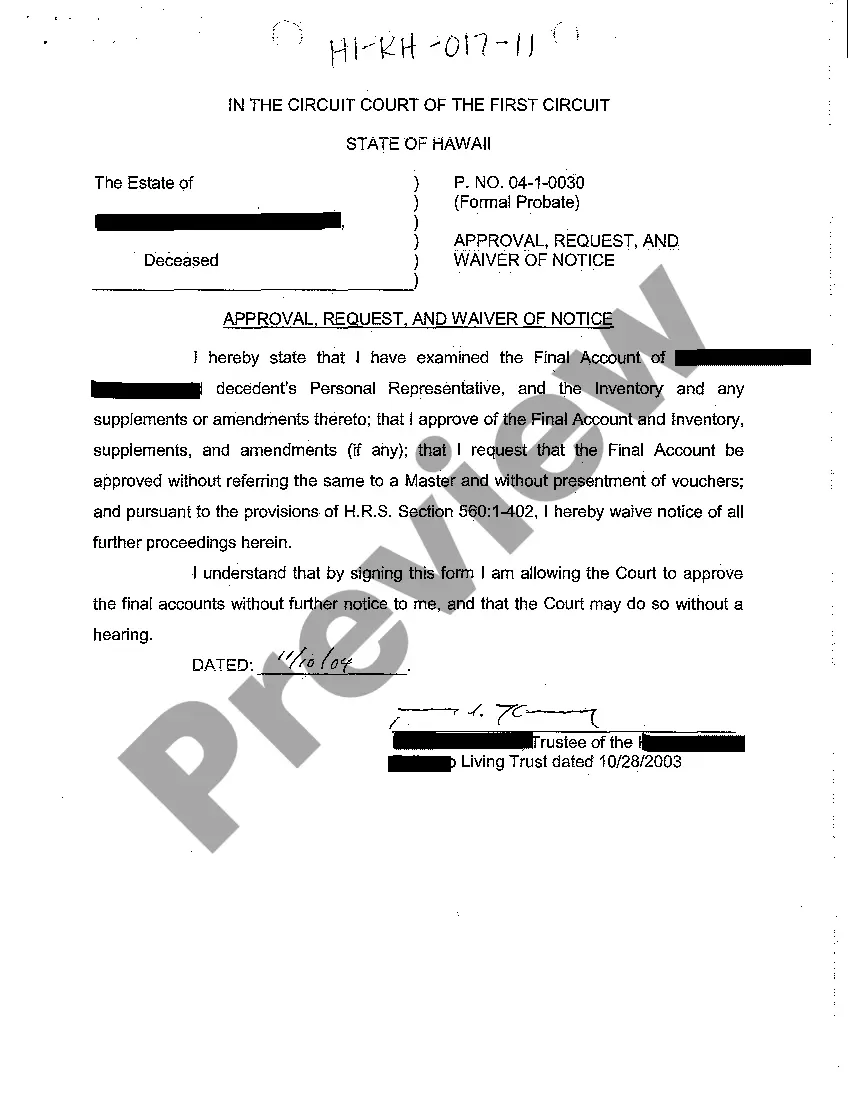

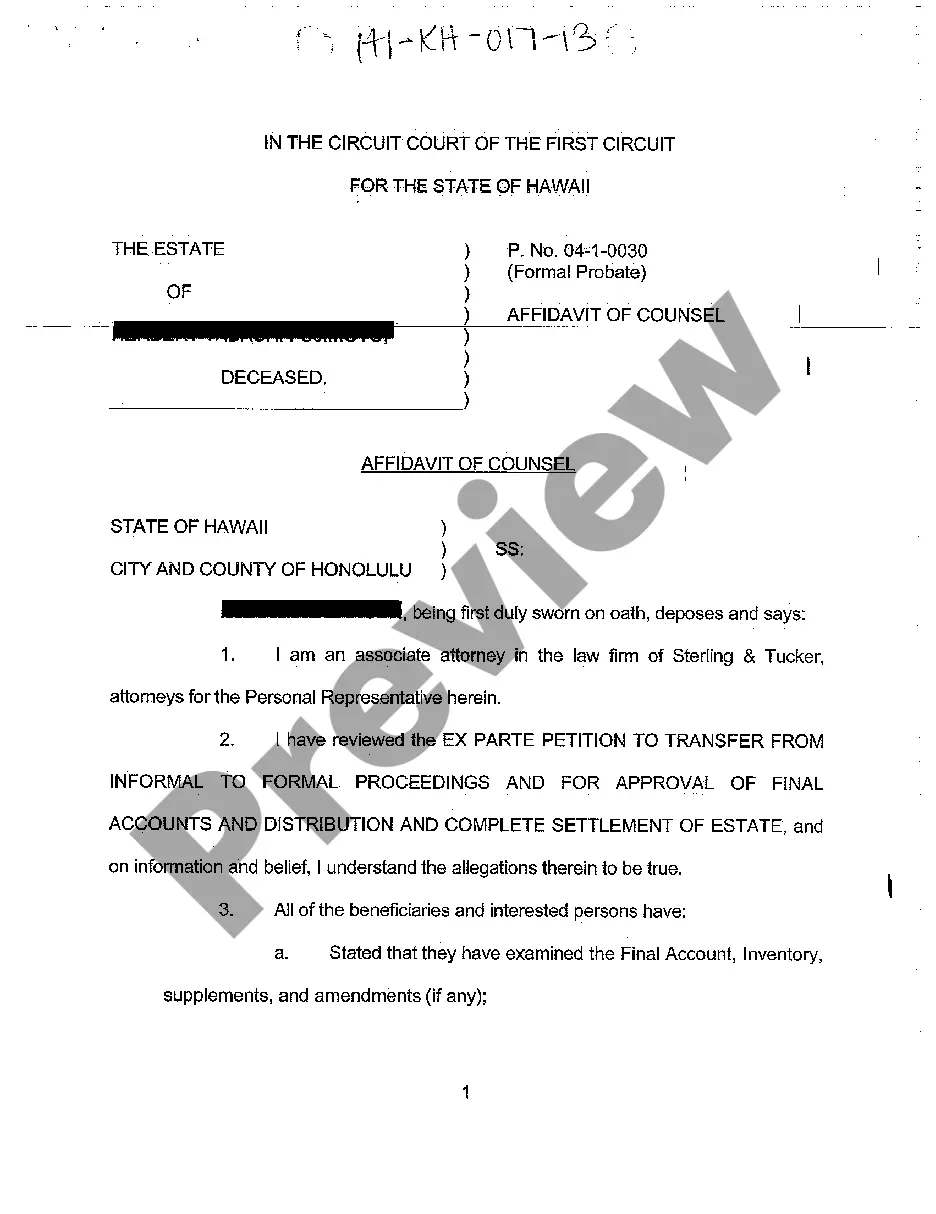

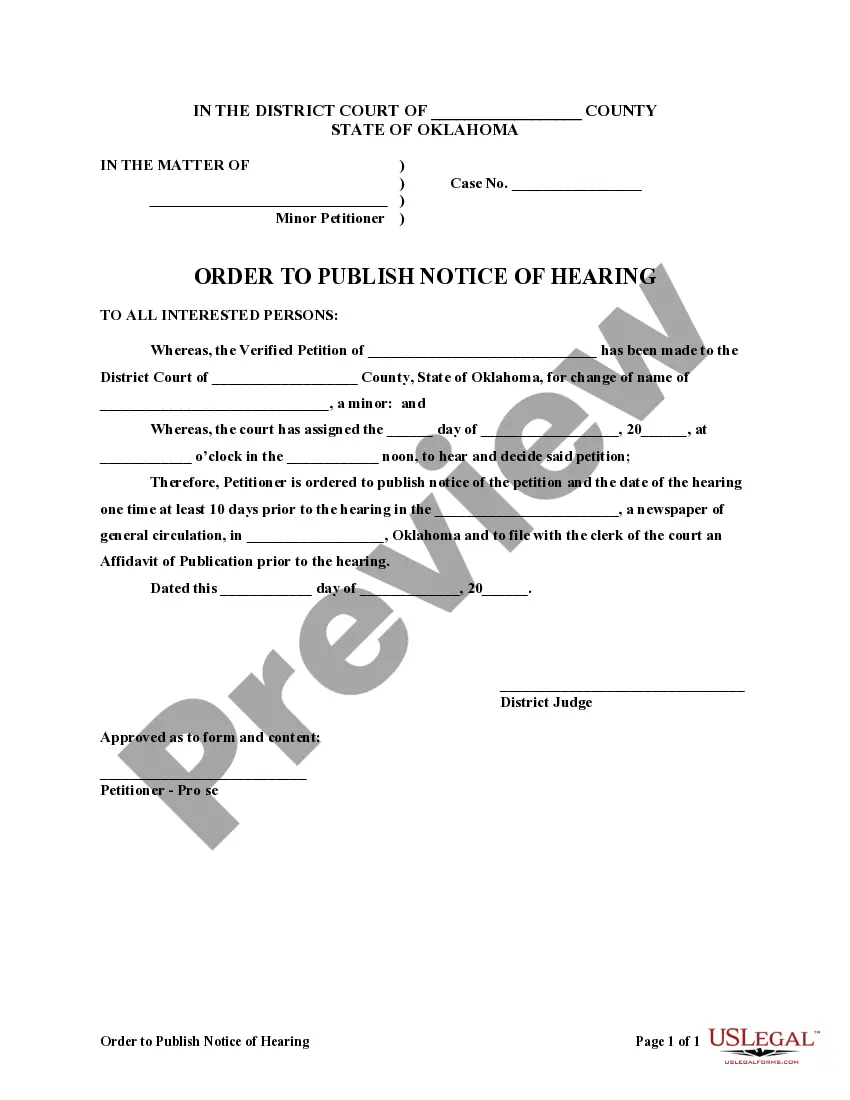

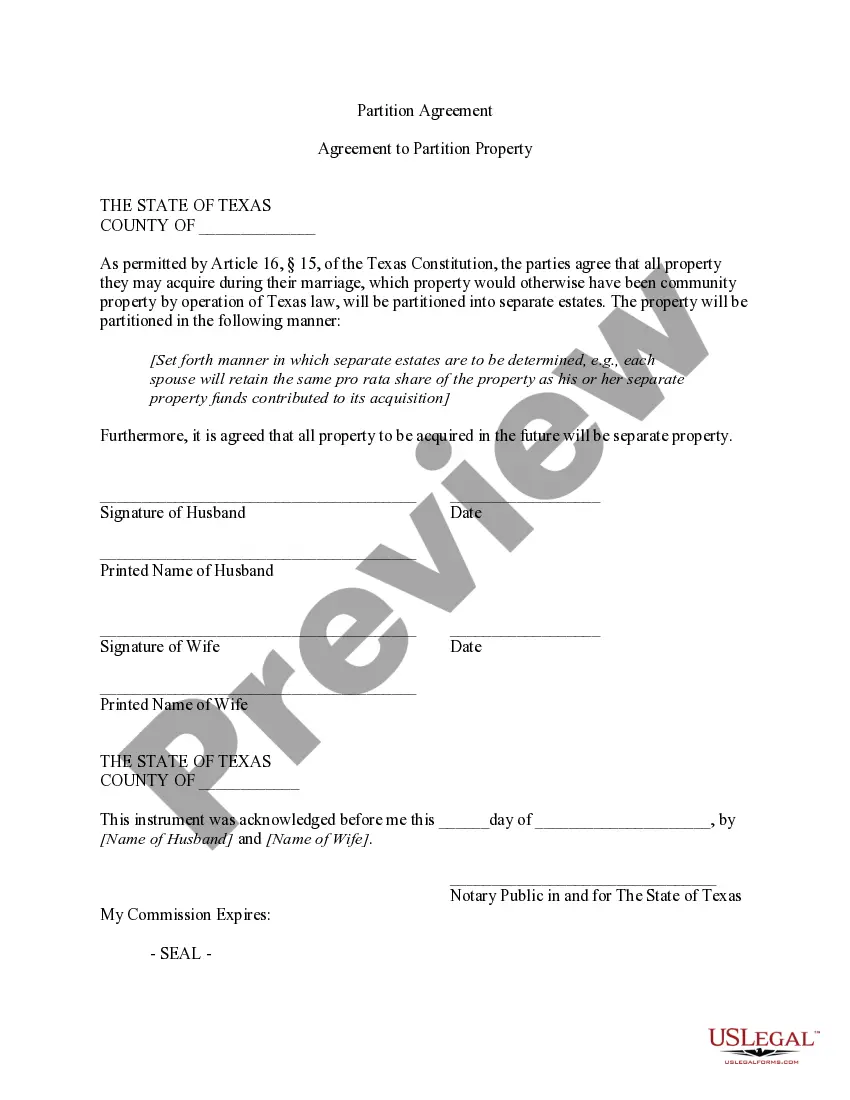

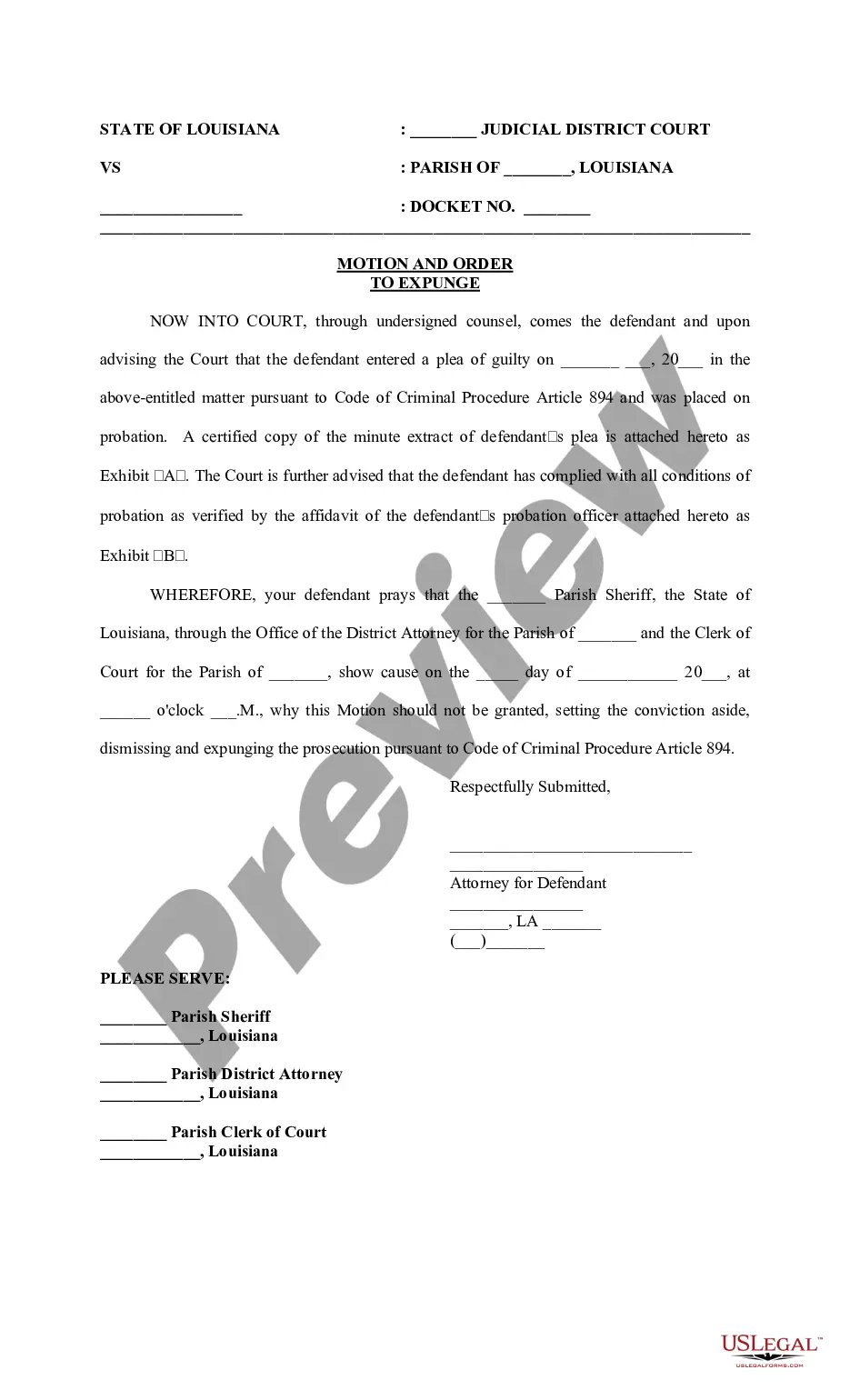

The Illinois Garnishment Summons-Non Wage is a legal document issued by the court to a non-wage debtor in the State of Illinois. This document informs the debtor that they are required to appear before the court and answer questions regarding their assets and liabilities, and the court may issue a garnishment order to the debtor if they fail to appear. The garnishment order allows the court to take assets or income from the debtor in order to satisfy a debt. There are two types of Illinois Garnishment Summons-Non Wage: one for consumer debts and another for commercial debts. The