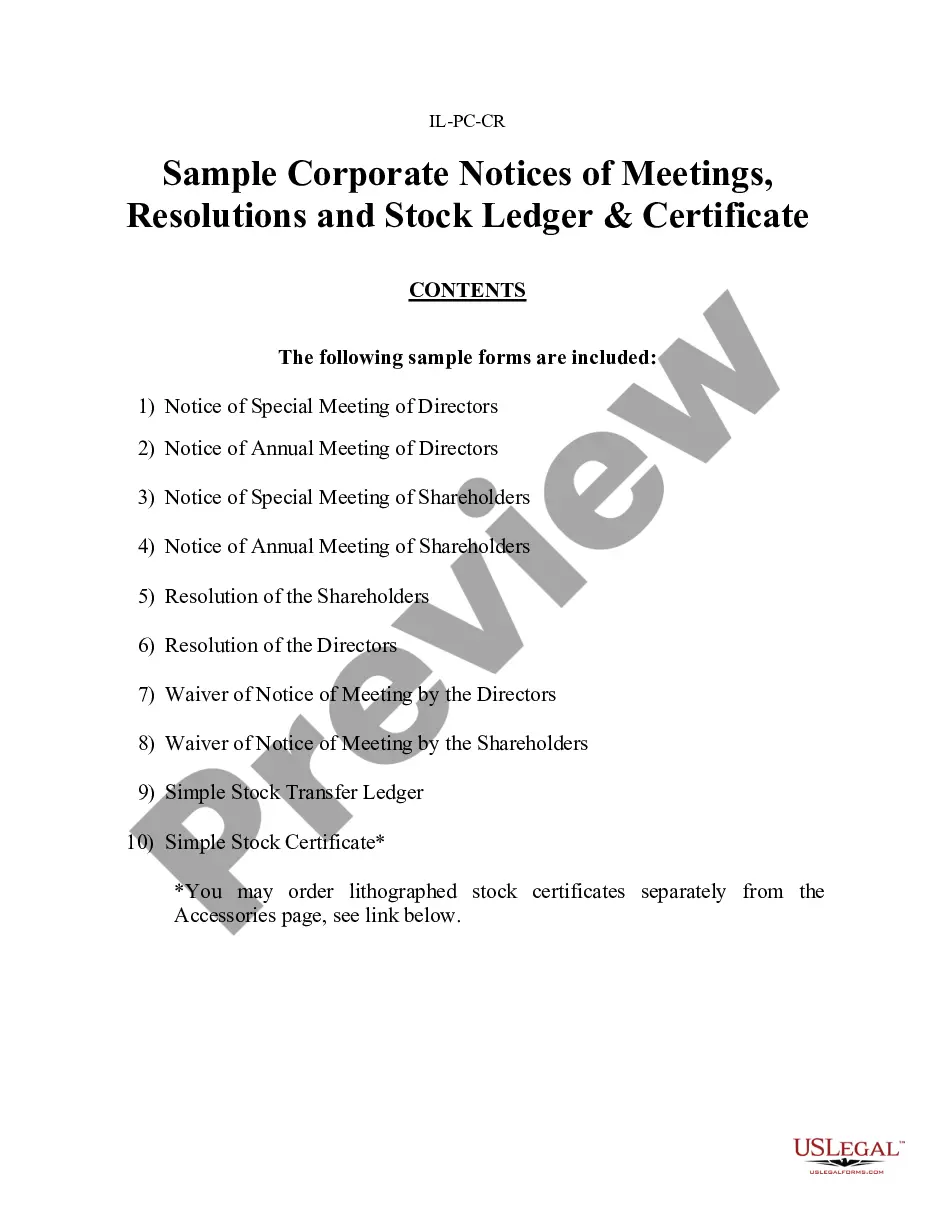

Sample Annual Minutes for an Illinois Professional Corporation

Description

How to fill out Sample Annual Minutes For An Illinois Professional Corporation?

Looking for Sample Annual Minutes for an Illinois Professional Corporation templates and completing them could be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable sample specifically for your state in just a few clicks.

Our lawyers prepare each document, so you merely need to complete them. It’s truly that easy.

Now you can print the Sample Annual Minutes for an Illinois Professional Corporation template or complete it using any online editor. Don’t be concerned about making errors since your form can be utilized, submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account.

