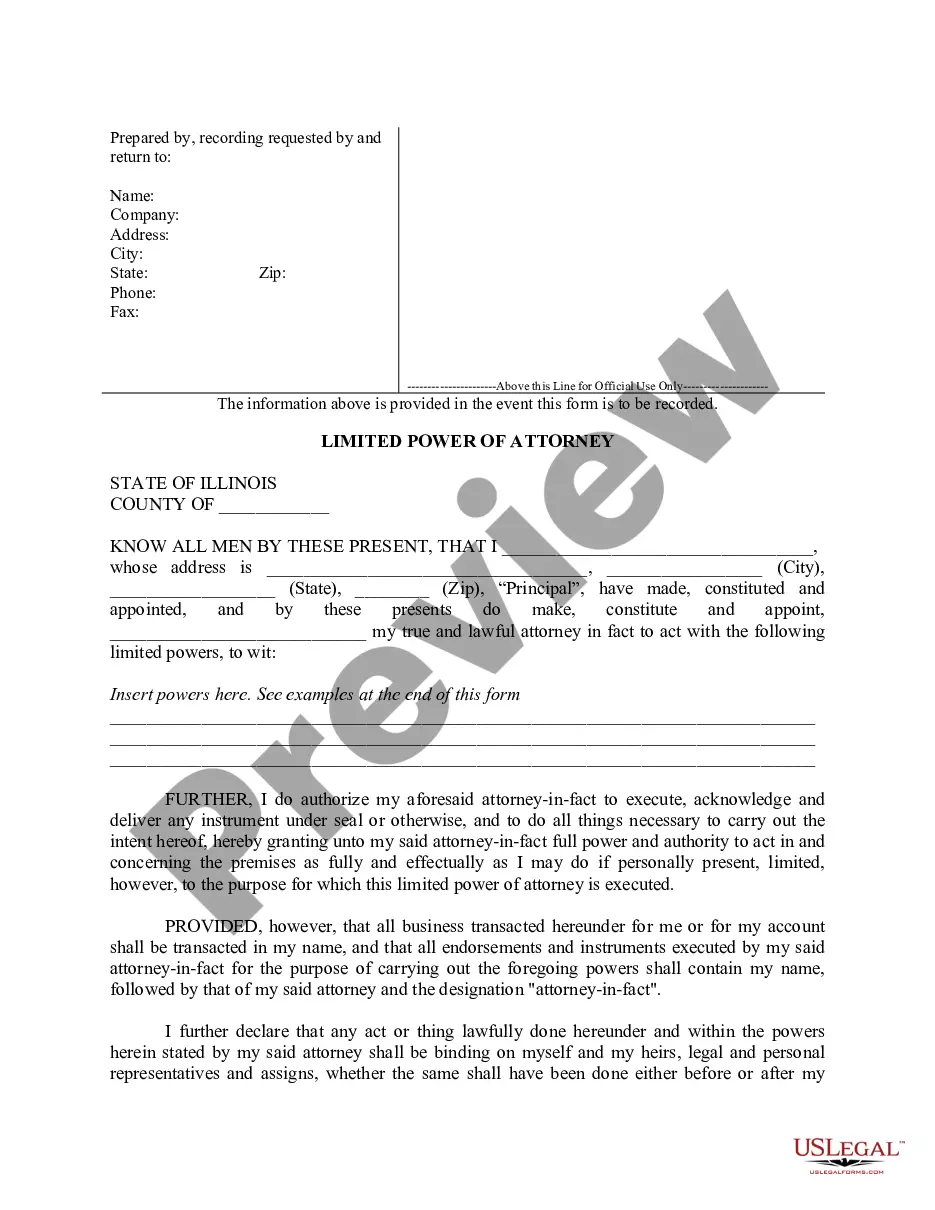

Illinois Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Looking for Illinois Limited Power of Attorney where you Define Powers with Sample Powers Included forms and completing them might pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the right sample specifically for your state within just a few clicks.

Our attorneys prepare every document, so all you need to do is fill them out. It is genuinely so easy.

Select your payment method via credit card or PayPal. Save the template in your preferred format. You can print the Illinois Limited Power of Attorney where you Define Powers with Sample Powers Included form or complete it using any online editor. Don’t worry about typos as your template can be utilized, submitted, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the sample.

- Your saved templates are stored in My documents and can be accessed anytime for future use.

- If you haven’t signed up yet, you must register.

- Review our detailed instructions on how to obtain your Illinois Limited Power of Attorney where you Define Powers with Sample Powers Included template in minutes.

- To find a valid example, verify its applicability for your state.

- Examine the form using the Preview feature (if it’s available).

- If there is a description, read it to comprehend the details.

- Click Buy Now if you found what you need.

Form popularity

FAQ

To complete a limited power of attorney form, write the principal's name and details first, followed by the agent's information. It’s important to list specific powers and limitations, making it clear what the agent can and cannot do. Utilizing the Illinois Limited Power of Attorney where you Specify Powers with Sample Powers Included ensures clarity and effectiveness in creating your document.