consumer debt type is used when the debtor owes money to an individual, while the commercial debt type is used when the debtor owes money to a business or organization.

Illinois Garnishment Summons-Non Wage (copy)

Description

How to fill out Illinois Garnishment Summons-Non Wage (copy)?

If you’re looking for a method to properly finalize the Illinois Garnishment Summons-Non Wage (copy) without employing an attorney, then you’ve come to the correct spot.

US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every individual and business circumstance.

Another significant benefit of US Legal Forms is that you never misplace the documents you obtained - you can access any of your downloaded forms in the My documents tab of your account at any time you require it.

- Ensure the document you observe on the page aligns with your legal situation and state regulations by reviewing its textual description or browsing through the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the dropdown to find another template in case of any discrepancies.

- Conduct another content verify and click Buy now when you are certain about the paperwork complying with all requirements.

- Log in to your account and click Download. If you do not have an account yet, register for the service and select a subscription plan.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. You will be able to download the document immediately afterward.

- Select the format in which you want to receive your Illinois Garnishment Summons-Non Wage (copy) and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper version manually.

Form popularity

FAQ

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

Employment income is usually not exempt under Illinois law, but other kinds of income are exempt from wage deductions. Some examples of exempt income include Social Security and other income from the federal government, workers' compensation benefits, unemployment benefits, and government assistance, to name a few.

Non-wage garnishment is the judgment creditor's attachment, after judgment, of the judgment debtor's property, other than wages, which is in the possession, custody or control of third parties. Example: A creditor files a non-wage garnishment to attach funds your client has deposited in the local bank.

Wage Garnishment in Illinois In Illinois, if a creditor wins a court judgment against you, the maximum your employer can garnish from your weekly earnings is either 15 percent of your earnings or the amount left over after you deduct 45 hours' worth of Illinois' minimum wage.

For the most part, there are only two ways to stop wage garnishments in Illinois. First, you can pay off the judgment. You may be able to pay the judgment in a lump sum, or you may have to wait for the garnishment to run its course. The second way to stop a garnishment is by filing bankruptcy.

The most the employer can hold out for you is 15% of the debtor's gross income before taxes or deductions. However, the withholding can't leave the debtor with less than 45 times the state minimum wage as weekly take-home pay.

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.