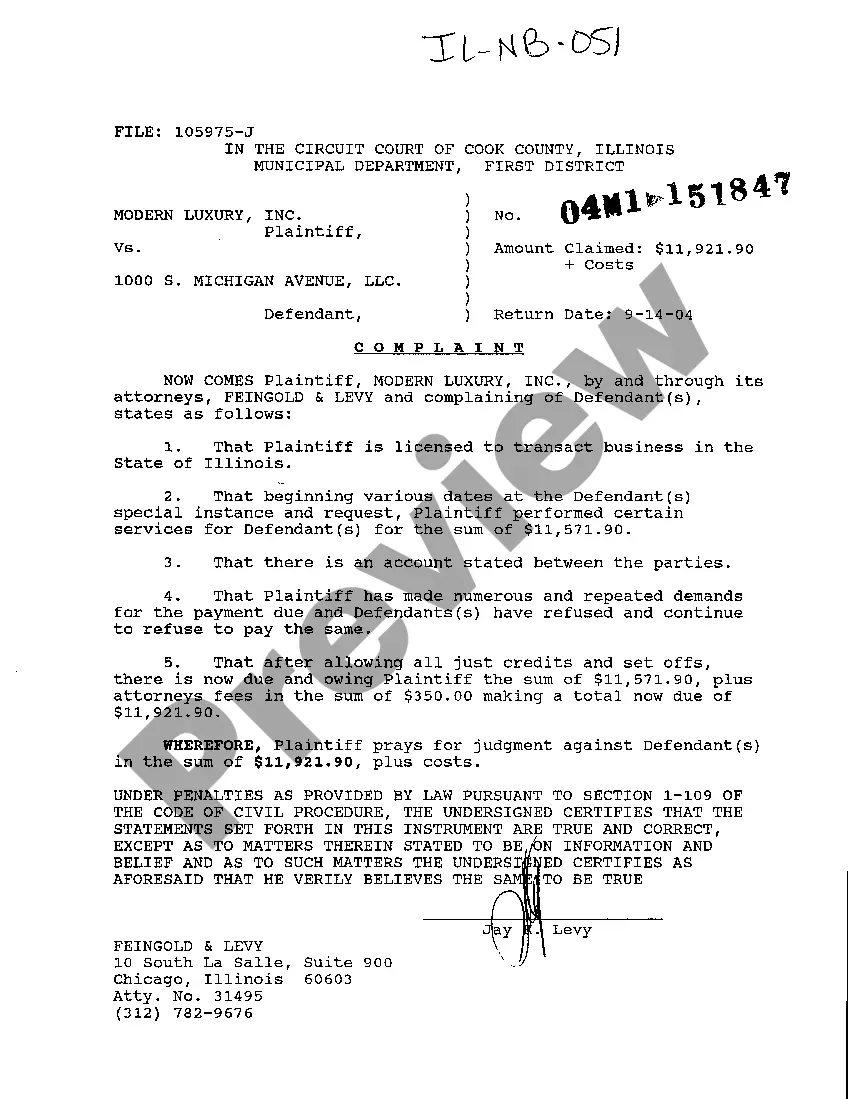

Illinois Complaint for Collection for Services Rendered

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

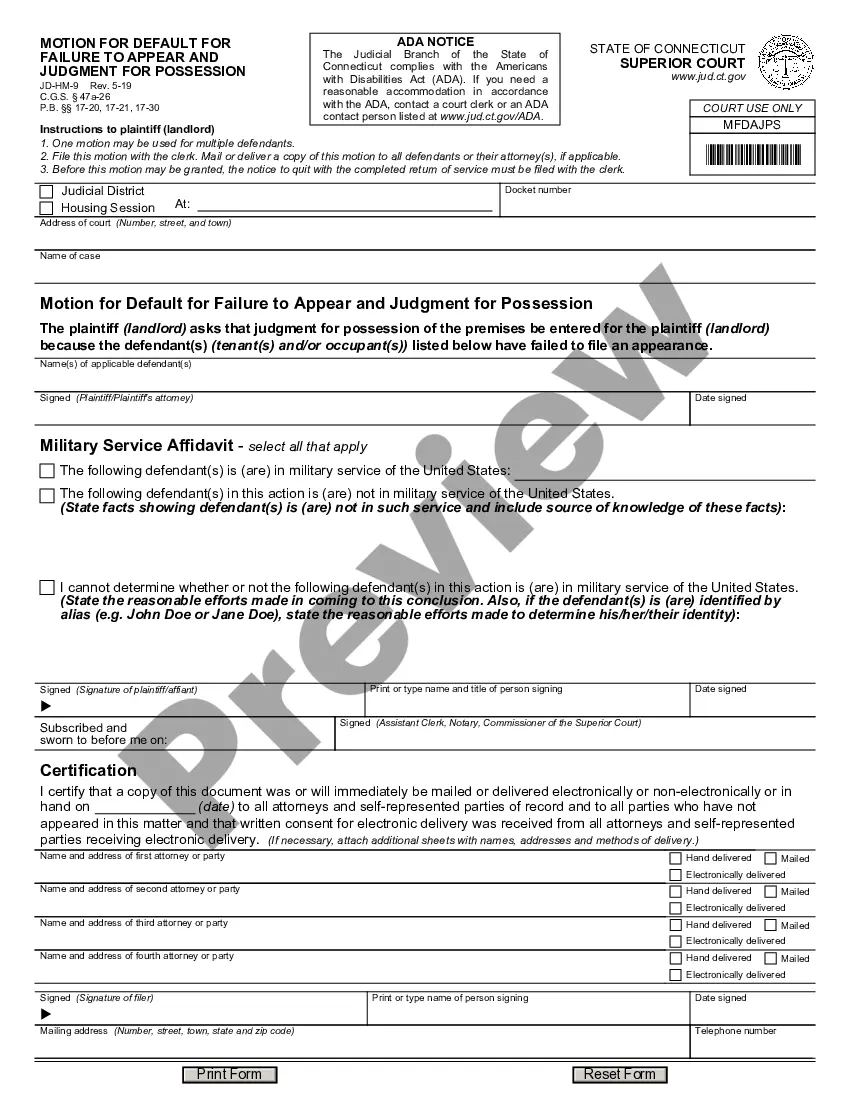

How to fill out Illinois Complaint For Collection For Services Rendered?

Locating Illinois Complaint for Collection for Services Rendered forms and completing them can be quite difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and swiftly find the relevant template specifically for your state within a few clicks.

Our attorneys prepare all documents, so you merely need to complete them. It’s truly that simple.

Choose your plan on the pricing page and create your account. Indicate whether you prefer to pay by card or via PayPal. Save the form in your desired format. You can now print the Illinois Complaint for Collection for Services Rendered template or fill it out using any online editor. Don’t worry about typos as your form can be utilized, sent, and printed as many times as you wish. Explore US Legal Forms for access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the sample.

- All of your stored samples are kept in My documents and are available at any time for future use.

- If you haven’t signed up yet, you should create an account.

- Review our comprehensive guidelines on how to acquire the Illinois Complaint for Collection for Services Rendered template in just a few minutes.

- To obtain a valid sample, verify its acceptance for your state.

- Use the Preview feature to examine the form (if available).

- If there is a description, read through it to understand the specifics.

- Click the Buy Now button if you found what you need.

Form popularity

FAQ

