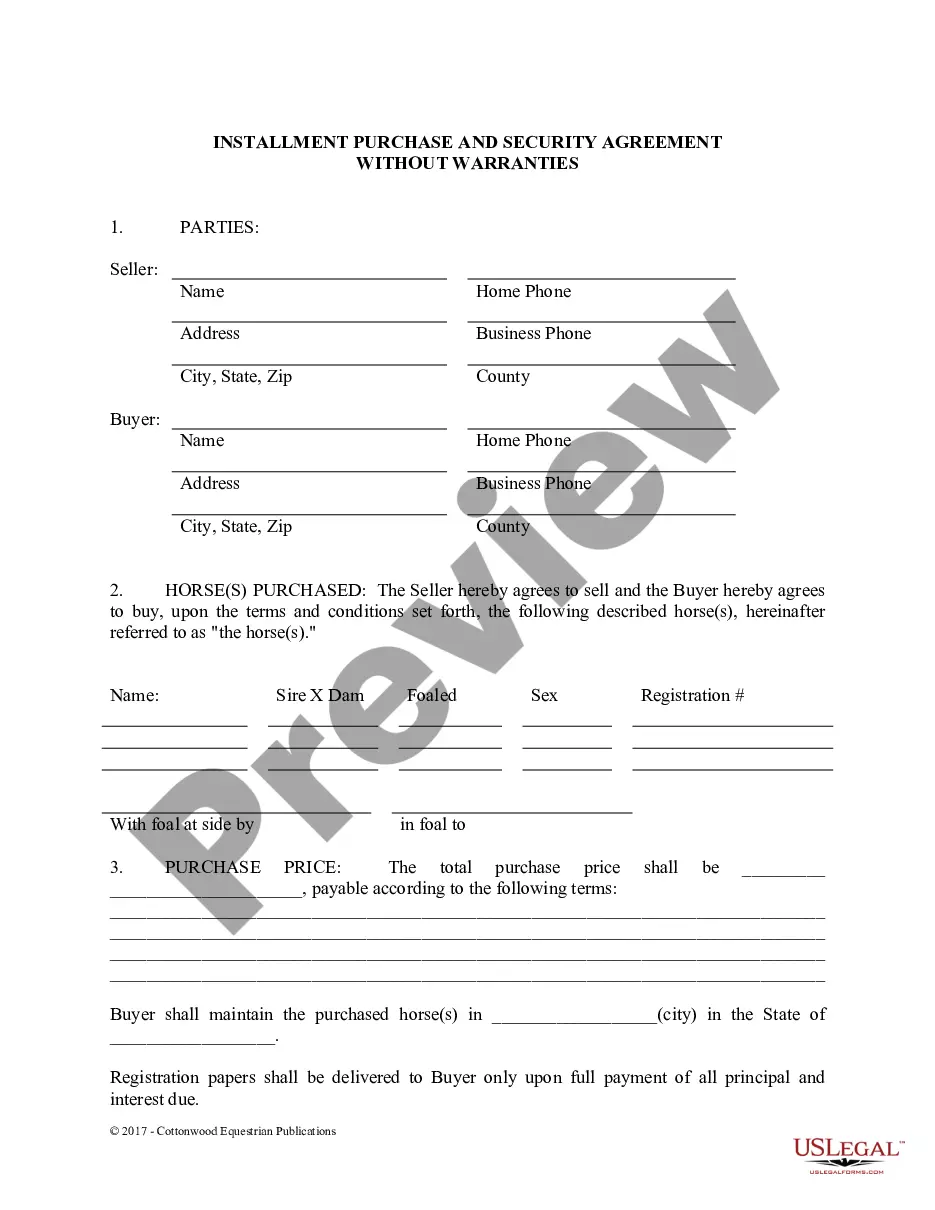

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Have you ever been in a situation where you need documents for either business or specific tasks nearly every day.

There are numerous legitimate document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms provides thousands of form templates, such as the Illinois Rejection of Claim and Report of Experience with Debtor, designed to comply with state and federal regulations.

