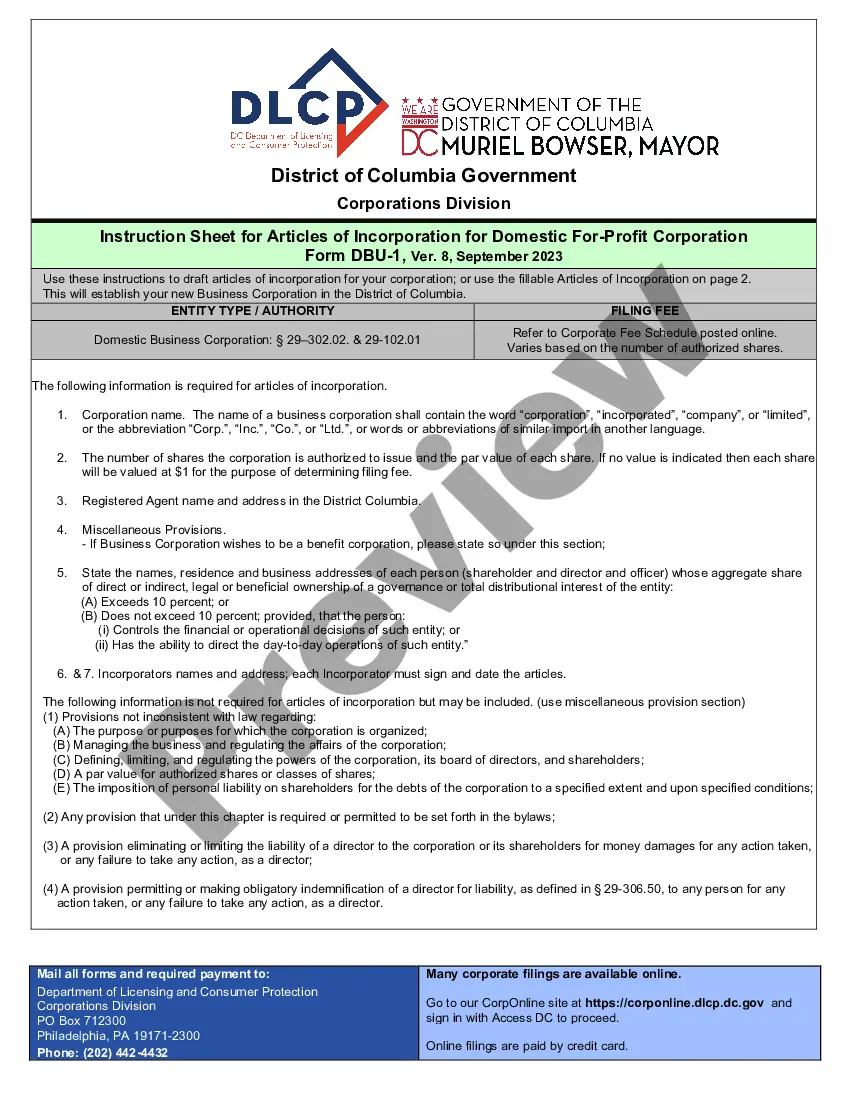

An Illinois Payment Order is a legal document issued by the Illinois Department of Revenue. It provides for payment of delinquent taxes or other liabilities owed by taxpayers to the state. It is issued by the Department's Revenue Division and sent to the taxpayer or their representative. There are two types of Illinois Payment Order: 1. Certificate of Payment Order: This is issued when a taxpayer has paid the full amount of their tax liability, and the Certificate of Payment Order serves as proof of payment. 2. Notice of Payment Order: This is issued when a taxpayer has not paid the full amount of their tax liability. The Notice of Payment Order serves as a notice of the taxpayer's liability and ordering them to pay the amount due.

