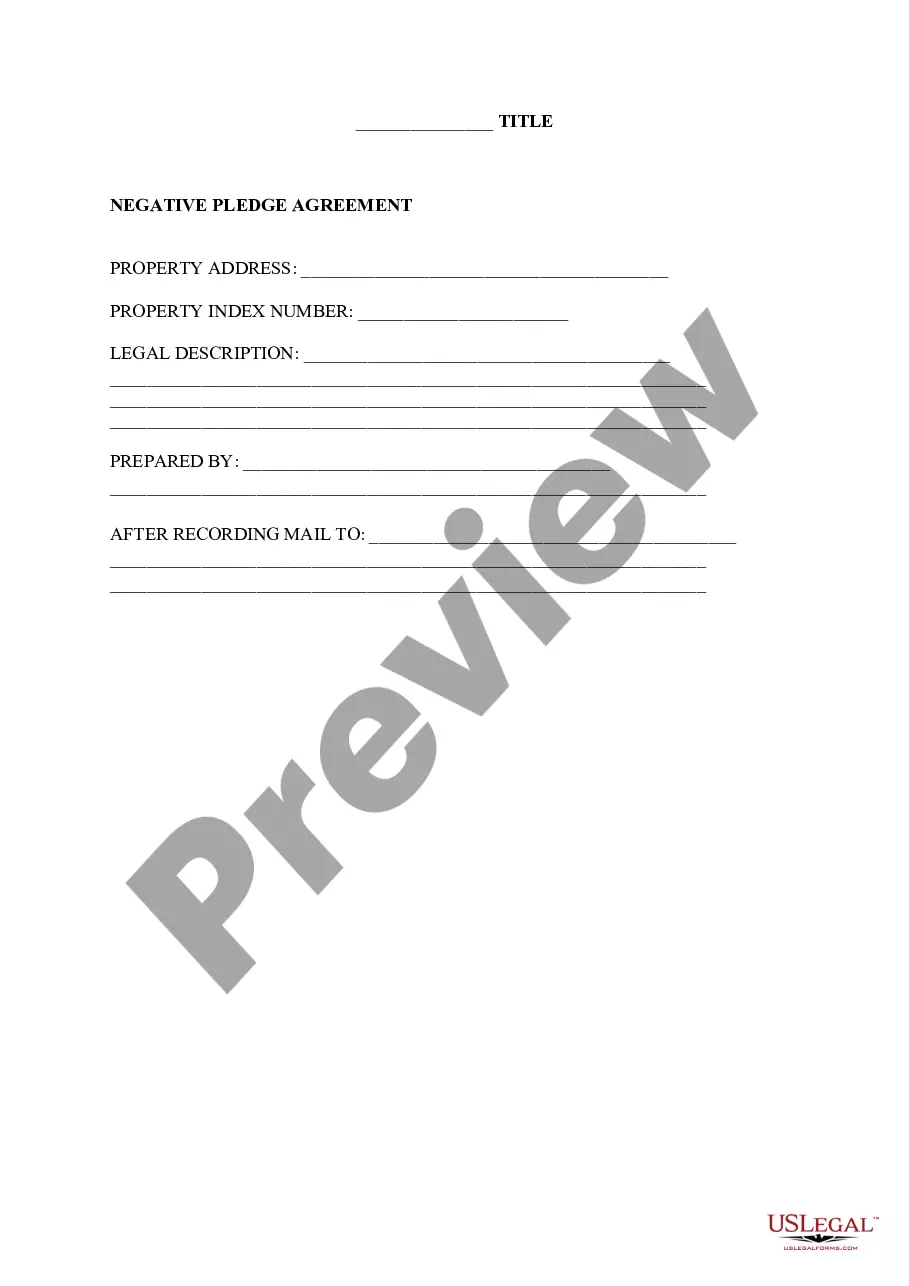

Illinois Negative Pledge Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Negative Pledge Agreement?

Leverage US Legal Forms to secure a downloadable Illinois Negative Pledge Agreement. Our court-acceptable documents are crafted and periodically refreshed by experienced attorneys.

Our collection is the most extensive Forms repository online and offers economical and precise templates for clients, legal professionals, and small to medium-sized businesses.

The papers are organized into state-specific categories, with several available for preview before downloading.

US Legal Forms offers a vast selection of legal and tax templates and packages for both business and personal requirements, including the Illinois Negative Pledge Agreement. Over three million users have successfully availed themselves of our service. Opt for your subscription plan to access high-quality documents in just a few clicks.

- Ensure you have the accurate template pertaining to the required state.

- Examine the document by reading its description and utilizing the Preview option.

- Select Buy Now if it is the template you desire.

- Establish your account and complete payment through PayPal or credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Utilize the Search field if you wish to locate another document template.

