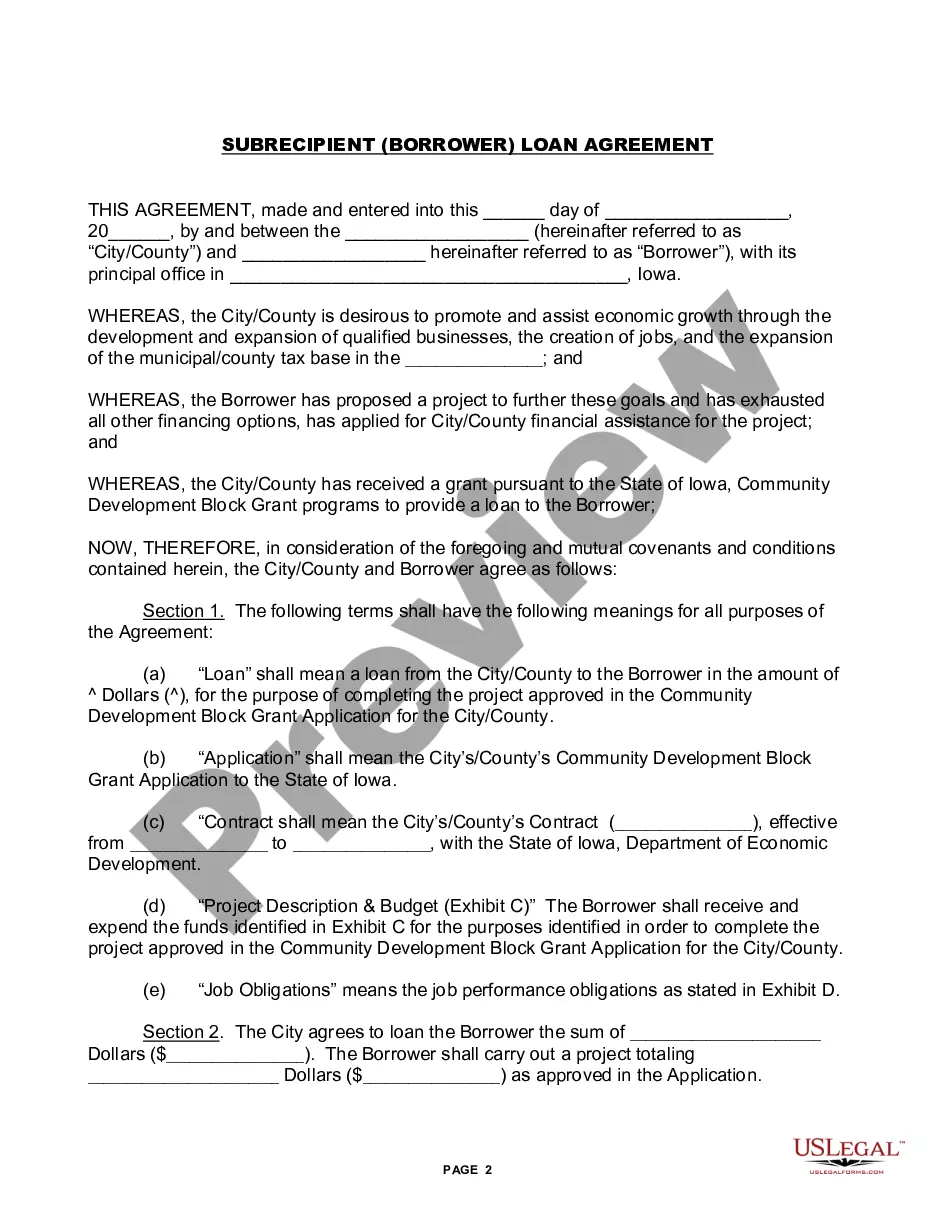

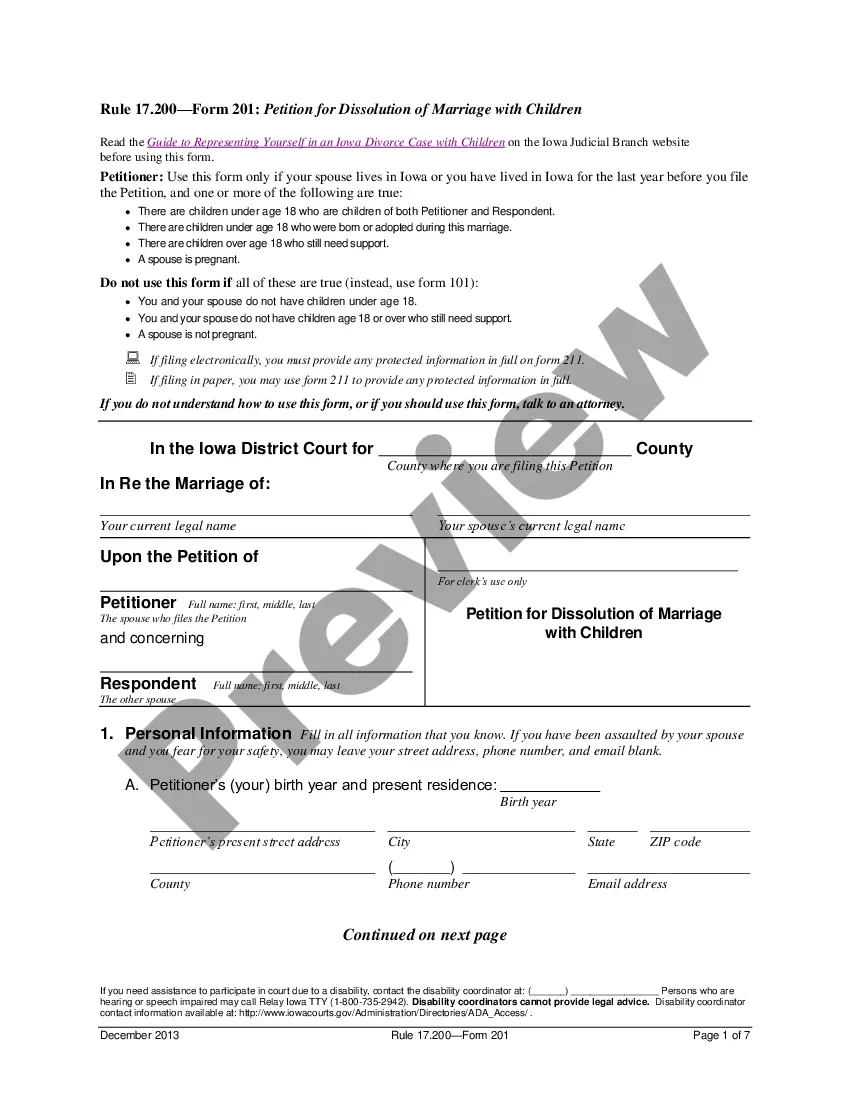

Illinois Non-Hotel Form is a document used by the Illinois Department of Revenue to report and pay taxes on lodging that is not part of a hotel. This form is used to report and pay taxes on short-term rental properties, such as vacation rentals, Airbnb, room rentals, dormitories, and other dwellings, for stays of 30 days or less. There are two types of Illinois Non-Hotel Form: Form ST-1 and ST-1 N. Form ST-1 is used to report and pay taxes on rental properties when the lessor, or the person renting the property, is a non-resident of Illinois. Form ST-1 N is used to report and pay taxes on rental properties when the lessor is a resident of Illinois. Both forms require the lessee to report the rental income and calculate the appropriate taxes.

Illinois Non-Hotel Form

Description

How to fill out Illinois Non-Hotel Form?

Engaging with legal paperwork demands diligence, precision, and the use of properly constructed templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Illinois Non-Hotel Form template from our platform, you can be confident it complies with federal and state regulations.

Utilizing our platform is straightforward and efficient. To acquire the required document, all you'll need is an account with an active subscription. Here’s a concise guide for you to locate your Illinois Non-Hotel Form in a matter of minutes.

All documents are designed for multiple uses, like the Illinois Non-Hotel Form you find on this page. If you require them in the future, you can complete them without making any additional payments - just access the My documents tab in your profile and finalize your document whenever you need it. Experience US Legal Forms and efficiently handle your business and personal documentation while ensuring full legal compliance!

- Ensure to meticulously review the form's content and its alignment with both general and legal stipulations by previewing it or examining its description.

- Look for another official template if the previously accessed one does not fit your situation or state requirements (the tab for that is located at the top page corner).

