An Illinois Order Directing Representative To Show Cause is a legal document issued by the court that orders a representative to appear in court to explain why they are not in compliance with a court order or directive. There are two types of Illinois Order Directing Representative To Show Cause: 1) an order to show cause why a representative should not be held in contempt for failing to comply with a court order or directive; and 2) an order to show cause why a representative should not be sanctioned for failing to comply with a court order or directive. The order requires the representative to appear before the court on a specified date and time to explain why they are not in compliance. If the representative does not appear or fails to provide a satisfactory explanation, the court may impose a fine, jail time, or other sanctions.

Illinois Order Directing Representative To Show Cause

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Order Directing Representative To Show Cause?

Drafting legal documents can be quite a challenge if you lack readily available fillable templates. With the US Legal Forms online database of official paperwork, you can trust in the forms you acquire, as they all adhere to federal and state regulations and are verified by our experts.

Acquiring your Illinois Order Directing Representative To Show Cause from our library is as easy as pie. Previously registered members with an active subscription just need to sign in and click the Download button after finding the suitable template. Later, if desired, users can access the same document from the My documents section of their account. However, even if you are not familiar with our service, creating an account with a valid subscription will only take a few moments. Here’s a quick guide for you.

Haven't signed up for US Legal Forms yet? Register for our service today to access any official document swiftly and effortlessly whenever you require it, and keep your paperwork organized!

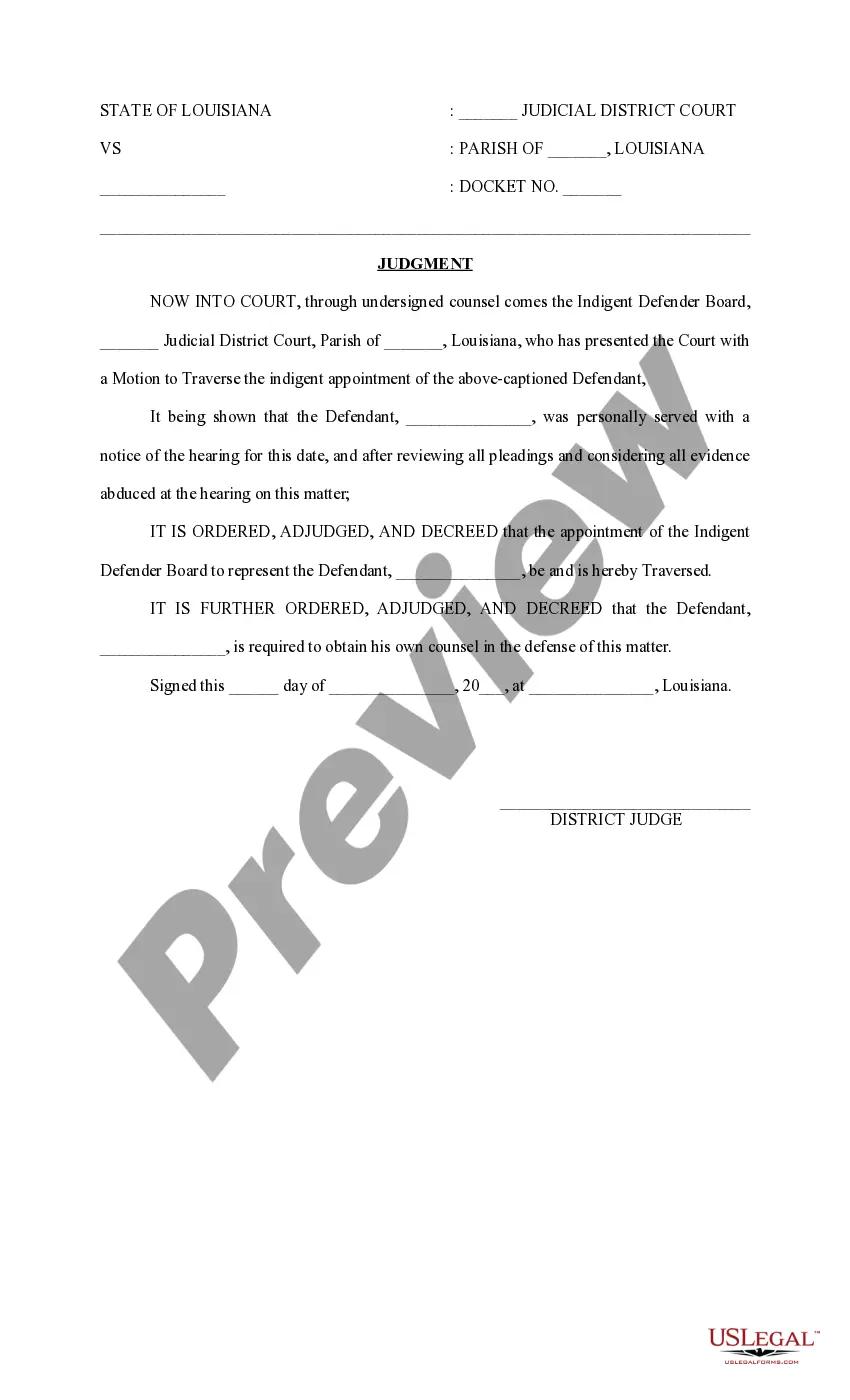

- Document compliance validation. It is important to carefully review the contents of the form you intend to use and confirm that it meets your requirements and fulfills your state law standards. Previewing the document and checking its overall description will assist you in doing just that.

- Alternative search (optional). If you encounter any discrepancies, navigate through the library using the Search tab at the top of the page until you discover the correct template, then click Buy Now once you find what you need.

- Account creation and form acquisition. Establish an account with US Legal Forms. After account verification, sign in and select your most appropriate subscription plan. Process a payment to proceed (both PayPal and credit card methods are supported).

- Template download and subsequent use. Choose the file format for your Illinois Order Directing Representative To Show Cause and click Download to store it on your device. Print it for manual completion, or utilize a feature-rich online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

As you may recall, the Illinois Code of Civil Procedure allows substitute service, through which process can be served by leaving a copy of the summons at a defendant's abode, with some family member or resident over the age of 13. 735 ILCS 5/2-203(a)(2).

Even if an executor fails to administer an estate in ance with Illinois law, he/she can only be removed if the parties seeking the removal file a petition requesting removal, provide the court with evidence to support their claims, and attend an evidentiary hearing before a judge.

The statute of limitations for probate claims in Illinois provides that creditors have two years from the decedent's death to file a claim against the estate. However, the representative can shorten this period by providing notice to known and unknown creditors.

The law in Illinois provides such creditors six months to file those claims. The executor is required to protect or preserve the assets, to pay any valid claims, and eventually to distribute the remainder of the estate to those individuals specifically listed in the Will.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

On average, probate in Illinois takes no less than twelve months. The probate process must allow time for creditors to be notified, filing of required income tax returns, and the resolution of any disputes. Creditors must file any claims against the estate within six months of notification.

Once the original will has been filed, the executor named in the decedent's will is responsible for filing a petition to probate the will within 30 days, or refusing to accept their position as executor. If they fail to act within 30 days, the court may deny them the right to act as executor.