Illinois Marital Legal Separation and Property Settlement Agreement Minor Children Parties May have Joint Property or Debts effective Immediately

Description

How to fill out Illinois Marital Legal Separation And Property Settlement Agreement Minor Children Parties May Have Joint Property Or Debts Effective Immediately?

Looking for Illinois Marital Legal Separation and Property Settlement Agreement Minor Children Parties May possess Joint Assets or Liabilities effective Immediately example and completing them can be rather a task.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the appropriate example specifically for your region in just a few clicks.

Our lawyers prepare each document, so all you need to do is complete them.

Click Buy Now if you found what you're looking for. Select your plan on the pricing page and create your account. Choose whether you wish to pay by card or via PayPal. Download the document in your preferred format. You can print the Illinois Marital Legal Separation and Property Settlement Agreement Minor Children Parties May possess Joint Assets or Liabilities effective Immediately form or complete it using any online editor. Don’t worry about making mistakes because your form can be utilized and submitted, and published as many times as you desire. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's web page to download the document.

- All your downloaded templates are stored in My documents and are available at any time for subsequent use.

- If you haven’t signed up yet, you should create an account.

- Review our comprehensive instructions regarding how to obtain your Illinois Marital Legal Separation and Property Settlement Agreement Minor Children Parties May possess Joint Assets or Liabilities effective Immediately example in minutes.

- To obtain a qualified form, verify its applicability for your region.