Form popularity

FAQ

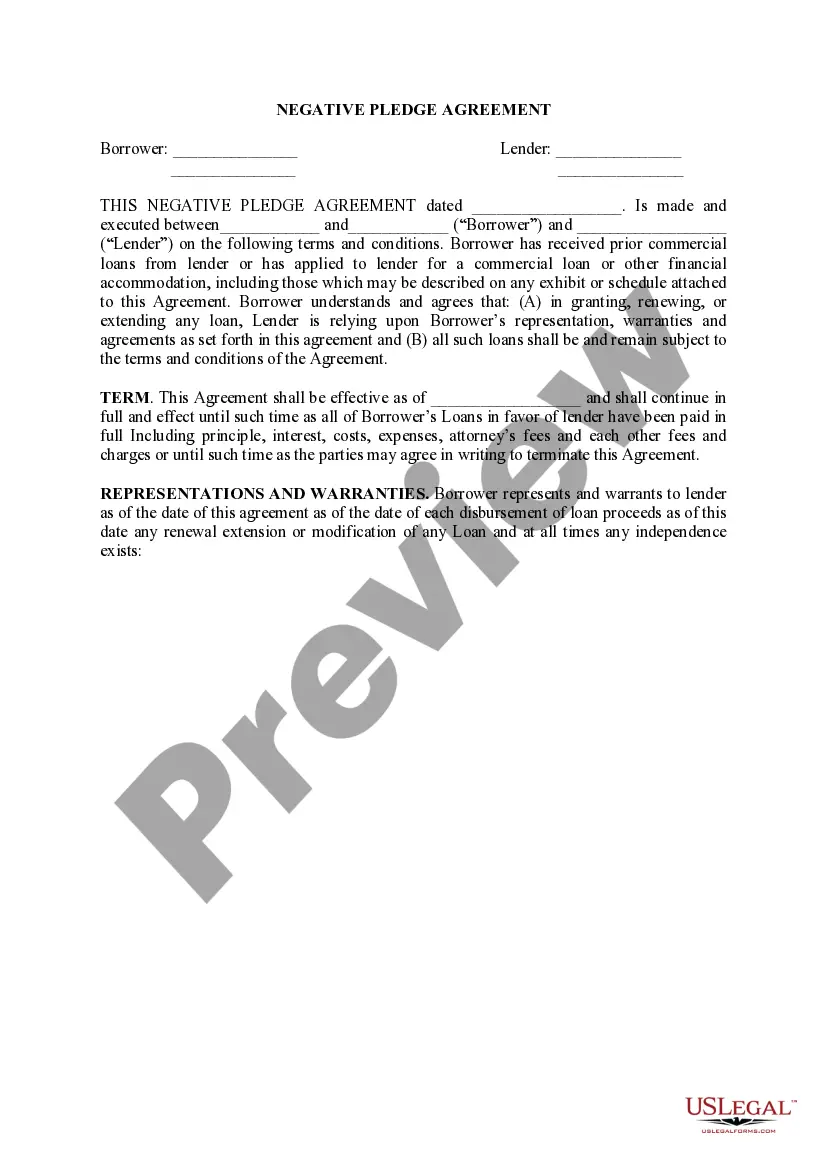

Negative pledges are agreements where a borrower commits not to secure any other debts with specific assets. These pledges provide protection for lenders, ensuring their loans remain secured without competition from future borrowers. Understanding negative pledges is essential for anyone entering into an Illinois Negative Pledge Agreement, as they can significantly affect the financial landscape of borrowing and lending.

A negative lien, on the other hand, is a right of a person to restrict another person from disposing of or creating encumbrance over a property belonging to the latter which is in the latter's possession or control till the time the debt or other obligation (for which such negative lien is conferred) is discharged.

Lenders will sometimes require a negative pledge from a borrower or related party as a condition of a loan. Despite the title, a negative pledge is not a pledge of collateral and does not grant any kind of a security interest in assets.

While a Negative Pledge is not a security instrument, it can be useful in the right context so long as a Lender recognizes its limitations. The advantages of a Negative Pledge include its flexibility and the ease with which it can be incorporated into any finance agreement.

A negative covenant is a bond covenant preventing certain activities unless agreed to by the bondholders. Negative covenants are written directly into the trust indenture creating the bond issue, are legally binding on the issuer, and exist to protect the best interests of the bondholders.

Positive Covenants and Negative (Restrictive) Covenants A covenant can be either positive or negative. A negative obligation is often referred to as a restrictive covenant. Positive covenants are obligations to do something, such as keep contribute to a maintenance fund or maintain a wall.

A pledged asset is a valuable possession that is transferred to a lender to secure a debt or loan. A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged.

A Double Negative Pledge is an agreement whereby a borrower agrees to both abstain from granting liens on assets to any other existing or prospective lender (negative pledge), and abstain from offering any current or prospective lender an agreement not to pledge (double negative pledge).

A negative pledge clause is a type of negative covenant that prevents a borrower from pledging any assets if doing so would jeopardize the lender's security. This type of clause may be part of bond indentures and traditional loan structures.

What Is a Negative Pledge Clause? A negative pledge clause is a type of negative covenant that prevents a borrower from pledging any assets if doing so would jeopardize the lender's security. This type of clause may be part of bond indentures and traditional loan structures.