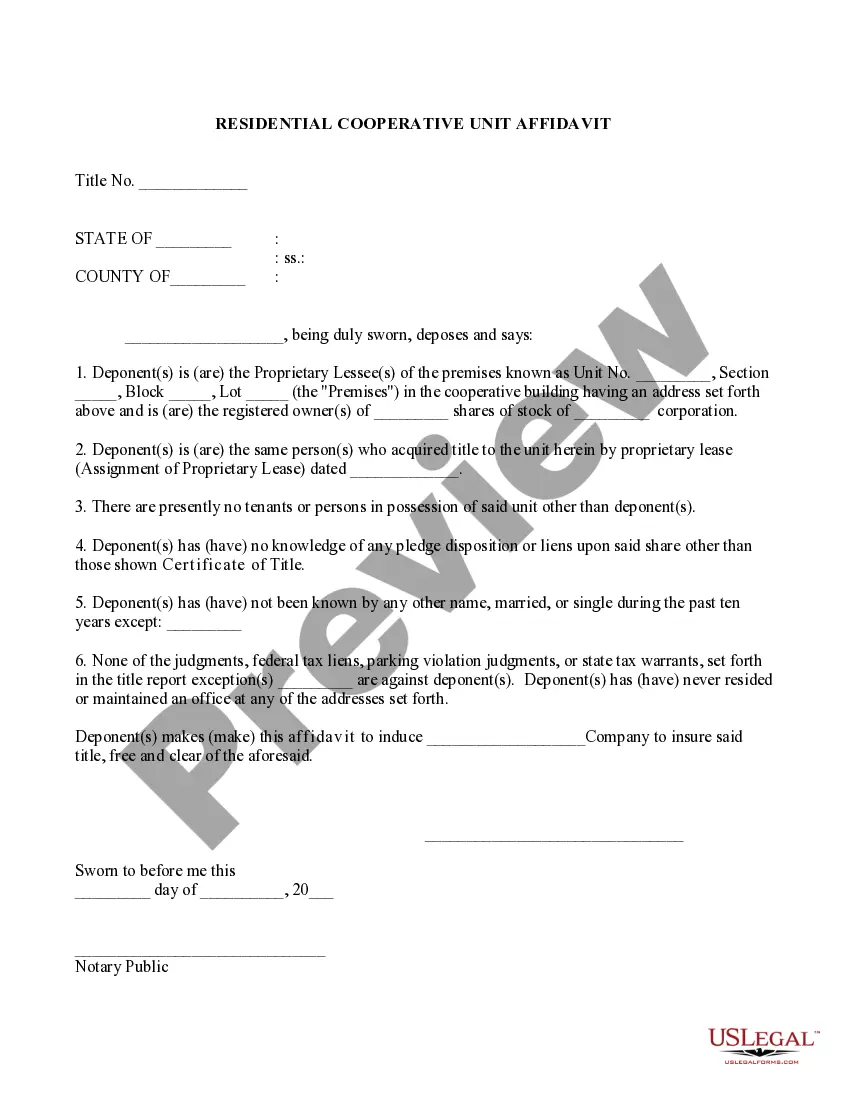

An Illinois Vacancy Affidavit-10 or More Stories, also known as a Vacancy Affidavit or Statement of Vacancy, is a legal document used to certify that a dwelling unit in Illinois is vacant. It is typically required to be completed by the owner or landlord of the property when a tenant moves out or when a unit becomes vacant. It must be notarized and filed with the local government. The affidavit is intended to provide assurance that the unit is vacant and ready for a new tenant. For buildings with ten or more stories, the affidavit must also include the following information: the address of the building, the total number of stories, the number of vacant units, the total number of units in the building, the name, address, and telephone number of the managing agent, the name, address, and telephone number of the owner, and the date the unit became vacant. For buildings with fewer than ten stories, the affidavit must include the same information, but does not need to include the total number of stories in the building. Types of Illinois Vacancy Affidavit-10 or More Stories 1. Residential Vacancy Affidavit-10 or More Stories: This affidavit is used in residential buildings with ten or more stories. 2. Commercial Vacancy Affidavit-10 or More Stories: This affidavit is used in commercial buildings with ten or more stories. 3. Non-Residential Vacancy Affidavit-10 or More Stories: This affidavit is used in non-residential buildings with ten or more stories.

Illinois Vacancy affidavit-10 or More Stories

Description

How to fill out Illinois Vacancy Affidavit-10 Or More Stories?

How much effort and resources do you typically allocate to producing formal documentation.

There’s a greater chance of obtaining such documents than engaging legal professionals or spending numerous hours searching online for an appropriate template. US Legal Forms is the premier online repository that provides expertly crafted and verified state-specific legal forms for any requirement, including the Illinois Vacancy affidavit-10 or More Stories.

An additional advantage of our service is that you can retrieve previously acquired documents that you securely store in your profile under the My documents tab. Access them anytime and redo your documentation as often as you wish.

Conserve time and energy preparing official documentation with US Legal Forms, one of the most reliable online solutions. Register with us today!

- Browse through the form details to ensure it meets your state criteria. To do so, examine the form description or use the Preview option.

- If your legal form doesn’t fulfill your requirements, look for another using the search bar at the top of the page.

- If you already possess an account with us, Log In and obtain the Illinois Vacancy affidavit-10 or More Stories. If not, continue to the following steps.

- Click Buy now once you locate the appropriate blank. Select the subscription plan that best fits your needs to access the complete service of our library.

- Create an account and pay for your subscription. You can pay with your credit card or through PayPal - our service is completely secure for that.

- Download your Illinois Vacancy affidavit-10 or More Stories onto your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

The problem in Cook County is that commercial landlords already pay high property taxes. Unlike the rest of Illinois, Cook County assesses commercial property at 25% of market value, compared with 10% for residential property.

There is no set rate for property tax in Illinois. Your tax bill is based on two factors, the equalized assessed value (EAV) of your property, and the amount of money your local taxing districts need to operate during the coming year. Most property is assessed at 33 1/3 percent of its fair market value.

Commercial Property Taxes Property taxes continue to be the largest, single recoverable expense for commercial real estate owners in the City of Chicago, with average property taxes rising 34.4 percent to $7.50 per square foot since the 2012 Economic Impact Study.

For residential property owners, the assessed value equals 10% of the fair market value of the home. For most commercial property owners, the assessed value is 25% of the fair market value. This level of assessed value is the taxable amount of the property, as determined by Cook County ordinance.

What is the sales tax rate in Cook County? The minimum combined 2023 sales tax rate for Cook County, Illinois is 10.25%. This is the total of state and county sales tax rates. The Illinois state sales tax rate is currently 6.25%.

In order to qualify for a property tax exemption, your organization must be exclusively beneficent and charitable, religious, educational, or governmental and own the property that is used exclusively for charitable, religious, educational, or governmental purposes and not leased or used for profit.

Commercial and Industrial properties in Cook County are assessed at 25% of market value. Unlike most counties in Illinois, Cook County does not assess at the township assessor level. The Cook County Assessor is responsible for assessing all properties in all townships.