The Illinois Final Report of Independent Representative (IF RIR) is a document issued by the Illinois Department of Financial and Professional Regulation (ID FPR) to licensed independent representatives (IR's) in the state of Illinois. The IF RIR is used to document an IR's compliance with applicable state and federal laws and regulations. The report consists of a detailed summary of the IR's activities, including any disciplinary actions taken against the IR, and a summary of any financial or other interest the IR may have in the company or products they are representing. There are two types of IF RIR documents: the Annual Report and the Complete Report. The Annual Report is typically submitted annually and includes information on the IR's activities for the past year, as well as any disciplinary actions taken by the ID FPR against the IR. The Complete Report is typically submitted in conjunction with a license renewal and includes a detailed summary of the IR's activities for the entire period of licensure, including any disciplinary actions. Both the Annual Report and the Complete Report must be signed and submitted to the ID FPR. The IF RIR is an important document for IR's and must be kept up-to-date in order to maintain compliance with state and federal regulations.

Illinois Final Report of Independent Representative

Description

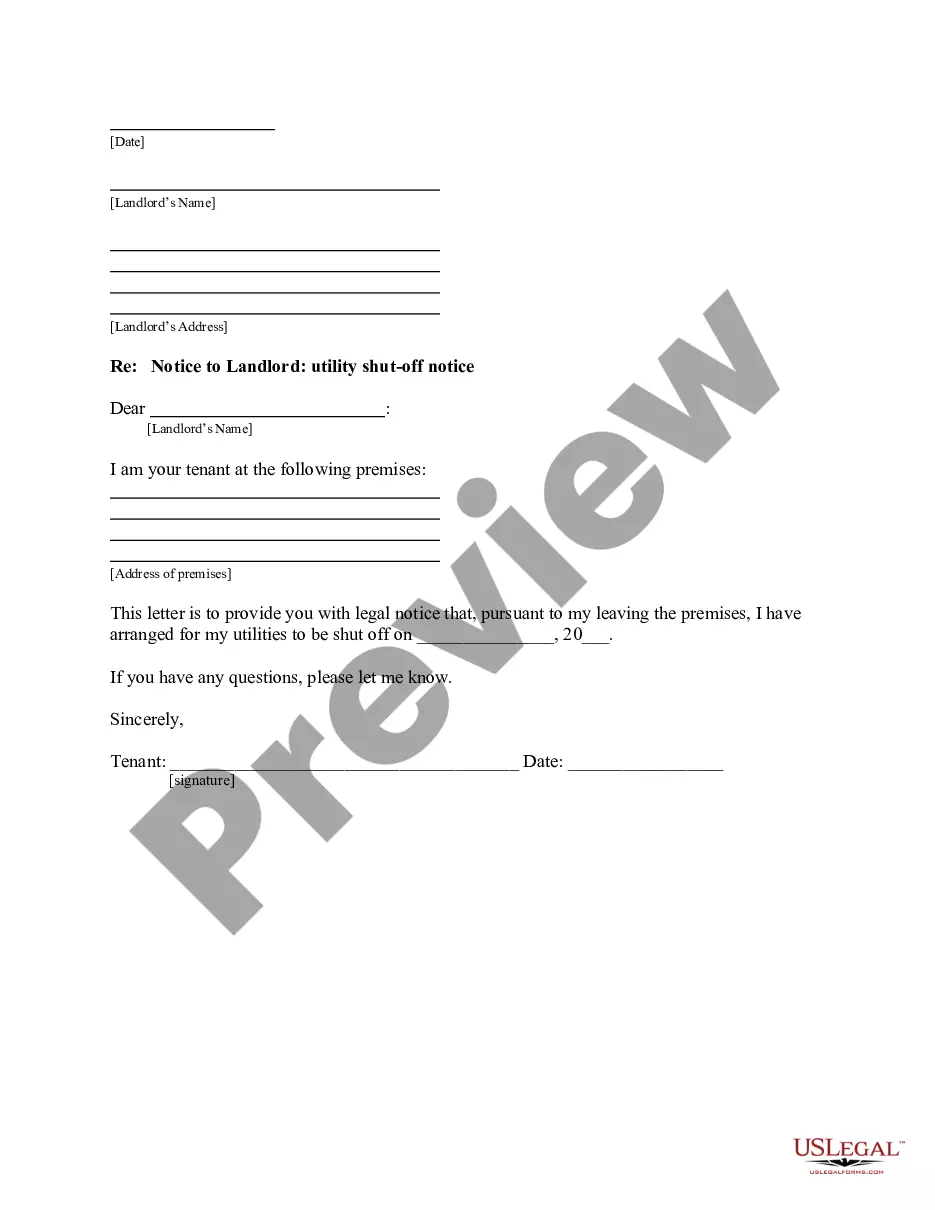

How to fill out Illinois Final Report Of Independent Representative?

If you’re looking for a means to suitably prepare the Illinois Final Report of Independent Representative without employing a legal advisor, then you’re precisely in the correct spot.

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every individual and business circumstance. Each document you find on our online platform is crafted in accordance with national and state laws, ensuring that your paperwork is in order.

Another significant advantage of US Legal Forms is that you will never misplace the documents you’ve obtained - you can access any of your downloaded templates in the My documents section of your profile whenever you need it.

- Verify that the document you see on the page aligns with your legal situation and state regulations by reviewing its text description or browsing through the Preview mode.

- Enter the document title in the Search tab located at the top of the page and select your state from the drop-down list to find an alternative template if any discrepancies arise.

- Repeat the content assessment and click Buy now when you are assured of the paperwork's compliance with all the stipulations.

- Log in to your account and click Download. If you haven’t registered for the service, sign up and choose a subscription plan.

- Utilize your credit card or the PayPal method to acquire your US Legal Forms subscription. The template will be available for download immediately after.

- Select the format in which you wish to save your Illinois Final Report of Independent Representative and download it by clicking the respective button.

- Incorporate your template into an online editor to swiftly complete and sign it or print it out to prepare your physical copy manually.

Form popularity

FAQ

FORM OF PETITION TO TERMINATE ADMINISTRATION Under section 28-4 of the Probate Act of 1975 (Illinois Compiled Statues 1991 755 ILCS 5/28-4) any interested person may petition the court to terminate Independent Administration at any time by mailing or delivering a petition to terminate to the clerk of the court.

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

Rates might vary from $10 an hour up to $50 an hour or more. I am aware of at least one court case in which a $50 an hour fee was approved by the court. Ultimately, the reasonableness of the fee must be determined by the court.

This statement of the decedent's intent is commonly known as that person's "Will." Under Illinois law, it is required that any person who possesses the Will of a decedent file it with the Clerk of the Circuit Court of the county in which that individual resided within 30 days after the death of the testator is known to

On average, probate in Illinois takes no less than twelve months. The probate process must allow time for creditors to be notified, filing of required income tax returns, and the resolution of any disputes.

Closing of an Illinois Probate Estate The executor must file a final accounting with the court showing how estate assets were handled. The accounting will list the assets, possible income the estate generated, the amount paid for any debts or other expenses, and the distributions made to beneficiaries.

If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit. Beneficiaries can petition the court to have the executor removed from their positon if they can prove they should be removed for one of the reasons listed above.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.