A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Illinois Conditional Guaranty of Payment of Obligation

Description

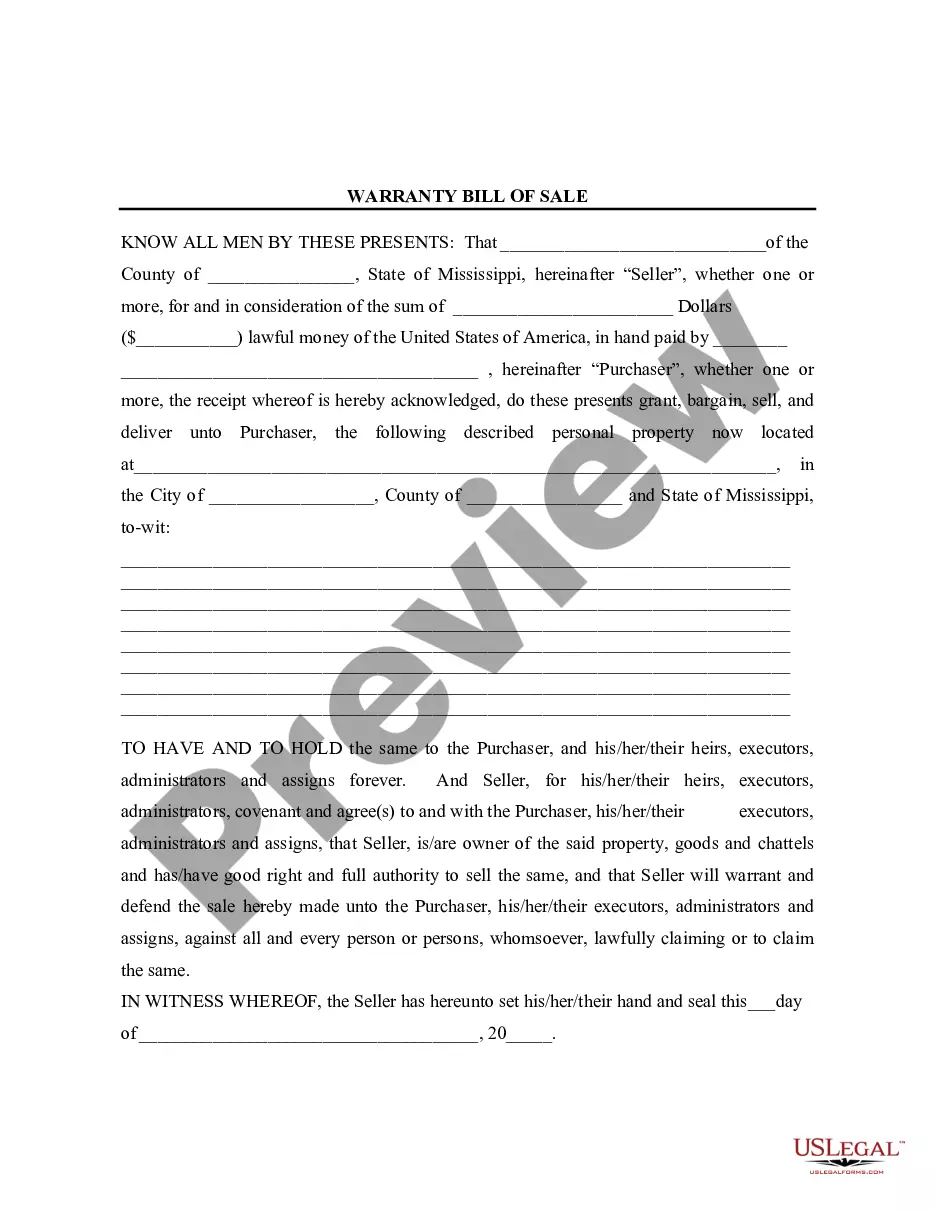

How to fill out Conditional Guaranty Of Payment Of Obligation?

