Illinois Motion to Voluntarily Dismiss for Workers' Compensation

Description

Key Concepts & Definitions

A motion to voluntarily dismiss is a legal filing by which a plaintiff seeks to terminate their own legal case before it reaches a verdict. In the context of workers, such motions may arise when an employee initially files a lawsuit against their employer for workplace-related grievances but then decides to withdraw the lawsuit, often due to settlement out of court, a change in circumstances, or legal advice.

Step-by-Step Guide on Filing a Motion to Voluntarily Dismiss for Workers

- Determine the Grounds: Assess why you wish to dismiss the case. Common grounds include settlement, reconciliation of the dispute, or inability to continue the case.

- Consult with Your Attorney: Before proceeding, it's advisable to speak to a legal professional who can provide tailored advice and ensure the motion is the right step.

- Prepare the Motion: Draft the motion to dismiss, stating the reasons for the decision and ensuring compliance with court rules regarding form and content.

- File the Motion: Submit the motion to the court where the case is being heard. This usually involves a filing fee.

- Notify the Opposing Party: Inform the other parties involved in the case about your motion to dismiss. They may have the option to contest it.

- Attend the Hearing: Some cases might require a hearing before the dismissal is approved. Be prepared to explain your reasons for dismissal to the judge.

Risk Analysis

- Legal Risks: Incorrectly filing a motion to dismiss can result in legal penalties or the motion being denied, prolonging the case.

- Financial Costs: There might be costs associated with filing the motion, and if the motion is not granted, additional court fees and attorney's fees may be incurred.

- Reputation Risks: For employers, being publicly involved in worker lawsuits might impact business reputation negatively, even if the case is dismissed voluntarily.

- Settlement Risks: Workers considering dismissal due to settlement agreements must ensure that the settlement is duly honored, or they may lose legal leverage.

Key Takeaways

Filing a motion to voluntarily dismiss for workers is a significant legal step that requires careful consideration of the risks and benefits. It's essential to consult with a legal professional and follow proper legal procedures to mitigate any associated challenges.

