Illinois Third Party Lender Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Third Party Lender Agreement?

Utilize US Legal Forms to obtain a printable Illinois Third Party Lender Agreement.

Our court-recognized documents are crafted and frequently refreshed by experienced attorneys.

We boast the most comprehensive library of forms available online, providing reasonably priced and precise examples for clients and legal professionals, as well as small to medium-sized businesses.

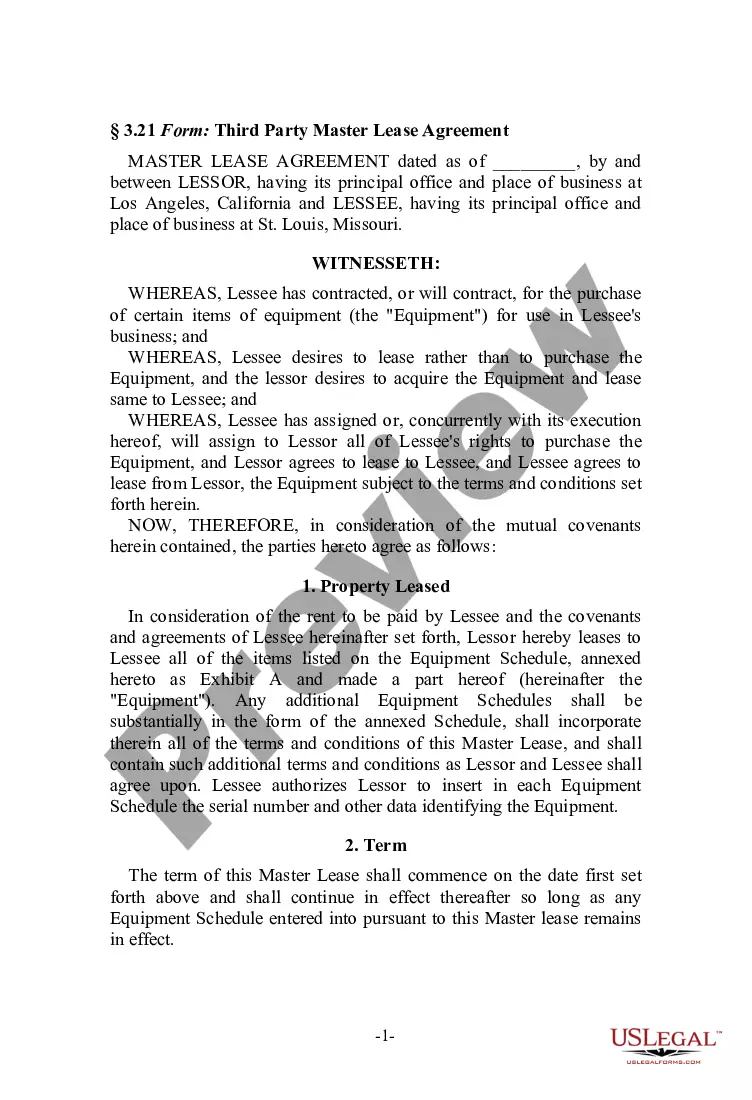

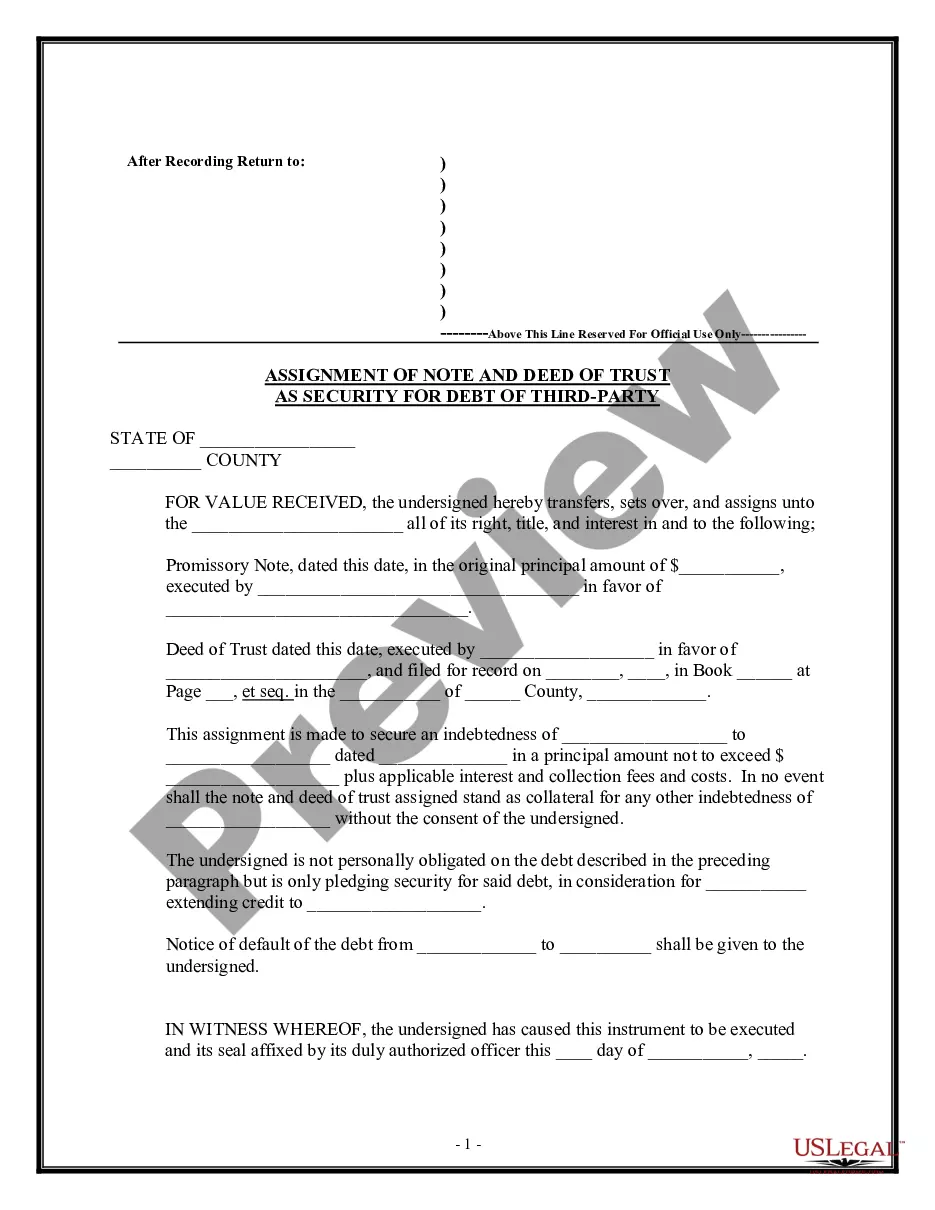

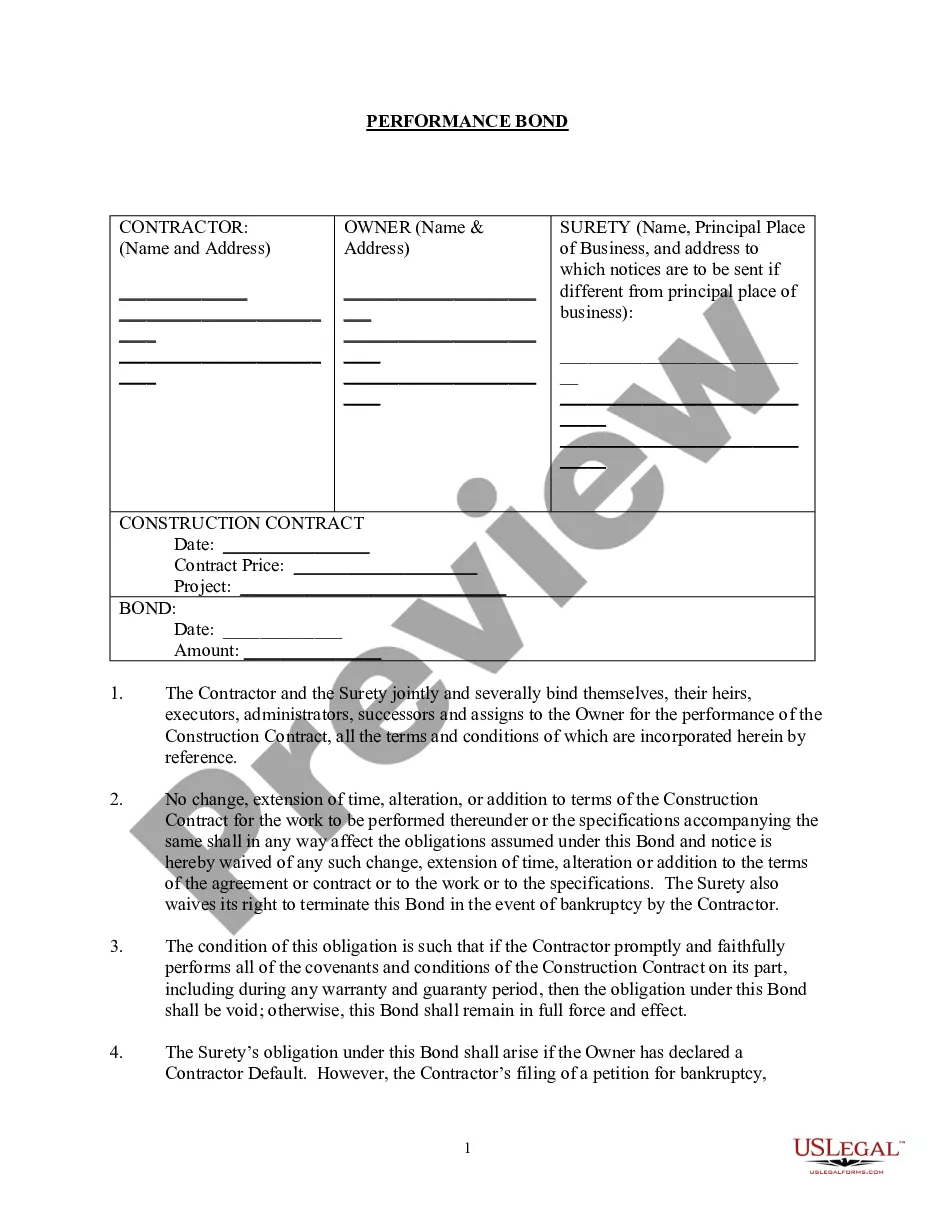

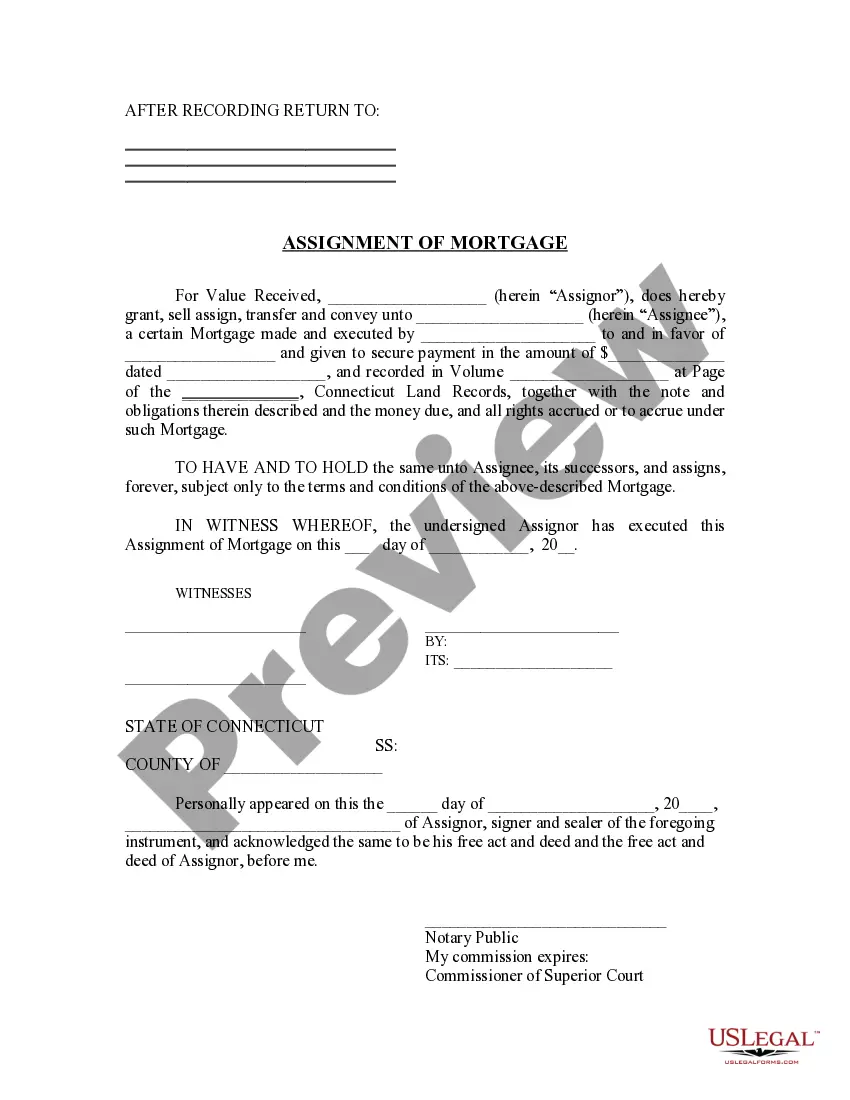

Review the form by inspecting the description and using the Preview option.

- The templates are sorted into state-specific categories.

- Many templates can be previewed before downloading.

- Customers must possess a subscription to download templates and must Log In to their accounts.

