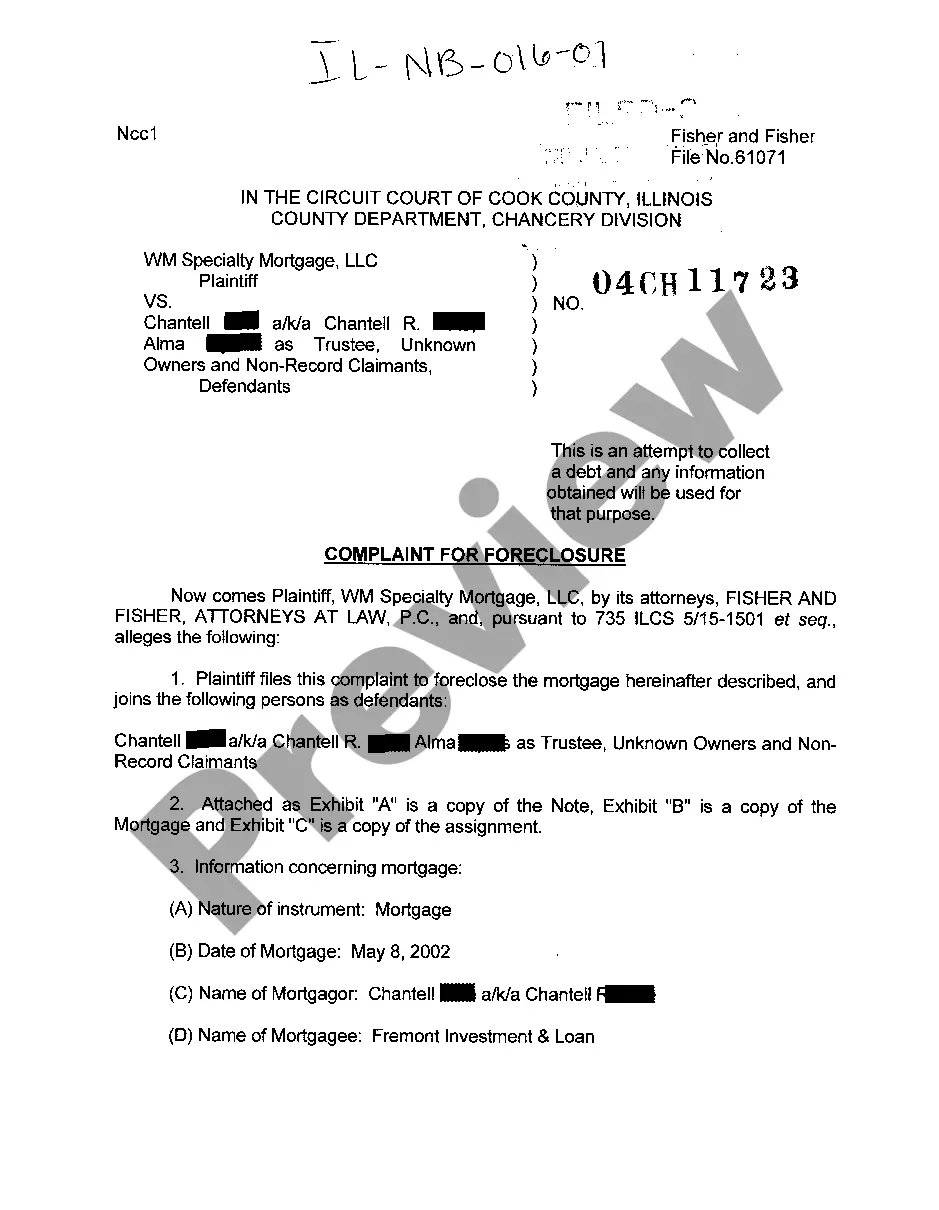

Illinois Complaint For Foreclosure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

