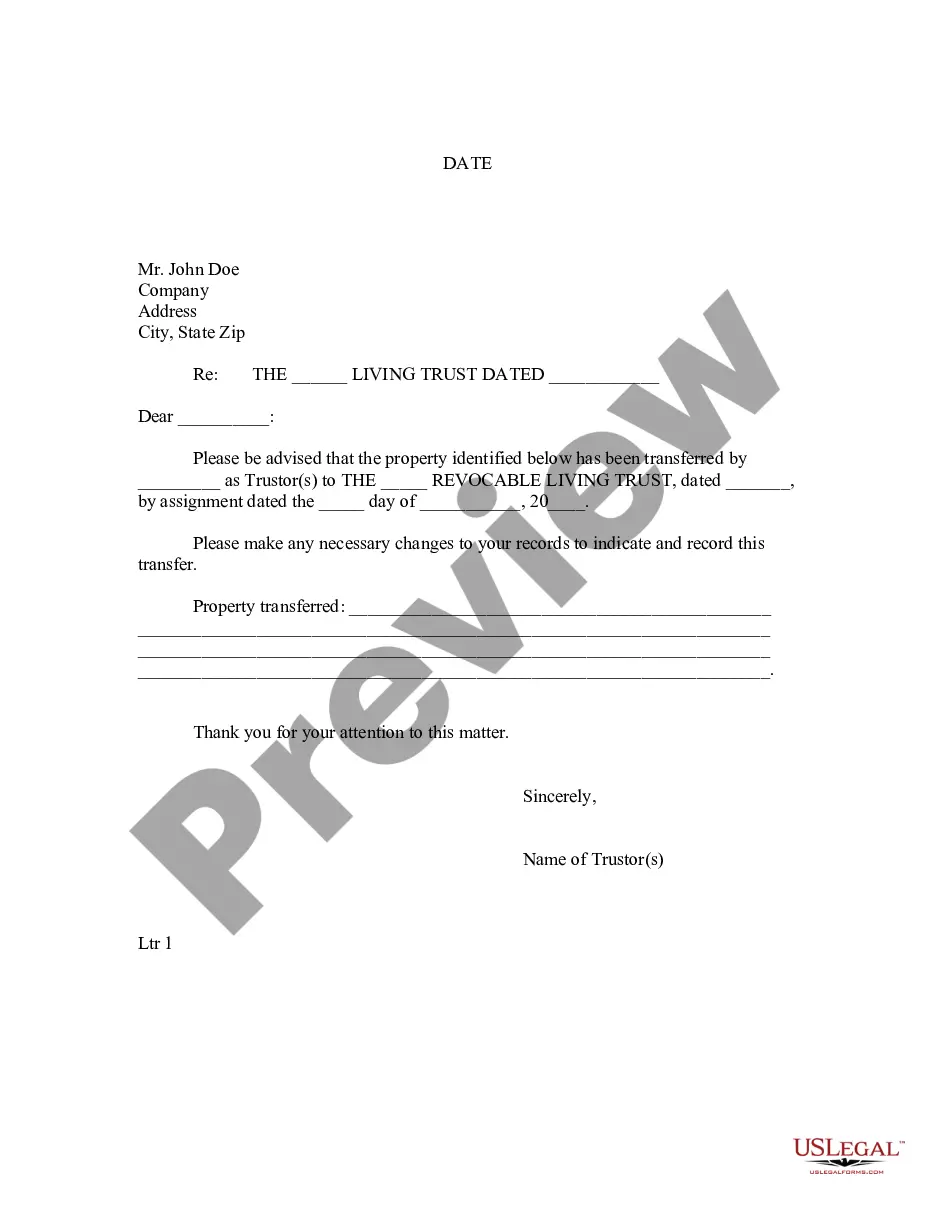

Illinois Letter to Lienholder to Notify of Trust

Description

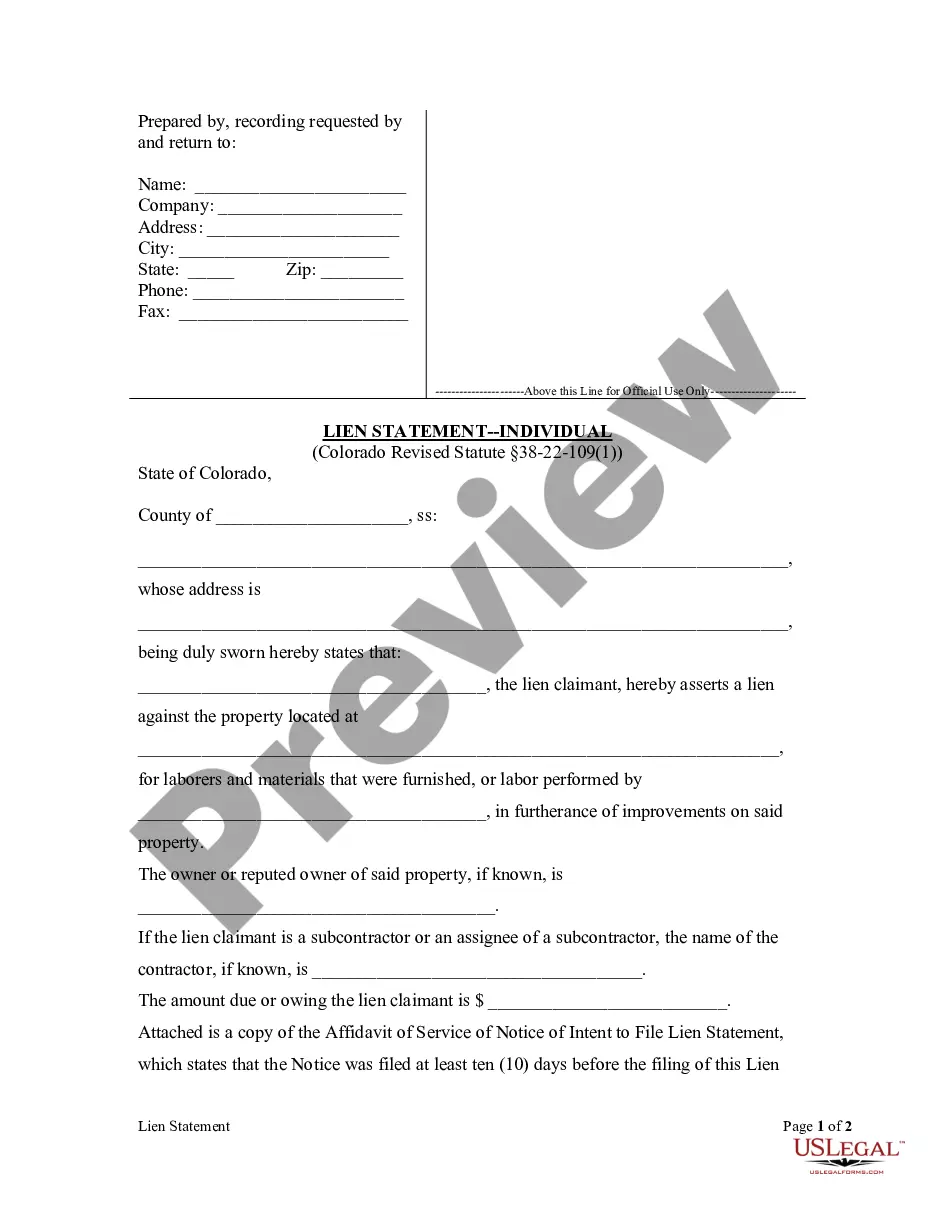

How to fill out Illinois Letter To Lienholder To Notify Of Trust?

Searching for Illinois Letter to Lienholder for Trust notification samples and completing them can be difficult.

To conserve time, expenses, and energy, utilize US Legal Forms and select the appropriate sample tailored for your state in merely a few clicks.

Our attorneys prepare each document, so you just need to complete them. It's really that easy.

Select your plan on the pricing page and create an account. Choose your payment method via credit card or PayPal. Save the sample in your preferred file format. You can print the Illinois Letter to Lienholder for Trust form or complete it using any online editor. Don’t worry about typos as your template can be used and submitted, and printed as many times as you need. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the document.

- Your saved samples are kept in My documents and are accessible at any time for future use.

- If you haven't signed up yet, you'll need to register.

- Review our detailed instructions on how to obtain your Illinois Letter to Lienholder for Trust form in a few minutes.

- To acquire a qualified sample, verify its validity for your state.

- Examine the sample using the Preview option (if available).

- If there’s a description, read it to grasp the details.

- Click on the Buy Now button if you found what you are looking for.