- Click Download next to any required form to find it in My documents.

- For those without a subscription, adhere to the following steps to quickly locate and download the Illinois Third Party Lender Agreement.

- Verify that you have the correct form applicable to your state.

Form popularity

FAQ

Loan agreements are binding contracts between two or more parties to formalize a loan process.Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

In the lending industry, third-party mortgage originators can be broad in scope and may be loosely defined as any person or company involved in the process of marketing mortgages, gathering borrower information for a mortgage application, underwriting, closing, or funding a mortgage loan.

Third Party Lender agrees that the Common Collateral will only secure its Third Party Loan and the Common Collateral is not currently, and will not be used in the future, as security for any other financing provided by Third Party Lender to Borrower that purports to be in a superior position to that of the CDC Lien,

When a lender, bank, or mortgage company sells a home loan to another entity, the seller usually takes the following steps. It endorses the promissory note (signs it over) to the new loan owner. The promissory note owner is the only party with the legal right to collect on the debt.

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person.As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

Identity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.

Borrower-lender agreement means a credit agreement (i) to finance a transaction between the borrower and a person (the supplier) other than the lender, and. (ii)

The buyer of a bond is a lender. The seller of a bond is a borrower. The bond buyers pay now in exchange for promises of future repaymentthat is, they are lenders. The bond sellers receive money now and in exchange for their promises of future repaymentthat is, they are borrowers.