Illinois Personal Property Lease

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

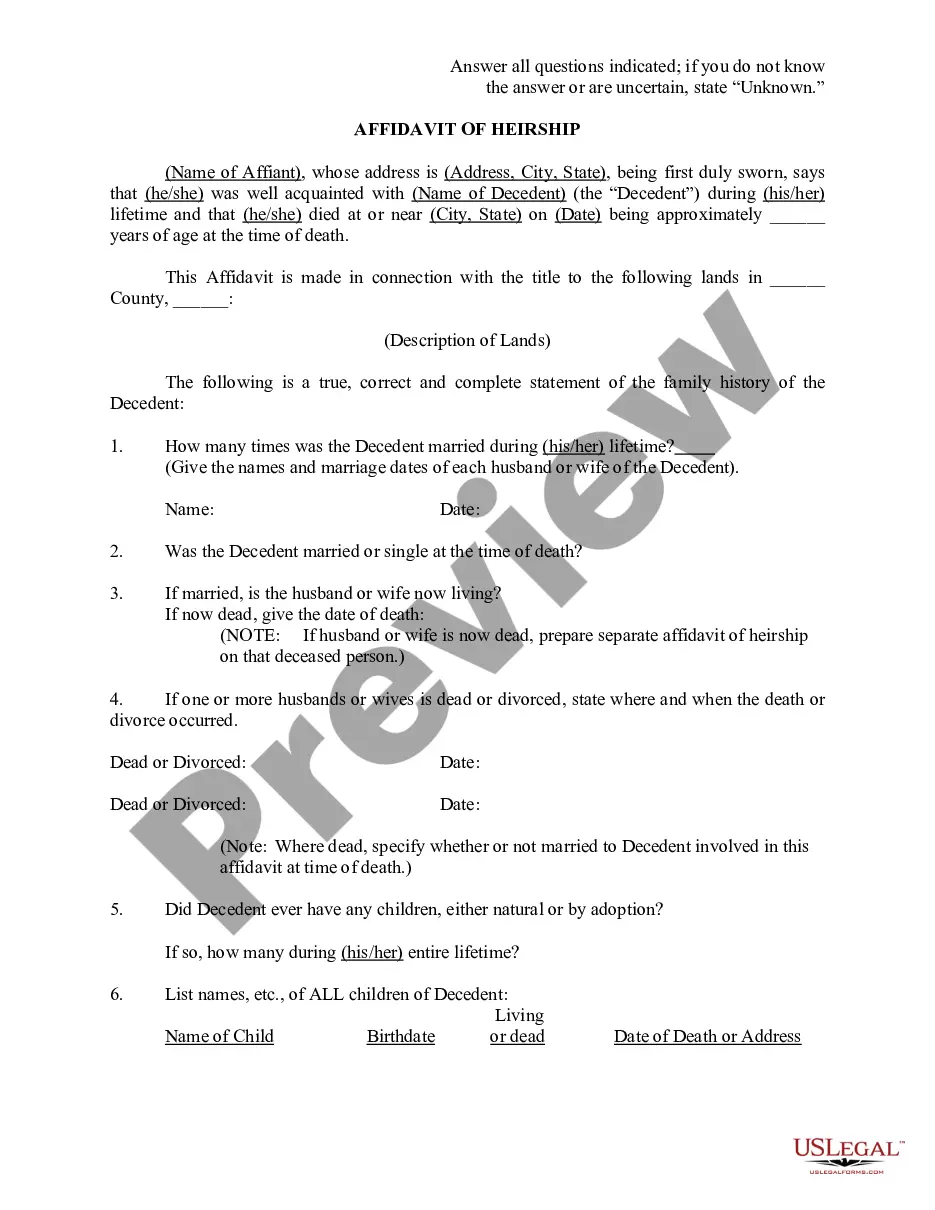

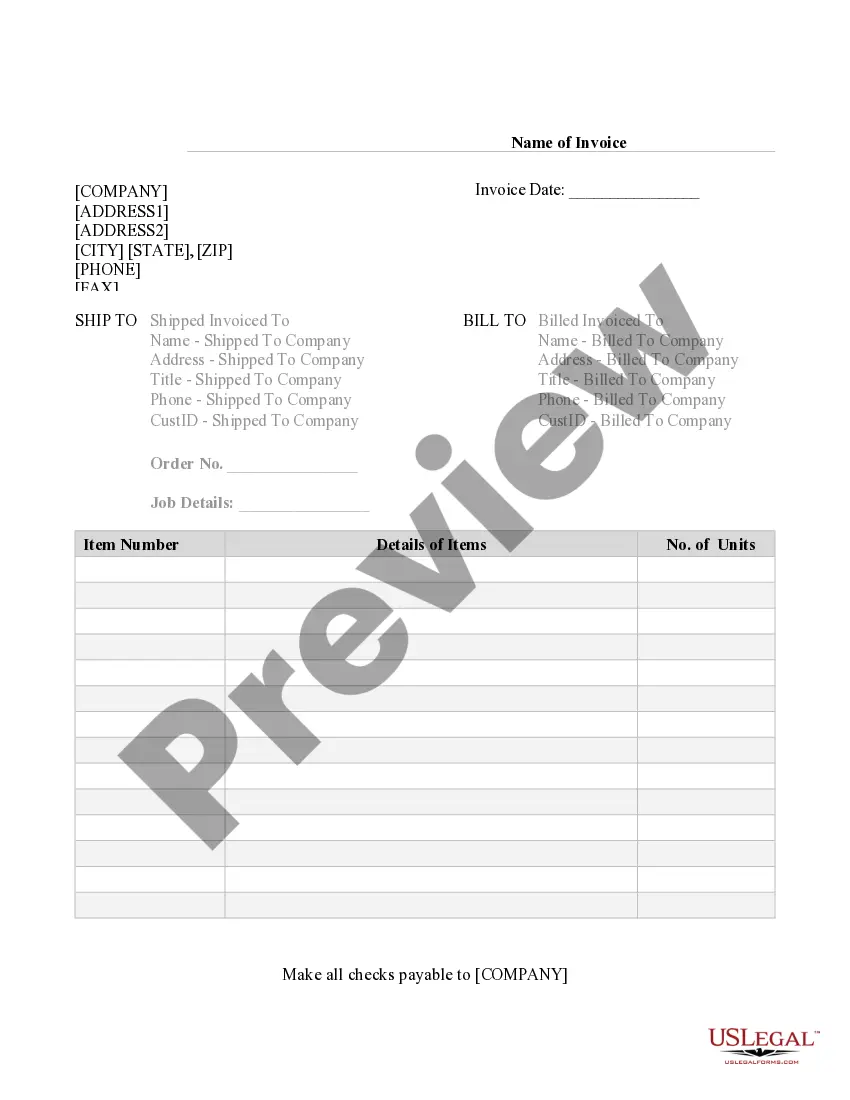

How to fill out Personal Property Lease?

If you need to total, obtain, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's easy and user-friendly search feature to find the documents you require.

A selection of templates for corporate and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and input your information to register for an account.

Step 5. Complete the purchase. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Use US Legal Forms to find the Illinois Personal Property Lease with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Illinois Personal Property Lease.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to evaluate the form's content. Make sure to read the details.

- Step 3. If you do not like the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, Illinois taxes personal property, and this tax is often a key consideration for businesses and individuals. Depending on your activities, these taxes could apply to items you lease or own outright. When entering an Illinois Personal Property Lease, it's wise to understand your tax responsibilities to ensure compliance.

The tax on $1 million dollars in Illinois depends on the specific locality and the governing tax rates applied to that amount. Typically, property taxes average around 1-2% of the property value, but rates can fluctuate. If you're investing in property through an Illinois Personal Property Lease, consulting with tax professionals can clarify your financial commitments.

Yes, Illinois imposes personal property taxes, which can vary based on the property type and its assessed value. Tax rates and regulations may differ between counties, making it essential for property owners to remain informed. Engaging with platforms like uslegalforms can provide the necessary guidance on navigating taxes associated with an Illinois Personal Property Lease.