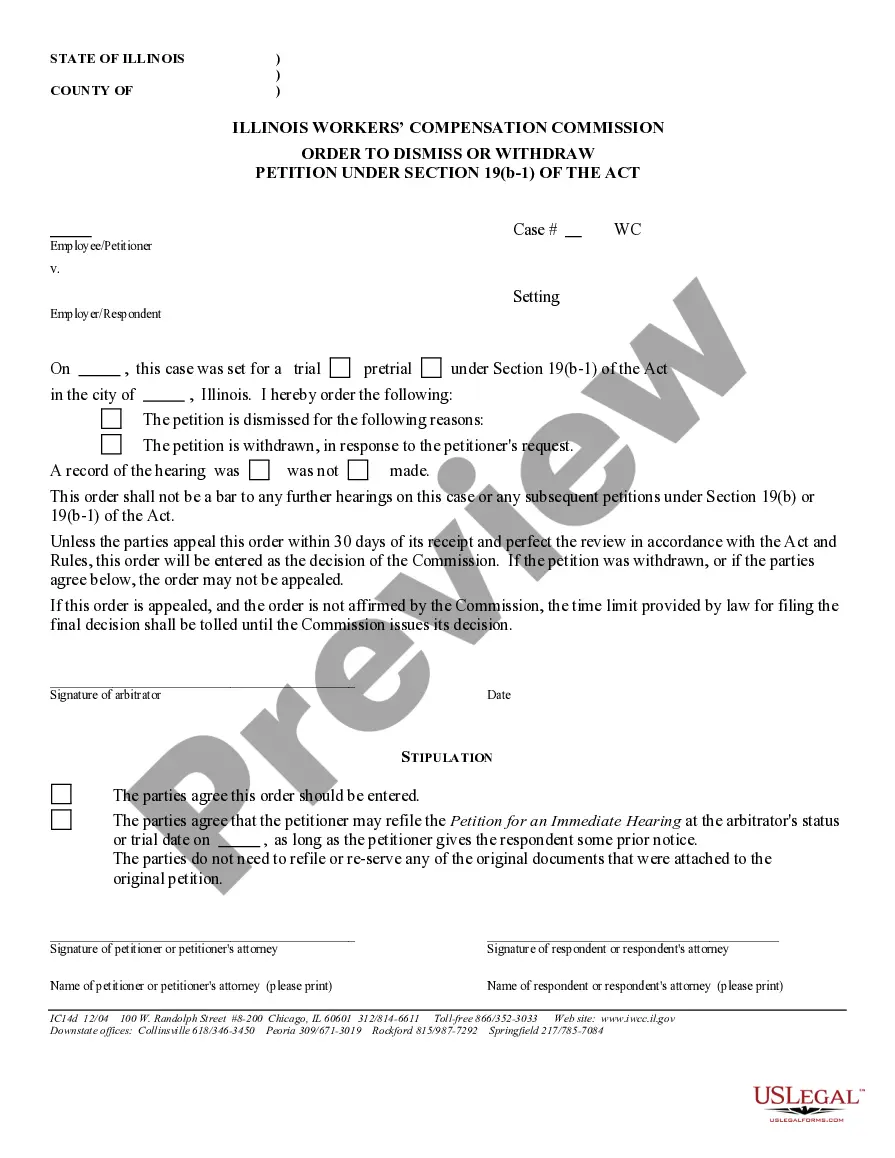

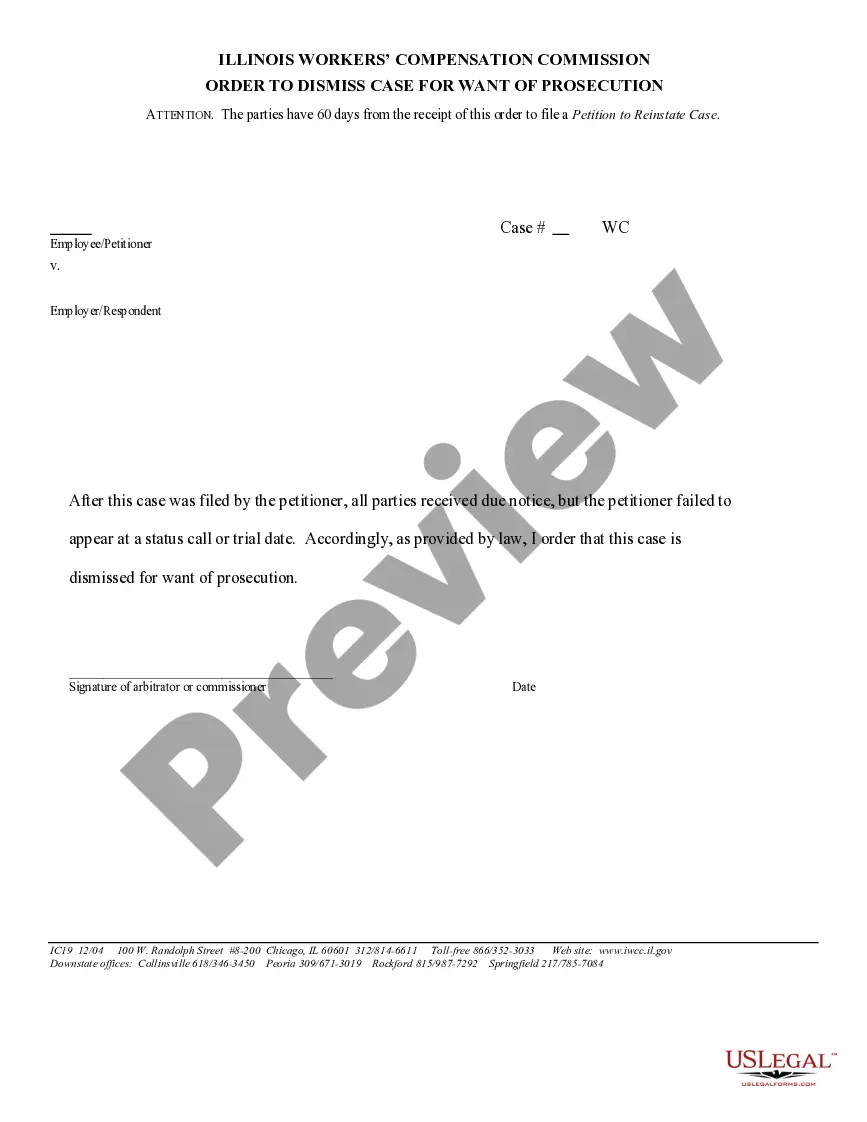

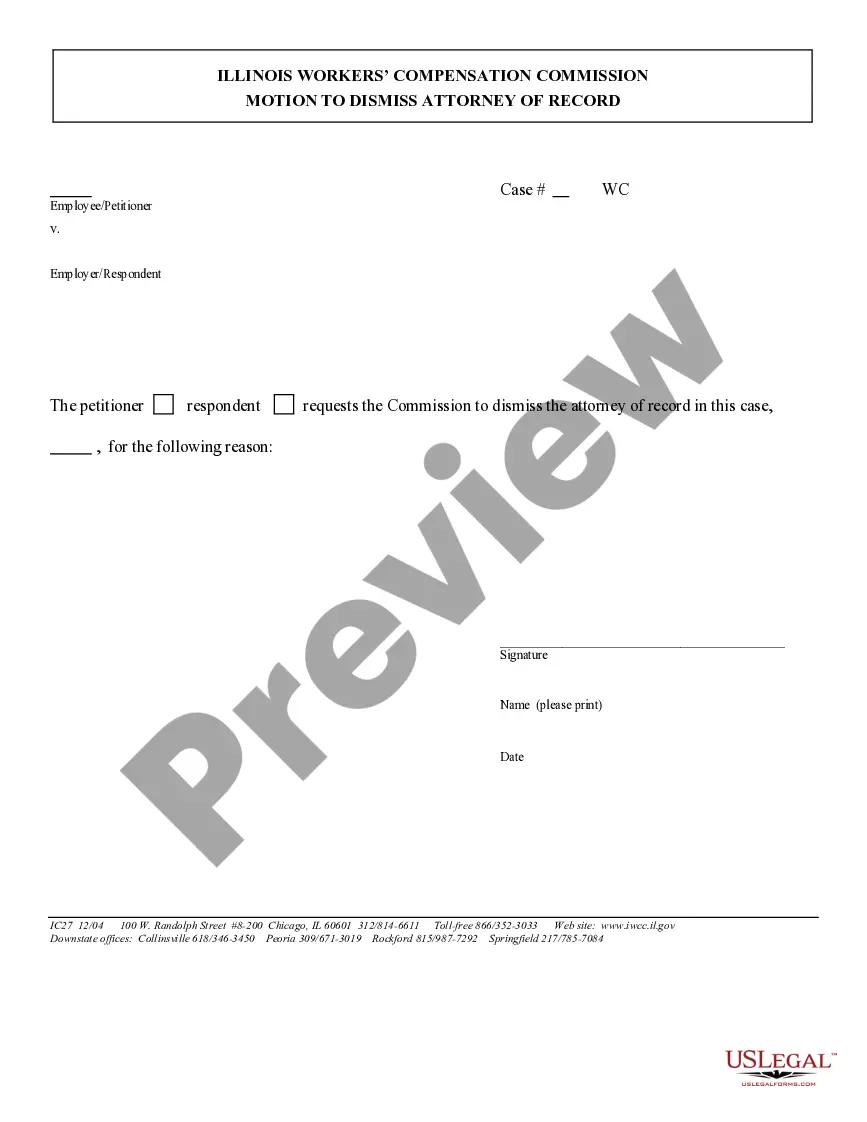

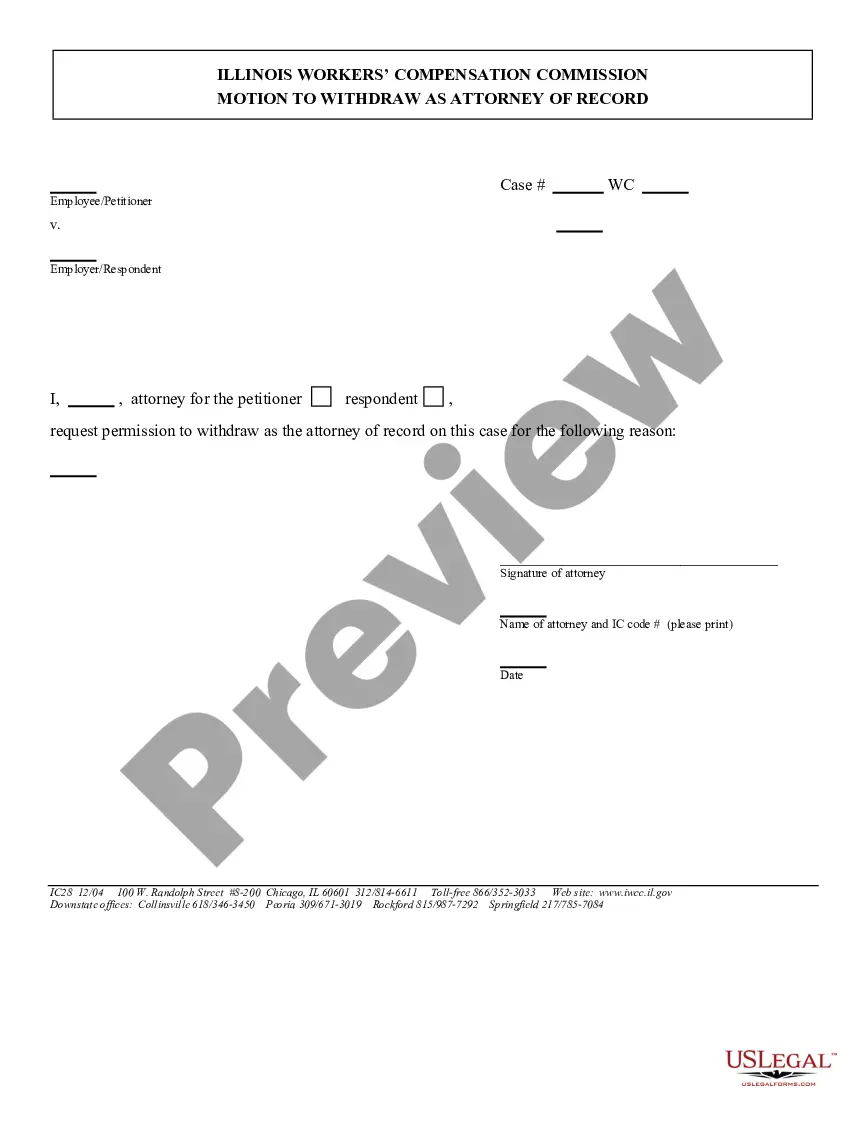

How to fill out Illinois Motion To Voluntarily Dismiss For Workers' Compensation?

Looking for an Illinois Motion to Voluntarily Dismiss regarding Workers' Compensation template and completing it can be challenging. To save considerable time, money, and effort, utilize US Legal Forms to locate the accurate template specifically for your state with just a few clicks. Our attorneys prepare each document, so you only need to complete them. It’s that straightforward.

Sign in to your account and navigate back to the form's webpage to save the template. Your stored templates can be found in My documents and are available at any time for future use. If you haven’t registered yet, you should create an account.

Check out our comprehensive instructions on how to obtain the Illinois Motion to Voluntarily Dismiss for Workers' Compensation template in just a few minutes.

