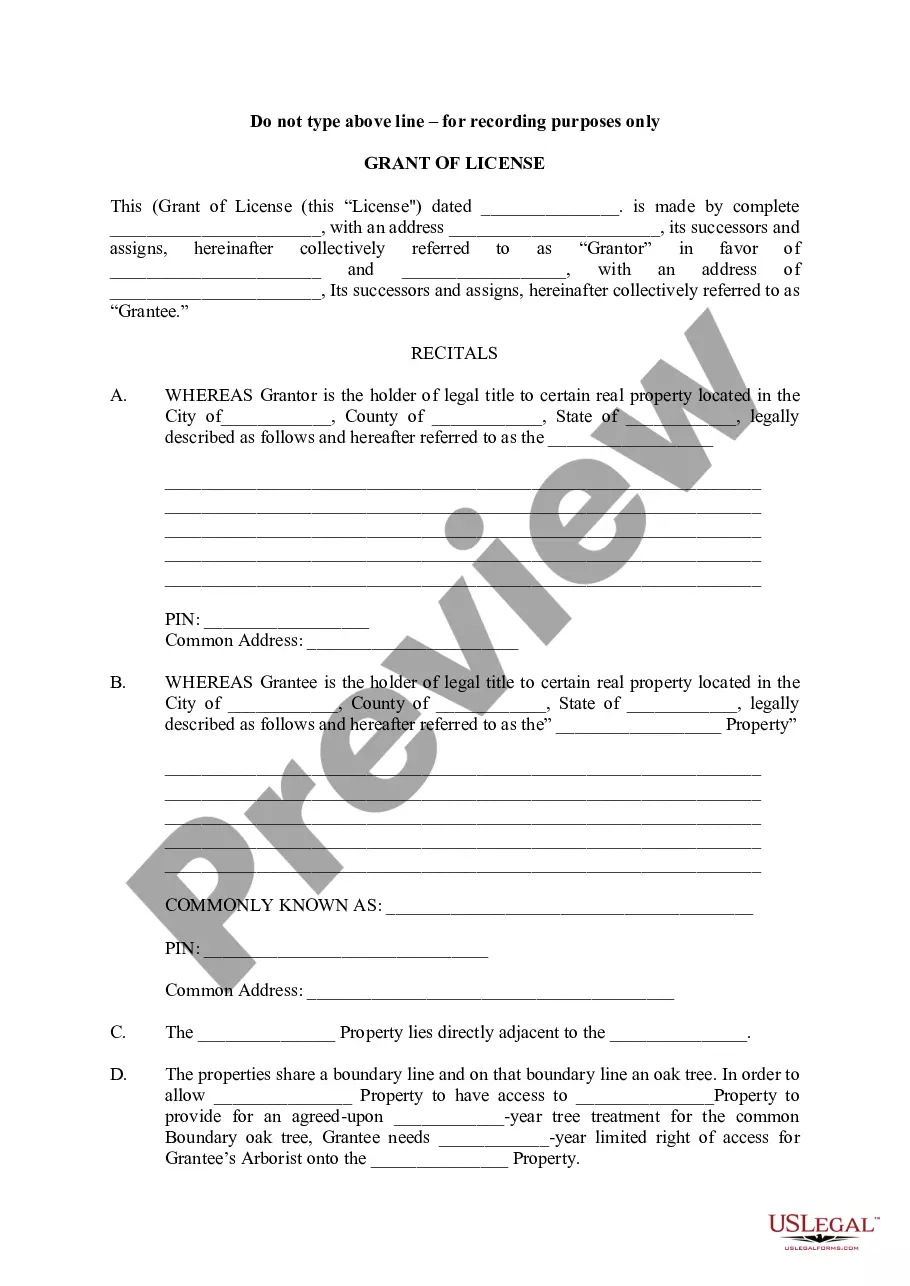

Illinois Grant for License

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

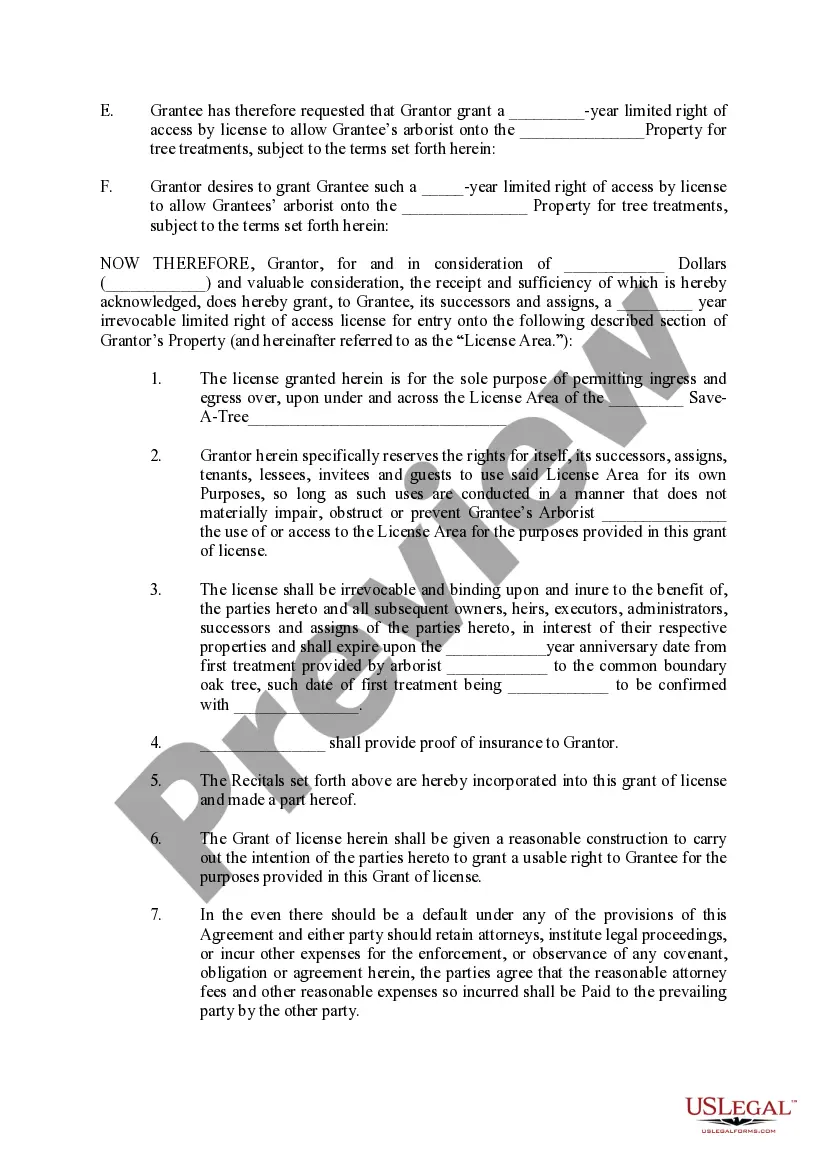

How to fill out Illinois Grant For License?

Utilize US Legal Forms to obtain a printable Illinois License Grant.

Our court-accepted documents are created and frequently revised by experienced attorneys.

Ours is the most extensive catalog of forms available online, offering economical and precise examples for consumers, legal professionals, and small to medium-sized businesses.

Select Buy Now if it is the document you wish to purchase. Create your account and pay using PayPal or credit card. Download the form to your device and feel free to reuse it repeatedly. Use the Search function if you need to locate another template. US Legal Forms offers a wide variety of legal and tax templates and packages for both business and personal purposes, including the Illinois License Grant. Over three million users have effectively used our service. Choose your subscription option and acquire high-quality forms with just a few clicks.

- The templates are organized into categories based on state, and numerous options can be viewed prior to downloading.

- To access samples, users must be subscribed and Log In to their profile.

- Click Download next to any template required and locate it in My documents.

- For those without a subscription, adhere to these instructions to quickly locate and download the Illinois License Grant.

- Verify that you have the correct template for the relevant state.

- Examine the document by reading the overview and using the Preview feature.

Form popularity

FAQ

In most instances, grant funds are counted as taxable income on your federal tax return. This means that you will be required to pay taxes on these funds.