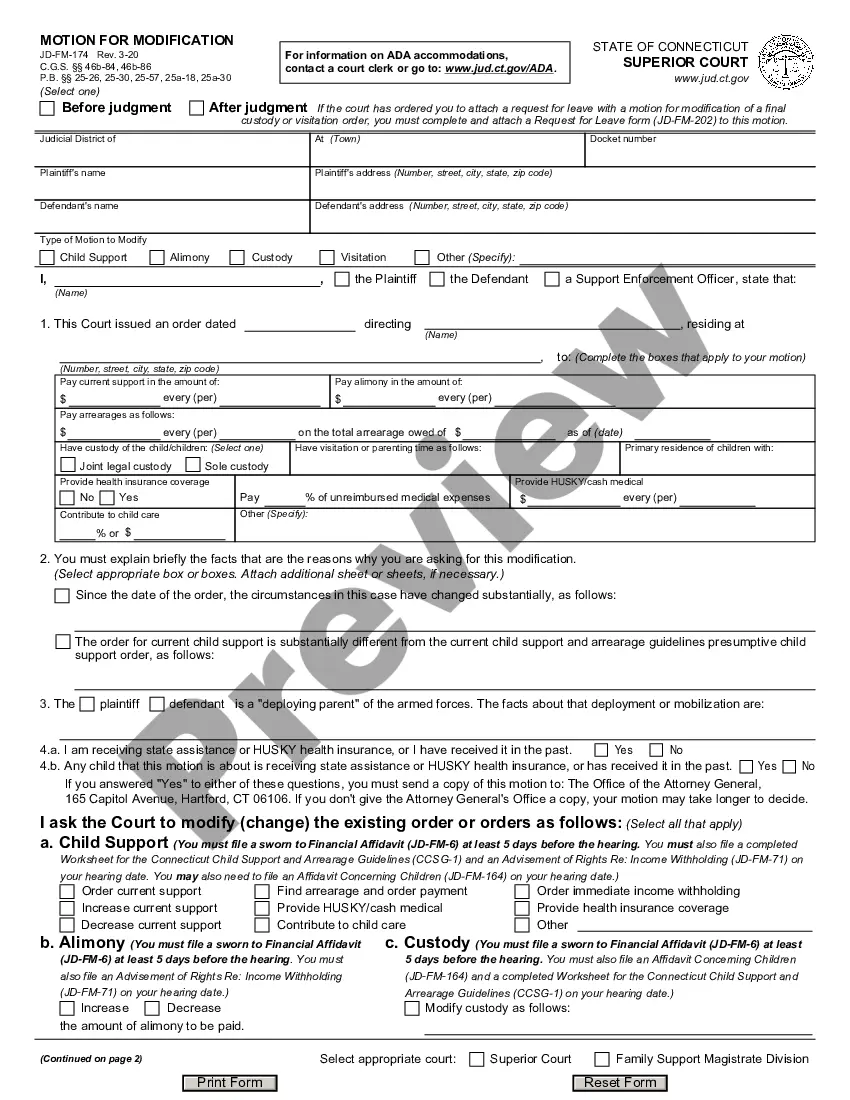

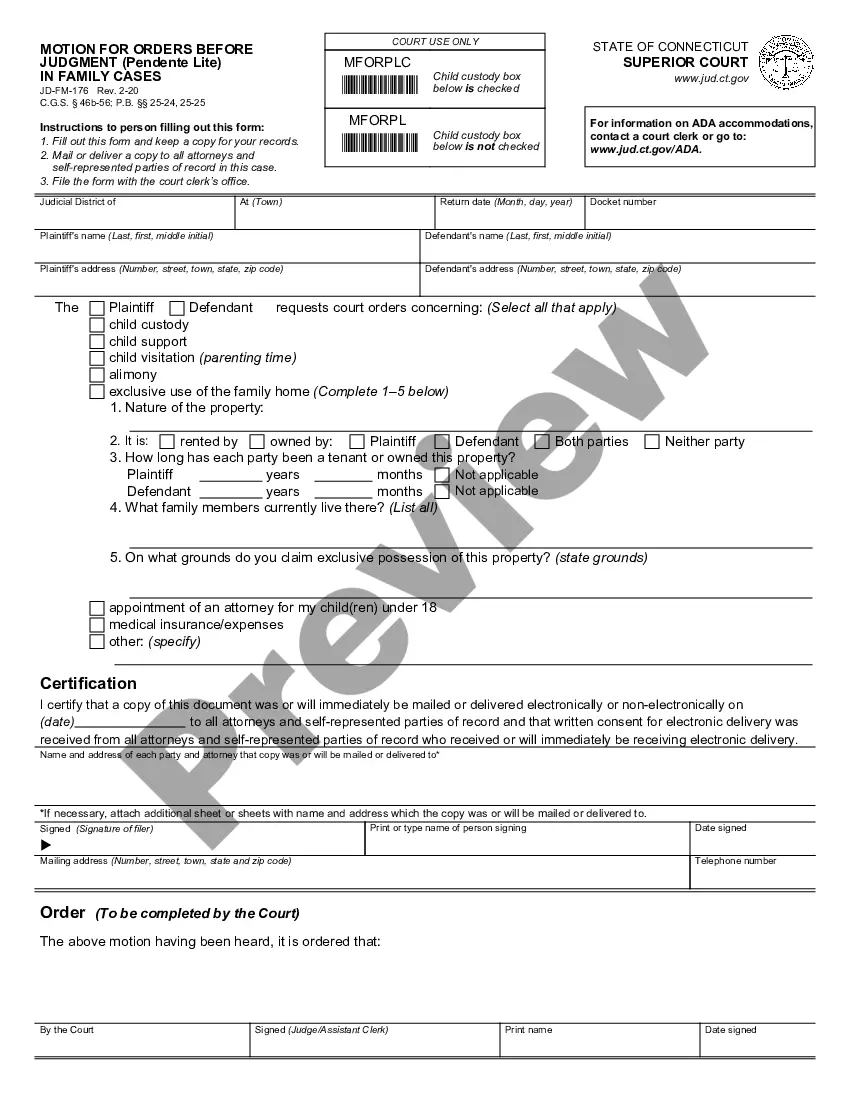

How to fill out Illinois Complaint For Foreclosure?

