Illinois Contract with Employee to Work in a Foreign Country

Description

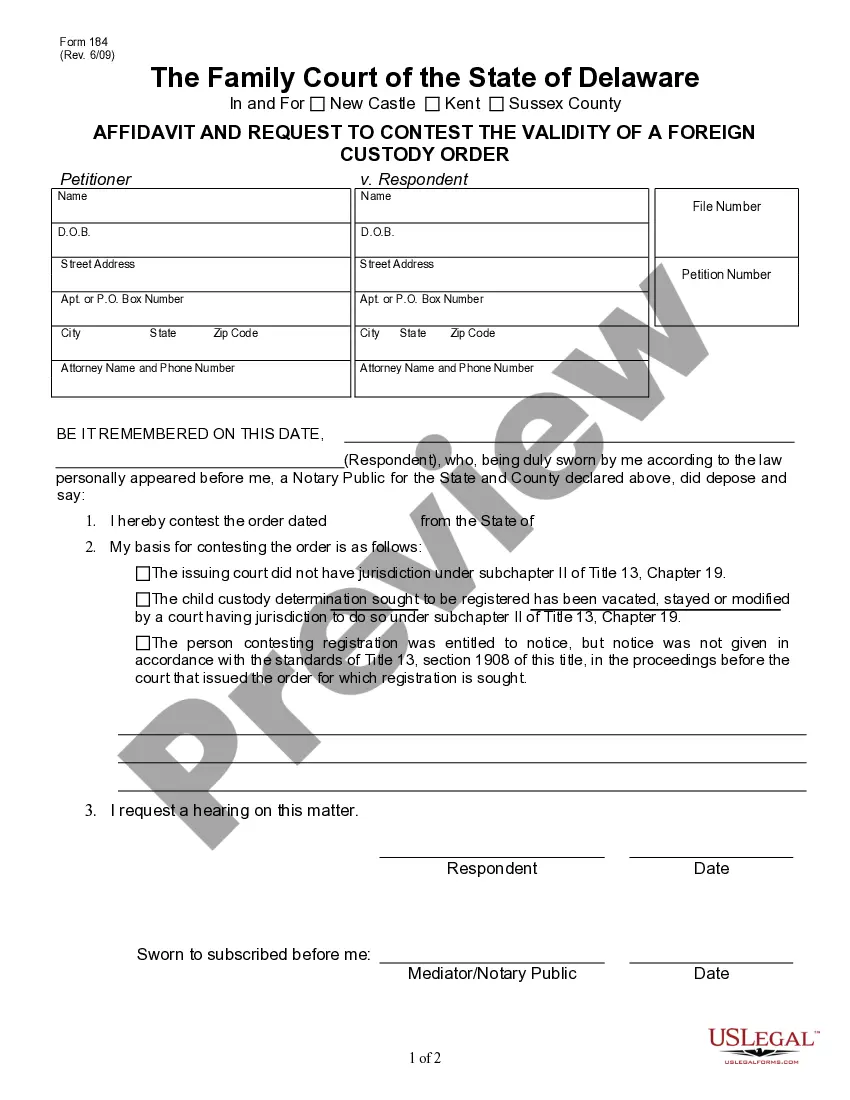

How to fill out Contract With Employee To Work In A Foreign Country?

Are you currently in a scenario where you require documents for various business or personal activities almost every day.

There are numerous legal document templates accessible online, but locating reliable forms isn't easy.

US Legal Forms offers thousands of form templates, such as the Illinois Contract with Employee to Work in a Foreign Country, designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

This service provides professionally crafted legal document templates you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois Contract with Employee to Work in a Foreign Country template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

- Use the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs and requirements.

- Once you locate the appropriate form, click Buy now.

- Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Illinois Contract with Employee to Work in a Foreign Country anytime, if needed. Click the required form to download or print the document template.

Form popularity

FAQ

Yes, salaries of University of Illinois employees are public information. This transparency allows for accountability and informed discussions about public funding. If you are considering an Illinois Contract with Employee to Work in a Foreign Country, familiarize yourself with salary data that could affect your financial planning.

Illinois imposes a tax on non-residents earning income from Illinois sources. This means if you are working abroad under an Illinois Contract with Employee to Work in a Foreign Country, you may still have filing obligations. It is advisable to consult with a tax professional to understand your specific situation.

Illinois State University is a public institution. It is part of the Illinois public university system and receives state funding to support its operations. If you plan to work under an Illinois Contract with Employee to Work in a Foreign Country, you may want to consider the implications of a public employee status on your employment rights and taxes.

Yes, employees of the University of Illinois are generally considered state employees. They participate in various state programs and are subject to state employment benefits. If you’re working under an Illinois Contract with Employee to Work in a Foreign Country, knowing your employment classification can impact your taxation and benefits.

Yes, filing Illinois state taxes is necessary even if you do not owe any taxes. This requirement ensures that the state maintains accurate financial records. If you have an Illinois Contract with Employee to Work in a Foreign Country, filing correctly can help you avoid complications with taxation.

The University of Illinois is a public university. As part of the state university system, it offers education and services funded by state resources. Understanding the nature of this institution is crucial, especially if you plan an Illinois Contract with Employee to Work in a Foreign Country and need to comply with specific regulations.

A state of Illinois employee is someone who works for the state government or its agencies. These employees typically receive a steady paycheck, benefits, and job security. If you enter into an Illinois Contract with Employee to Work in a Foreign Country, it’s essential to understand how your status may affect taxes and benefits.