Illinois Payment Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

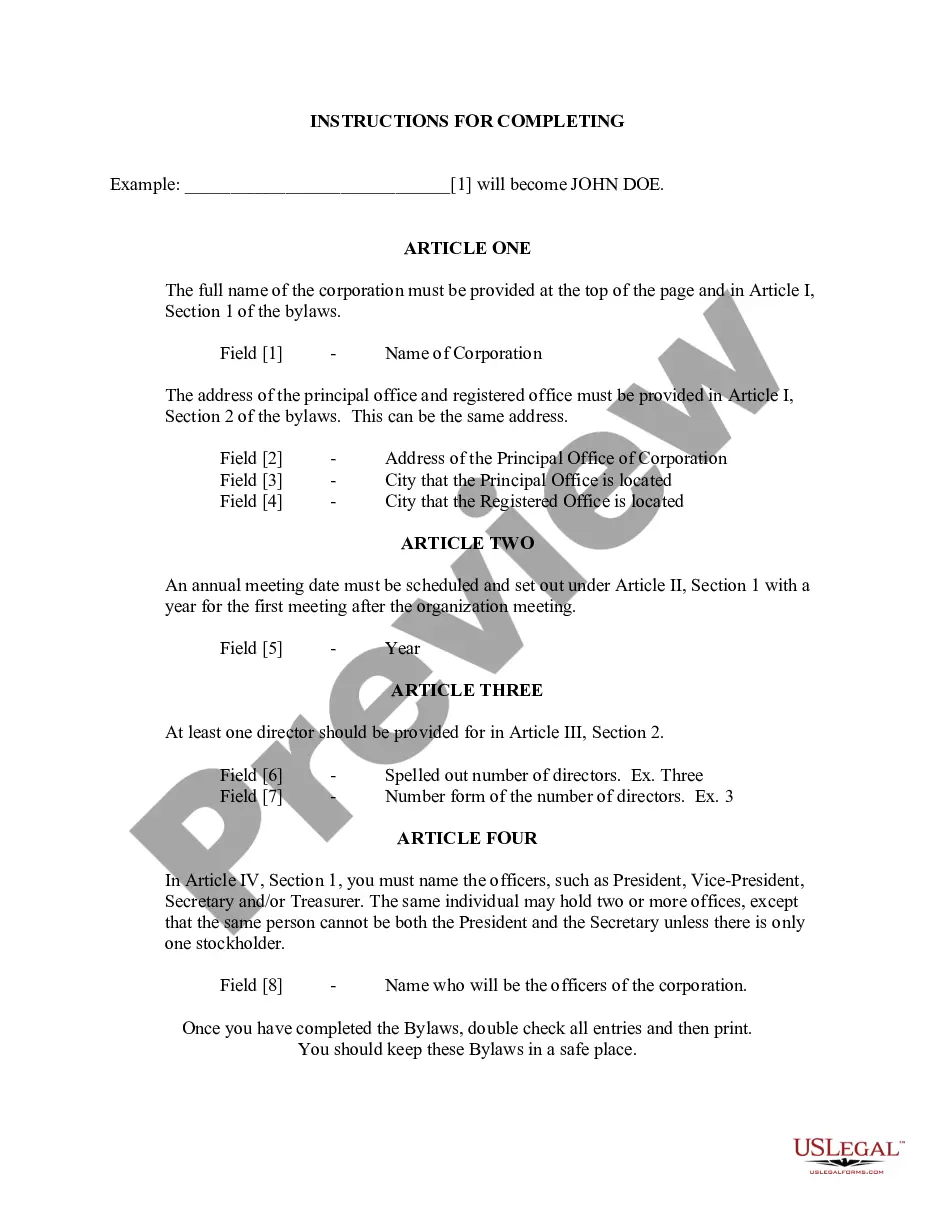

How to fill out Illinois Payment Order?

US Legal Forms is the easiest and most lucrative method to discover appropriate legal templates.

It boasts the largest online repository of business and personal legal documents prepared and verified by legal experts.

Here, you can locate printable and fillable templates that adhere to federal and local regulations - just like your Illinois Payment Order.

Review the form description or preview the document to ensure you’ve located the one that fits your needs, or search for another one using the search tab above.

Click Buy now when you’re confident about its suitability with all the requirements, and select the subscription plan you prefer most.

- Obtaining your template requires just a few straightforward steps.

- Users with an existing account and valid subscription only need to Log In to the web platform and download the document to their device.

- Afterward, they can find it in their profile under the My documents section.

- And here’s how to get a professionally drafted Illinois Payment Order if you are using US Legal Forms for the first time.

Form popularity

FAQ

If no payment is enclosed, mail your return to: If a payment is enclosed, mail your return to: ILLINOIS DEPARTMENT OF REVENUE. ILLINOIS DEPARTMENT OF REVENUE. PO BOX 19041. PO BOX 19027. SPRINGFIELD IL 62794-9041. SPRINGFIELD IL 62794-9027.

Payment For Fiscal The Secretary of State's office will accept up to 10 renewals per check, cashier's check or money order by mail. Payments for more than 10 transactions will be returned. If paying in person, we will process multiple transactions for payments by a credit card or check.

Make your check or money order payable to the "Illinois Department of Revenue" (not IRS). Write your Social Security number, and your spouse's Social Security number if filing jointly, in the lower left corner of your payment. Send e-payment through state website.

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

The purpose of Form IL-505-I, Automatic Extension Payment, is to provide taxpayers who are unable to file their tax return by the due date a means of calculating and remitting their tentative tax liability (including any other taxes you will report on your Form IL-1040) on or before the original due date of the return

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in.Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

Pay using: MyTax Illinois. If you have a MyTax Illinois account, click here and log in.Credit Card. Check or money order (follow the payment instructions on the form or voucher associated with your filing) ACH Credit - ACH credit is NOT the preferred payment option for most taxpayers.