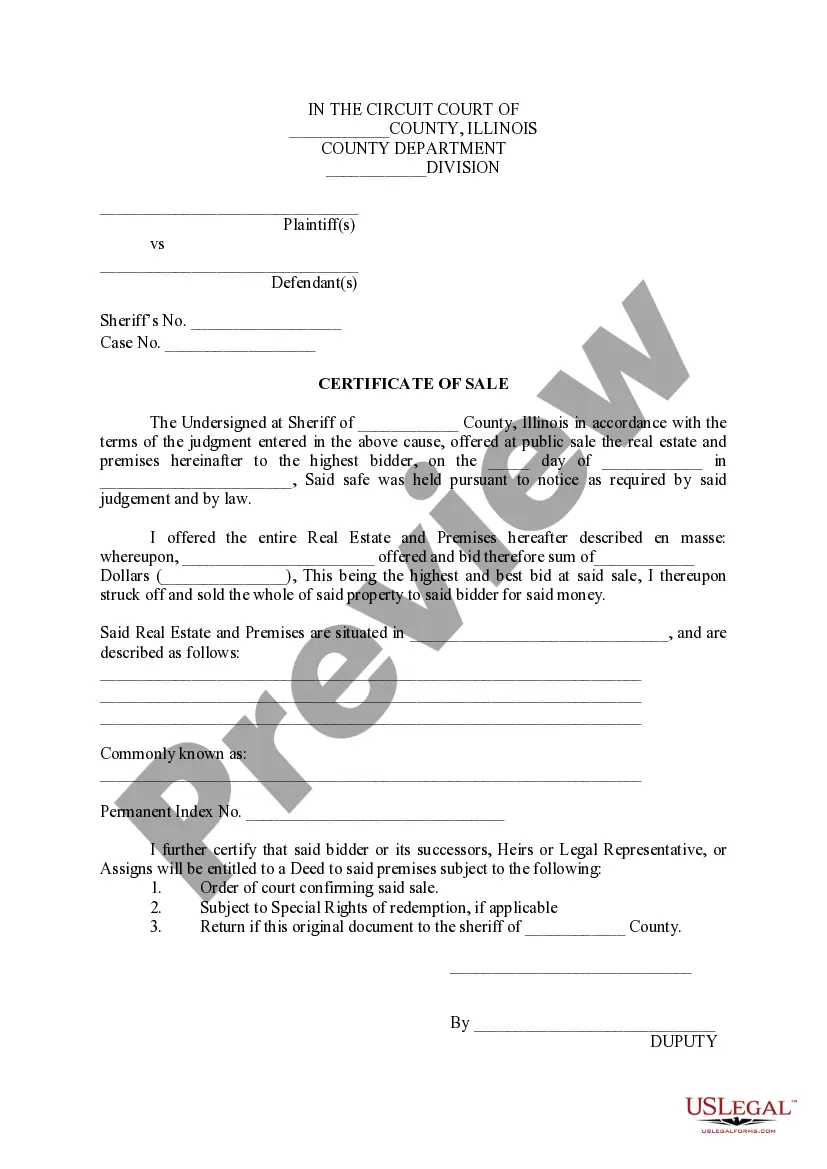

Illinois Certificate of Sale

Description

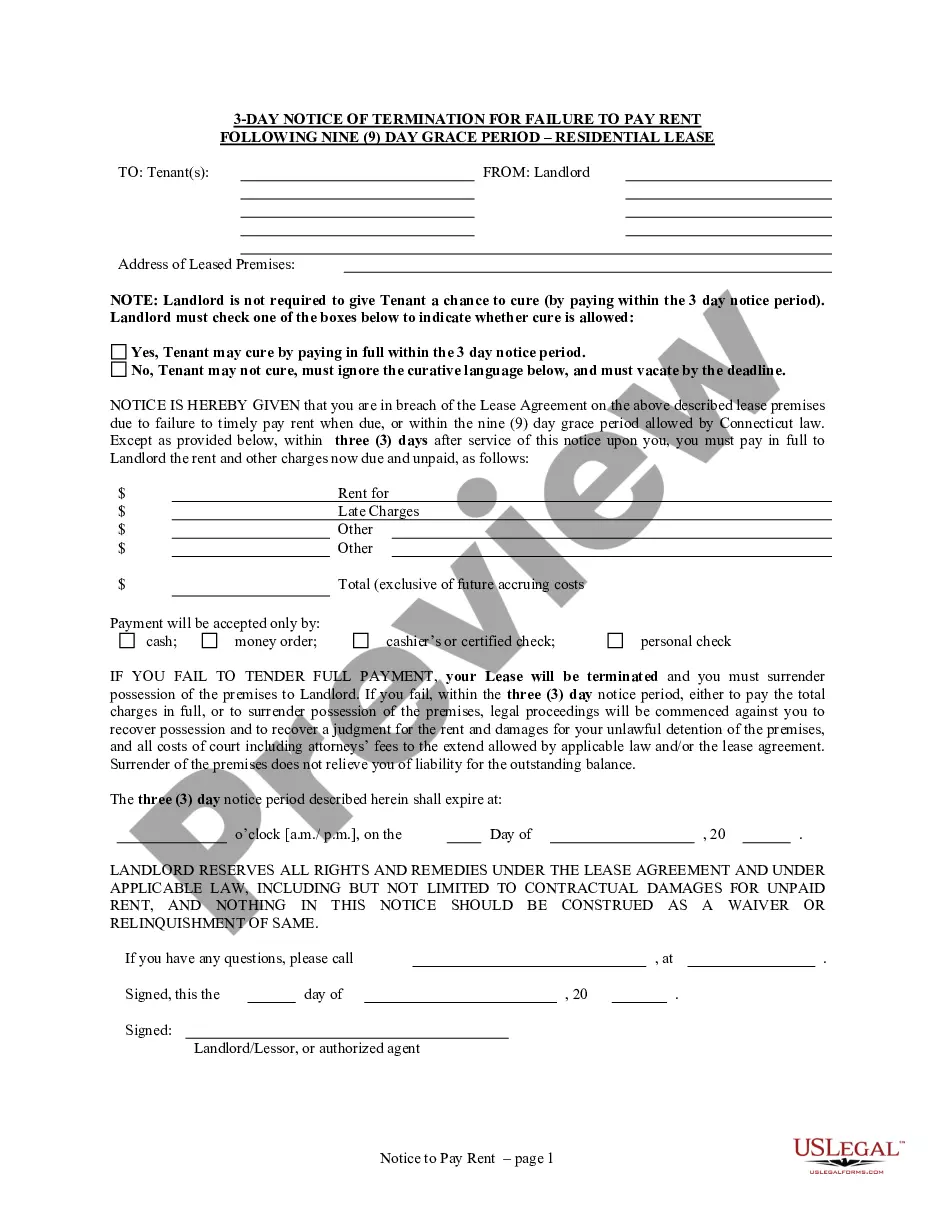

How to fill out Illinois Certificate Of Sale?

Utilize US Legal Forms to acquire a printable Illinois Certificate of Sale. Our court-recognized forms are created and frequently refreshed by experienced attorneys.

Ours is the most extensive Forms library available online and offers economical and precise templates for clients, lawyers, and small to medium-sized businesses (SMBs).

The templates are organized into state-specific categories, and some can be previewed prior to downloading.

Set up your account and pay through PayPal or credit card. Download the form to your device and feel free to use it multiple times. Utilize the Search field if you need to find another document template. US Legal Forms provides a vast array of legal and tax templates and packages to meet both business and personal requirements, including the Illinois Certificate of Sale. Over three million users have successfully utilized our platform. Select your subscription plan and obtain high-quality forms within moments.

- To obtain samples, users must have a subscription and Log In to their account.

- Click Download next to any template you wish and find it in My documents.

- For those without a subscription, follow the instructions below to swiftly locate and download the Illinois Certificate of Sale.

- Ensure you have the correct form relevant to the state it is needed for.

- Examine the form by reading the description and by utilizing the Preview feature.

- Click Buy Now if it is the document you require.

Form popularity

FAQ

Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

It is free to apply for a sales tax permit in Illinois. Other business registration fees may apply. Contact each state's individual department of revenue for more about registering your business. 6.

In Illinois, when you sell a car, you are required to remove the license plates and submit a valid title to the buyer that is signed and dated.In Illinois, there is no official bill of sale, so you can make your own. It should contain the name, address and phone number of both the buyer and seller.

An Illinois bill of sale is not required to register a vehicle. However, a bill of sale can be a helpful document.To register a vehicle in Illinois, you need to apply for registration and title on the vehicle. You can use a bill of sale along with the proper VSD form depending on your needs.

The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state, while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell. After registering, a sales tax number will be provided by the Department of Revenue.

Register electronically using MyTax Illinois. Complete and mail Form REG-1, Illinois Business Registration Application. Visit a regional office.

Illinois businesses may purchase items tax free to resell. Sales tax is then collected and paid when the items are sold at retail. To document tax-exempt purchases of such items, retailers must keep in their books and records a certificate of resale.Certificates of Resale should be updated at least every three years.