- Log in to your account and save the Illinois Non-Hotel Form in your preferred format. If it's your initial visit to our website, click Buy now to continue.

- Create an account, select your subscription option, and settle the payment using your credit card or PayPal.

- Specify in which format you wish to receive your form and click Download. Print the template or upload it to a suitable PDF editor to complete it electronically.

Form popularity

FAQ

The owner-occupied property tax exemption in Illinois reduces the taxable value of a property owned and occupied by its owner. This exemption can substantially lower property taxes, making homeownership more affordable for residents. If you want to apply or understand this exemption, the Illinois Non-Hotel Form from USLegalForms provides the necessary forms and instructions to simplify your experience.

Non-residents must file an Illinois tax return if they earn income in the state. You need to complete the Illinois Non-Hotel Form and report your Illinois-sourced income. It’s essential to familiarize yourself with any credits or deductions you may qualify for as a non-resident to optimize your tax situation.

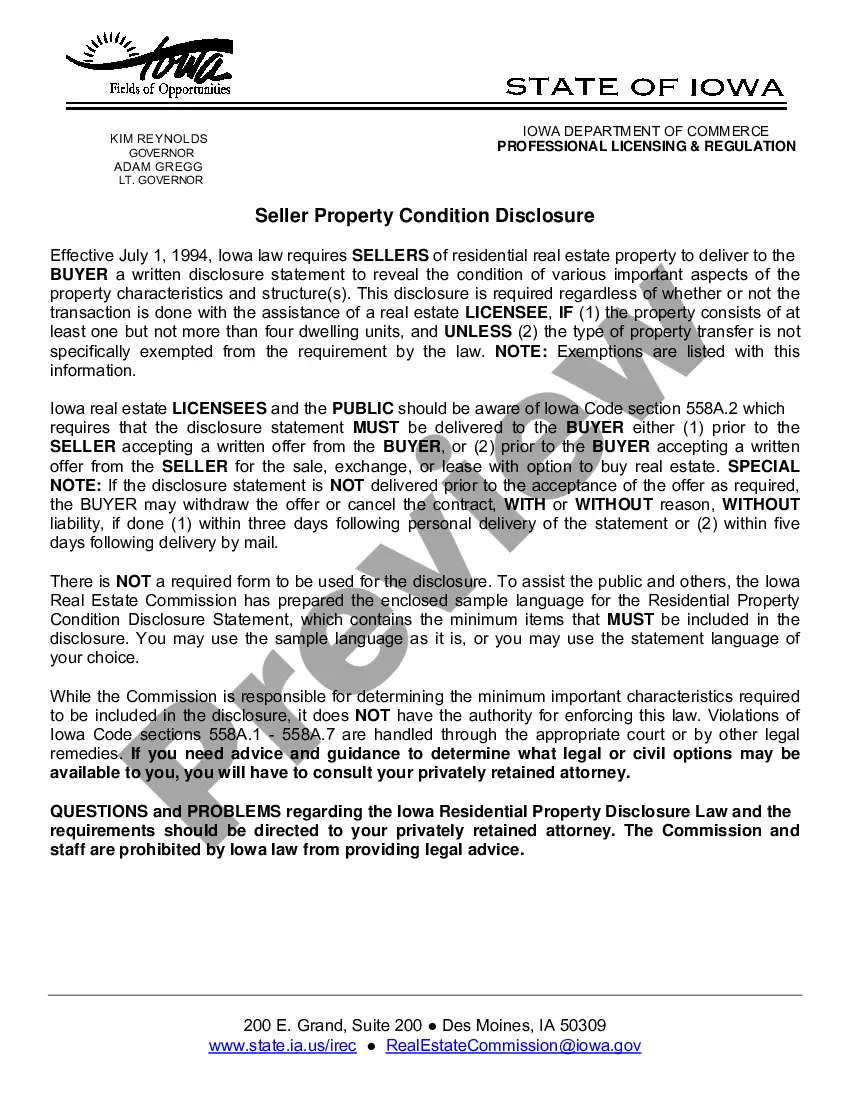

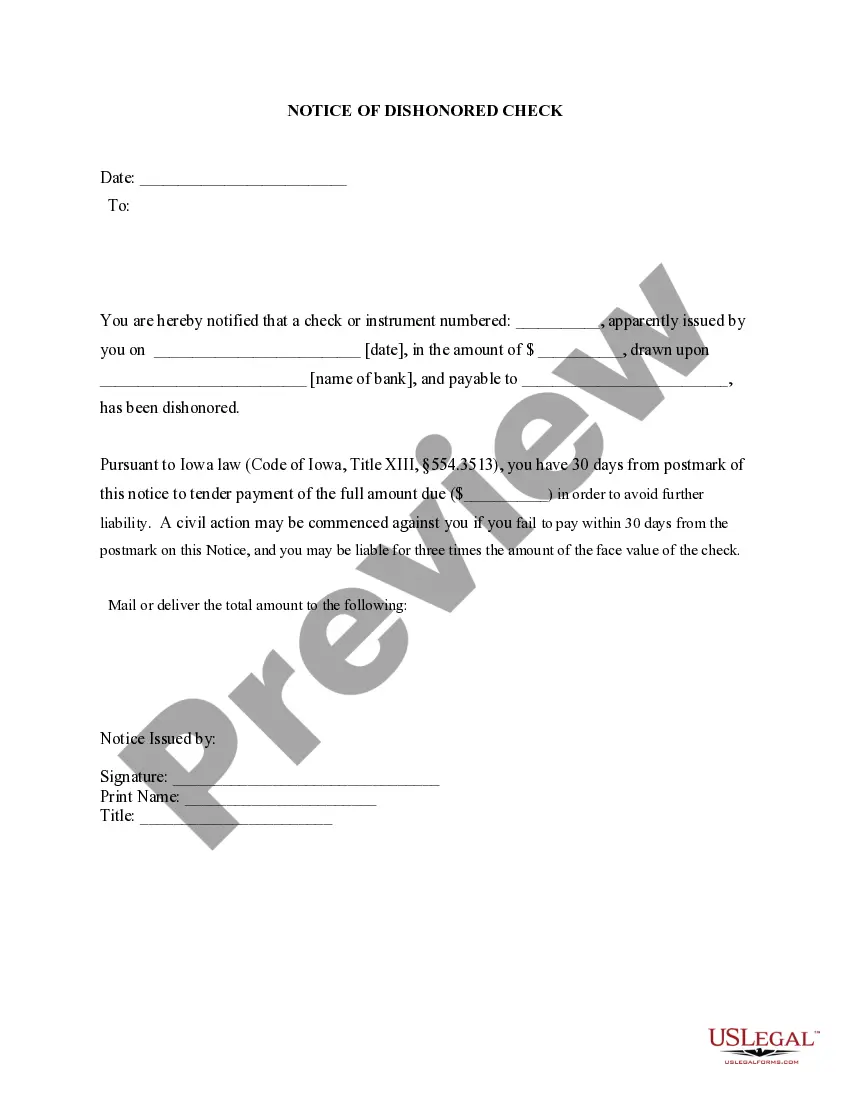

Exemption from Hotel Occupancy Tax Occupancy in the same hotel for 30 consecutive days qualifies you for exemption from the 11.9% Illinois Hotel Occupancy Tax. After 30 days, all taxes are waived and the occupant is credited for the first month's tax.

A hotel guest is just the reverse?a transient who can't vote. So in addition to the underlying commercial real estate taxes that are probably higher than what's levied on residences, hotel guests need to pay sales taxes and special excise taxes.

When you have a binding contract with a permanent resident for at least 30 days, no hotel tax is due. However, if the contract is terminated before the end of the first 30 days, you owe hotel tax for the period up to the time when the contract was terminated.

REG-1 - Illinois Business Registration Application.

Definition. The tax is imposed on the occupation of renting, leasing, or letting rooms to persons for living quarters for periods of less than 30 consecutive days.

The Hotel/Motel Tax is a 5% tax that is levied upon all persons engaged in the business of renting, leasing or letting rooms in a hotel in Lombard.

Occupancy in the same hotel for 30 consecutive days qualifies you for exemption from the 11.9% Illinois Hotel Occupancy Tax. After 30 days, all taxes are waived and the occupant is credited for the first month's tax.

Hotel/Motel Tax - collected on rental of hotel/motel rooms at the rate of 7%.