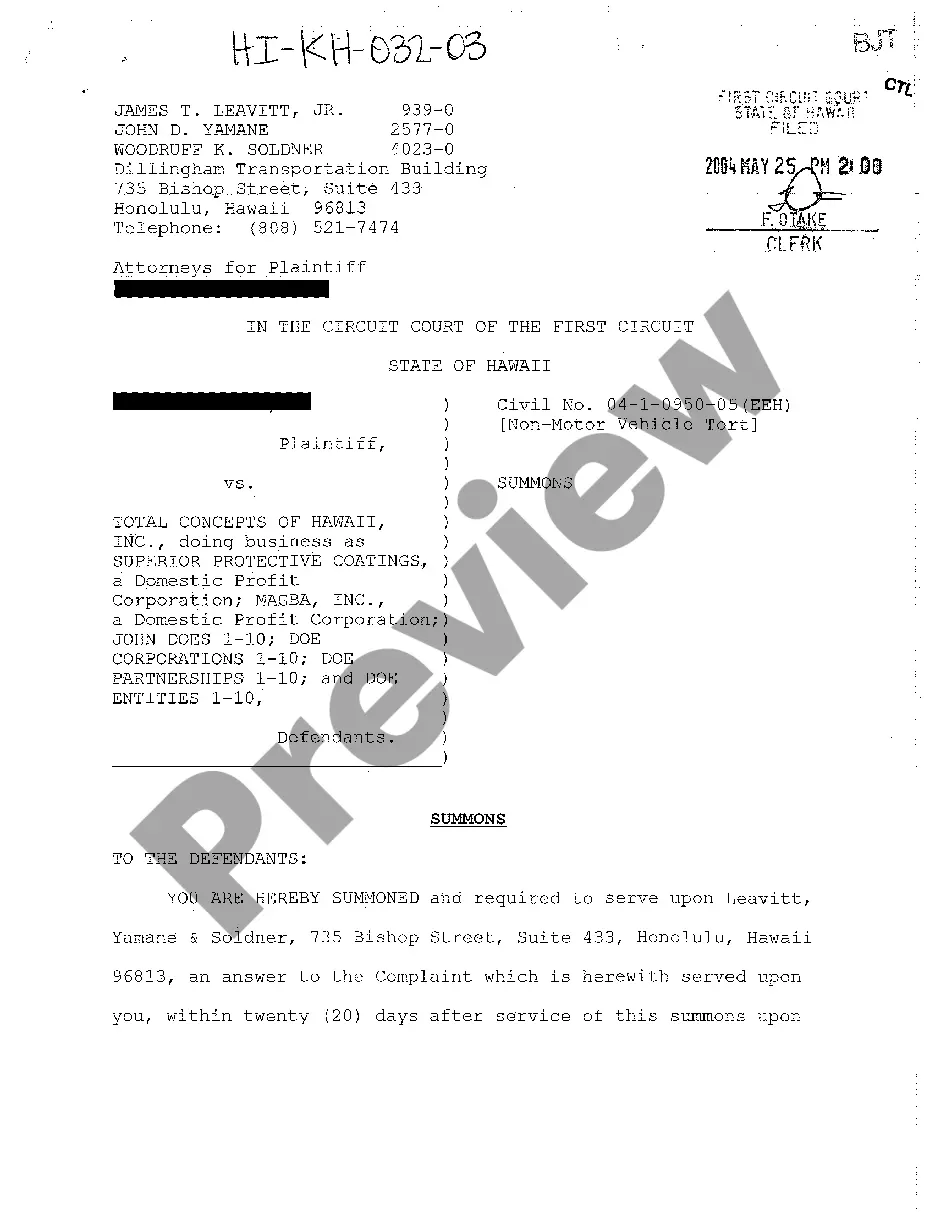

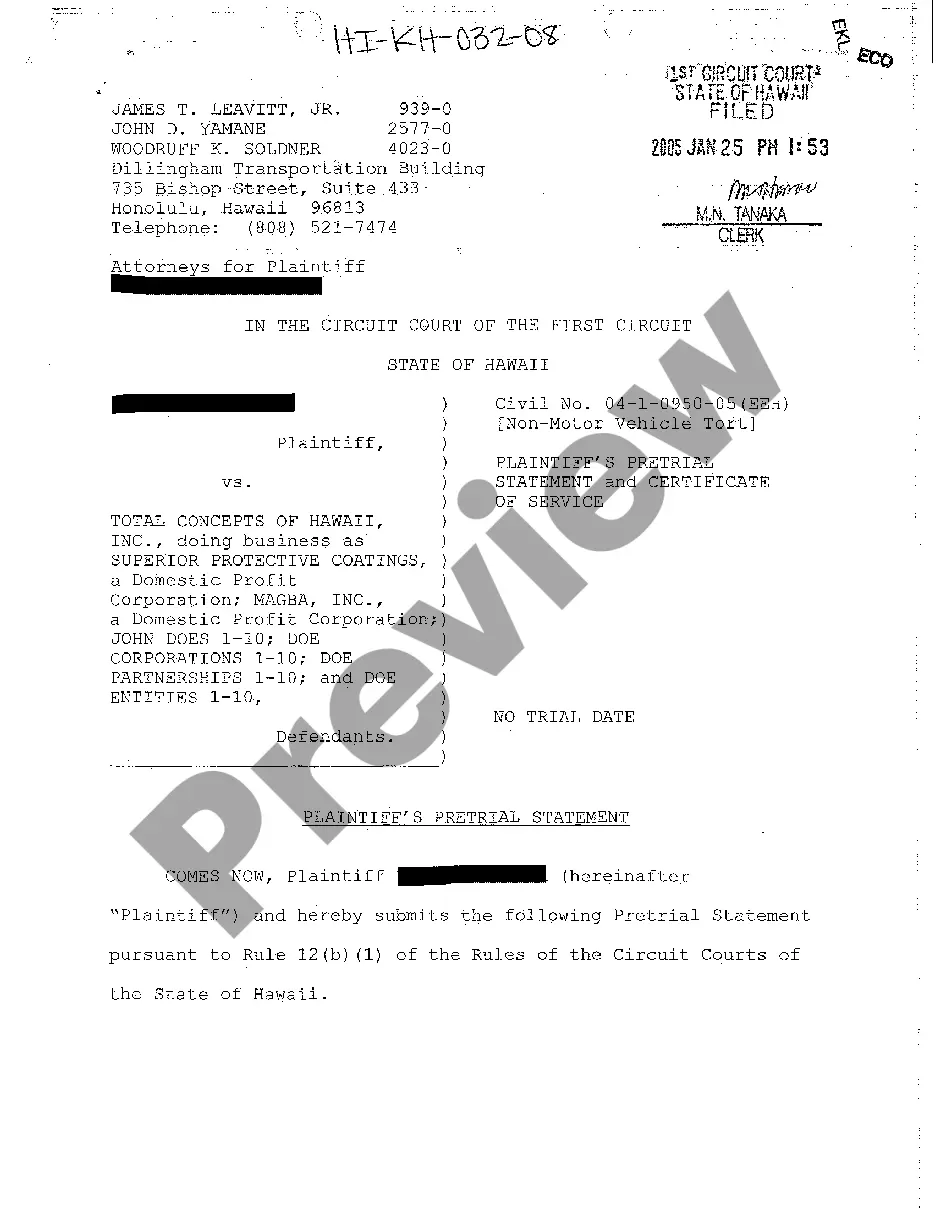

Illinois Claim on Estate is the process by which someone can make a claim on the estate of a deceased person. These claims are made by people who have a valid legal interest in the estate, such as creditors, heirs, or beneficiaries. The claims can be made against the estate for unpaid debts, distributions, or other legal matters. The claims must be filed in the county court where the estate is being administered. There are two types of Illinois Claim on Estate: Predate Claims and Post-Death Claims. Pre-Death Claims are claims that were made against the estate before the decedent's death. This could include creditors who are owed money by the decedent, or heirs who believe they are entitled to a portion of the estate. Post-Death Claims are claims that are made after the decedent's death. These can include creditors who have a claim against the estate, heirs who are seeking a portion of the estate, or beneficiaries who are owed money from the estate.

Illinois Claim on Estate

Description

How to fill out Illinois Claim On Estate?

How much time and resources do you regularly allocate to producing official documents.

There’s a greater chance to acquire such forms than enlisting legal professionals or wasting hours searching the internet for a suitable template. US Legal Forms is the leading online repository that offers expertly drafted and validated state-specific legal documents for any reason, like the Illinois Claim on Estate.

Another advantage of our service is that you can retrieve previously downloaded documents securely stored in your profile under the My documents section. Access them anytime and re-complete your paperwork as often as necessary.

Save time and effort preparing formal documents with US Legal Forms, one of the most reliable online services. Register with us today!

- Review the form details to confirm it adheres to your state regulations. To do this, read the form overview or utilize the Preview option.

- If your legal template doesn't meet your requirements, find another one using the search bar at the top of the page.

- If you are already registered with our service, sign in and download the Illinois Claim on Estate. Otherwise, move on to the following steps.

- Press Buy now once you identify the correct document. Choose the subscription plan that fits you best to access our library’s complete offerings.