Looking for an Illinois Complaint For Foreclosure example and completing it may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate template tailored for your state in just a few clicks.

Our legal experts prepare all documents, allowing you to simply fill them out. It’s truly that straightforward.

Select your payment plan on the pricing page and set up your account. Choose whether to pay by card or through PayPal. Save the example in your desired file format. You can print the Illinois Complaint For Foreclosure template or complete it using any online editor. Don’t worry about making errors as your form can be used, submitted, and printed as many times as needed. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the example.

- All your downloaded templates are kept in My documents and are available at any time for future use.

- If you haven’t registered yet, you will need to create an account.

- Review our comprehensive instructions on how to obtain your Illinois Complaint For Foreclosure example in a matter of minutes.

- To obtain a valid form, verify its relevance to your state.

- Examine the example using the Preview feature (if it’s available).

- If a description is provided, read it to understand the details.

- Click Buy Now once you find what you are looking for.

Form popularity

FAQ

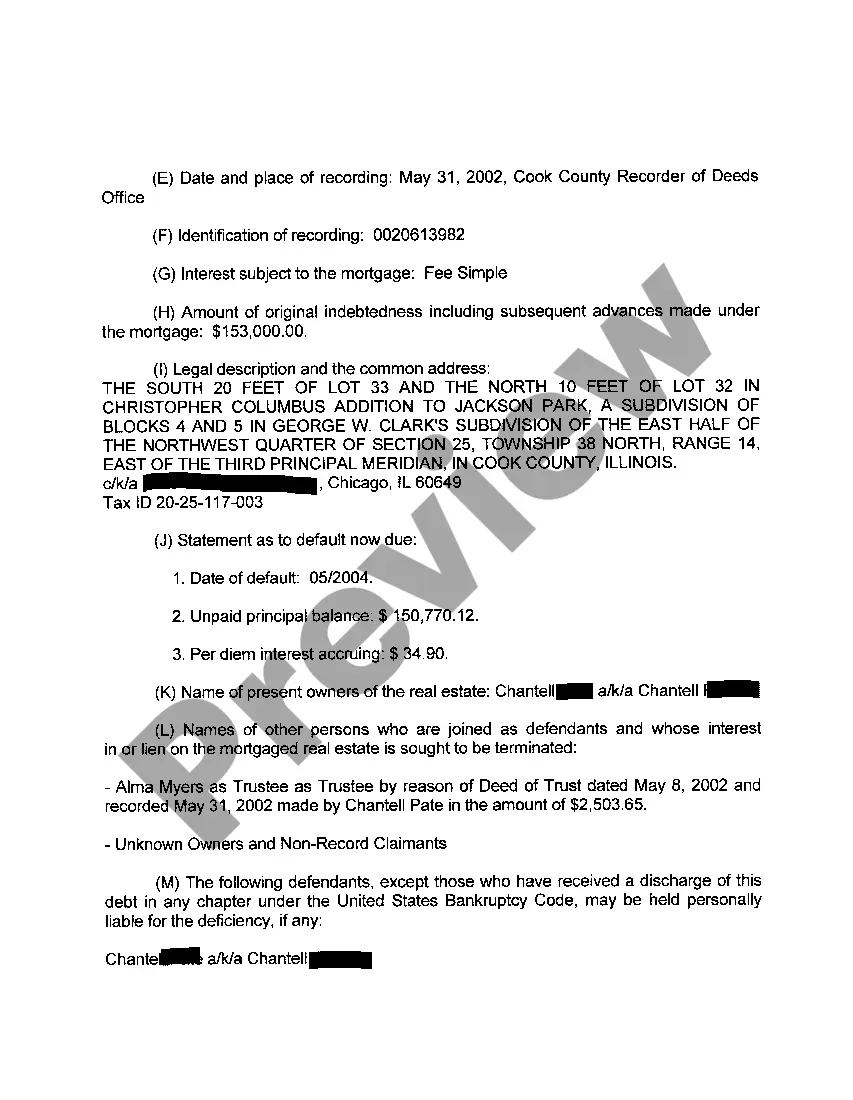

Foreclosure proceedings begin with a complaint filed by the lender. The borrower is served a copy of the complaint and a summons, along with a notice of his or her rights during foreclosure. In most cases, the borrower has 30 days to file a response. Failure to respond will result in a default judgment for the lender.

If you have recently lost your home to a foreclosure and the sale has already occurred, you might be able to reverse the sale or get the property back through the right of redemption.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

When You Have to Leave After an Illinois Foreclosure Sale The foreclosed homeowner can remain in the home for 30 days after the court confirms the sale.

A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale (or for a short period after the sale, in some cases), or filing for bankruptcy. Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

In Illinois, it can take approximately 12-15 months for a foreclosure to be completed. Call your lender or a HUD-certified counseling agency as soon as you can.