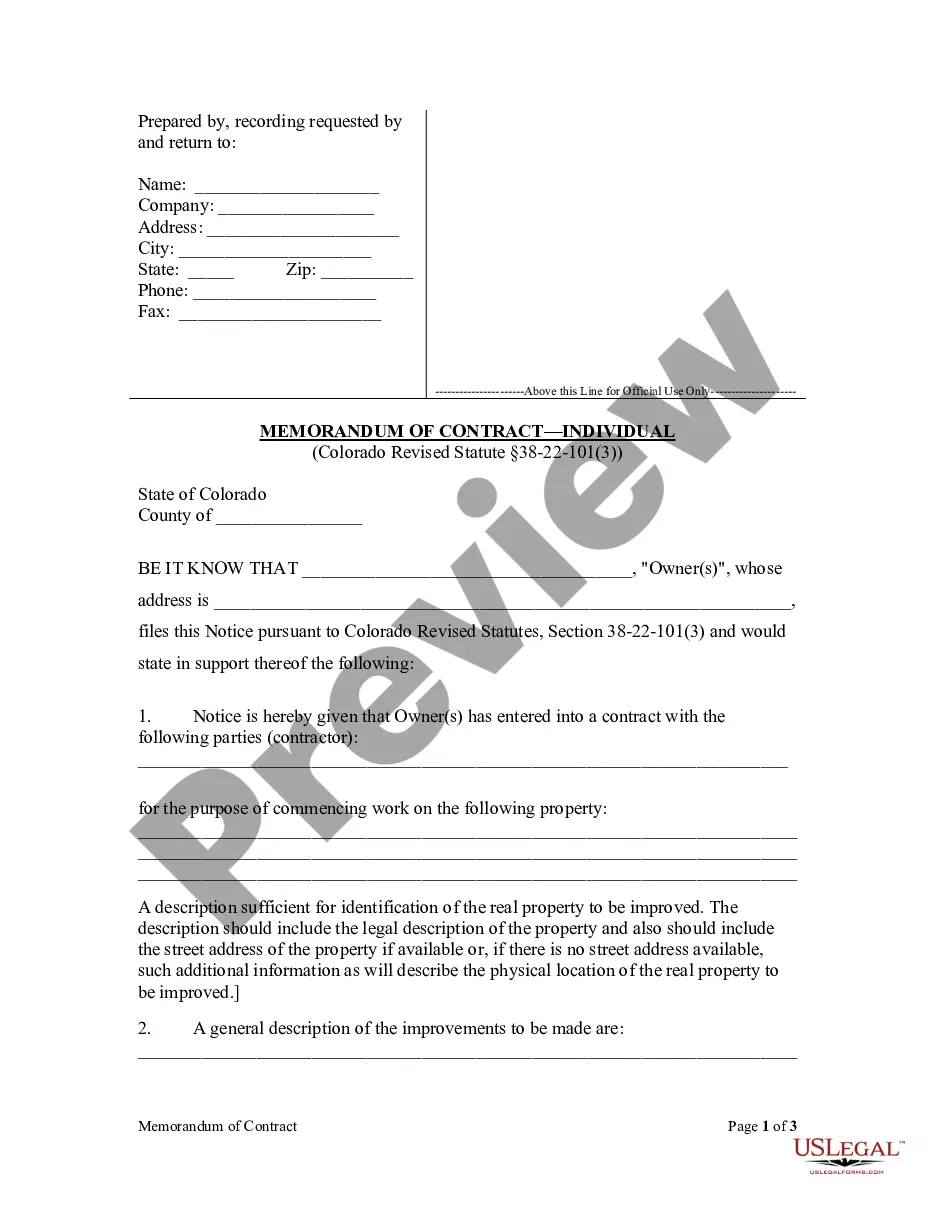

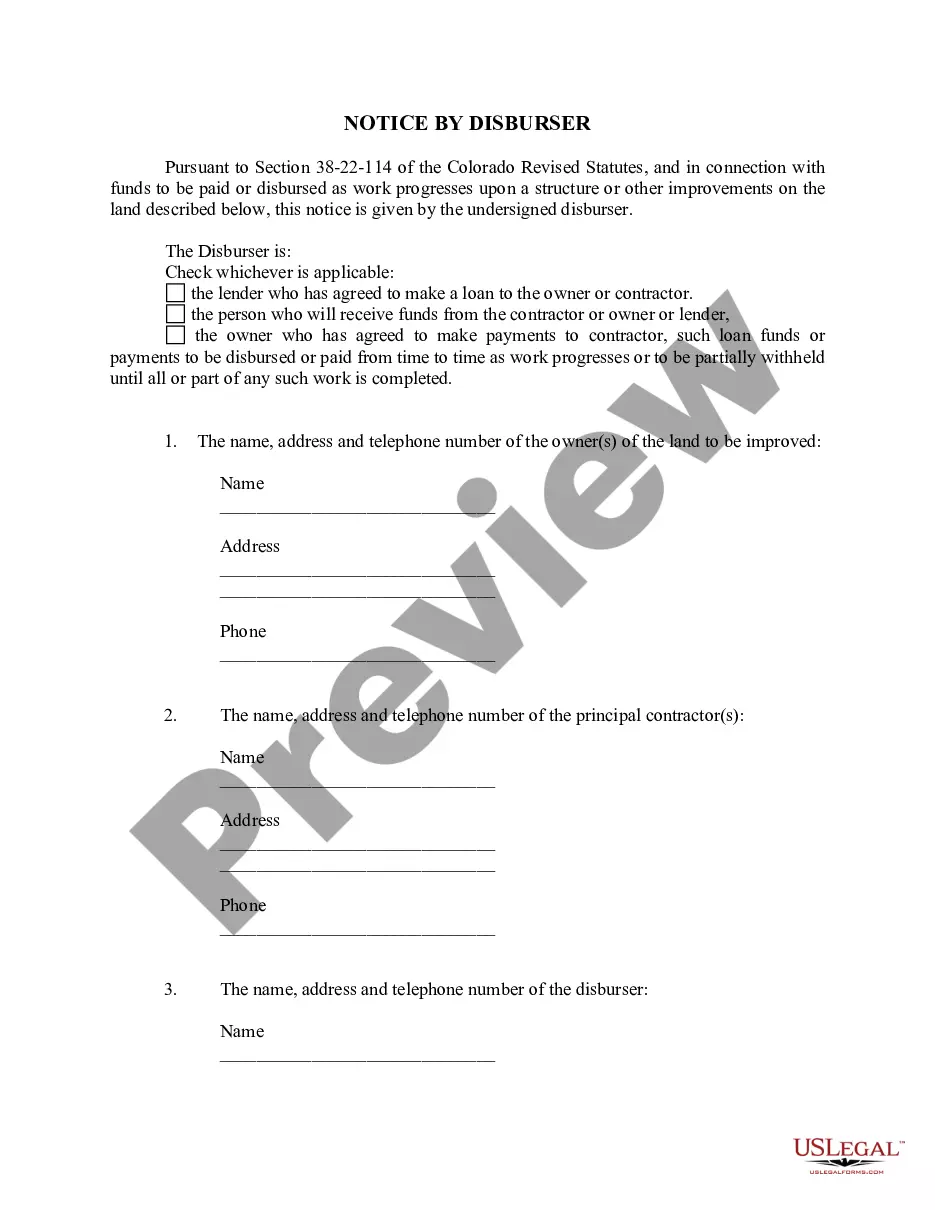

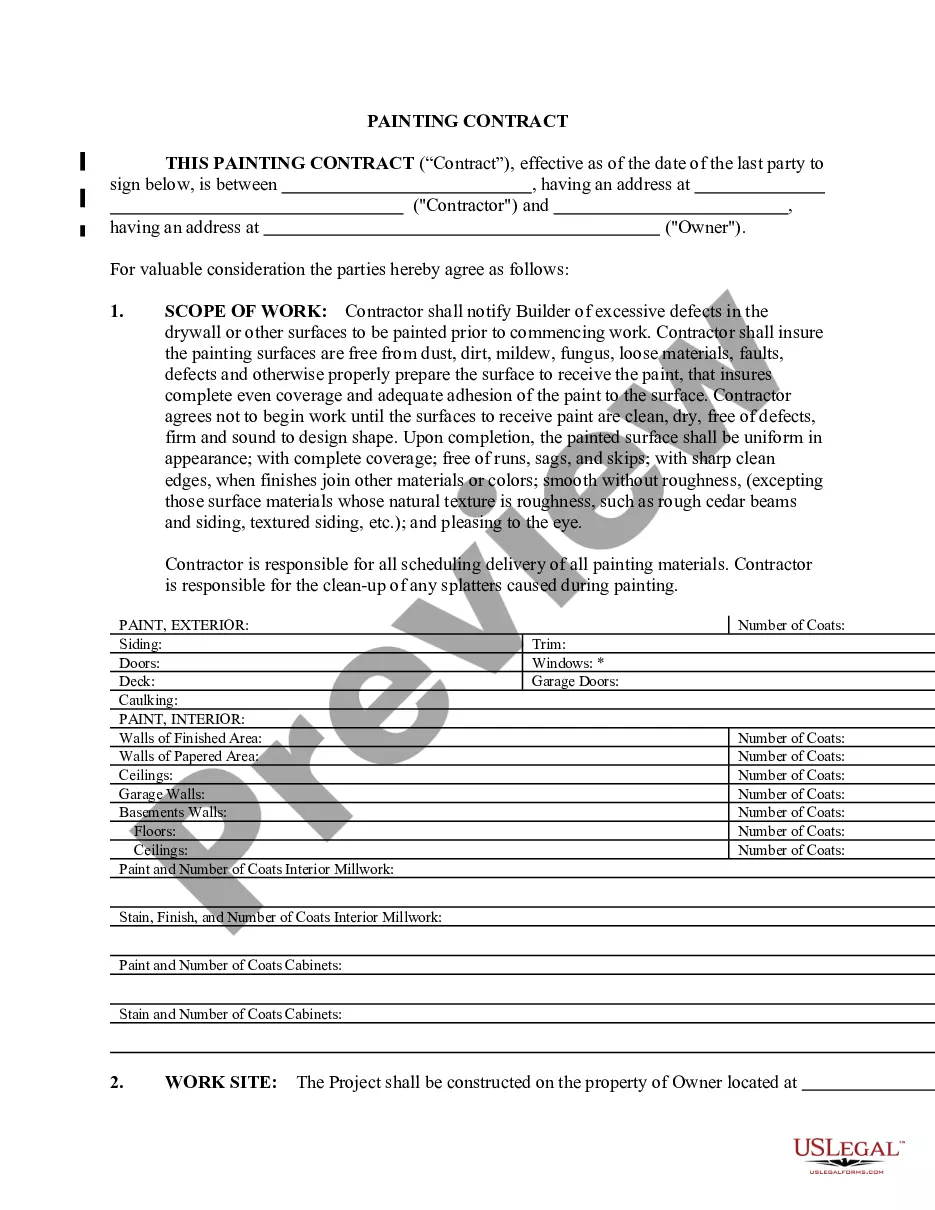

- Examine the form using the Preview feature (if it’s available).

- If there's a description, read it to understand the key points.

