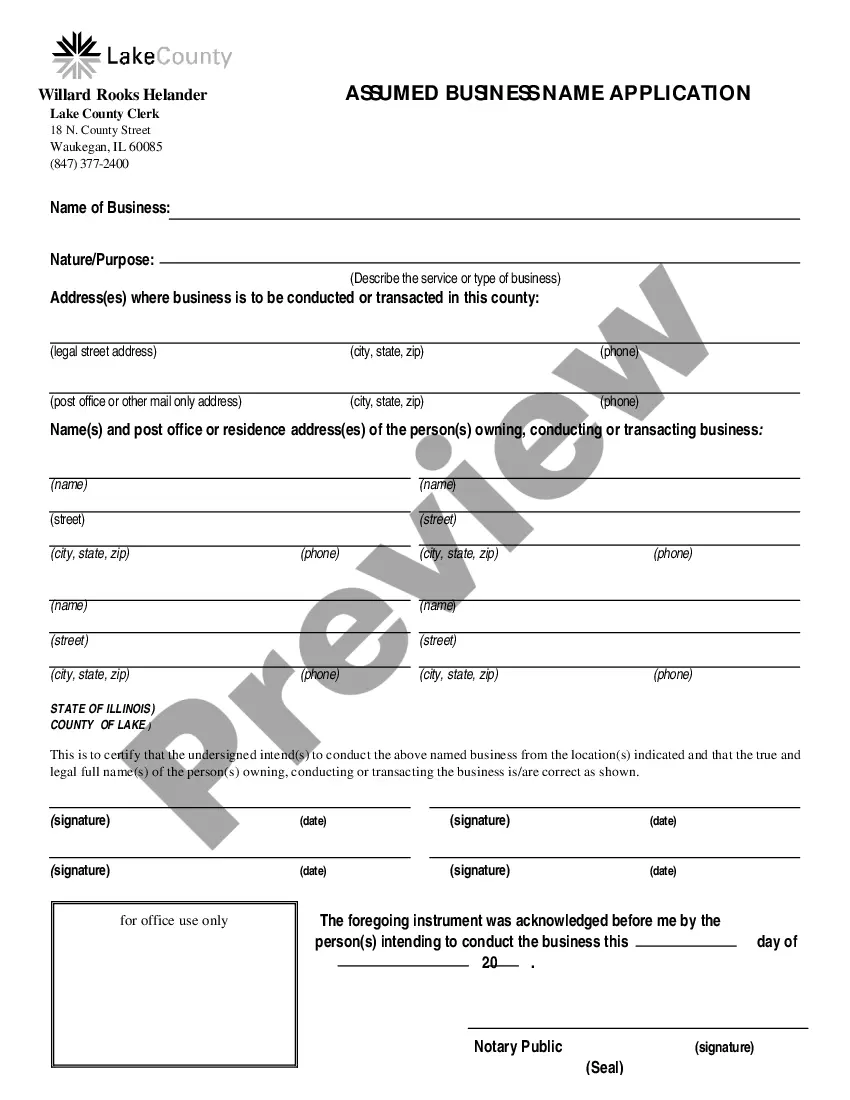

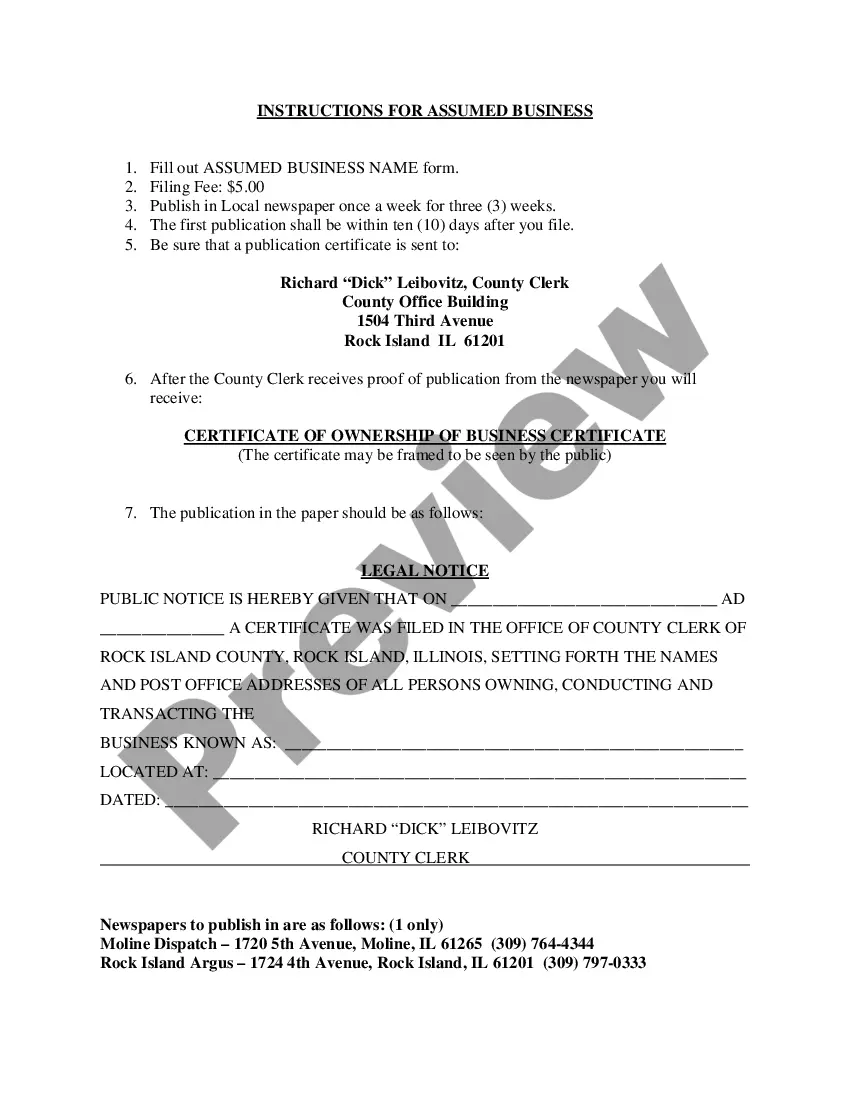

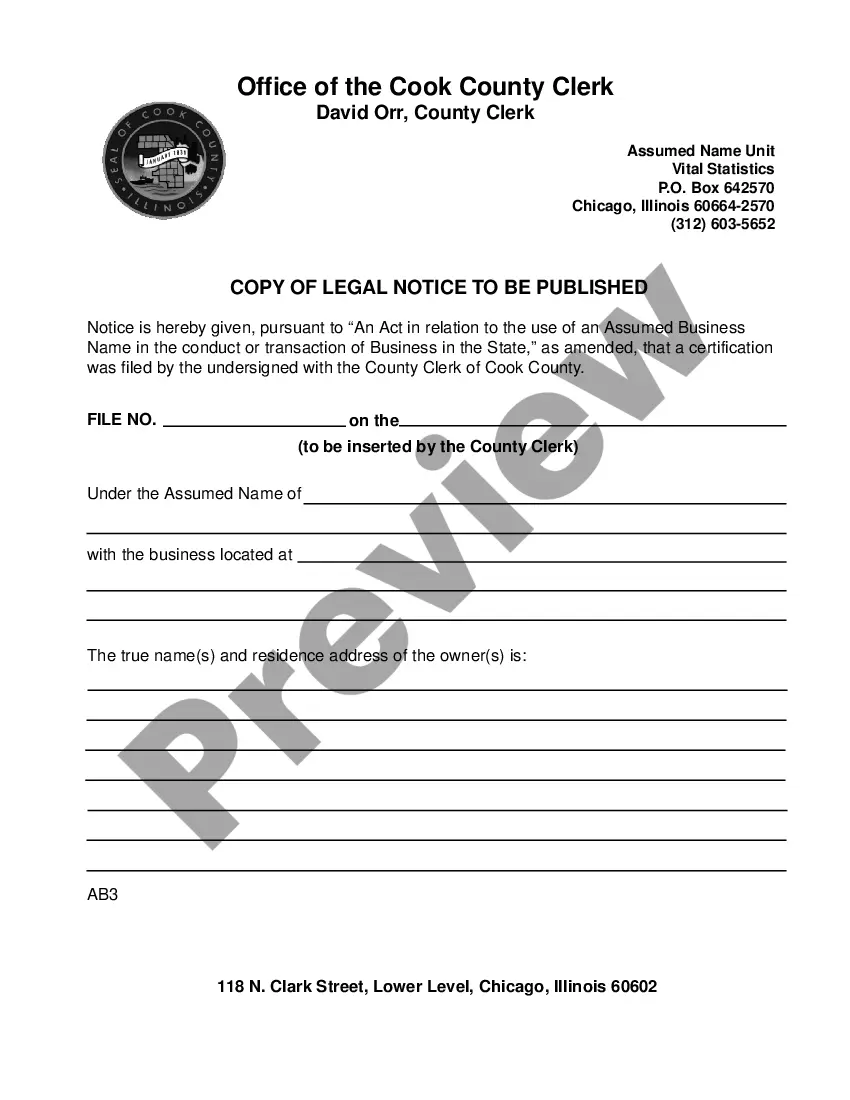