- Return to the form's webpage and download the document.

- All your downloaded templates are kept in My documents and are always accessible for future use.

- If you haven't signed up yet, you should register.

- Review our detailed guidelines on how to obtain your Sample Annual Minutes for an Illinois Professional Corporation sample in a few minutes.

- To obtain an authorized form, verify its relevance for your state.

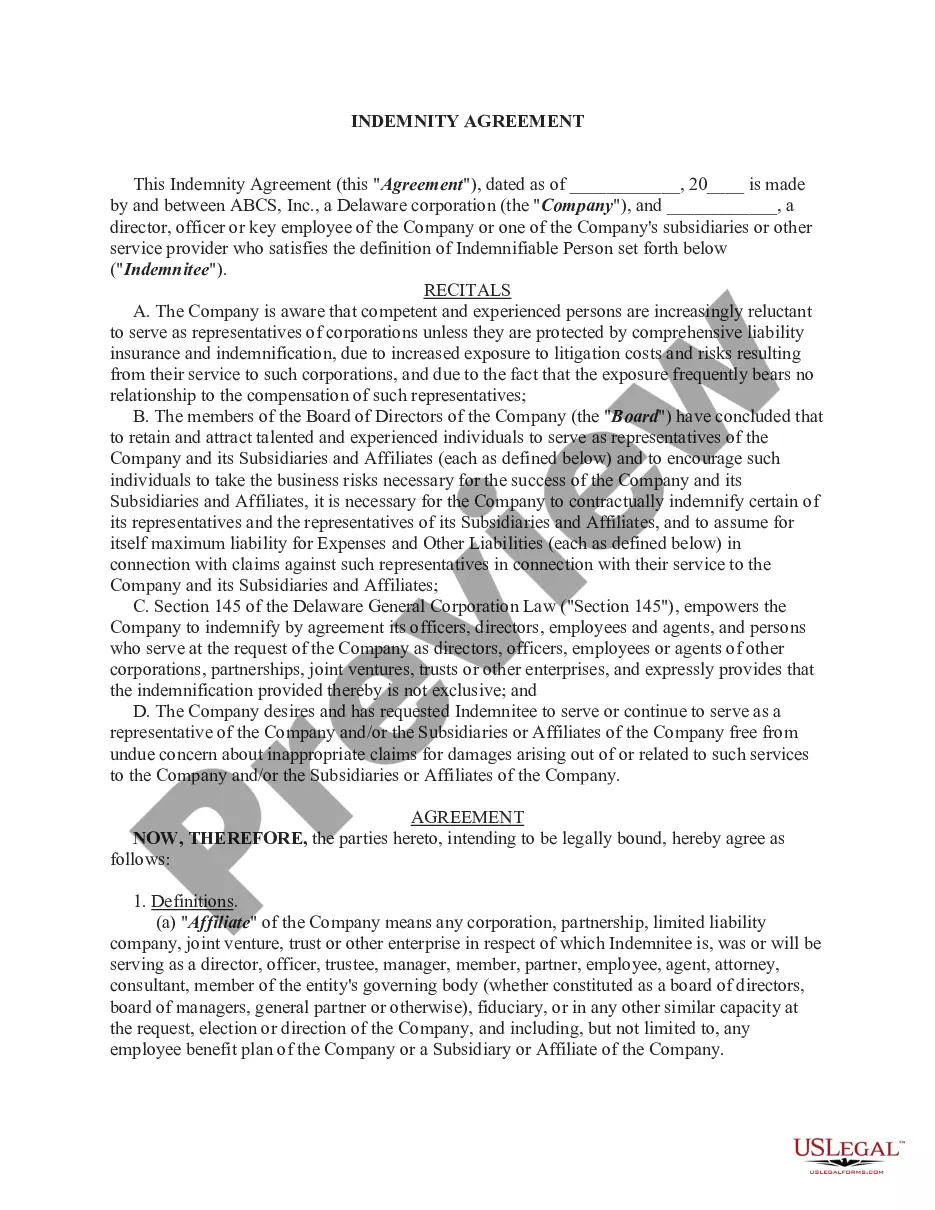

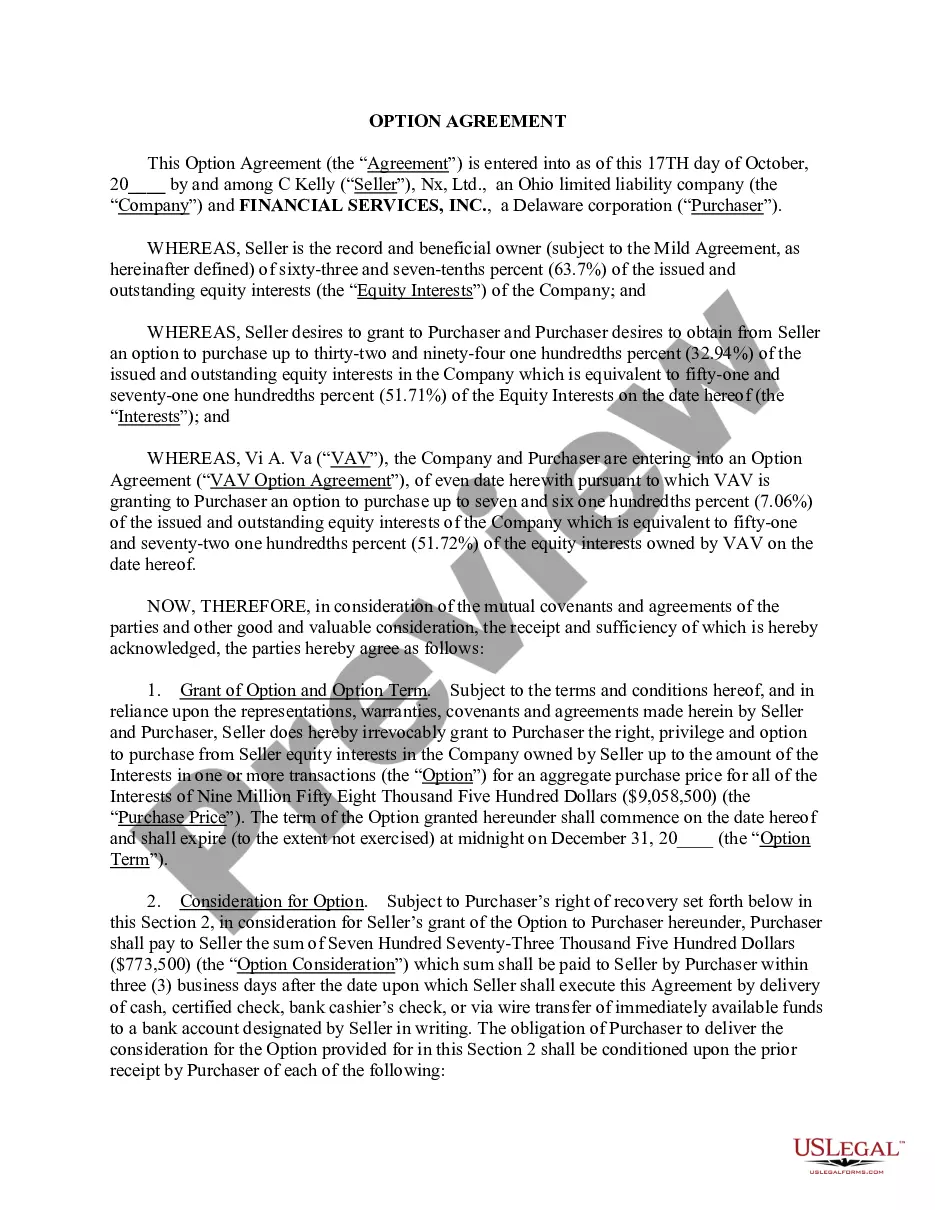

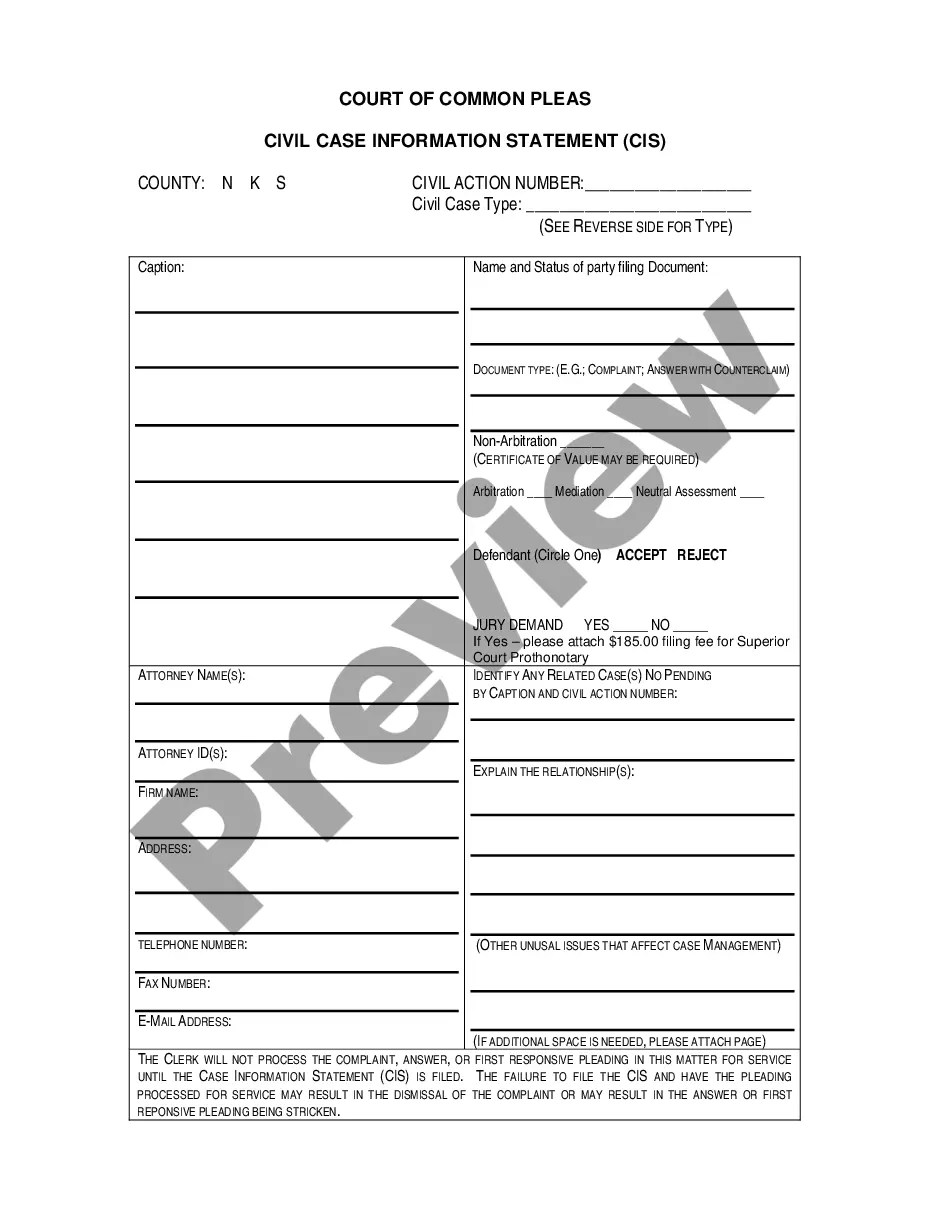

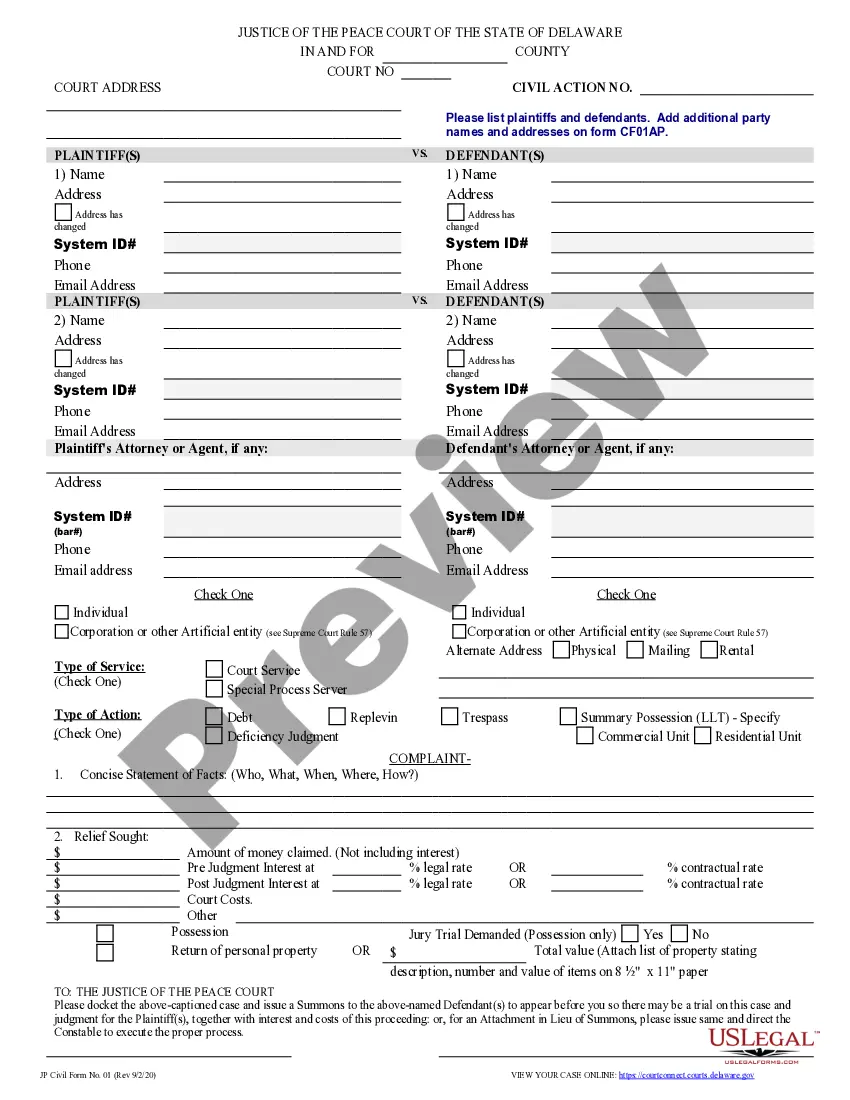

- Examine the example using the Preview option (if available).

- If there’s a description, read it to understand the particulars.

- Click Buy Now if you have found what you’re looking for.

- Select your plan on the pricing page and create your account.