Form popularity

FAQ

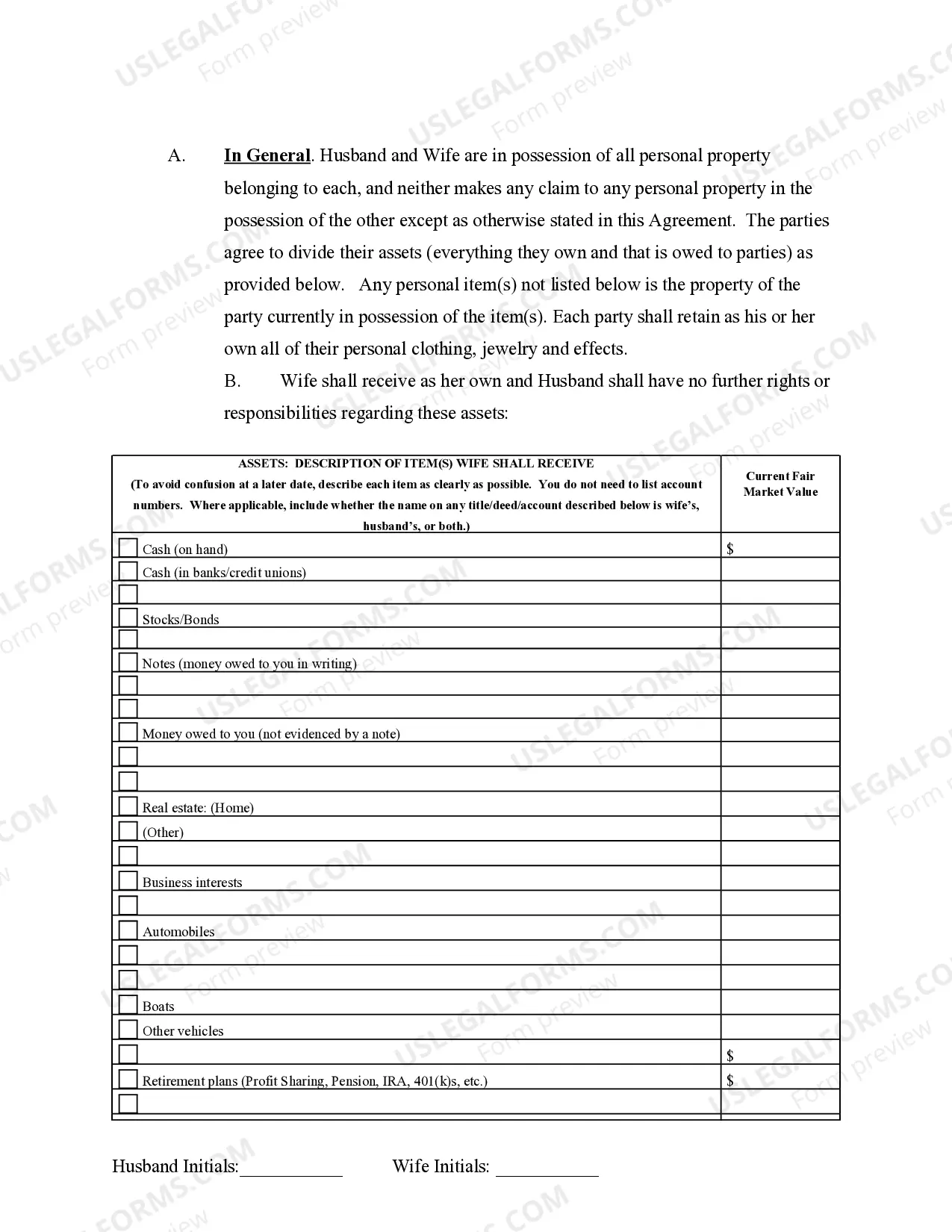

Marital property is any property that was acquired by either spouse during the marriage, using marital funds.Similarly, a house owned by one spouse alone before the marriage can become marital property if both spouses pay the mortgage and other expenses.

Any assets acquired before the marriage are considered separate property, and are owned only by that original owner. A spouse can, however, transfer the title of any of their separate property to the other spouse (gift) or to the community property (making a spouse an account holder on bank account).

Generally in California, property acquired by a spouse prior to marriage is considered under the family code as separate property while those acquired after marriage are considered community assets.The process of apportioning between the separate and community property component is laid out in the Marriage of Madsen.

California's separate property laws apply to a house owned before marriage.(b) A married person may, without the consent of the person's spouse, convey the person's separate property." Therefore, you should have a separate property interest during the divorce in that premarital asset which is your house.

