Illinois Direct Deposit Form for Stimulus Check

Description

How to fill out Direct Deposit Form For Stimulus Check?

Selecting the optimal valid document template can be a challenge. Naturally, there are countless designs available online, but how will you find the appropriate form you need? Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Illinois Direct Deposit Form for Stimulus Check, that you can use for business and personal needs. All of the forms are reviewed by professionals and meet state and federal standards.

If you are already registered, Log In to your account and click the Acquire button to access the Illinois Direct Deposit Form for Stimulus Check. Use your account to browse through the legal forms you have obtained previously. Visit the My documents section of your account and retrieve another copy of the document you need.

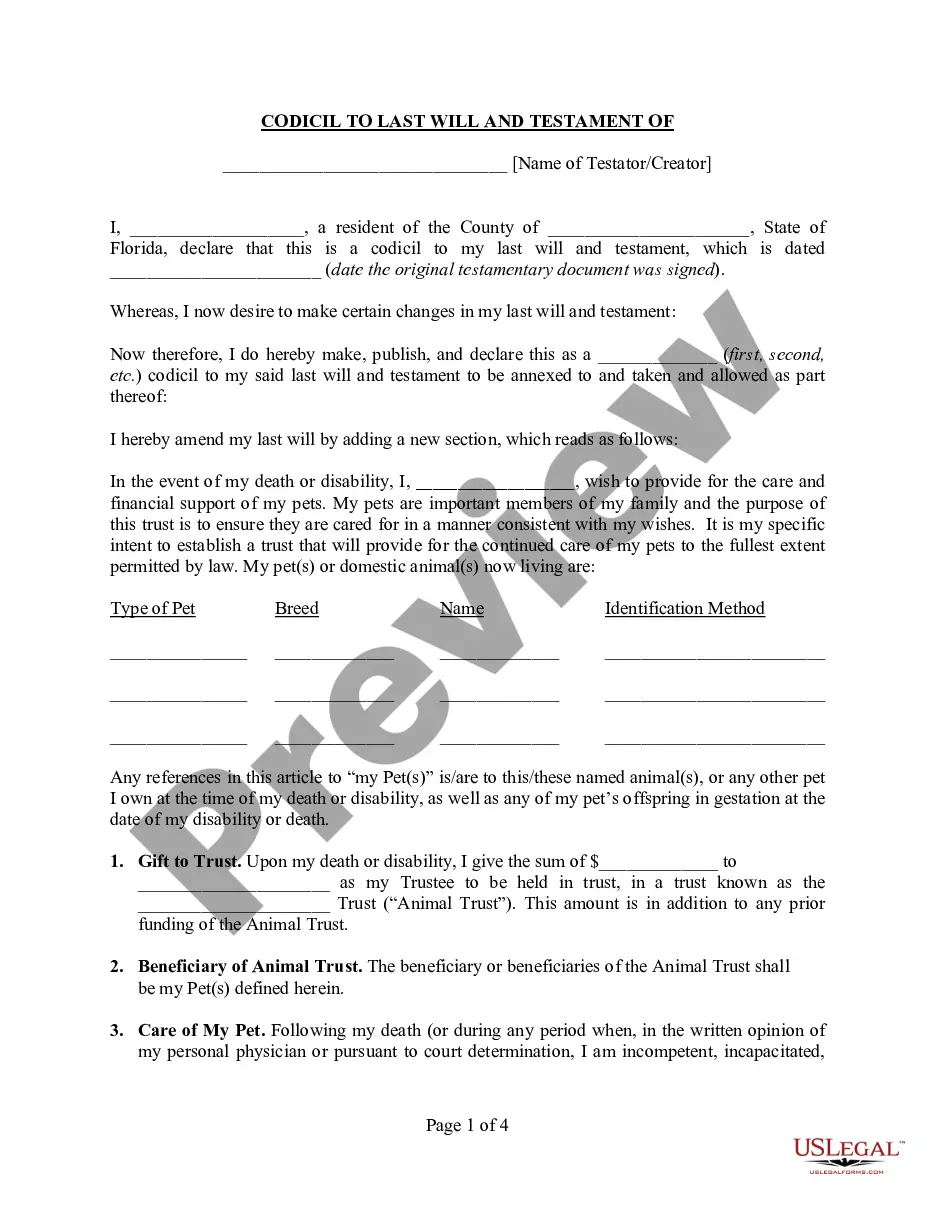

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and check the form description to confirm this is suitable for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are certain that the form is appropriate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and process the order using your PayPal account or credit card. Select the file format and download the valid document template to your device. Complete, edit, print, and sign the downloaded Illinois Direct Deposit Form for Stimulus Check.

Take advantage of the resources available at US Legal Forms to ensure you have the appropriate legal documentation.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to acquire professionally crafted documents that comply with state regulations.

- The templates available are verified by experts to ensure they meet legal standards.

- You have access to a wide range of forms for different purposes, both personal and business-related.

- The platform is user-friendly and provides easy navigation for finding and purchasing forms.

- It supports multiple payment methods for a convenient transaction experience.

Form popularity

FAQ

Typically, direct deposit from the Illinois Department of Employment Security (IDES) takes about two to three business days to process. After you submit your Illinois Direct Deposit Form for Stimulus Check, the time frame may vary based on your bank's processing times. It's important to ensure that your form is filled out correctly to avoid any delays in receiving your funds.

To set up direct deposit for Illinois unemployment, you will need to complete the Illinois Direct Deposit Form for Stimulus Check. This form requires your bank account information and can be submitted online through the Illinois Department of Employment Security website. Once your application is processed, you will begin receiving your unemployment benefits directly into your bank account.

Yes, you can print out a direct deposit form for your convenience. Using the US Legal Forms platform, you can easily access the Illinois Direct Deposit Form for Stimulus Check and print it directly from your device. This allows you to fill it out by hand or submit it electronically, ensuring a smooth process for receiving your funds.

2-3 days after certifying for benefits, payment will be made on your debit card or through direct deposit. You must continue to certify (on the same day of the week indicated in your UI Finding letter) every two weeks to continue to receive benefits.

Direct Deposit Step-by-Step Guide. How to Enroll or Edit Your Direct Deposit. 1) Sign into your IDES account. a. ... 2) Once you are logged into your benefits page, hover over the Individual Home tab and. ... 4) You will see the Enroll in Direct Deposit/Edit My Direct Deposit page. ... again.

Determining your direct deposit status is as simple as logging into your online bank account to see if your money's arrived. If there is a delay, you may have to check with your employer's payroll department.

A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS.

If you have direct deposit, fill out the papers directing your employer to reroute your paychecks to your new account. Do the same for any other direct deposit, such as Social Security payments. Find out the date your direct deposits will transfer.

You will need to complete a Direct Deposit Account Number Change Request form. This form is available through your Member Services account, or to request one to be mailed you can contact us at sers@srs.illinois.gov or (217) 785-7444.

You will need to provide your new bank's routing number and your new account number to each payer or payee. You can do this online, by phone, by mail, or in person, depending on the method they prefer.