Form popularity

FAQ

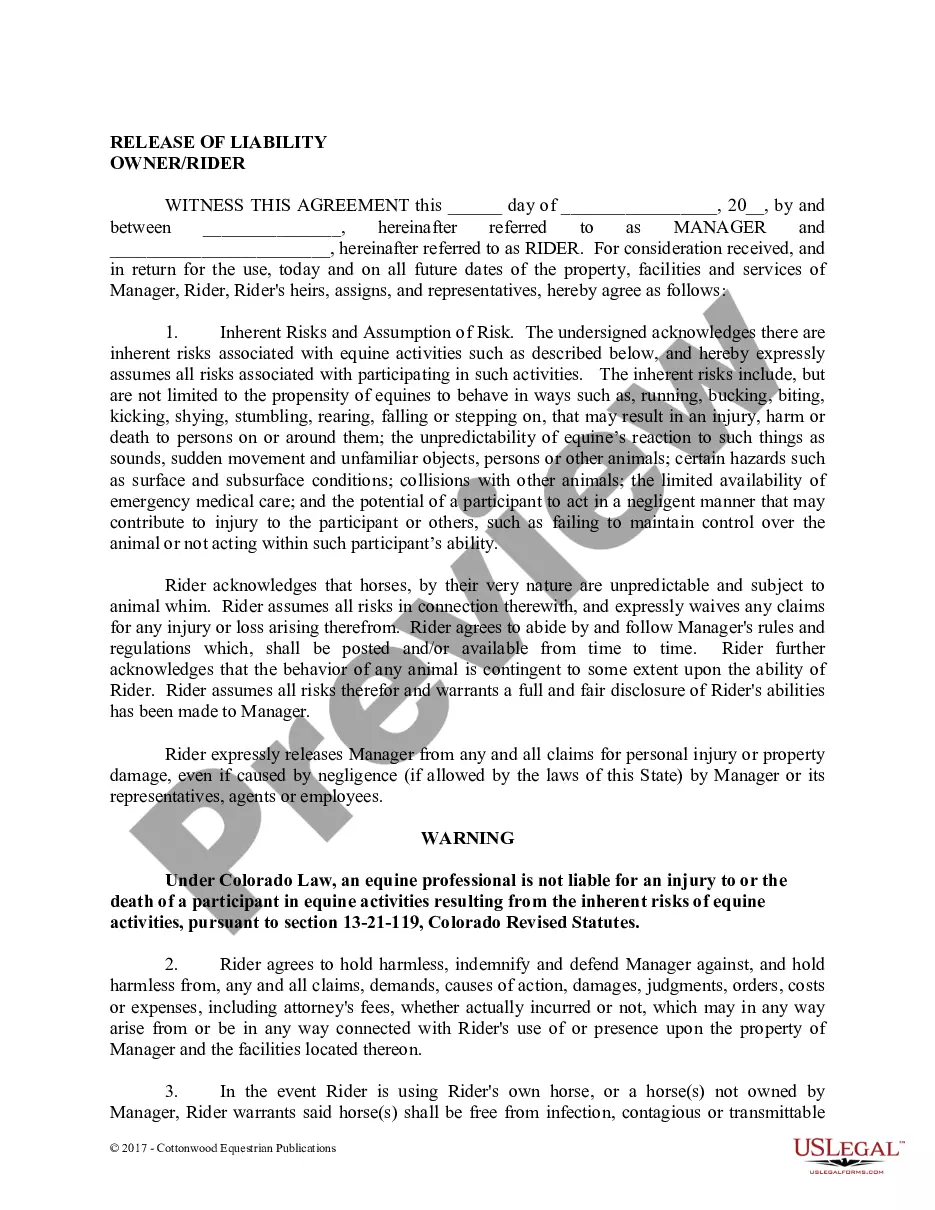

A lienholder is a lender that legally has an interest in your property until you pay it off in full. The lender which can be a bank, financial institution or private party holds a lien, or legal claim, on the property because they lent you the money to purchase it.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

Lien release letters should have a conspicuous title such as Release of Lien at the top of the page. The first paragraph should list the date the lien was placed on the property and the names and addresses of both the lienholder and the owner of the property.

The majority of states are, which means the state holds the title until the loan is paid in full. If you want to know who the lienholder is but you don't have the title, you can contact your local DMV or Secretary of State (SOS) and give them your vehicle's identification number (VIN), and the make and model.

When there is a lien holder on the vehicle, the settlement check for the car's ACV goes to that financial institution and any money left over after the payout would come to you.

A lien on a car gives the lien holder typically your auto loan lender a legal right to the vehicle until the loan is paid in full.And if you plan to buy a car from a private seller, you'll want to check its lien status first to help make sure the seller can transfer ownership to you.

If you are in an accident and file a claim, an insurance adjuster will inspect the vehicle to determine if it is repairable or a total loss.If there is a lien, the check goes to the lien holder and any amount exceeding what is owed then goes to the owner of the vehicle," says Stewart J.