Illinois Contract between General Agent of Insurance Company and Independent Agent

Description

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

If you wish to finalize, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Make use of the site's straightforward and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document format you buy is yours for an extended period.

You can access every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Stay competitive and download, and print the Illinois Contract between General Agent of Insurance Company and Independent Agent with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Illinois Contract between General Agent of Insurance Company and Independent Agent in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Illinois Contract between General Agent of Insurance Company and Independent Agent.

- Additionally, you can access forms you previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the correct form for your region/state.

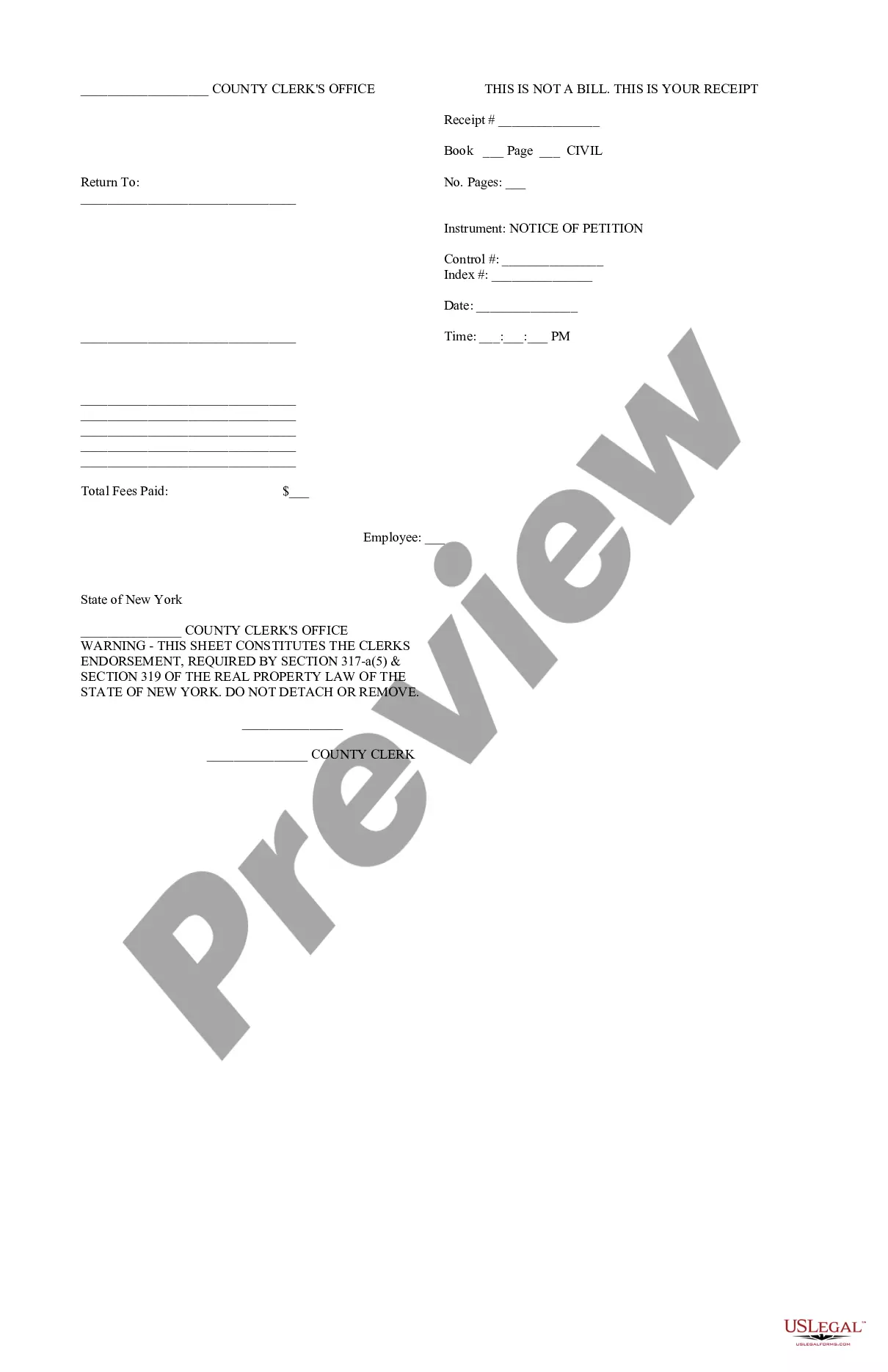

- Step 2. Use the Review option to examine the content of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, employ the Search field at the top of the page to find alternative forms in the legal document format.

- Step 4. After locating the form you need, click the Purchase now button. Choose the payment plan you prefer and input your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Illinois Contract between General Agent of Insurance Company and Independent Agent.

Form popularity

FAQ

Yes, insurance agents in Illinois are required to be licensed to sell insurance products legally. This licensing process ensures that agents understand state regulations and the insurance market. Engaging with the Illinois Contract between General Agent of Insurance Company and Independent Agent can help agents navigate compliance and licensing requirements effectively.

The income of a licensed insurance agent in Illinois can vary widely based on experience, expertise, and the commission structure they work under. On average, agents can earn a substantial income if they build a solid client base and leverage effective sales strategies. Understanding the Illinois Contract between General Agent of Insurance Company and Independent Agent can help agents maximize their earning potential.

An insurance agent maintains a professional relationship with their insurance company, acting as a liaison to clients. They help clients understand available products and provide ongoing service. The Illinois Contract between General Agent of Insurance Company and Independent Agent outlines the terms under which agents operate, ensuring both the agent and company fulfill their commitments effectively.

The insurer and the broker work together to facilitate the sale of insurance products to clients. Brokers represent the interests of consumers, while the insurer provides the actual coverage. The Illinois Contract between General Agent of Insurance Company and Independent Agent can help clarify how brokers interact with insurers and the overall dynamics of this important relationship.

An agent plays a key role in the life insurance industry by helping clients select the right policies that meet their needs and financial goals. They provide valuable insights and support throughout the purchasing process and often help with ongoing service and claims. Having a clear Illinois Contract between General Agent of Insurance Company and Independent Agent can streamline this process and enhance client satisfaction.

The agreement between the agent and the insurer spells out the terms of their professional relationship, including commission rates, responsibilities, and service standards. This contract ensures both parties understand their roles and obligations clearly. Key elements of the Illinois Contract between General Agent of Insurance Company and Independent Agent can significantly influence the success of this partnership.

The insurance company provides coverage to the insured in exchange for a premium. This relationship is built on trust and the promise that the insurer will deliver on claims when needed. Understanding the Illinois Contract between General Agent of Insurance Company and Independent Agent can help clarify the roles involved in this arrangement.

A GA, or general agent, acts as a middleman between an insurance company and independent agents. They have the authority to oversee the agents in their network while also helping to manage their performance. The Illinois Contract between General Agent of Insurance Company and Independent Agent outlines the responsibilities and expectations within this vital relationship.

Yes, an insurance agent can be independent. An independent agent operates under their own business, representing multiple insurance companies rather than being tied to just one. This flexibility allows the agent to offer a wider range of options, benefiting clients with tailored insurance solutions. To establish an Illinois Contract between General Agent of Insurance Company and Independent Agent, both parties can ensure clear terms for representation and commission structures.

General Agents have several key responsibilities, including recruiting and training Independent Agents, providing ongoing support, and ensuring compliance with regulations. They also play a significant role in developing marketing strategies and managing overall agency performance. The Illinois Contract between General Agent of Insurance Company and Independent Agent outlines these duties to maintain clarity and mutual understanding in the partnership.