Read the full grant application, including the grant guidelines, and eligibility requirements, to ensure that all required qualifications are fulfilled. Gather data, plans, and budget details that are requested before diving in. Answer all parts of all questions. Give the budget request proper attention.

Is the grant taxable? Yes, grant proceeds will count to 2020 taxable income and businesses must submit a completed and signed W-9 with their application.

Proposal summary. Introduction/overview of your business or organization. Problem statement or needs analysis/assessment. Project objectives. Project design. Project evaluation. Future funding. Project budget.

Monetary Award Program (MAP) Illinois National Guard (ING) Grant Program. Illinois Veteran Grant (IVG) Program. Grant Program for Dependents of Police or Fire Officers. Grant Program for Dependents of Correctional Officers. Grant Program for Exonerees. Higher Education License Plate (HELP) Program

Government grants and payments that are tax free.

Read the full grant application, including the grant guidelines, and eligibility requirements, to ensure that all required qualifications are fulfilled. Gather data, plans, and budget details that are requested before diving in. Answer all parts of all questions. Give the budget request proper attention.

Grants and Your Tax ReturnGrants only fall under taxable income if you (or your business) register a profit that tax year.People receiving the SEISS grant are subject to paying both Income Tax and National Insurance and must include this grant as their income in their tax return.

Pell Grants. Federal Supplemental Educational Opportunity Grant (FSEOG) Grants. Academic Competitiveness Grant (ACG) SMART Grants. TEACH Grants. GPA Isn't Everything Scholarship. Gen and Kelly Tanabe Scholarship. Scholarships Sponsored by Sallie Mae.