A summons in the form provided in paragraph (b) of Rule 101 may not be served later than three days before the day for appearance. (c) Indorsement Showing Date of Service. The officer or other person making service of summons shall indorse the date of service upon the copy left with the defendant or other person.

In Illinois, the Statute of Limitations on debt ranges from 5 years to 10 years. Some debt collection agencies buy old debts, out the Statute of Limitation period for pennies on the dollar from the original creditor in order to collect what they can.

There is no statute of limitations on how long a creditor can attempt to collect an unpaid debt, but there is a deadline for when they can still use litigation to receive a court judgment against the debtor.Creditors can request methods of enforcing the court order, such as wage garnishment.

In Illinois, the Statute of Limitations on debt ranges from 5 years to 10 years. Some debt collection agencies buy old debts, out the Statute of Limitation period for pennies on the dollar from the original creditor in order to collect what they can.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

There is no statute of limitations on how long a creditor can attempt to collect an unpaid debt, but there is a deadline for when they can still use litigation to receive a court judgment against the debtor.

Although there's no debtor's prison, it's possible to wind up in jail in a collection case. But, not because you owe money, or can't pay it. Jail can only happen if you're able to pay, and refuse to, or if you miss a court-ordered court date.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

The statute of limitations in Illinois is five years for open accounts for debt collections and oral contracts and ten years for written contracts. The good news is that the debts are time-barred and you can't be sued for them.