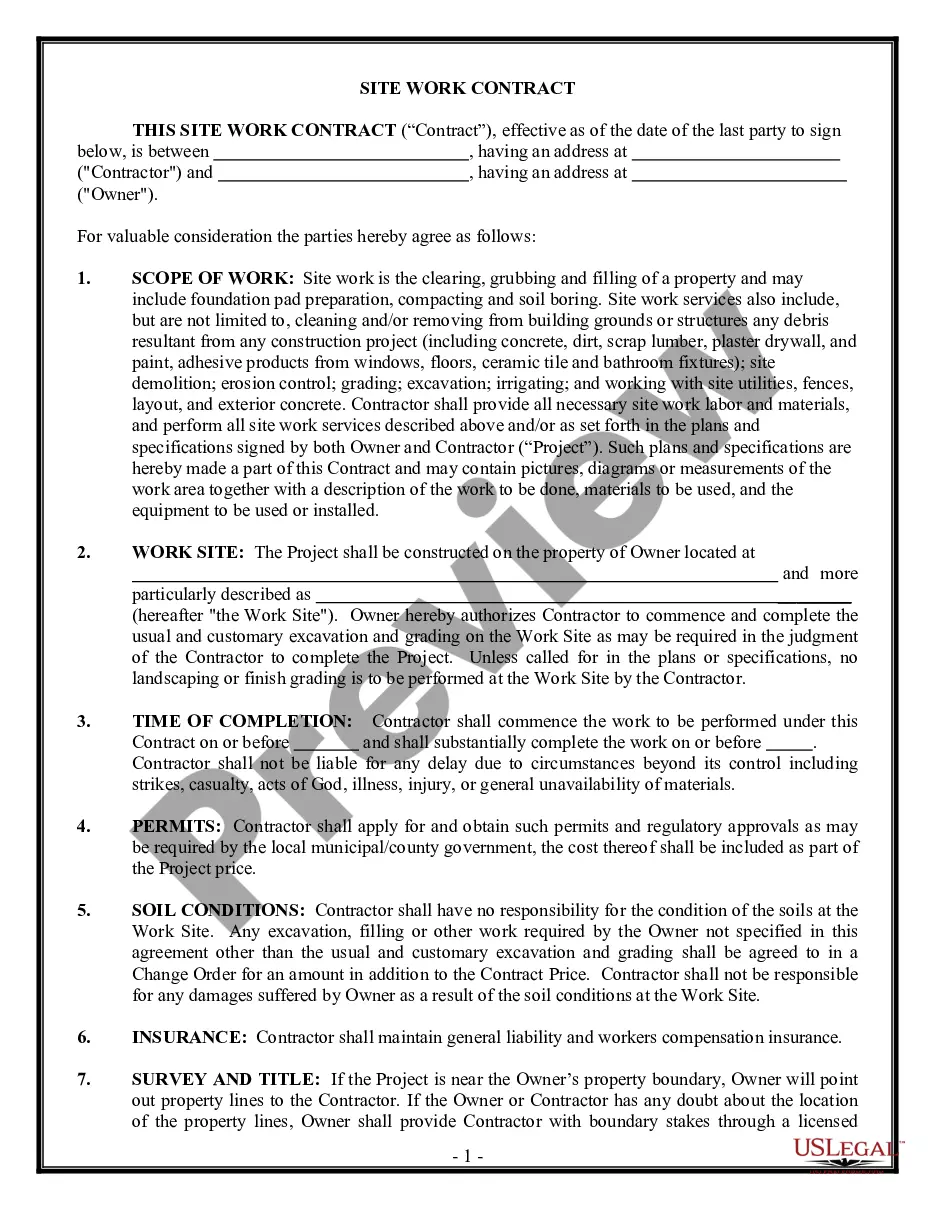

Illinois Order Allowing Compensation For Representation Of Chapter 13 Debtor is a court-issued order authorizing the attorney representing a Chapter 13 debtor in a bankruptcy case to receive payment for their services. This order is issued by the Bankruptcy Court in the district where the bankruptcy case is being heard. There are two types of Illinois Order Allowing Compensation For Representation Of Chapter 13 Debtor: (1) an interim order which is issued after the petition is filed and before the confirmation hearing; and (2) a final order which is issued after the confirmation hearing. The order will specify the amount of compensation the attorney will receive and the payment schedule, if applicable. The order also requires the debtor to sign a consent to the order and a copy of the order must be provided to all creditors in the case.

Illinois Order allowing Compensation For Representation Of Chapter 13 Debtor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Order Allowing Compensation For Representation Of Chapter 13 Debtor?

Preparing formal documentation can be quite a challenge if you lack ready-to-use fillable templates. With the US Legal Forms online repository of official paperwork, you can trust the blanks you discover, as all of them adhere to federal and state regulations and are verified by our specialists.

Therefore, if you need to create the Illinois Order permitting Compensation For Representation Of Chapter 13 Debtor, our service is the ideal source for obtaining it.

Here’s a brief guide for you: Document compliance verification. You must thoroughly review the content of the form you wish to ensure it meets your requirements and complies with your state regulations. Checking your document and going over its general description will assist you in accomplishing this. Alternative search (optional). If there are any discrepancies, search the library using the Search button located at the top of the page until you identify an appropriate template, and click Buy Now when you find the one you require. Account creation and form purchase. Create an account with US Legal Forms. After the account verification process, Log In and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are provided). Template download and further usage. Select the file format for your Illinois Order permitting Compensation For Representation Of Chapter 13 Debtor and click Download to save it on your device. Print it to manually complete your paperwork, or use a versatile online editor to prepare an electronic version more quickly and effectively. Haven’t you tried US Legal Forms yet? Register for our service today to access any official document swiftly and simply whenever you require it, and maintain your paperwork organized!

- Acquiring your Illinois Order permitting Compensation For Representation Of Chapter 13 Debtor from our service is as easy as pie.

- Previously registered users with an active subscription simply need to Log In and hit the Download button once they locate the appropriate template.

- Subsequently, if necessary, users can select the same document from the My documents section of their account.

- However, even if you are not acquainted with our service, signing up with a valid subscription will only take a few moments.

Form popularity

FAQ

Answer. If your income goes down during your Chapter 13 bankruptcy and you can no longer afford your monthly plan payment, you can ask the court to modify your Chapter 13 repayment plan and reduce your payment amount.

If you filed for bankruptcy to avoid foreclosure or are behind in house payments, your Chapter 13 plan payment could be more or less $1500 per month. Additionally, high income, high debt Chapter 13 filers would usually be required to make payments between $2000 and $3000, or even more.

Many low-income filers have little or no nonexempt property, and no disposable income left after paying their bills and expenses. If you are in this situation, your plan can propose to pay off only your required debts, making no payments on your unsecured debt.

A Secured Debt is Paid Off The chapter 13 repayment amount is largely influenced by the debts you have and the income you receive. Major changes to either factor could cause your payment to increase. If you own a home or a vehicle, paying it off means that you have more disposable income each month.

This chapter of the Bankruptcy Code provides for adjustment of debts of an individual with regular income. Chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

Creditors in bankruptcy cases have debts paid either by waiting for a distribution from the estate (unsecured creditors), by reclaiming property from the bankruptcy estate (secured creditors), or by obtaining a judgment that the debt is not dischargeable.

With confirmed Chapter 13 plans, you can ask the court to reduce your monthly payment amounts by filing a motion.

If your Chapter 13 plan payment is too high, you can sometimes get it lowered if you encounter a reduction in household income. If your income reduces, you are many times also allowed to reduce your plan payment. This is accomplished usually by filing a Motion to Modify your Chapter 13 plan.