You can print the Illinois Motion to Voluntarily Dismiss for Workers' Compensation template or complete it using any online editor. No need to worry about errors since your template can be used and submitted, and printed multiple times. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- To acquire a suitable template, verify its applicability for your state.

- Preview the template using the available option (if applicable).

- If there’s a description, read it to understand the details.

- Click Buy Now if you have found what you are looking for.

- Choose your plan on the pricing page and create an account.

- Indicate whether you prefer to pay with a credit card or via PayPal.

- Download the document in your preferred format.

Form popularity

FAQ

Seek medical care. It is important that you seek medical care as soon as you know that you have sustained a workplace injury. Notify your employer. Employer response. Regularly report to your employer. Check the status of your claim.

How much does workers' compensation insurance cost in Illinois? Workers' compensation insurance costs vary by state and the nature of the occupation. Estimated employer costs for workers' compensation in Illinois are $1.07 per $100 covered in payroll.

You must notify your employer of the accidental injury or illness within 45 days, either orally or in writing. To avoid possible delays, it is recommended the notice also include your name, address, telephone number, Social Security number, and a brief description of the injury or illness.

Seek medical help. Any time you are injured, you should seek medical care right away. Notify your employer. Document your injuries. Report to your employer regularly. Check the status of your claim.

Illinois workers' comp benefits include reasonable medical care required to cure or relieve the impact of the injury, temporary total or partial disability disability benefits, vocational rehabilitation, permanent partial or total disability benefits, and death benefits. Workers' comp benefits are not taxable.