Illinois Revocable Living Trust for Unmarried Couples

Description

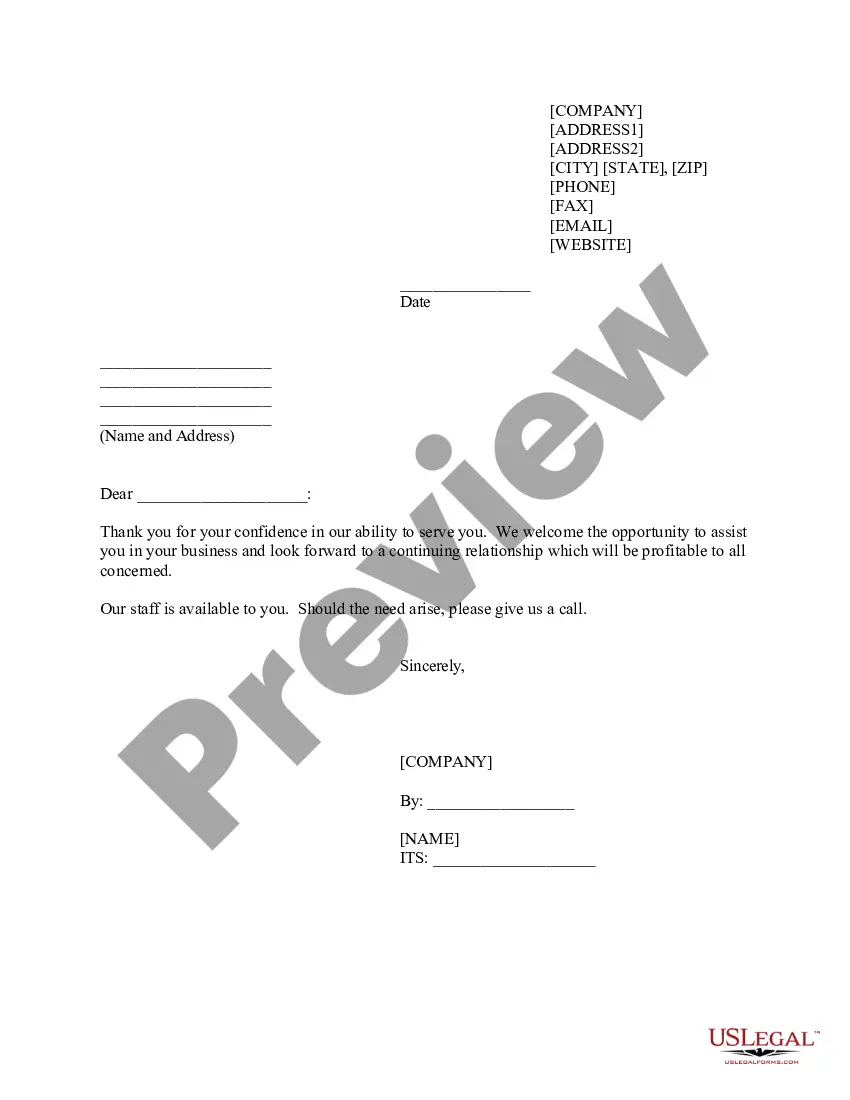

How to fill out Revocable Living Trust For Unmarried Couples?

Have you ever found yourself in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating reliable ones is not easy.

US Legal Forms provides thousands of form templates, including the Illinois Revocable Living Trust for Unmarried Couples, designed to fulfill state and federal standards.

Select a convenient file format and download your document.

Access all the document templates you have purchased in the My documents section. You can acquire another version of the Illinois Revocable Living Trust for Unmarried Couples whenever necessary. Simply click on the desired form to download or print the document template. Make use of US Legal Forms, which offers the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Illinois Revocable Living Trust for Unmarried Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Review button to verify the form.

- Review the description to confirm that you have chosen the correct template.

- If the form is not what you are looking for, use the Search field to find the document that fits your needs.

- Once you find the appropriate form, click on Buy now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and purchase the order using your PayPal or credit card.

Form popularity

FAQ

A trust does not need to be filed to be legal in Illinois. The Illinois Revocable Living Trust for Unmarried Couples is valid once the trust document is created and executed properly. Its legality comes from the appropriate drafting of the trust terms and not from filing it with a government agency. This makes it an ideal option for those seeking privacy and control over their assets.

Filing a trust in Illinois involves preparing the trust document and properly executing it according to state laws. For Illinois Revocable Living Trust for Unmarried Couples, consider working with a legal professional or using platforms like US Legal Forms for ease. Once the trust is created, transferring assets into the trust is essential, but there is no formal filing process with the state. This process allows you to manage your assets conveniently and privately.

In Illinois, a trust does not need to be recorded to be valid. For Illinois Revocable Living Trust for Unmarried Couples, you create the trust document, and while it remains private, it still serves its purpose effectively. The trust can hold assets and facilitate smooth transitions without requiring public registration. This keeps your plans confidential and simplifies estate management.

For a single person, an Illinois Revocable Living Trust for Unmarried Couples is often seen as a practical choice. This type of trust allows for flexibility and can be modified if your circumstances change. It also helps you avoid probate, providing peace of mind concerning how your assets will be managed and distributed after your passing.

Deciding to place your house in an Illinois Revocable Living Trust for Unmarried Couples can enhance asset management and offer legal benefits. It can shield your estate from probate and simplify the transfer process to heirs. Make sure to examine your circumstances and consult a professional to ensure this decision aligns with your goals.

In the case of a joint revocable trust, such as an Illinois Revocable Living Trust for Unmarried Couples, the surviving partner generally retains full control over the trust's assets. This arrangement allows for seamless management of property without the need for probate. However, it is advisable to review the trust terms to understand how assets will be divided in the long term.

Utilizing an Illinois Revocable Living Trust for Unmarried Couples can be a beneficial choice. This approach can help you avoid probate and provide more control over asset distribution after your death. However, assessing your personal financial situation and future goals is crucial. Consulting with a lawyer can help determine if it's the right move for you.

Placing your house in an Illinois Revocable Living Trust for Unmarried Couples can have downsides. First, the transfer process may require paperwork and legal fees, which can add initial costs. Additionally, you might lose some control over the property since it is held by the trust. It's essential to weigh these factors carefully before deciding.

Typically, an Illinois Revocable Living Trust for Unmarried Couples does not need to be filed with the court. This privacy allows the trust's creator to manage their assets without public scrutiny. However, certain circumstances may require a trust to be activated in court, especially if disputes arise. Consult with legal experts at uslegalforms to ensure compliance with Illinois law and to address any specific court requirements.

Yes, having an Illinois Revocable Living Trust for Unmarried Couples can be a wise decision for your parents. It provides control over their assets and a clear plan for distribution, which can reduce potential family disputes. Additionally, a trust can simplify the transfer process upon their passing, avoiding the lengthy probate process. Encourage them to consider this option and seek legal assistance to create the best structure for their needs.