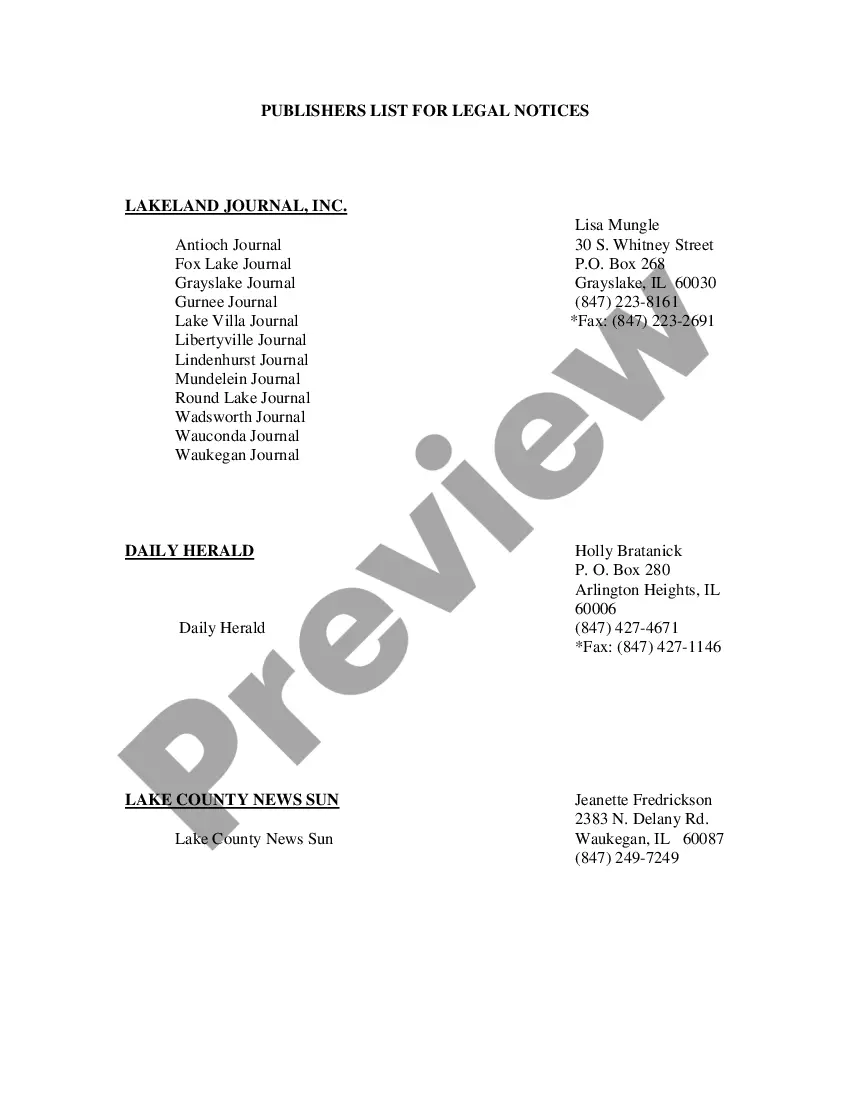

Illinois Notice Under Assumed Business Act for Sangamon County

Description

How to fill out Illinois Notice Under Assumed Business Act For Sangamon County?