It is feasible to spend time online looking for the sanctioned document format that meets the state and federal requirements you will require.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can obtain or create the Illinois Conditional Guaranty of Payment of Obligation from their service.

If available, utilize the Review button to examine the format as well. If you wish to locate another version of the document, use the Search field to find the template that fulfills your needs and requirements. Once you have identified the format you want, click Get now to proceed. Select the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to purchase the legal document. Find the format of the file and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Illinois Conditional Guaranty of Payment of Obligation. Access and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Illinois Conditional Guaranty of Payment of Obligation.

- Every legal document you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct format for the county/city you choose.

- Examine the form details to ensure you have chosen the correct template.

Form popularity

FAQ

The maximum payment out of the Illinois guaranty fund varies based on the type of claim. Typically, for property and casualty insurance, the maximum amount is capped at $300,000 per policyholder. It's important to be aware of these limits when considering your insurance options. Gaining insight into how the Illinois Conditional Guaranty of Payment of Obligation interacts with these limits can enhance your overall planning strategy.

In Illinois, the limits on insurance depend largely on the type of coverage you have. For instance, there are specific caps for life insurance and health insurance policies. Knowing these limits will help you choose the right insurance to meet your needs effectively. Understanding the Illinois Conditional Guaranty of Payment of Obligation ensures you select policies that provide you with suitable protections.

The guaranty of recourse obligations refers to a guarantee that allows a lender to seek repayment from a third party if the primary borrower defaults. This mechanism adds a layer of security for lenders and ensures the integrity of financial transactions. It is crucial for both parties to understand their obligations clearly. Familiarizing yourself with the Illinois Conditional Guaranty of Payment of Obligation can provide additional clarity on these responsibilities.

A guaranty of payment clause is a contractual provision that assures the payment of a debt if the primary debtor defaults. This clause is important for ensuring that obligations are fulfilled, allowing lenders and service providers to proceed with confidence. By incorporating such clauses, you minimize financial risk and enhance trust. If you’re looking for more information about the Illinois Conditional Guaranty of Payment of Obligation, exploring relevant legal documents can be beneficial.

The Illinois insurance guarantee fund is a mechanism that provides financial support to policyholders whose insurance companies become bankrupt. This fund exists to ensure that obligations are met even during challenging situations, safeguarding the interests of consumers. Understanding this fund is essential, especially when considering the Illinois Conditional Guaranty of Payment of Obligation for your peace of mind regarding financial security.

In Illinois, the maximum insurance guaranty fund amounts can vary depending on the specific type of insurance policy involved. Generally, the limit for claims related to property and casualty insurance is set at $300,000 per claim. It's crucial to familiarize yourself with these limits to ensure adequate coverage. Knowing how the Illinois Conditional Guaranty of Payment of Obligation applies can help you understand your protection level.

A form of guarantee serves as a written commitment promising to fulfill an obligation, such as covering payments if a borrower defaults. In the context of the Illinois Conditional Guaranty of Payment of Obligation, this form solidifies the promise made by the guarantor. Understanding this concept is vital for anyone entering into financial agreements, as it ensures that all parties fulfill their commitments.

A form of payment guarantee is a legally binding assurance that specifies how a payment will be made, ensuring that the payee receives it under agreed conditions. When you engage in an Illinois Conditional Guaranty of Payment of Obligation, you define the terms of this guarantee, providing clarity and trust between parties. Such guarantees are particularly important in transactions with significant financial implications.

A bank guarantee is issued by a bank, assuring payment to a beneficiary if the principal defaults. In contrast, a payment guarantee, like the Illinois Conditional Guaranty of Payment of Obligation, can be provided by individuals or entities. This distinction helps you understand the options available for securing your transactions and ensuring that payments are made as agreed.

To obtain a payment guarantee, you typically need to reach out to a financial institution or a service that specializes in guarantees. Through uslegalforms, you can create and customize an Illinois Conditional Guaranty of Payment of Obligation tailored to your needs. This streamlined process makes securing a payment guarantee easier and more accessible for both individuals and businesses.