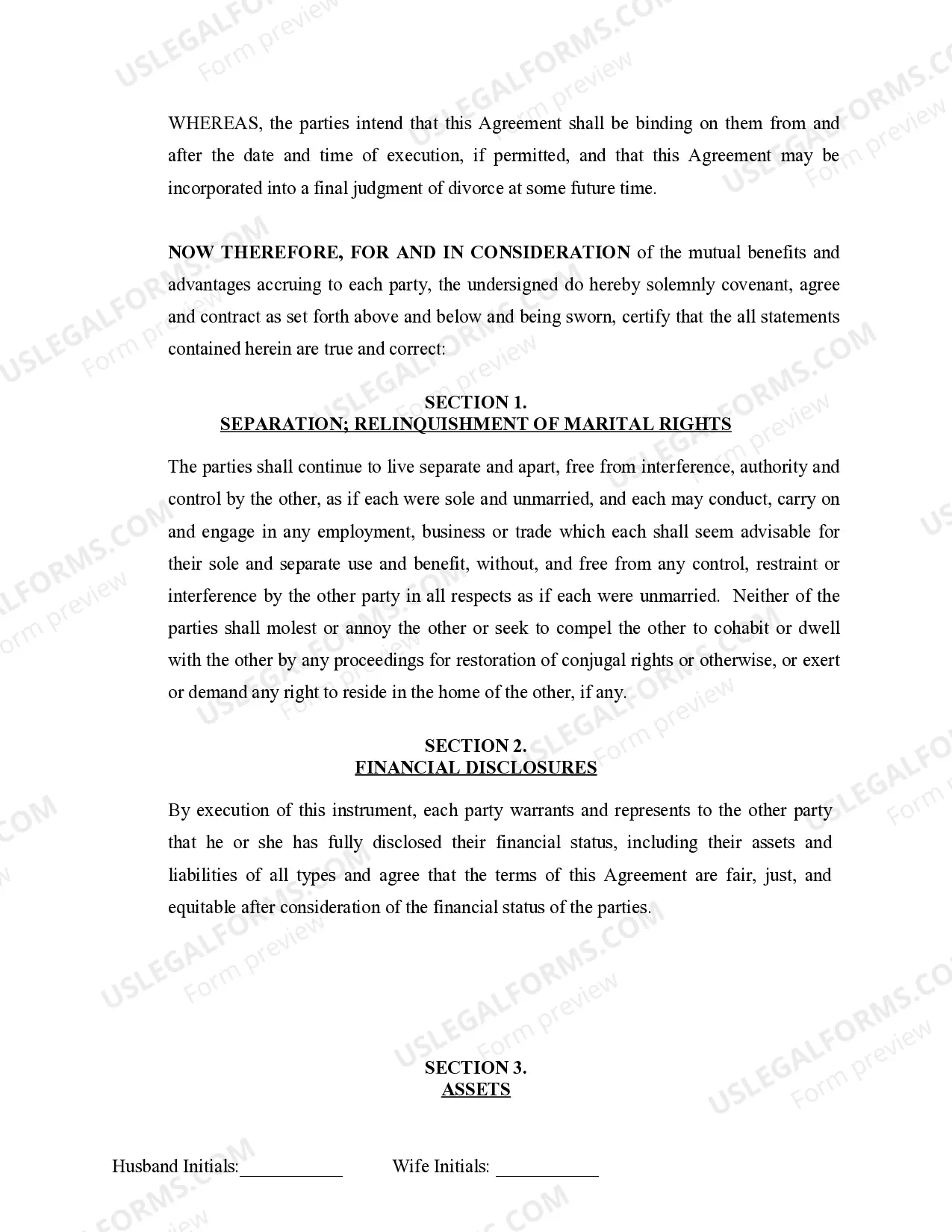

Illinois is not a community property state it is an equitable division state. That means marital property and debts need not be divided 50 / 50. Rather, the law requires property to be divided "equitably." Many cases are resolved with 60/40, 70/30 splits and some even allocate ALL marital property to one spouse.

Only marital property is divided during an Illinois divorce. Marital property generally includes property obtained by either spouse during the marriage.For example, if a spouse receives an inheritance from a relative during the marriage, those funds are typically considered separate property.

Under Illinois law, non-marital property can be defined as a property: Received as a gift, descent, or legacy. Obtained by a spouse after legal separation. Purchased before the marriage. Excluded by a valid agreement signed between the parties.

Illinois law about possessing the marital home There are two ways that a person can force his or her spouse to leave the marital home in Illinois. A person can file a petition for exclusive possession of the home under the Illinois Marriage and Dissolution of Marriage Act.

Any assets acquired before the marriage are considered separate property, and are owned only by that original owner.Spouses can also comingle their separate property with community property, for example, by adding funds from before the marriage to the community property funds.