Once you obtain the right form, click Get now.

Choose the pricing plan you want, complete the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Illinois Rejection of Claim and Report of Experience with Debtor form.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct city/state.

- Use the Preview button to review the form.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

To stop tax garnishment in Illinois, individuals may need to negotiate with the Illinois Department of Revenue. Filing an offer in compromise may serve as a way to address the tax debt and halt garnishment proceedings. It's also beneficial to understand your rights during this process, as additional documentation may be required. Knowledge of the Illinois Rejection of Claim and Report of Experience with Debtor can guide you through these negotiations effectively.

Illinois can typically collect back taxes for a period of 20 years. This extended timeline allows the state to pursue tax debts and ensures compliance with tax laws. It is crucial for taxpayers to understand their rights and obligations regarding these debts. Familiarizing yourself with the Illinois Rejection of Claim and Report of Experience with Debtor can provide valuable insights on how to manage outstanding tax liabilities.

Creditors have a statutory period of six months to file a claim against an estate after the estate representative has been appointed. This timeline is crucial for creditors to secure their claims and ensures that all debts are settled before distributing assets to heirs. Adhering to this timeframe can prevent complications, which is why understanding the Illinois Rejection of Claim and Report of Experience with Debtor is important.

In Illinois, the statute of limitations for probate is typically 30 days from the time the decedent's will is admitted to probate. It is essential to file a claim before this period elapses to ensure your interests are protected. If you miss this deadline, you might lose the right to seek your claims against the estate. Knowing the Illinois Rejection of Claim and Report of Experience with Debtor can help you navigate these timelines effectively.

Yes, a debtor can file a proof of claim, although it is less common. In situations related to Illinois Rejection of Claim and Report of Experience with Debtor, this might occur if the debtor believes they have a valid claim against a creditor. Filing a claim allows the debtor to formally assert their rights in the bankruptcy process. Utilizing platforms like uslegalforms can simplify this process by providing easy-to-understand documentation and guidance for debtors.

Various parties can object to a proof of claim, including the debtor themselves or other interested parties in the bankruptcy case. Under the framework of Illinois Rejection of Claim and Report of Experience with Debtor, objections typically arise if there are discrepancies in the claim or if the claim is deemed invalid. This process allows for transparency and fair treatment in bankruptcy proceedings. Interested parties must provide a valid basis for their objections to be considered by the court.

If a creditor fails to file a proof of claim, they may lose their right to payment from the debtor. In the context of Illinois Rejection of Claim and Report of Experience with Debtor, this could have significant implications for the creditor's ability to recover owed funds. Without a timely filed claim, creditors often find themselves excluded from distribution during bankruptcy proceedings. It's essential for creditors to understand the importance of this filing to protect their interests.

If a creditor does not validate the debt when requested, they may face challenges in collecting the amount owed. Being unable to validate debt can also result in an Illinois Rejection of Claim and Report of Experience with Debtor, harming the creditor's position in bankruptcy proceedings. Creditors should be prepared to provide documentation that proves the legitimacy of the debt. Platforms like US Legal Forms can guide creditors through the validation process, ensuring compliance with legal requirements.

When a creditor is not listed in a Chapter 13 bankruptcy filing, they may not receive any distributions from the bankruptcy plan. This can lead to an Illinois Rejection of Claim and Report of Experience with Debtor, effectively excluding them from the repayment process. Creditors should always verify if they have been properly listed to avoid these complications. Using resources from US Legal Forms can assist both debtors and creditors in ensuring that all relevant parties are included in the bankruptcy documentation.

If a creditor does not file proof of claim in Chapter 13, they generally forfeit their right to receive any payments through the bankruptcy plan. This situation can result in an Illinois Rejection of Claim and Report of Experience with Debtor, leaving the creditor unable to collect the debt. As a creditor, it is essential to stay informed and file the necessary documents in a timely manner to protect your interests. Utilizing platforms like US Legal Forms can help ensure that all filings are completed correctly and on time.