Illinois Specific Guaranty

Description

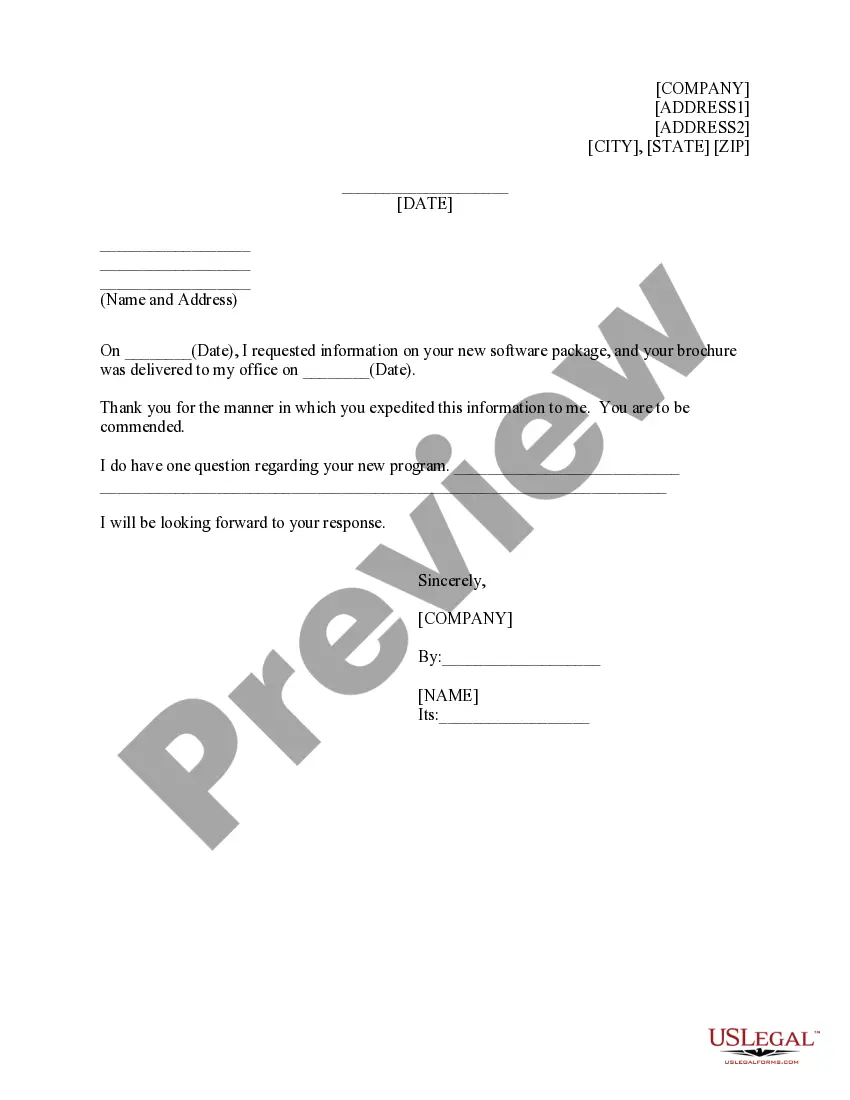

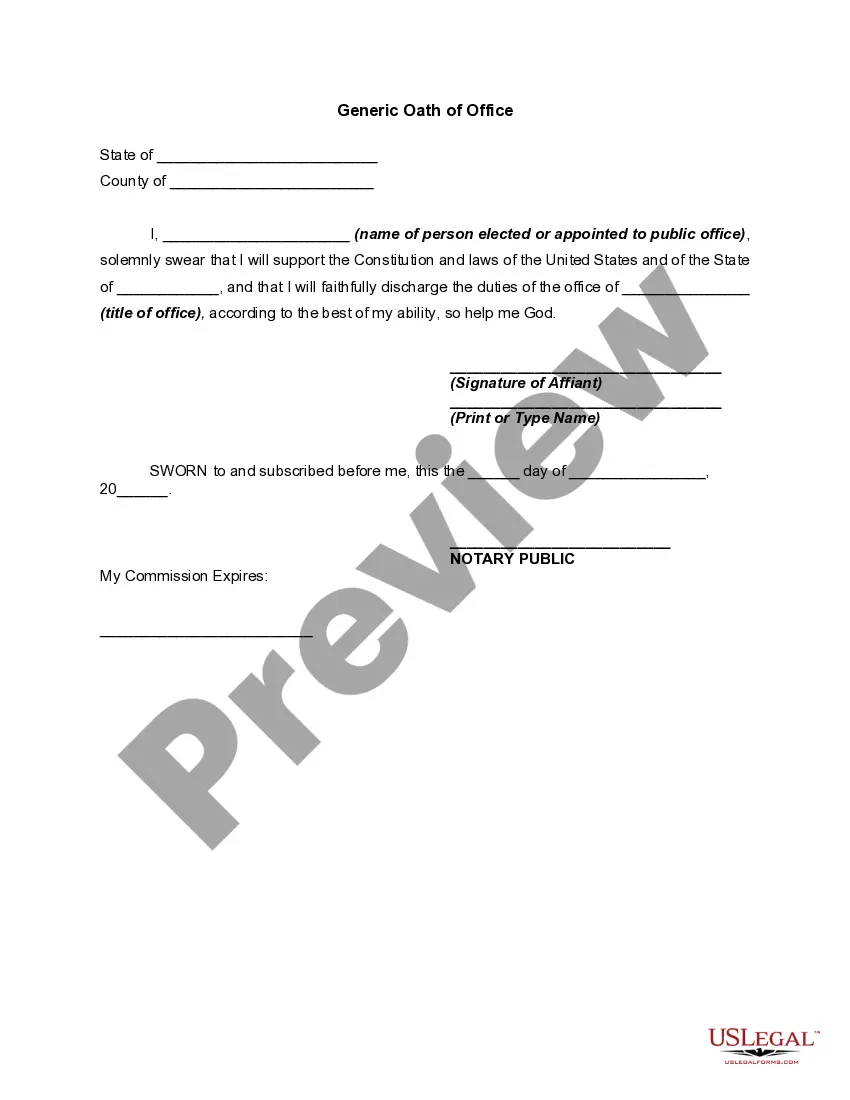

How to fill out Specific Guaranty?

US Legal Forms - one of many greatest libraries of legitimate varieties in America - offers a wide range of legitimate file layouts you are able to down load or printing. Utilizing the website, you will get a large number of varieties for company and individual reasons, categorized by classes, claims, or search phrases.You will discover the most recent versions of varieties just like the Illinois Specific Guaranty within minutes.

If you already possess a membership, log in and down load Illinois Specific Guaranty through the US Legal Forms collection. The Obtain key can look on each and every type you perspective. You have accessibility to all earlier downloaded varieties within the My Forms tab of the account.

If you would like use US Legal Forms the very first time, allow me to share straightforward recommendations to help you started off:

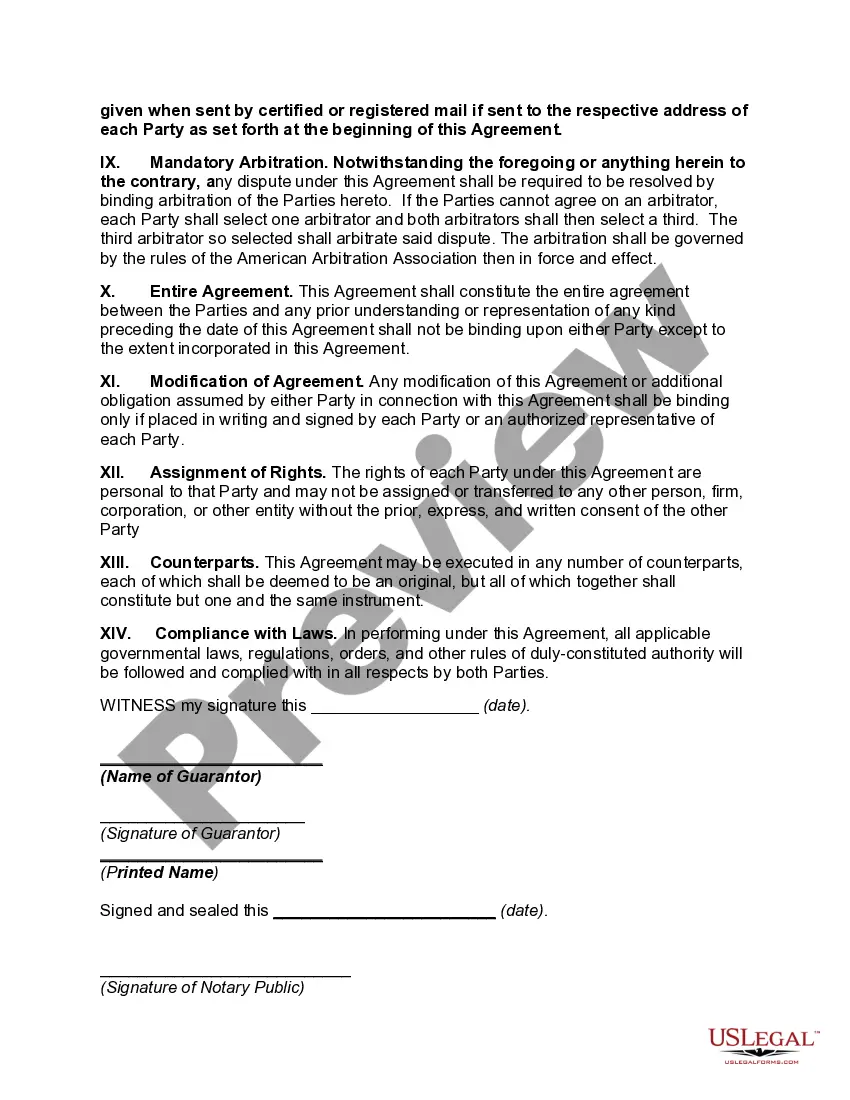

- Be sure you have selected the right type for the metropolis/region. Select the Review key to check the form`s content material. See the type explanation to actually have selected the proper type.

- In the event the type does not fit your demands, utilize the Look for discipline near the top of the monitor to get the the one that does.

- If you are satisfied with the form, validate your option by clicking the Get now key. Then, pick the rates prepare you favor and provide your references to sign up to have an account.

- Procedure the financial transaction. Make use of your Visa or Mastercard or PayPal account to accomplish the financial transaction.

- Find the formatting and down load the form on the product.

- Make changes. Complete, modify and printing and signal the downloaded Illinois Specific Guaranty.

Every format you added to your money lacks an expiration time and is your own property for a long time. So, if you want to down load or printing another version, just go to the My Forms section and click on around the type you will need.

Gain access to the Illinois Specific Guaranty with US Legal Forms, by far the most considerable collection of legitimate file layouts. Use a large number of professional and state-specific layouts that meet up with your company or individual requirements and demands.

Form popularity

FAQ

Also known as a guarantee. An agreement by which a party (the guarantor) assumes the responsibility for the payment or performance of an obligation or action of another party.

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

For purposes of administration and assessment, the Association must maintain 2 accounts: (1) The life insurance and annuity account, which includes the following subaccounts: (a) Life Insurance Account; (b) Annuity account, which shall include annuity contracts owned by a governmental retirement plan (or its trustee) ...

The Buyer's Guarantor acknowledges that it is the owner of the Buyer, and consequently it will benefit materially from the transactions contemplated by the Agreement, and thus it has received adequate consideration for its covenants, guarantees and agreements set forth herein.

The Illinois Insurance Guaranty Fund (IIGF) is a non-profit organization created by statute in July 1971. We were created to act as the ?safety net? for Illinois property and casualty insurance companies and their policyholders.

In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt.

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit. If the guarantor has pledged collateral to secure the guaranty obligation, foreclosure proceedings against that will often be commenced.

In Illinois, a guaranty is simply a contract where a guarantor promises to pay the debts of a ?principal? (the main debtor) to a third party creditor. A guaranty is construed like any other contract and a guarantor is given the benefit of any doubts that may arise from the language of a guaranty.