Looking for Illinois Notice Under Assumed Business Act for Sangamon County documents and completing them might be a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template specifically for your state within just a few clicks.

Our legal experts prepare every document, so you only need to complete them. It truly is that simple.

Now you can either print the Illinois Notice Under Assumed Business Act for Sangamon County form or complete it using any online editor. Don’t worry about making errors since your template can be used, submitted, and printed as many times as you need. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage and save the document.

- Your downloaded templates are stored in My documents and are always accessible for future use.

- If you haven’t signed up yet, you will need to register.

- Check out our comprehensive instructions on how to obtain your Illinois Notice Under Assumed Business Act for Sangamon County template in minutes.

- To obtain a valid template, verify its relevance for your state.

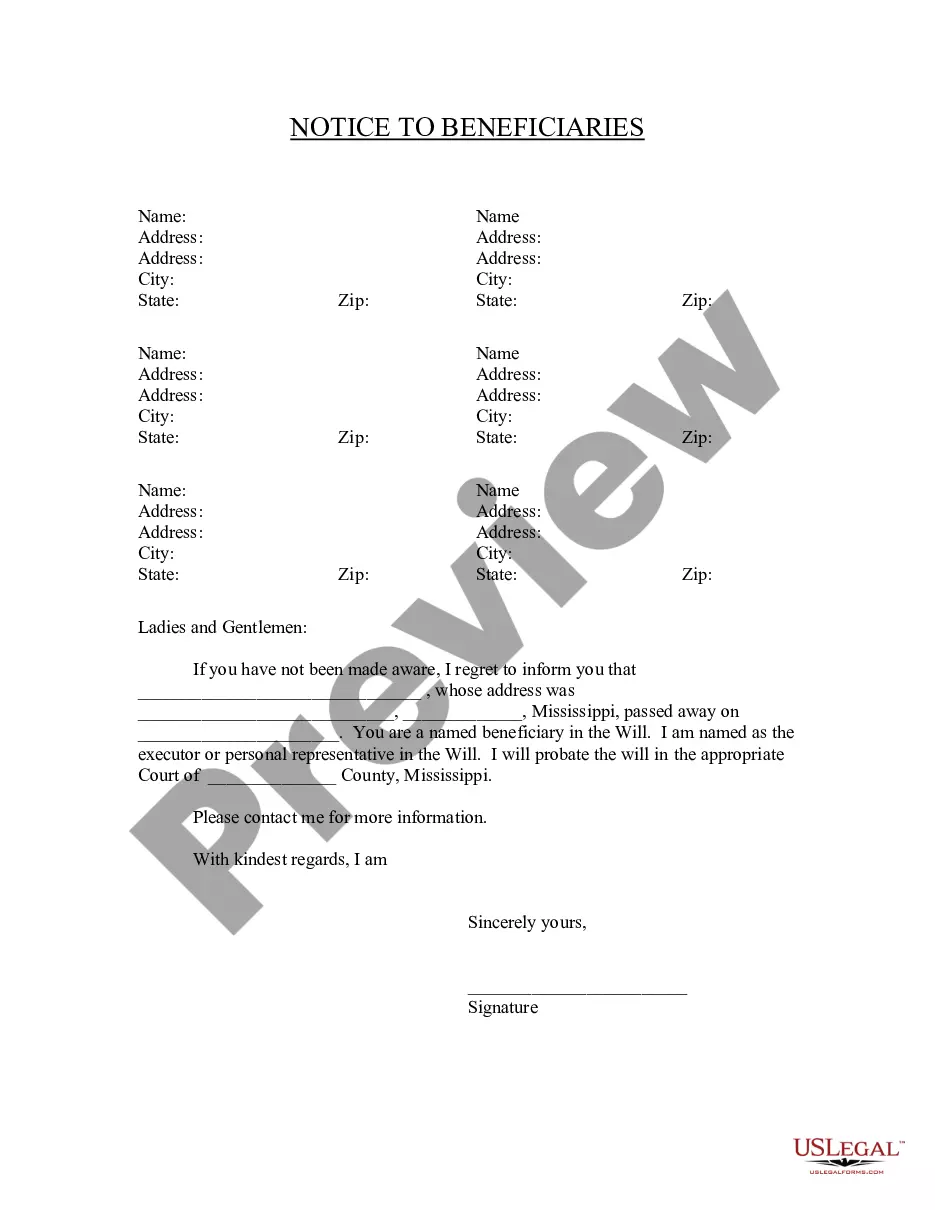

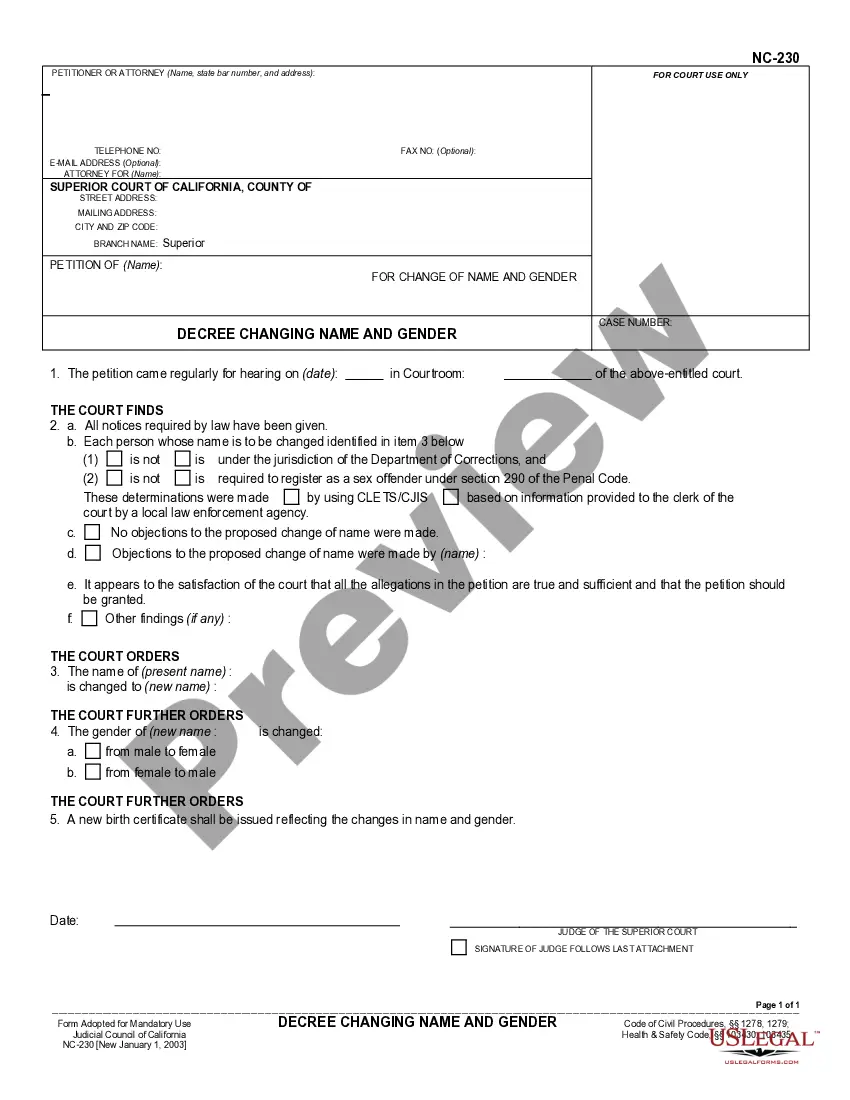

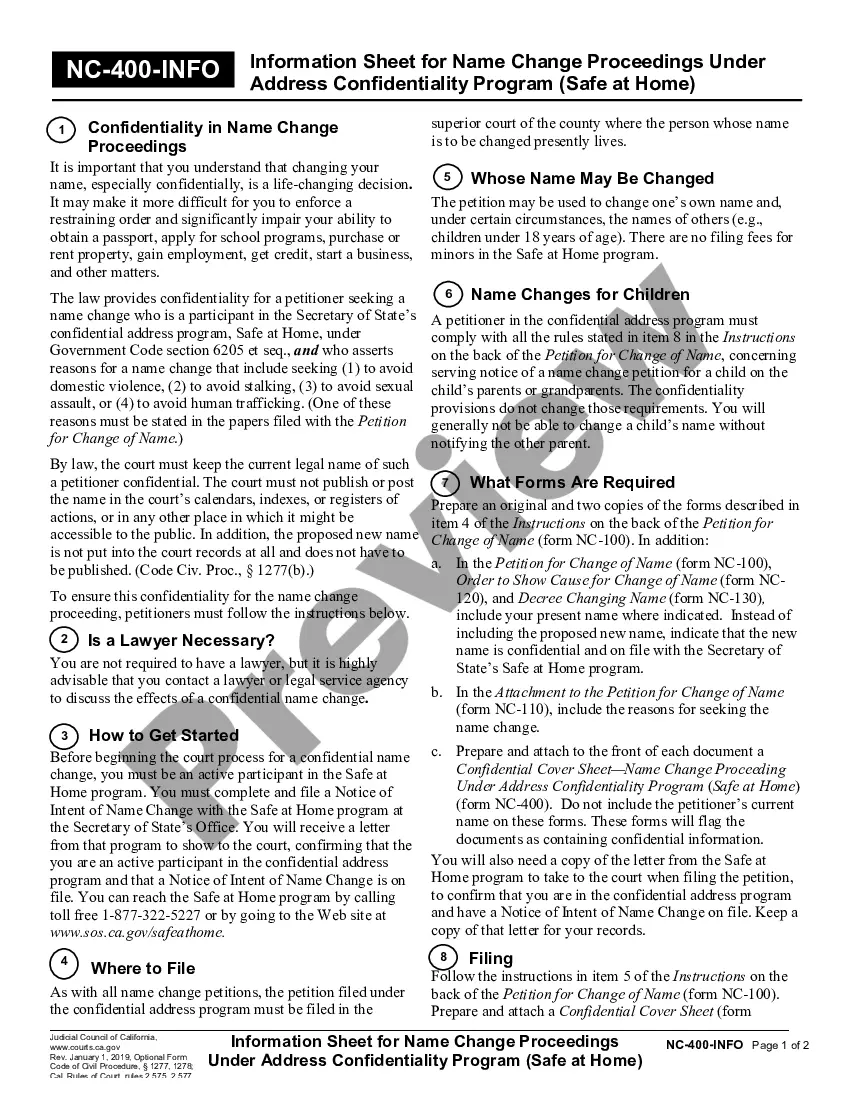

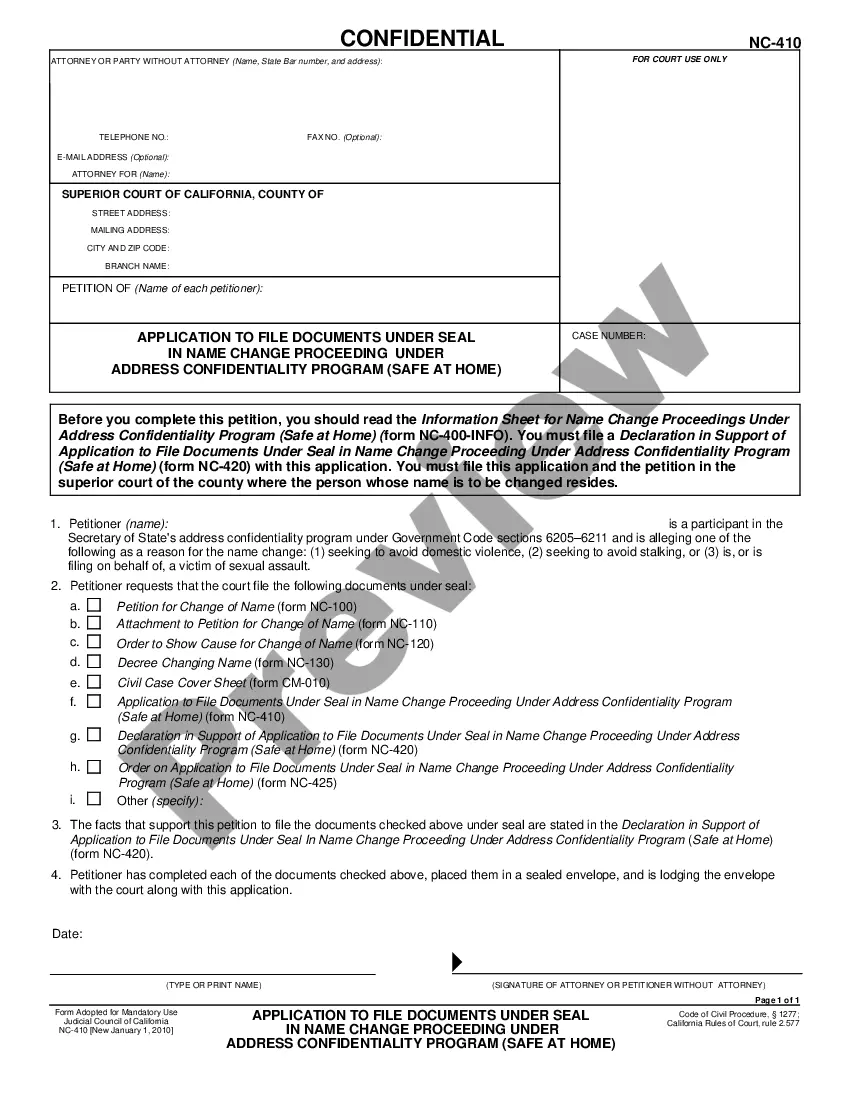

- View the sample using the Preview feature (if available).

- If there is a description, read through it to understand the key details.

- Click on the Buy Now button if you found what you are looking for.

- Select your plan on the pricing page and create an account.

- Choose your payment method with a card or through PayPal.

- Download the form in your desired format.

Form popularity

FAQ

Eligibility requirements Operate for profit. Be engaged in, or propose to do business in, the U.S. or its territories. Have reasonable owner equity to invest. Use alternative financial resources, including personal assets, before seeking financial assistance.

When it comes to your personal credit score, a lender typically will want to see a minimum of 640 to 680 to qualify for an SBA loan.If your business has a FICO credit score, the lender will look for one that's at least 140 to 160, on a scale of zero to 300.