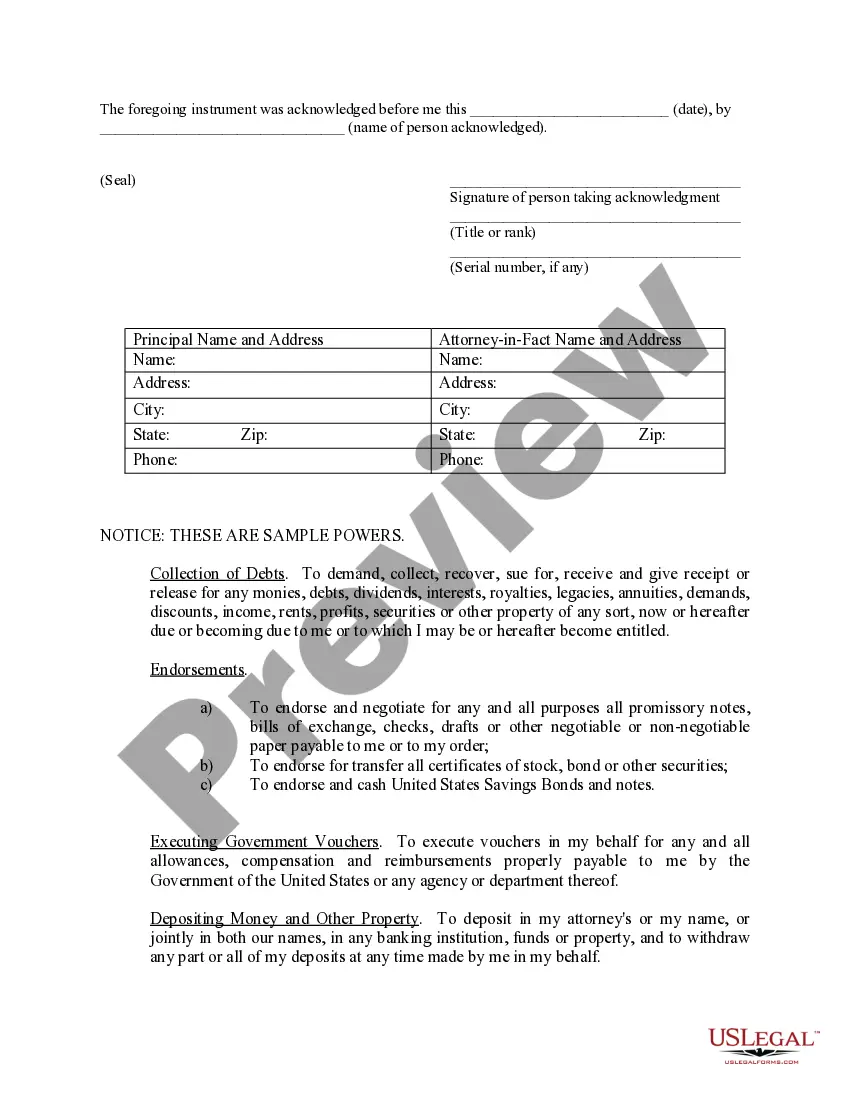

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

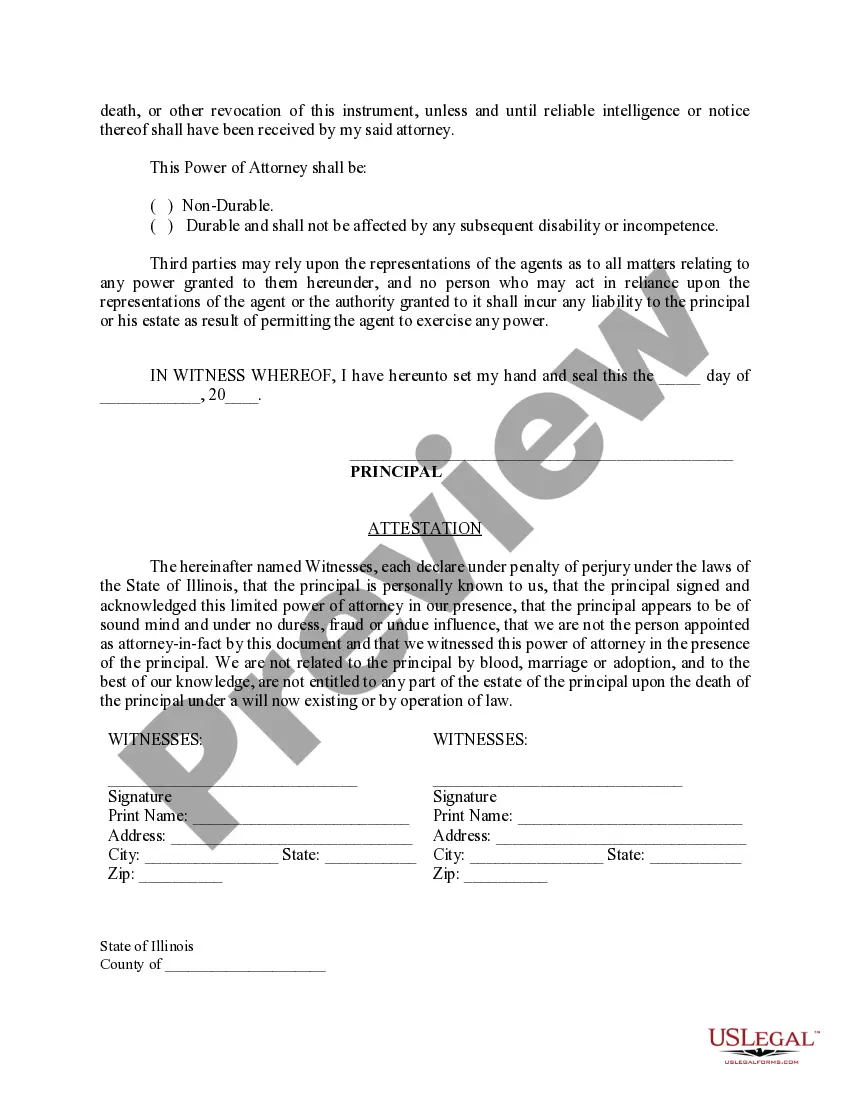

1. Durable Power of Attorney. A durable power of attorney, or DPOA, is effective immediately after you sign it (unless stated otherwise), and allows your agent to continue acting on your behalf if you become incapacitated.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

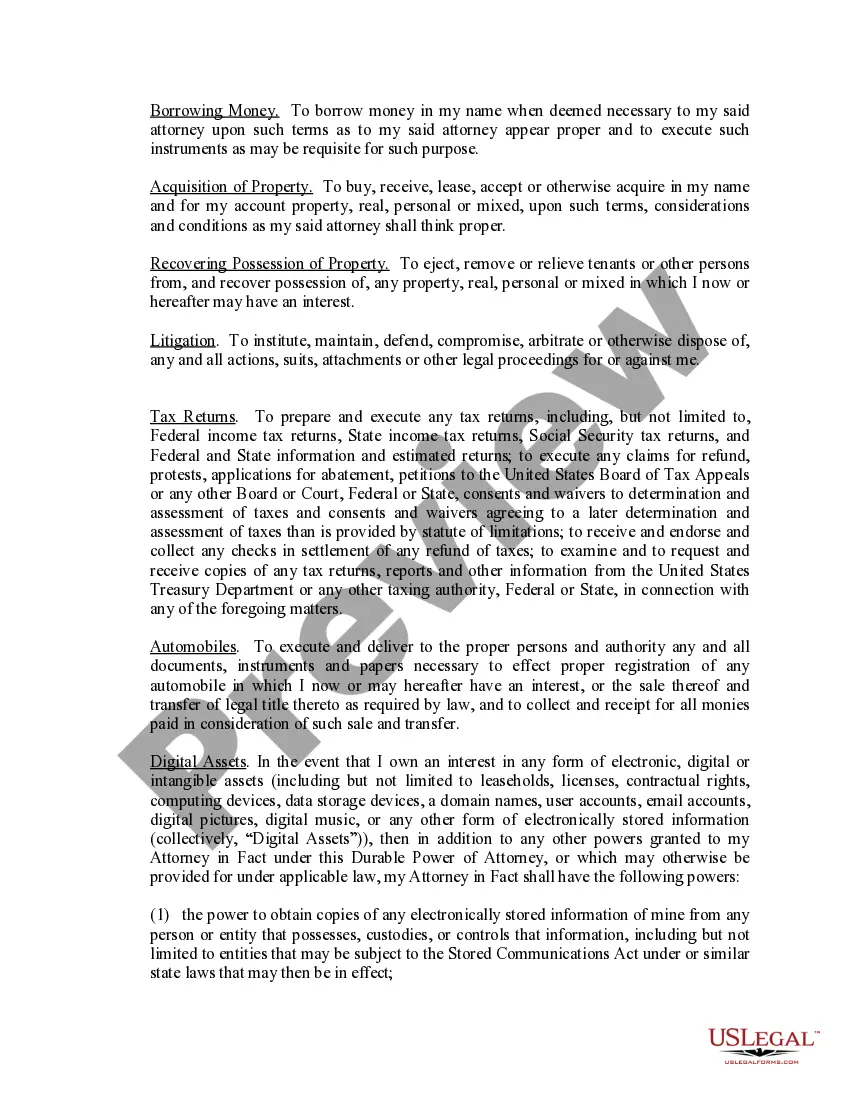

A general power of attorney is comprehensive and gives your attorney-in-fact all the powers and rights that you have yourself. For example, a general power of attorney may give your attorney-in-fact the right to sign documents for you, pay your bills, and conduct financial transactions on your behalf.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

A power of attorney is accepted in all states, but the rules and requirements differ from state to state.The person named in a power of attorney to act on your behalf is commonly referred to as your "agent" or "attorney-in-fact." With a valid power of attorney, your agent can take any action permitted in the document.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.