- Create an account and pay for your subscription. You have the option to pay with your credit card or via PayPal - our service ensures complete security for that.

- Download your Illinois Claim on Estate onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

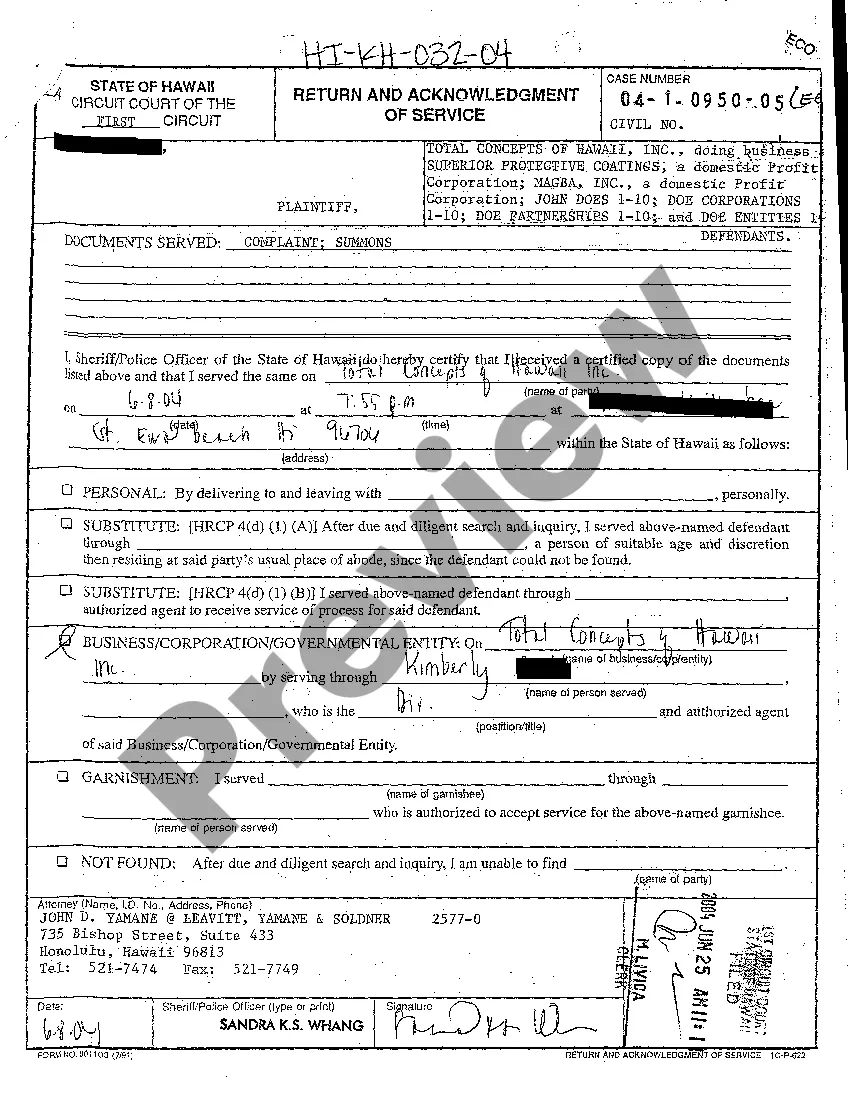

Illinois law requires that the ?last expenses? of funeral and burial expenses, expenses of administration, and statutory custodial claims are paid first from the probate estate.

When is the Deadline to File a Probate Claim in Illinois? The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate.

18-11. Allowance and disallowance of claims by representative. (a) The representative may at any time pay or consent in writing to all or any part of any claim that is not barred under Section 18-12, if and to the extent the claim has not been disallowed by the court and the representative determines it to be valid.

The law in Illinois provides such creditors six months to file those claims. The executor is required to protect or preserve the assets, to pay any valid claims, and eventually to distribute the remainder of the estate to those individuals specifically listed in the Will.

A claim against the probate estate can either be filed with the court or mailed to the representative of the estate. Once the representative receives notice of the claim, he or she can either allow the claim or send a notice to the claimant informing them that they are ?disallowing? the claim.

Generally, the statute of limitations for probate claims in Illinois provides that a collector has up to two years following the death of the person in question to file a claim against the estate.

Things that aren't part of the deceased person's estate don't have to be handled in settling their estate. Probate is just one way to settle an estate when someone dies. And it's not always required. Illinois law allows a different and simplified procedure for handling small estates.

The executor immediately must publish a written notice in a newspaper within the county of the Probate Court to notify potential creditors of the existence of the estate and the necessity for their filing of written claims against the estate. The law in Illinois provides such creditors six months to file those claims.