- Choose your payment method via credit card or PayPal.

- Download the sample in your preferred file format.

Form popularity

FAQ

Minutes typically include: Meeting date, time, and location. Names of attendees and whether they missed any part of the meeting. List of those absent. Agenda items and brief descriptions. Any voting actions and how each individual voted. Time that meeting was adjourned.

The meeting's date, time, and location. Who wrote the minutes. The names of the members in attendance. Brief description of the meeting agenda. Details about what the members discussed. Decisions made or voting actions taken. The time that the meeting adjourned.

Typically, an annual report will contain the following sections: General corporate information. Operating and financial highlights.Financial statements, including the balance sheet, income statement, and cash flow statement.

Annual reports are entity information updates due to the secretary of state each year. LLCs, corporations, and nonprofits are required to file annual reports to maintain good standing. Due dates, filing fees, and forms vary greatly by entity type and whether the entity is domestic or foreign to the state.

You have the option of filing your Corporation and LLC Annual Report online or by mail. To file online, visit the Illinois Secretary of State's website, otherwise you can fill out the Annual Report form that is sent by mail or by downloading and filling out Form 50.1 for LLCs and Form BCA 14.05 for Corporations.

To reinstate a corporation, you must file BCA 12.45, Application for Reinstatement, in duplicate with the Secretary of State's office. You also must file Annual Reports for the years that were not filed. For more information, please call 217-785-5782.

Taking Meeting Notes. Type Meeting Notes - Type up a full version of the meeting minutes. Circulate a Draft - Follow your corporation's policy about who must review the draft notes. Distribute Minutes to Board - Usually in advance of the next meeting.

Date, time, and location of the meeting. Who attended and who was absent from the meeting. Meeting agenda items with a brief description of each. Details about what was discussed during the meeting.

Determine If You Need To File an Annual Report. Every state has its own annual report requirements. Find Out When the Annual Report is Due. Complete the Annual Report Form. File Annual Report. Repeat the Process for Other States Where You're Registered to Do Business. Set Up Reminders for Your Next Annual Report Deadline.