Well, according to the SBA, a small businesses have a maximum of anywhere between 250 and 1500 employees all depending on the specific industry the business is in. Additionally, businesses have revenue limits that they must not exceed if they want to qualify for SBA financing.

All small businesses with 500 or fewer employees are eligible, including self-employed individuals, sole proprietors, independents contractors, nonprofits, tribes, and veteran organizations. There is a very limited opportunity for larger businesses in certain industries.

The 7(a) Loan Program is the SBA's primary business loan program.The SBA guarantees 7(a) Loans up to a certain percentage. The amount the SBA guarantees varies based on the amount of the loan. For loans up to $150,000, the SBA guarantees 85%. For loans greater than $150,000, the guarantee is 75%.

The Paycheck Protection Program is providing small businesses with the resources they need to maintain their payroll, hire back employees who may have been laid off, and cover applicable overhead.

Paycheck Protection Program (PPP) The CARES Act (as amended) allocates approximately $800 billion for loans to help small businesses keep workers employed amid the pandemic and economic downturn.Loans are guaranteed by the Small Business Administration (SBA) as part of its Section 7(a) loan program.

Qualifying for an SBA loan is generally easier than a standard secured bank loan. The SBA is slightly more lenient on certain criteria than a bank or a credit union. However, the SBA maintains a few broad standards that all applicants must meet if they want to get approved for a loan.

Eligibility requirements Operate for profit. Be engaged in, or propose to do business in, the U.S. or its territories. Have reasonable owner equity to invest. Use alternative financial resources, including personal assets, before seeking financial assistance.