Yes, tangible personal property is taxable in Illinois, especially when it is leased or rented. This taxation affects businesses and individuals who utilize such property as part of their operations. Thus, when considering an Illinois Personal Property Lease, factor in these taxes to avoid surprises.

In Illinois, personal property includes assets that are not tied to real estate, such as furniture, machinery, and equipment. This can range from office supplies to vehicles, depending on their intended use. When engaging with an Illinois Personal Property Lease, understanding what qualifies as personal property is crucial to ensure smooth transactions.

In Illinois, rental property owners typically face property taxes based on the assessed value of their real estate. The exact tax rate varies by locality, but property owners should prepare for this obligation as part of managing an Illinois Personal Property Lease. Understanding this responsibility helps ensure compliance and avoids unexpected costs.

Yes, rental income is taxable in Illinois. If you earn income from an Illinois Personal Property Lease, you need to report that income on your state tax returns. Understanding the tax implications of your rental income can guide you in making informed financial decisions.

Yes, Illinois has property taxes that are assessed on both real and personal property. These taxes are collected by local governments to fund services such as schools, roads, and public safety. When you engage in an Illinois Personal Property Lease, being aware of your potential property tax obligations is crucial.

In Illinois, personal property refers to assets that are not fixed to land. This includes items like furniture, equipment, and vehicles. Understanding the definition of personal property is vital when entering an Illinois Personal Property Lease, as it can affect your rights and obligations.

The personal property replacement tax in Illinois applies to businesses and corporations. This tax replaces the former personal property taxes that were levied on tangible assets. If you’re engaged in renting property, knowing how this tax impacts the Illinois Personal Property Lease can help you with budgeting and compliance.